Australia Oil and Gas Industry: Energy Transition Drivers, Economic Impact, and Opportunities

Introduction:

Australia has firmly established itself as a dominant force in the global liquefied natural gas (LNG) market, maintaining its position as one of the world's leading exporters. The country's strategic geographical location in the Asia-Pacific region, combined with substantial natural gas reserves, has enabled it to become a critical energy supplier to rapidly growing Asian economies, particularly China, Japan, and South Korea.

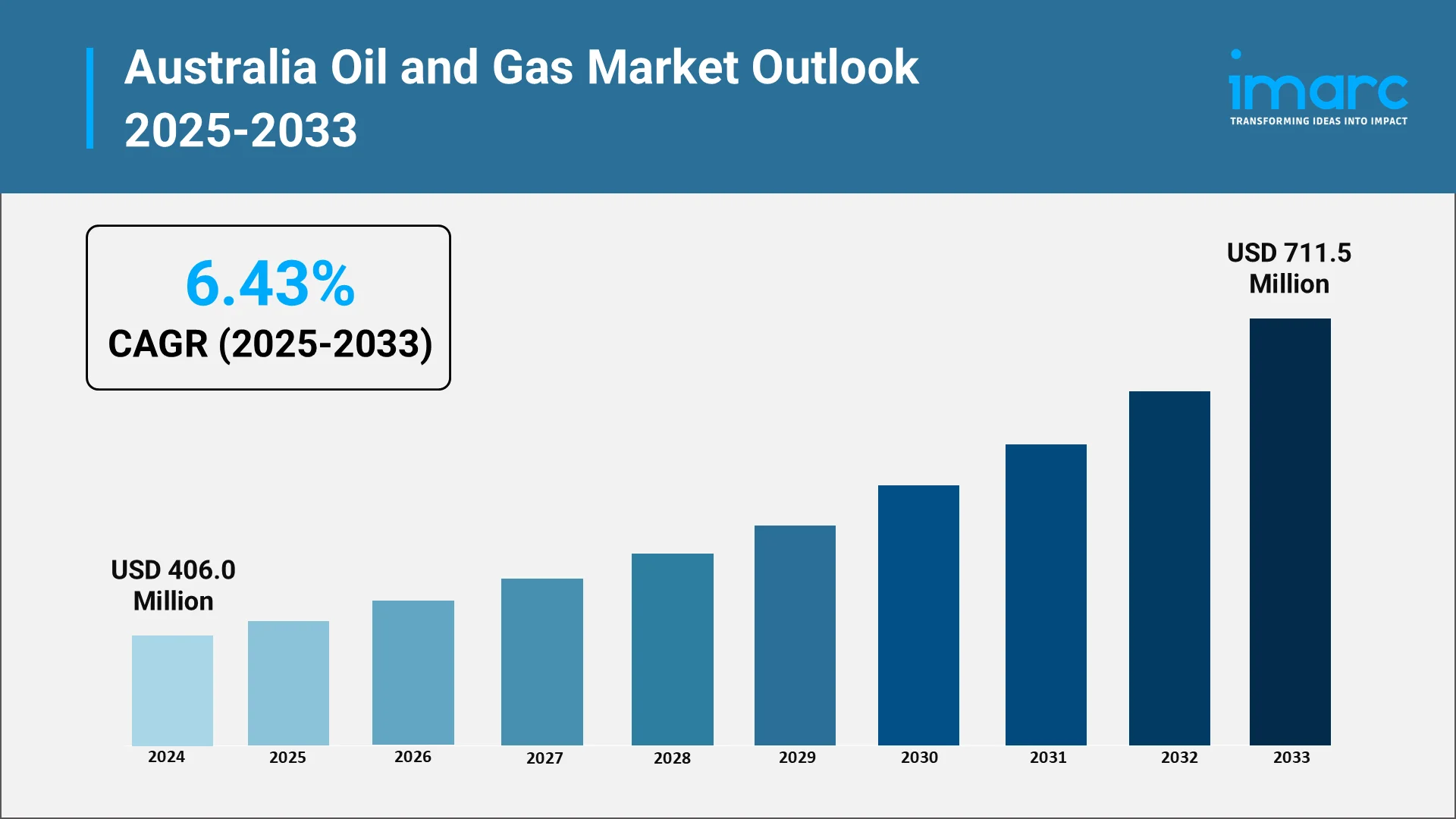

The Australia oil and gas market was valued USD 406.0 Million in 2024. However, this growth trajectory masks a more complex reality: while natural gas production continues to expand, crude oil production is experiencing a notable decline.

Explore in-depth findings for this market, Request Sample

Recent Market News and Major Research & Development:

Energy Transition and Carbon Capture Initiatives

The Australia oil and gas industry is undergoing significant transformation driven by sustainability imperatives and technological innovation. Carbon capture and storage (CCS) has emerged as a cornerstone technology for the sector's decarbonization strategy.

Major CCS Projects:

- Chevron's Gorgon Project: Currently the world's largest operational CCS project, located off Western Australia's coast, designed to store up to 4 Million Tons of CO2 annually in deep saline aquifers beneath Barrow Island.

- Santos Moomba CCS Project: Successfully launched in January 2025 in South Australia's desert region, this facility aims to capture and store 1.7 Million Tons of CO2 annually, demonstrating CCS viability at scale and enabling low-carbon hydrogen production.

- Inpex Bonaparte CCS Assessment: Joint ventures are exploring the Bonaparte basin's potential for geological CO2 storage to reduce emissions from LNG operations.

The Australian government has committed AUD 65 Million through the Carbon Capture Technologies Program to support seven CCU projects utilizing technologies such as mineral carbonization and direct air capture. As of July 2025, Australia operates two commercial CCS projects, with numerous others in development stages.

Digital Transformation and Technological Advancement

The industry is embracing artificial intelligence, machine learning, and automation to optimize production processes and enhance operational efficiency. Major operators are developing integrated digital platforms for real-time monitoring and decision-making, transforming traditional operational models.

Key technological initiatives include:

- Advanced analytics for exploration optimization

- Digital twins for asset management and predictive maintenance

- Automated drilling and production systems

- Real-time data integration across upstream and midstream operations

Hydrogen Economy Development

Australia's oil and gas companies are positioning themselves as key players in the emerging hydrogen economy:

- Woodside Energy's H2Perth Project: A large-scale hydrogen and ammonia production facility combining natural gas with CCS (blue hydrogen) and renewable energy (green hydrogen).

- Santos Hydrogen Exploration: Leveraging the Moomba CCS Project to produce low-emission hydrogen in South Australia.

- BP's Asian Renewable Energy Hub Partnership: Developing large-scale renewable hydrogen and ammonia production in the Pilbara region.

Infrastructure Developments

Major projects shaping the industry:

- Scarborough Gas Field Development: Woodside's USD 12.5 Billion project off Western Australia, despite facing environmental challenges and legal opposition, received all primary environmental approvals by August 2025.

- Browse Gas Project: After years of delays, Woodside is advancing plans for two 360-meter-long floating production storage and offloading (FPSO) facilities to deliver approximately 10 million tonnes per annum of gas.

- Crux Project: Shell Australia's natural gas field development in the Browse Basin includes an unmanned platform with five production wells designed to support the Prelude FLNG facility.

- Vopak LNG Import Terminal: Secured a floating storage and regasification unit (FSRU) for Port Phillip Bay, Victoria, addressing gas shortage concerns in southeast Australia with operations expected to begin around 2029.

Top Companies in the Australia Oil and Gas Industry:

Woodside Energy Group Limited

Australia's largest oil and gas company following its 2022 merger with BHP's oil and gas assets, Woodside leads the country's natural gas production and accounts for approximately 5% of global LNG supply. The company achieved a net profit after tax of USD 3.57 Billion for 2024, representing a 115% increase year-over-year, bolstered by the successful startup of the Sangomar offshore oil project in Senegal.

Key Operations:

- North West Shelf Project (operator)

- Pluto LNG facility

- Browse Basin developments

- Scarborough gas field

Santos Limited

Australia's second-largest oil and gas producer, Santos operates multiple joint ventures including the Papua New Guinea LNG project and the Gladstone LNG project in Queensland. The company reported USD 5.4 Billion in sales revenue and USD 1.9 Billion in free cash flow for 2024.

Recent Achievements:

- Secured a 10-year LNG supply agreement with Japan's Hokkaido Gas for 400,000 tonnes annually starting 2027

- Announced new oil discovery on Alaska's North Slope in March 2025

- Successfully launched the Moomba CCS project in South Australia

Chevron Australia Pty Ltd

As a major international player with significant Australian operations, Chevron operates the Gorgon and Wheatstone LNG projects and holds substantial interests across Western Australia's gas basins. The company's Gorgon CCS project represents a landmark investment in emission reduction technology.

Shell Energy Holdings Australia

Shell maintains extensive operations across Australia's upstream, midstream, and downstream sectors, including participation in multiple LNG projects and exploration activities. The company is actively investing in the energy transition through hydrogen projects and renewable energy initiatives.

BP Australia Pty Ltd.

BP operates significant upstream assets including interests in the North West Shelf project and various exploration permits. The company is partnering on major renewable hydrogen initiatives, particularly the Asian Renewable Energy Hub development.

ExxonMobil Australia Pty Ltd

Through its Esso subsidiary, ExxonMobil operates the historic Gippsland Basin Joint Venture with BHP, which has produced more than half of all crude oil ever produced in Australia and 17% of all-natural gas consumed domestically. The company invested over USD 500 Million in domestic gas supply projects in 2024, including the Kipper 1B and Turrum Phase 3 developments.

Origin Energy Limited

Origin Energy is a key integrated energy company in Australia's oil and gas sector. It focuses on natural gas, particularly through its major role in the APLNG venture, supplying both domestic and LNG export markets. Origin Energy is an integrated Australian energy company. Its core oil and gas activity is focused on natural gas production as the upstream operator of the major APLNG joint venture, supplying both domestic and LNG export markets.

Opportunities and Challenges in the Australia Oil and Gas Industry:

Key Opportunities:

- Infrastructure Repurposing

Decommissioned oil and gas facilities present opportunities for repurposing into offshore wind farms, CCS facilities, hydrogen production hubs, and marine conservation centers, extending asset value while supporting the energy transition.

- Digital Innovation

The adoption of AI, machine learning, big data analytics, and IoT technologies creates immense opportunities to reduce costs, optimize production, enhance safety, and improve environmental performance across all operations.

- Strategic Location

Australia's proximity to major Asian energy markets provides a competitive advantage for LNG and emerging hydrogen exports, supported by established trade relationships and reliable supply chains.

Major Challenges:

- Declining Exploration and Reserves

Offshore exploration activities have plummeted dramatically, with new wells falling from over 50 in 2010 to just 3 in 2023. This 20-year decline in exploration threatens future production capacity and raises concerns about long-term supply, particularly as mature fields like Gippsland Basin experience depletion.

- Regulatory and Policy Uncertainty

The industry's investment climate and long-term planning are significantly complicated by regulatory and policy uncertainty, stemming from a complex and evolving landscape that includes domestic gas reservation requirements, tightening Safeguard Mechanism emission limits, and potential future carbon pricing mechanisms. Furthermore, project timelines are frequently hampered by regulatory hurdles such as environmental approval delays and stringent indigenous heritage protection obligations, collectively creating considerable instability that dampens confidence for major capital deployment.

- Decommissioning Obligations

As assets approach end-of-life, decommissioning activity is accelerating, presenting both technical challenges and significant financial obligations. Australia's refining capacity has already declined dramatically, from 457,000 to 229,000 barrels per day.

Future Outlook: Australia Oil and Gas Industry

The Australia oil and gas industry is undergoing a fundamental restructuring, shifting from high-growth expansion to strategic optimization amid divergent production paths and a challenging global export outlook. By 2033, the market is projected to reach USD 711.5 Million, exhibiting a growth rate (CAGR) of 6.43% during 2025-2033.

To remain competitive, producers must secure new LNG contracts in a buyer's market, pivot focus to emerging price-sensitive markets, and urgently deploy technology—such as AI and automation—to offset structural cost disadvantages and implement Carbon Capture and Storage (CCS) to meet rising environmental standards. While the sector's long-term role will diminish (projected market value of USD 711.5 million by 2033), natural gas remains a critical transitional fuel for grid stability and a foundation for the emerging hydrogen export pathway. Success depends on a strategic imperative: shifting from expansion to low-cost operational excellence, diversifying portfolios into low-carbon technologies, and working proactively with government to establish a stable, predictable policy framework.

Partner with IMARC Group for Strategic Market Intelligence:

- Data-Driven Market Research: Deepen your understanding of the Australia oil and gas sector through comprehensive market research reports covering production trends, LNG export dynamics, energy transition technologies, and regulatory developments shaping the industry's future.

- Strategic Growth Forecasting: Predict emerging trends in energy markets, from carbon capture and storage projects to hydrogen economy developments, offshore exploration opportunities, and digital transformation initiatives across major producing regions.

- Competitive Benchmarking: Analyze competitive forces in the Australian oil and gas market, review major operators' strategies, assess infrastructure developments, and monitor technological breakthroughs in LNG production, CCS deployment, and emission reduction technologies.

- Policy and Infrastructure Advisory: Stay ahead of regulatory changes, government energy policies, domestic gas security mechanisms, environmental approval processes, and investment incentives affecting exploration, production, and export operations.

- Custom Reports and Consulting: Receive tailored insights aligned with your organizational objectives—whether entering the Australian energy market, investing in LNG infrastructure, developing low-carbon energy projects, or navigating the transition to sustainable operations.

At IMARC Group, our goal is to empower energy sector leaders with the clarity and intelligence required to navigate Australia's complex oil and gas landscape. Join us in shaping a sustainable energy future—because strategic insights drive competitive advantage. For more details, click: https://www.imarcgroup.com/australia-oil-gas-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)