Australia’s Fantasy Sports Industry Embraces Blockchain Integration with New Investments

Introduction:

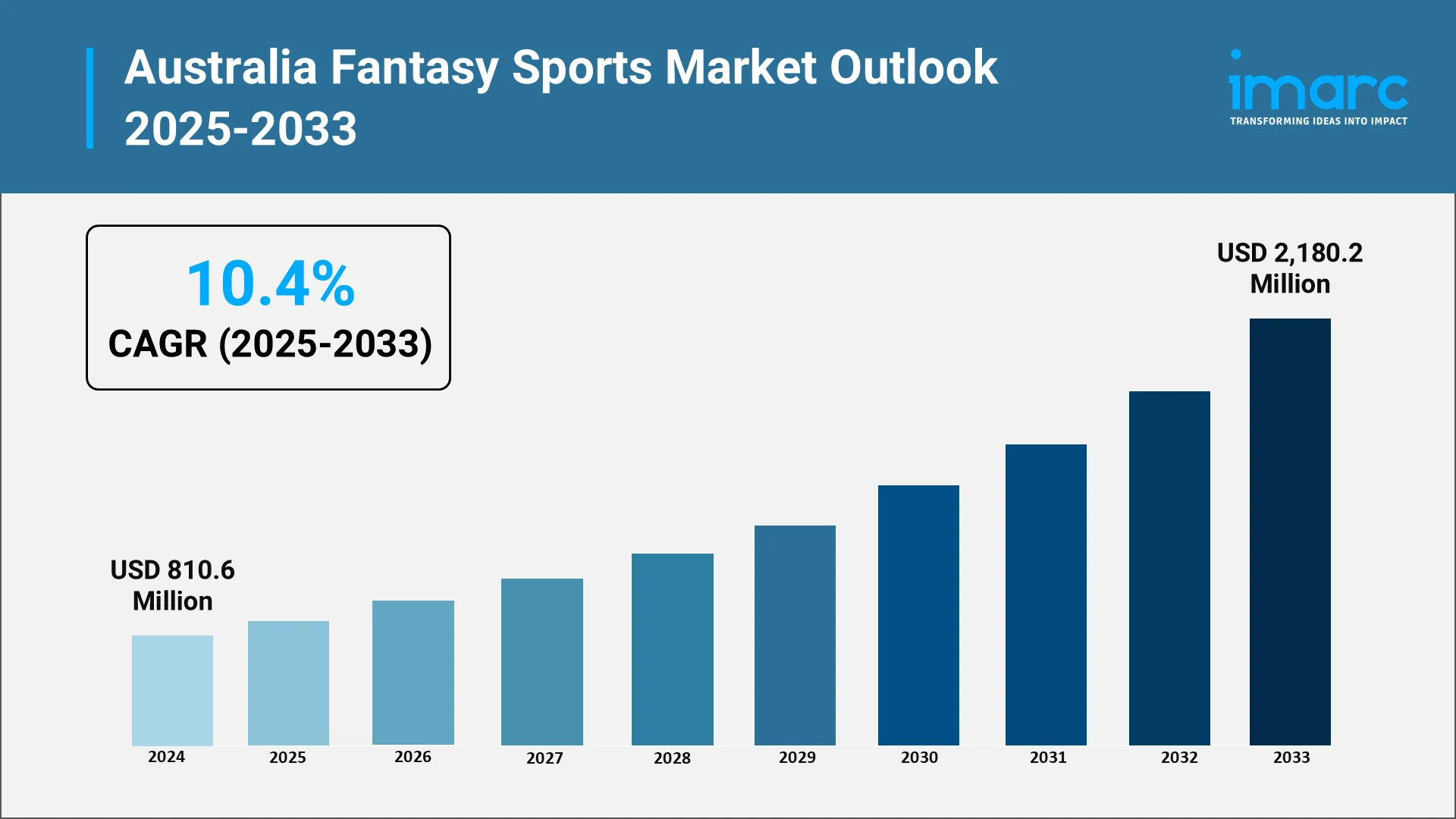

The Australian fantasy sports industry is entering a phase of heightened momentum, with market size for 2024 reaching approximately USD 810.6 Million, as detailed in a recent report. This market is forecast to reach USD 2,180.2 Million by 2033, representing a compound annual growth rate (CAGR) of 10.4% from 2025 through 2033. The growth is being driven by the rising interest in the Australia gaming console market, increased smartphone and app penetration, stronger engagement with domestic leagues such as the AFL and NRL, and the evolving regulatory environment that is opening up fantasy and online sports-gaming segments.

In addition to this, multi-platform access and cross-channel user engagement also support this growth trajectory. Also significant is the emerging convergence of fantasy sports with blockchain technology and Web3 mechanics, reflecting trends in digital asset ownership and decentralized gamification platforms. As the broader Australian sports betting market and the broader Australia gaming market mature, the fantasy sports sector is carving out its own path with distinct product formats, shorter-cycle contests (e.g., daily fantasy sports), and deeper integration with live data and mobile engagement.

Explore in-depth findings for this market, Request Sample

Role of AI, Impact, and Benefits in the Australian Fantasy Sports Industry:

Artificial intelligence is fundamentally transforming the Australian fantasy sports landscape through multiple value-creation pathways. Machine learning algorithms deliver personalized lineup recommendations, predictive player scoring models, and real-time strategic insights that democratize access to sophisticated analytics previously reserved for professional analysts. AI-powered dynamic pricing optimizes contest structures, entry fees, and prize pools based on demand patterns and user behavior. Operationally, natural language processing enables 24/7 automated customer support, while computer vision verifies player statistics and generates highlights.

Critically, AI-driven responsible gaming systems identify problematic behavior patterns, triggering interventions that protect vulnerable users and ensure regulatory compliance—positioning platforms favorably amid intensifying scrutiny from Australian consumer protection authorities and gambling regulators. Emerging technologies are reshaping the fantasy sports industry in Australia, and the integration of blockchain is among the most impactful. Globally, the fantasy sports industry size was valued at USD 28.95 Billion in 2024, evidencing early traction for decentralized models.

Platforms are incorporating tokenization of awards, immutable smart-contract-based prize mechanisms and NFT-style digital collectibles to build more transparent systems of user ownership and reward. For example, BlitzBets announced, in January 2025, a new fantasy sports platform that merges blockchain technology with the dynamic world of sports contests, thereby enhancing the gaming experience for fans worldwide, signaling this shift. As a result, Australian fantasy platforms are increasingly adding features such as token-gated contests, digital-asset trading within fantasy games, and mobile-first user interfaces driven by data analytics and live-match integration. These technology developments are likely to enhance user engagement, boost retention and create new monetization vectors beyond traditional contest entry fees. Typically, individuals aged 50-70 in Australia are the biggest crypto ATM users and account for almost 72% of transactions by value.

Top Companies in the Australian Fantasy Sports Industry:

Leading Australian fantasy sports operators are pursuing aggressive growth strategies through exclusive broadcast partnerships with networks like Fox Sports and Kayo, enabling seamless in-platform live streaming and synchronized gameplay. Recent studies reveal that 54% of sports fan engagement in Australia now happens beyond live match broadcasts, through activities like fantasy leagues and tipping contests. The reports highlight fantasy sports as one of the most popular interactive outlets among the nation’s 17 million active sports enthusiasts. In parallel with the expanding Australia sports betting market, companies are diversifying revenue through freemium models with premium subscription tiers, in-app merchandise sales, and white-label corporate league solutions targeting workplace engagement. Strategic collaborations with major sporting codes, including official AFL and NRL licensing agreements, enhance brand credibility and unlock co-marketing opportunities. Operators are also expanding demographically by launching women's sport-focused contests aligned with AFLW and WBBL growth, while investing heavily in influencer partnerships and grassroots community ambassador programs to drive user acquisition beyond traditional male-dominated segments.

Some of the most recent developments in the industry include:

- In June 2025, News Corp Australia acquired Melbourne-based Vapormedia, the technology developer behind the fantasy franchise SuperCoach. The move brings SuperCoach operations in-house, allowing stronger integration with content creators and advertisers. With over 430,000 active players and 700 million annual page views, News Corp plans to position SuperCoach as Australia’s leading fantasy sports innovation hub.

- In February 2025, Rugby League star James Tedesco partnered with GameDay Squad, Australia’s fastest-growing free-to-play fantasy sports platform. With over 500,000 downloads, the platform removes salary caps and weekly drafts, allowing fans to collect, trade, and manage teams year-round. As fantasy sports participation in Australia surges to 2.4 million players—double the figure from three years ago—GameDay Squad is positioning itself as a frontrunner in the nation’s evolving fantasy sports landscape.

Opportunities and Challenges in the Australian Fantasy Sports Industry:

Opportunities

- Tokenized rewards and digital collectibles: The adoption of token-based rewards and NFTs is unlocking new revenue streams while allowing players to own and trade digital assets. This sense of ownership enhances loyalty and long-term engagement. As these features evolve, they are likely to redefine the value proposition of fantasy gaming in Australia.

- Short-cycle daily fantasy contests: Demand for fast-paced, short-duration contests is rising as users seek quick engagement and instant gratification. These formats cater to both casual and competitive players, expanding the participant pool. They also offer operators higher engagement frequency and flexible monetization models.

- Women’s sports and niche leagues inclusion: The expansion into women’s leagues and niche sports provides a major opportunity to reach underrepresented audiences. Increased visibility and media coverage of these leagues are creating new engagement pathways. This diversification helps platforms appeal to a broader demographic beyond traditional male users.

- Cross-platform and mobile innovation: As mobile and streaming usage surge, seamless app integration and live updates are driving retention. Cross-platform compatibility allows users to engage anytime, anywhere, boosting overall participation. Platforms that blend mobile accessibility with real-time engagement will continue to outperform competitors.

- Blockchain transparency as differentiator: Blockchain-backed systems provide verifiable asset ownership and fair play, enhancing user trust. This transparency strengthens credibility in a market increasingly shaped by regulation. Early movers using blockchain are setting new standards for integrity and user assurance in fantasy sports.

Challenges

- User churn and acquisition-cost pressure: High competition has led to rising user acquisition costs and declining retention rates. Maintaining engagement now requires tailored content, innovative features, and active community management. Without sustained differentiation, platforms risk rapid churn and reduced profitability.

- Regulatory-licensing uncertainty across states: Inconsistent legal definitions and licensing processes across Australian states make compliance complex. This lack of uniformity limits scalability and increases operational costs for fantasy operators. Companies must invest heavily in legal oversight to ensure continued market access.

- Data-privacy and platform security risks: Fantasy platforms handle vast amounts of personal and financial data, making them prime targets for cyber threats. Strengthening security infrastructure is essential to protect user trust and meet evolving regulations. Any data breach could have lasting reputational and financial consequences.

- Seasonality and sport-calendar dependence: Engagement often peaks during major league seasons, causing off-season slowdowns. This dependence on sports calendars affects consistent revenue flow and user activity. Multi-sport offerings and year-round events are becoming essential to offset these fluctuations.

- Technological complexity of blockchain roll-out: Implementing blockchain features requires substantial investment in development, testing, and maintenance. The technology’s complexity can introduce integration risks and operational delays. Without careful execution, the benefits of decentralization may be outweighed by cost and instability.

Future Outlook: Australia's Fantasy Sports Industry:

Australia’s fantasy sports sector is poised for rapid expansion, supported by digital innovation, regulatory evolution, and growing fan engagement across multiple sports. As technology transforms how fans interact with their favorite games, platforms are exploring new monetization avenues, immersive experiences, and community-driven engagement to sustain long-term growth.

- Mobile and digital usage: Reflecting the shift to mobile-first sports engagement, the fantasy sports market in Australia is experiencing significant growth driven by high smartphone penetration and improved digital infrastructure. In Australia, ease of access to apps and real-time data enhances participation in fantasy sports contests.

- Sports fandom and year-round calendars: Australia’s strong sports culture and continuous scheduling across multiple leagues (AFL, NRL, Big Bash Cricket, etc.) support fantasy sports engagement throughout the year. This multi-sport ecosystem reduces seasonal revenue fluctuations and enables platforms to maintain consistent user engagement and cross-promotional opportunities across different sporting codes.

- Blockchain and Web3 innovation: Platforms are differentiating with blockchain-backed mechanisms, tokenization and NFTs. These blockchain-based features enhance transparency, enable verifiable ownership of digital assets, and create new revenue streams through player-owned economies and secondary marketplaces. Early adopters are leveraging these Web3 capabilities to attract tech-savvy demographics and crypto-native users.

- Regulatory shifts and monetization models: As fantasy sports gain regulatory clarity and new formats (daily, short-cycle contests) gain popularity, operators are able to deploy innovative revenue models and reach younger demographics. By way of illustration, the Australia fantasy sports report notes legalization of online betting and fantasy sports in a number of states as contributing to growth.

- User engagement and social features: Fantasy sports platforms are increasingly embedding community, social sharing, leaderboards and real-time tracking features. These enhancements are driving measurable increases in session duration and user retention rates. For instance, the free-to-play platform SuperCoach with 430,000 registered users in Australia reports users spending an average of 173 minutes monthly in May 2025.

In conclusion, Australia’s fantasy sports industry is evolving into a dynamic ecosystem that blends technology, entertainment, and social interaction. With continuous innovation in gameplay and engagement models, the market is well-positioned to capture the next generation of digitally native sports fans and establish itself as a major pillar of the country’s sports economy.

Why Choose IMARC for the Analysis of Australia’s Fantasy Sports Industry:

For stakeholders navigating Australia’s fantasy sports industry and its blockchain integration, the research team at IMARC Group brings value through rigorous methodology and industry-relevant insight.

- Detailed market-size metrics: The firm provides accurate estimates such as USD 810.6 million for the 2024 Australian fantasy sports market.

- Forecast models with clear assumptions: IMARC delivers growth projections (e.g., 10.4 % CAGR through 2033) and context around drivers, trends and risk factors.

- Cross-sector integration: The analysis connects fantasy sports data with developments in blockchain, mobile gaming and sports-digital ecosystems.

- Practical segmentation: Reports offer breakdowns by league type, platform and monetization model, enabling tailored insights for business strategy.

- Timely updates and regional focus: IMARC’s coverage includes region-specific markets like Australia, bridging global trends with local dynamics.

By leveraging this level of detail, industry participants can base their strategies on reliable evidence and up-to-date data rather than anecdotal commentary.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)