Top Trends Shaping the Tequila Market in 2025 & Beyond

Tequila Market Overview: Premiumization, Global Reach, and Brand Leadership:

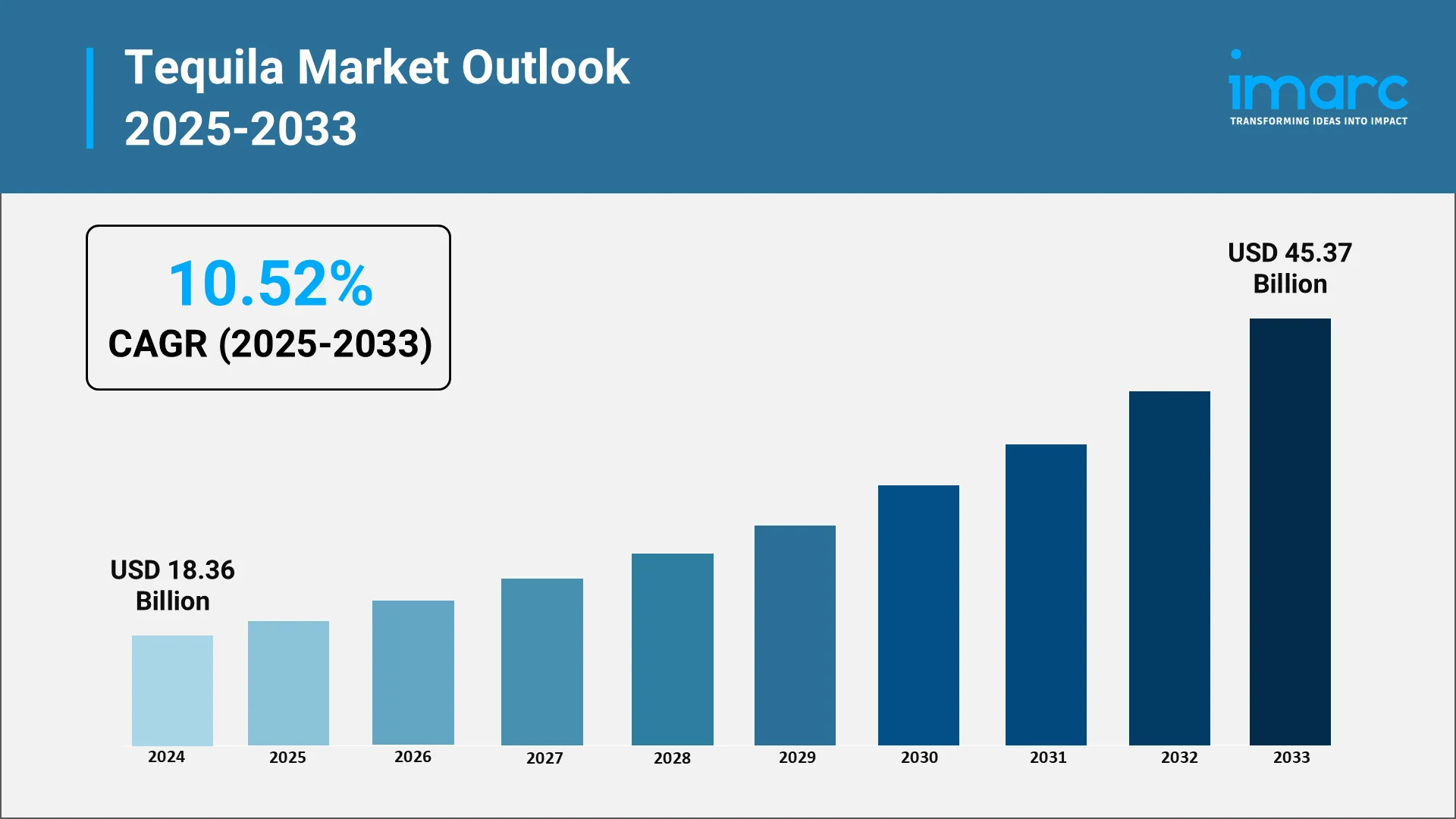

Tequila, once confined to regional consumption in Mexico, has now become a popular spirit worldwide, known for its rich heritage, skilled craftsmanship, and premium quality. Made from blue agave, tequila has attracted international consumers for its distinct flavor, artisanal qualities, and cocktail versatility. According to the IMARC Group’s report, the global tequila market was valued at USD 18.36 Billion in 2024 and is poised for continued expansion. Beyond being a beverage, it represents authenticity and celebration. The rise of cocktail culture, wellness-forward products, and gifting trends is fueling tequila's continued appeal. Emerging enthusiasm across Western Europe, Asia-Pacific, and Latin America is unlocking new revenue streams and shaping dynamic growth narratives.

Explore in-depth findings for this market, Request Sample

Redefining Spirits: Tequila’s Evolving Role in the Global Beverage Market:

Tequila has moved beyond its traditional role to become a staple in premium mixology. Its rise in upscale bars and luxury venues signals a broader consumer preference for authenticity and quality. Small-batch innovations and aging techniques have increased its complexity. Besides, brands are elevating tequila’s image through sustainability narratives, artisanal credentials, and luxury packaging, aligning the spirit with broader consumer movements in wellness, craft, and conscious consumption. For instance, in August 2024, De Nada Tequila announced the launch of its new sustainable packaging, introducing fully recyclable aluminum bottles for its Blanco and Reposado variants. The innovative design, which includes a recyclable cork and wooden stopper, significantly reduces the brand’s carbon footprint while maintaining premium aesthetics. These developments have not only broadened its demographic reach but also positioned tequila alongside premium offerings in global beverage portfolios. As a result, tequila now plays a key role in shaping beverage trends that value quality, sustainability, and cultural narrative.

Key Industry Trends Redefining the Global Tequila Landscape:

Agave to Añejo: Premium and Ultra-Premium Tequilas on the Rise

Premium and ultra-premium tequila categories are registering explosive growth as consumers gravitate toward refined sipping experiences. These segments emphasize aging techniques, terroir-driven production, and small-batch craftsmanship. Greater consumer literacy around agave sourcing, maturation, and barrel aging has led major tequila market players to experiment with French oak, ex-bourbon, and sherry cask finishes to craft distinctive expressions. Reflecting this trend, Louis Vuitton Moët Hennessy (LVMH) entered the Indian market in December 2024, with the launch of its luxury tequila label Volcán de Mi Tierra. Offering four expressions, Blanco, Reposado, Cristalino, and the ultra-premium Volcán X.A., the brand merges traditional Jalisco production with luxury branding. Its debut in key Indian markets signifies growing global demand for artisanal tequila and its resonance among quality-conscious consumers.

Fame Meets Fermentation: Expansion of Celebrity Tequila Brands

Celebrity-backed tequila brands are capturing media headlines and consumer wallets alike. From George Clooney's Casamigos to Kendall Jenner's 818, these brands blend star power with strategic marketing. They leverage massive social media footprints, cross-industry collaborations, and lifestyle storytelling to connect with millennials and Gen Z. In April 2025, 818 Tequila returned to Coachella with its third annual 818 Outpost. Designed as a festival within a festival, the activation fostered emotional engagement and expanded digital reach via social sharing. The space transported attendees into a vibrant scene inspired by a Slim Aarons 1970s postcard, combining vintage aesthetics with modern flair. These campaigns have normalized tequila as a sipping spirit, boosted its perception in mainstream markets, and accelerated international demand. While purists question the authenticity of some celebrity-backed brands, they have undeniably expanded the market's reach and spotlighted the heritage of Jalisco's agave fields.

Rooted in Responsibility: Sustainability and Organic Agave Practices

As environmental consciousness deepens, tequila producers are embracing more sustainable agricultural methods, including organic agave cultivation and biodiversity preservation. Pioneering brands are also deploying waste-to-energy distillery models and circular economy practices, such as converting agave bagasse into compost or construction materials. Organic certification is gaining traction, especially in Europe and North America, where eco-labeled spirits appeal to health-conscious consumers. On October 2024, Zamora Company USA launched Volteo, an organic, additive-free luxury tequila distilled at Destilería Casa de Piedra. The lineup, Blanco, Reposado, and Cristalino, is crafted in small batches and presented in striking 750 ml bottles. Tequila Volteo was crafted to elevate the luxury tequila category by challenging convention and honoring its founder Dak’s vision of uncompromising quality. Additionally, sustainability measures such as water stewardship, pesticide reduction, and fair-trade labor practices are now critical differentiators aligned with ESG frameworks.

Ready for the Moment: Rise of Tequila-Based RTDs

Ready-to-drink (RTD) tequila cocktails are surging in popularity, fueled by convenience culture and changing drinking habits. These beverages, often lower in alcohol and packaged in sleek formats, appeal to health-conscious consumers seeking natural ingredients and portion control. A 2024 study revealed 34% of respondents planned to purchase RTDs in the coming year, up from 32% previously. The findings also reflected openness to new RTD brands and ongoing innovation in the category. Innovative packaging, natural flavor infusions, and mixologist-developed recipes are driving repeat purchases. Single-serve cans and mini bottles have made RTDs ideal for events, travel, and e-commerce, while margarita variants and tequila spritzers dominate grocery aisles in the U.S., U.K., and Australia. As low-ABV beverages gain popularity, RTDs represent a fast-growing, scalable segment in the tequila ecosystem.

Journey to the Agave Trails: Tequila Tourism and Experiential Branding

Jalisco, the birthplace of tequila, is becoming a prominent spirits tourism destination. Visitors flock to distilleries, boutique agave farms, and tasting experiences that highlight craftsmanship. The Mexican government and private stakeholders are investing in infrastructure to support this boom. In May 2025, the Tequila Express train resumed operations after a nine-year hiatus, reconnecting Guadalajara with the town of Tequila in Jalisco. Supported by a USD 9 Million investment, the relaunch features panoramic rides through UNESCO-listed landscapes, unlimited tequila, food, and distillery visits. Experiential marketing initiatives—including pop-ups, masterclasses, and virtual tastings, are amplifying global brand storytelling. By engaging the senses and conveying heritage, tequila tourism is building emotional connections and long-term loyalty.

Distillers to Watch: Market Leaders and Competitive Outlook:

The tequila market is highly competitive, driven by rising global demand, evolving consumer preferences, and increasing emphasis on product quality. Leading global tequila brands are differentiating themselves through aging techniques, artisanal production, organic certifications, and innovative flavor profiles. The shift toward premium and ultra-premium categories has intensified the competition to offer refined, small-batch expressions aimed at discerning consumers. Moreover, marketing strategies now focus heavily on authenticity, heritage, and sustainability, with producers investing in eco-friendly practices and transparent sourcing. Regions outside Mexico are also seeing a surge in demand, prompting brands to localize offerings and invest in global distribution networks. Overall, the competitive landscape is shaped by innovation, premiumization, and a growing intersection of tradition with modern lifestyle branding, making it one of the most dynamic sectors in the global spirits industry.

Some of the top tequila companies in the market include Bacardi Limited, Becle SAB de CV, Brown-Forman Corporation, Casa Aceves, Clase Azul México, Diageo Plc, Heaven Hill Brands, Pernod Ricard S.A, Sazerac Company Inc. and Suntory Holdings Limited.

- Bacardi Global Travel Retail debuted Patrón El Alto in India's travel retail and domestic markets in June 2025, through a strategic collaboration with renowned Indian music artist Karan Aujla. The launch was marked by high-impact events at Mumbai and Delhi airports, featuring live performances and a drone-led product reveal. Crafted from a blend of Reposado, Añejo, and Extra Añejo tequilas using 100% Weber Blue Agave, the ultra-premium expression underscores Bacardi's commitment to innovation and craftsmanship. The brand further amplified its positioning with immersive storytelling content shot at Hacienda Patrón.

- Brown-Forman Corporation and the Sacramento Kings announced a multi-year strategic partnership in March 2025, introducing Tequila Herradura as the official tequila of Golden 1 Center. Under the agreement, Herradura will be prominently featured across all home games and arena events, enhancing guest experiences through elevated spirits programming. The collaboration aligns with the franchise's commitment to premium brand partnerships and enriching in-venue hospitality offerings.

- Casa Aceves, in collaboration with Alexandrion Group, established a joint venture in March 2024 to launch a portfolio of high-end tequilas sourced from the Highlands of Jalisco. The partnership marks Alexandrion's entry into the tequila category, leveraging its global distribution infrastructure to bring Casa Aceves's artisanal offerings to international markets. The venture reflects rising global demand for ultra-premium agave spirits.

- Cookies, CKS Distro, and Labor Smart Inc. (LTNC) launched Adios, a premium ready-to-drink tequila cocktail in July 2025. Crafted with additive-free Casa Rica tequila and real fruit juice, the product aims to deliver bar-quality flavor with cultural resonance in the growing RTD tequila segment. The initiative is powered by CKS Distro's woman-owned Latino-American distribution network and LTNC's growth strategy expertise.

- Clase Azul México introduced Blanco Ahumado in June 2025, a premium unaged tequila infused with a refined smoky essence achieved through ancestral production methods. Master Distiller Viridiana Tinoco crafted the expression using wild-yeast fermentation and double distillation in copper stills. Presented in a semi-opaque glass decanter with volcanic ceramic and copper accents, the tequila offers a complex flavor profile featuring smoked agave, red apple, plum, and lemon notes.

Mapping the Tequila Market: Segmentation Decoded:

By Product

- Blanco: Often unaged and crystal-clear, Blanco tequila retains the purest essence of blue agave. Its peppery, vegetal notes make it ideal for cocktails and entry-level sipping. Increasingly favored in craft cocktails, Blanco is championed by bartenders for its versatility and strong agave character.

- Reposado: Aged between 2 to 12 months in oak barrels, Reposado tequila offers a harmonious balance between agave freshness and mellow undertones of vanilla or caramel, making it a favorite among connoisseurs. This category appeals to mid-tier premium consumers seeking depth without overwhelming oak influence.

- Añejo and Extra Añejo: With aging periods extending beyond 1 to 3 years, Añejo and Extra Añejo tequilas exhibit deep complexity, rich amber hues, and velvety textures, drawing parallels with fine whiskies. These expressions are increasingly marketed as collector’s items, often released in limited editions with artisanal packaging.

- Flavored Tequila: Infused with flavors like citrus, berry, or spice, flavored tequilas cater to younger consumers and align with contemporary mixology trends, particularly in the ready-to-drink (RTD) segment. They are often released in seasonal or themed editions, such as tropical summer blends or festive winter variants.

- Organic: Certified organic tequilas are gaining momentum in health-conscious markets, resonating with consumers who prioritize purity, transparency, and environmental responsibility. Many of these offerings are promoted through stories of sustainable farming, including organic agave cultivation and eco-friendly production practices.

By Region

- North America: The United States remains the world’s leading tequila consumer, fueled by rising demand for sipping tequilas, RTDs, and wellness-driven agave products. Canada is also witnessing growing interest in premium tequilas, especially in upscale bars and specialty retailers. The market is heavily influenced by celebrity-endorsed brands that drive aspirational appeal, while retail innovations like subscription boxes and customized tasting kits are enhancing direct-to-consumer engagement. A significant development is that Reserva de la Familia joined forces with the MICHELIN Guide U.S. in September 2024, securing its role as the official tequila partner for 2025. The alliance underscores the brand’s dedication to championing refined Mexican culinary traditions across the country.

- Western Europe: Countries such as the UK, France, and Germany are seeing a steady rise in artisanal tequila consumption, with a preference for sipping neat or enjoying refined cocktails. Distribution is being bolstered by e-commerce growth and the prominence of spirits festivals across the region. The category is gaining traction as a luxury lifestyle product, often paired with gourmet cuisine, while education-led marketing initiatives—such as masterclasses and agave seminars—are cultivating an informed consumer base.

- Asia-Pacific: Japan and South Korea are emerging as dynamic tequila markets, driven by high-end retail expansion and an evolving cocktail culture. The spirit’s alignment with minimalism and artisanal craftsmanship resonates well with Japanese consumers. Notably, Charter Brands partnered with Drinks99 to distribute El Tequileno tequila across China, Hong Kong, and Singapore starting in July 2024. With significant investment planned for 2024, the company aims to extend its reach to over 40 countries, leveraging Asia Pacific’s growing demand for additive-free, premium tequila. Besides, the Indian market is also gaining momentum in the premium tequila space, driven by rising disposable incomes, global exposure, and a growing presence of celebrity-backed labels in upscale bars, cultural festivals, and travel retail. Additionally, the rise of digital influencer culture is spotlighting niche tequila brands among younger urban audiences.

- Latin America: Mexico continues to be the heart of global tequila production and cultural identity; while neighboring countries such as Colombia, Chile, and Brazil are contributing to the category’s regional growth. Domestic consumption is supported by export-focused branding campaigns and government-backed initiatives that promote tequila as a national heritage product. The rise of tequila tourism, through distillery tours and agave trail experience, is also increasing interest, alongside the emergence of craft and small-batch labels for local connoisseurs.

Bottling the Future: Market Forecast and Emerging Growth Drivers (2025-2033)

According to IMARC Group, the global tequila market is projected to reach USD 45.37 Billion by 2033, exhibiting a CAGR of 10.52% from 2025-2033. This upward trajectory is propelled by a confluence of cultural, technological, and economic factors reshaping global beverage preferences.

Growth Drivers:

- Rise of Global Cocktail Culture: From craft speakeasies to luxury hotel bars, tequila has become a staple in modern mixology.

- Agave-Based Wellness Trends: With its low glycemic index and gluten-free appeal, tequila is being rebranded as a “clean spirit” for health-conscious consumers.

- Premium Retail and E-Commerce Expansion: Online platforms and high-end retailers are facilitating access to rare, small-batch, and limited-edition tequilas worldwide.

Opportunities in New Markets:

- Emerging Regions: India, China, and Southeast Asia represent untapped potential, where growing middle-class affluence and exposure to global spirits are creating new entry points.

- Culinary Collaborations: Partnerships with Michelin-starred restaurants and global mixologists are enhancing brand prestige and reaching niche audiences.

Tapping into Tomorrow: IMARC’s Strategic Vision for the Tequila Market

As the global tequila market enters a new era of innovation, premiumization, and cultural resonance, IMARC Group empowers stakeholders across the value chain—from agave growers and distillers to retailers and global investors—with forward-looking intelligence and strategic clarity. The dynamic interplay of evolving consumer expectations, sustainability imperatives, and expanding global reach calls for data-backed decisions and proactive market positioning.

How IMARC Adds Value:

- Innovation Monitoring: Tracks emerging agave varietals, fermentation methods, barrel-aging, and RTD formats.

- Brand Strategy Insights: Analyzes digital storytelling, celebrity branding, and experiential campaigns.

- Supply Chain Optimization: Provides intel on sustainable farming, land use, and agave trends.

- Regulatory and Market Guidance: Navigates beverage alcohol laws and international trade policies.

- Strategic Forecasting: Offers granular demand projections by geography and product segment.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

-(1)_11zon.webp)