Key Challenges and Opportunities Shaping the Vietnam Athleisure Market

The Vietnam athleisure market stands at a pivotal juncture, experiencing remarkable transformation driven by evolving lifestyles, rising health consciousness, and rapid urbanization. As Vietnamese people are increasingly prioritizing wellness and seeking versatile clothing that seamlessly transitions from gym workouts to casual social settings, the demand for activewear trends has surged dramatically. With lifestyle apparel Vietnam witnessing unprecedented growth and fitness clothing demand reaching new heights, both international brands and homegrown labels are competing vigorously to capture market share in this dynamic sector. This comprehensive analysis examines the multifaceted landscape of Vietnam's athleisure industry, exploring market dynamics, competitive challenges, emerging opportunities, and strategic pathways for sustained growth through 2033.

Overview of Vietnam's Athleisure Industry:

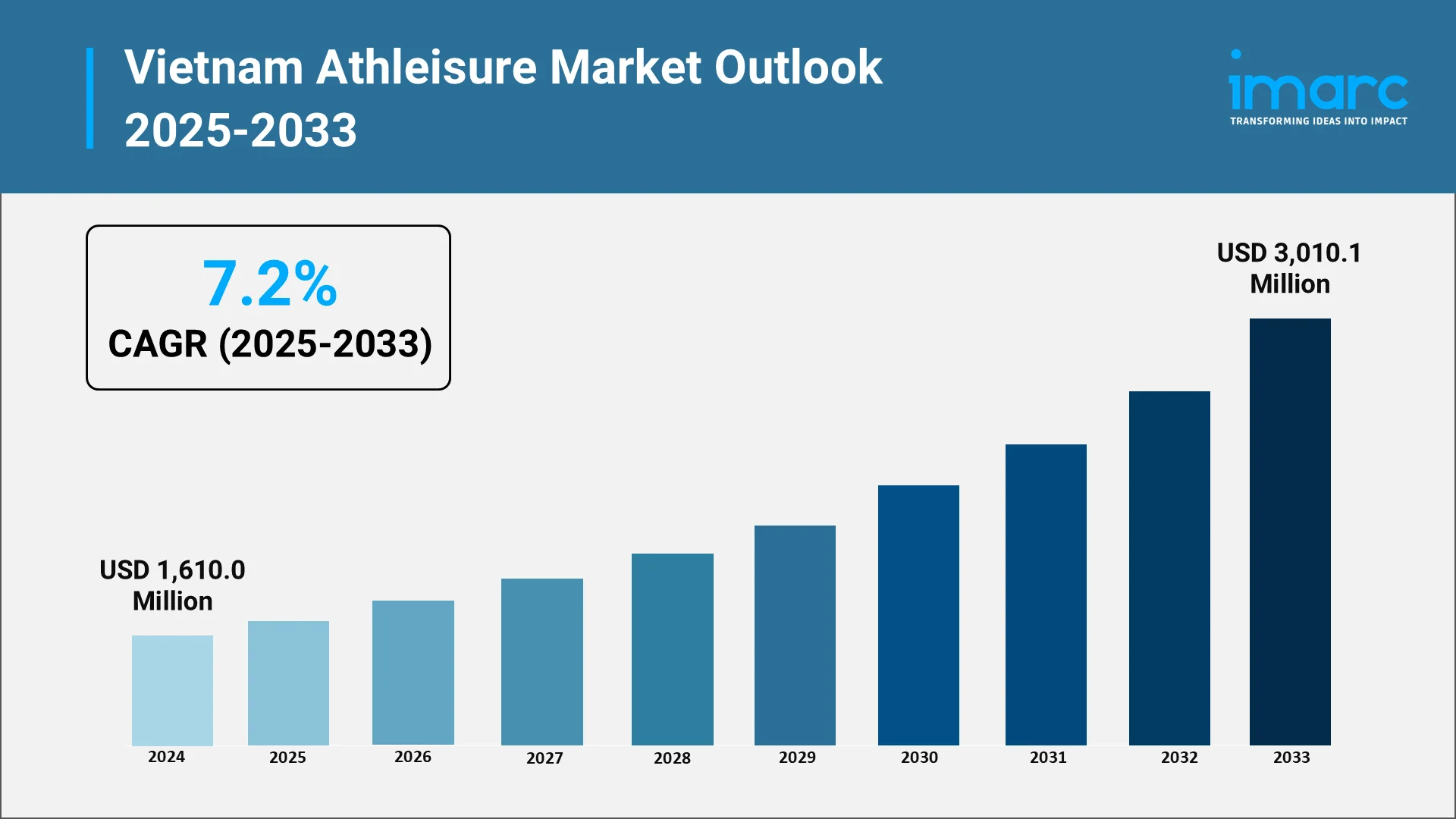

Vietnam's athleisure market represents one of the fastest-growing segments within the nation's broader apparel industry, reflecting a fundamental shift in consumer purchasing patterns and lifestyle choices. The Vietnam athleisure market reached USD 1,610.0 Million in 2024 according to IMARC Group. It is expected to reach USD 3,010.1 Million by 2033, exhibiting a CAGR of 7.2% in the forecast period (2025-2033).

The athleisure category encompasses a diverse range of products designed to blur the traditional boundaries between athletic performance wear and everyday casual attire. These offerings include yoga apparels (comprising tops, pants, unitards, and capris), hoodies, shirts, leggings, shorts, and complementary accessories that prioritize both functionality and fashion appeal. The increasing development of advanced fabrics featuring performance-enhancing characteristics such as moisture-wicking capabilities, four-way stretchability, and temperature control technologies has fundamentally transformed consumer expectations regarding comfort, durability, and versatility in their wardrobe selections.

The Vietnamese sportswear market, which encompasses athleisure products, was valued at USD 792 Million in 2024. The market is expected to reach USD 1,075.29 Million by 2033, exhibiting steady expansion fueled by rising fitness awareness, growing urbanization rates, and increasing demand for stylish yet functional apparel. Southern Vietnam currently dominates the market landscape, commanding a substantial 38.7% market share in 2024, attributed to higher urbanization levels, fitness-focused lifestyles, stronger retail infrastructure, and greater consumer spending power concentrated in metropolitan areas such as Ho Chi Minh City.

Explore in-depth findings for this market, Request Sample

Market Size and Consumption Patterns:

Understanding consumption patterns within Vietnam's athleisure market reveals profound insights into evolving consumer behaviors and preferences. The market segmentation demonstrates clear distinctions between mass athleisure and premium athleisure categories, with the mass segment currently holding the dominant position due to affordable pricing structures, widespread accessibility through both online and offline channels, and rapid design turnover that keeps pace with evolving fashion trends. However, the premium athleisure segment is experiencing accelerated growth as rising disposable incomes and aspirational consumer mindsets drive demand for higher-quality, performance-oriented products from established international brands.

Product category analysis indicates that shoes represents the largest segment within Vietnam's sportswear market, accounting for approximately 57.8% of total market share in 2024. This dominance stems from rising demand for performance-oriented athletic shoes alongside lifestyle sneakers that serve dual purposes for sports activities and daily casual wear. Consumers increasingly invest in athletic footwear driven by considerations of comfort, durability, design aesthetics, and brand reputation, with global labels such as Nike, Adidas, and Puma expanding their product offerings and retail presence across Vietnamese cities.

Vietnamese consumers now embrace active lifestyles, with certain regions such as the Mekong Delta demonstrating even higher adoption rates among the 35-44 age demographic. This behavioral shift manifests through increased participation in gym workouts, yoga classes, running events, cycling clubs, and recreational sports activities. The growing health consciousness directly translates into heightened demand for versatile clothing that accommodates both athletic performance requirements and everyday casual social settings, positioning athleisure as an essential wardrobe category rather than a niche specialty segment.

Distribution channel dynamics reveal a significant omnichannel transformation within the market landscape. While offline retail stores historically dominated sales channels, e-commerce platforms have experienced explosive growth, particularly accelerated by changing consumer shopping behaviors and technological adoption patterns. Online shopping offers Vietnamese consumers convenient access to extensive product catalogs, competitive pricing through promotional campaigns, detailed customer reviews, and seamless delivery options that overcome geographical limitations inherent in physical retail infrastructure.

Key Challenges in the Competitive Landscape:

Despite remarkable growth prospects, Vietnam's athleisure market faces several formidable challenges that industry participants must strategically navigate. The competitive landscape has intensified substantially as both international sportswear giants and emerging local brands vie for consumer attention and wallet share. Establishing strong brand differentiation proves increasingly difficult in a crowded marketplace where product designs, especially minimalist styles popular among local brands, can be easily replicated by competitors, potentially leading to consumer switching behaviors and eroding brand loyalty.

International brands operating in Vietnam encounter the persistent challenge of counterfeit products and unbranded merchandise that flood local markets, particularly in traditional retail channels and informal trading venues. According to Euromonitor market research, unbranded and counterfeit products continue to dominate certain market segments in 2024 due to significantly lower price points and widespread distribution networks that reach price-sensitive consumer segments. This reality creates pricing pressure on legitimate brands while simultaneously diluting brand equity and consumer trust in authentic products.

Supply chain complexity represents another critical challenge, particularly as Vietnam navigates evolving international trade dynamics and geopolitical tensions. Recent US tariff announcements have created uncertainty for sportswear and clothing retailers sourcing products from Vietnamese manufacturing facilities. The proposed 20% tariff on many imports from Vietnam, coupled with potential 40% levies on products deemed as transshipping from third countries through Vietnam, introduces significant cost implications that could affect pricing strategies and profit margins across the value chain.

Building consumer trust among Vietnamese shoppers, many of whom traditionally prefer established foreign brands over local alternatives, presents ongoing challenges for domestic athleisure labels. Local brands must invest substantially in quality assurance, marketing communications, customer service excellence, and product innovation to overcome perceptual barriers and establish credible market positions. The sustainability crisis affecting boutique fitness studios globally, where 91.2% struggle with profitability according to industry analysis, further complicates the retail ecosystem as these venues serve as important distribution and brand-building channels for athleisure products.

Growth Opportunities in Domestic and Export Markets:

The Vietnam athleisure market presents compelling growth opportunities across both domestic consumption and export manufacturing dimensions. Vietnam's domestic apparel industry is fueled by favorable macroeconomic conditions, rising middle-class consumer segments, and demographic advantages including a youthful population increasingly focused on health, wellness, and personal appearance. This economic foundation provides fertile ground for athleisure brands to expand their customer base and deepen market penetration through targeted strategies.

Government initiatives supporting fitness and wellness activities create substantial market-building momentum. In October 2024, Deputy Prime Minister Le Thanh Long signed Decision No. 1189/QD-TTg approving the Strategy for the development of physical training and sports in Vietnam through 2030, with a vision extending to 2045. This strategic policy framework emphasizes promoting active lifestyles, developing sports infrastructure, and encouraging regular physical activities among Vietnamese citizens—all factors that directly stimulate demand for fitness clothing and athleisure apparel across demographic segments.

Vietnam's established position as a global manufacturing powerhouse for sportswear and footwear presents exceptional export opportunities. The country maintains its status as the world's second-largest footwear exporter, shipping over one billion pairs annually to international markets. Vietnam exported footwear for serving major brands including Nike, Adidas, Puma, and numerous other international labels. This manufacturing expertise, combined with competitive labor costs, skilled workforce capabilities, and favorable free trade agreements, positions Vietnam strategically within global supply chains.

The integration of digital commerce and social media marketing creates powerful growth catalysts. Vietnamese consumers demonstrate strong interest in shopping through e-commerce platforms and social media channels, particularly TikTok, which offers regular discount campaigns and convenient purchasing experiences. TikTok continues attracting younger generations, especially Gen Z consumers, due to cost-effectiveness compared with traditional retail channels, extensive customer reach, and seamless integration with entertainment content that drives product discovery and purchase decisions.

Shifts in Consumer Preferences and Branding:

Consumer preferences within Vietnam's athleisure market have evolved dramatically, reflecting broader societal shifts toward health consciousness, sustainability awareness, and digital connectivity. Modern Vietnamese consumers, particularly those aged 18-34 years, increasingly view clothing as combining necessity with self-expression, favoring minimal designs that offer versatility across multiple usage occasions. This demographic prioritizes functionality, comfort, and value-for-money considerations while simultaneously seeking products that align with their lifestyle aspirations and social identities.

Sustainability and environmental consciousness have emerged as significant purchasing factors among urban Vietnamese consumers. Brands that champion eco-friendly materials such as organic cotton, recycled fibers, and innovative production processes including clean dye technology resonate strongly with environmentally aware shoppers. This trend aligns with Vietnam's broader commitment to achieving net-zero emissions by 2050, as articulated at the 26th United Nations Climate Change conference (COP26), creating favorable conditions for brands that genuinely integrate sustainability into their value propositions and supply chain operations.

The proliferation of social media influencers and celebrity endorsements has fundamentally transformed brand awareness and aspiration dynamics within the athleisure category. Fitness influencers, athletes, and entertainment personalities actively promote wellness trends, specific brands, and lifestyle choices through digital platforms, creating powerful word-of-mouth effects that influence purchasing decisions among their follower communities. Brands increasingly leverage Key Opinion Leaders (KOLs) and produce relatable content showcasing styling tips, workout routines, and everyday scenarios that authentically connect with target consumers' lived experiences.

Technology integration within athleisure products represents another evolving consumer expectation. The development of smart textiles incorporating sensors to track biometric data, temperature-regulating fabrics adapted to Vietnam's tropical climate conditions, and garments with enhanced breathability and quick-dry properties appeal to tech-savvy consumers seeking optimized performance characteristics. This technological sophistication differentiates premium offerings while meeting practical needs specific to Vietnamese environmental contexts and usage patterns.

Brand positioning strategies increasingly emphasize cultural relevance and local identity. Vietnamese sportswear startups capture consumer attention through designs that blend affordability, cultural resonance, and functionality, tapping into national identity by incorporating traditional motifs and climate-appropriate fabrics that appeal to local preferences. These homegrown labels demonstrate agility in adapting quickly to fashion trends while offering value-driven alternatives to global brands, earning loyal customer bases through authentic connections and responsive product development approaches.

Future Outlook and Strategic Insights:

The future trajectory of Vietnam's athleisure market appears exceptionally promising, underpinned by favorable demographic trends, economic development momentum, and evolving consumer behaviors that collectively support sustained expansion through 2033 and beyond. Industry forecasts indicate the country's intensifying focus on health and wellness driven by economic prosperity, rising disposable incomes, and greater awareness of active lifestyle benefits.

Strategic positioning within omnichannel retail ecosystems will prove critical for brands seeking market leadership. Successful players must seamlessly integrate online and offline touchpoints, offering consumers flexible shopping experiences that combine digital convenience with physical product interaction opportunities. The expansion of local brands like Coolmate into offline retail through partnerships with major retailers including Aeon, WinMart, and Big C, alongside strategic pop-up locations in shopping malls, exemplifies this omnichannel imperative that balances customer acquisition efficiency with experiential brand building.

Product innovation and differentiation will remain paramount competitive imperatives as market maturity progresses. Brands must continuously invest in research and development initiatives encompassing material science advancements, design optimization tailored to Vietnamese body types and climate conditions, and advanced laboratory testing capabilities that ensure product quality and performance standards. Collaborations between sportswear brands and fashion designers, athletes, and celebrities create unique, limited-edition collections that generate market buzz while attracting new customer segments through fresh design perspectives.

International brand expansions signal growing confidence in Vietnam's market potential. In November 2024, Puma opened its first flagship store in Vietnam, strategically located in the Vincom Dong Khoi shopping mall in Ho Chi Minh City, supporting the brand's growth strategy across Southeast Asia where it initially entered in the 2000s. Such premium retail investments by established global players validate market attractiveness while intensifying competitive dynamics that elevate overall market sophistication and consumer expectations.

Regional market expansion strategies present compelling growth pathways for Vietnamese brands that have established strong domestic positions. Coolmate's ambitious vision targeting USD 500 million in revenue by 2030, achieving unicorn valuation status, and expanding into Southeast Asian markets including Thailand demonstrates the export potential of homegrown labels that successfully leverage Vietnam's manufacturing capabilities, cultural insights, and price-value positioning to compete regionally against established international competitors.

The integration of artificial intelligence and data analytics will increasingly influence competitive advantage. Brands that effectively harness consumer data to personalize product recommendations, optimize inventory management, forecast demand patterns, and deliver targeted marketing communications will achieve superior operational efficiency and customer engagement metrics.

Conclusion: Navigating Vietnam's Athleisure Revolution

The Vietnam athleisure market stands as a testament to the powerful convergence of demographic vitality, economic development, cultural transformation, and technological innovation reshaping Southeast Asian consumer landscapes. With exceptional growth projections, expanding domestic demand, robust manufacturing capabilities, and increasingly sophisticated consumer preferences, Vietnam presents compelling opportunities for both international brands seeking market expansion and local labels pursuing domestic dominance and regional growth trajectories. Success within this dynamic environment demands strategic clarity across multiple dimensions: authentic brand positioning that resonates with Vietnamese cultural values and lifestyle aspirations, omnichannel excellence delivering seamless customer experiences, continuous product innovation addressing evolving functional and aesthetic requirements, sustainable practices aligning with environmental consciousness, and digital integration leveraging e-commerce platforms and social media engagement.

As the market evolves through 2033, industry participants who master these strategic imperatives while maintaining operational agility to adapt to shifting competitive dynamics, regulatory environments, and consumer trends will capture disproportionate value creation opportunities. The Vietnamese athleisure revolution has only just begun—offering forward-thinking brands an extraordinary platform to build enduring market positions, drive meaningful growth, and contribute positively to the health, wellness, and lifestyle aspirations of Vietnam's rising consumer class.

Choose IMARC Group for Comprehensive Athleisure Market Intelligence:

Harness unparalleled market intelligence to drive strategic decisions in Vietnam's rapidly evolving athleisure landscape:

- Data-Driven Market Research: Gain a clear view of Vietnam’s athleisure market through reports covering consumer behavior, competitive positioning, and growth across mass and premium segments.

- Strategic Growth Forecasting: Identify upcoming trends in activewear, including innovation, sustainability, and lifestyle-driven demand within Vietnam and Southeast Asia.

- Competitive Benchmarking: Assess international brands, local players, and manufacturing strengths to uncover positioning opportunities and partnership prospects.

- Distribution Channel Intelligence: Understand Vietnam’s evolving retail ecosystem, from e-commerce and social commerce to traditional and hybrid models.

- Custom Reports and Consulting: Access insights tailored to your goals—market entry, product expansion, supply chain optimization, or regional strategy development.

At IMARC Group, we deliver the intelligence and foresight needed to succeed in Vietnam’s fast-growing athleisure sector. Partner with us to identify opportunities, enhance competitiveness, and shape long-term market success.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)