Impact of AI in Indian Electric Vehicle (EV) Industry

_11zon.webp)

Introduction:

India's electric vehicle market is undergoing a profound transformation, impelled by green priorities, economic imperatives, and changing consumer trends. With rising concerns about air pollution and fossil fuel dependence, electric mobility has become a strategic option for India's transport industry. Policy clarity, technology development, and an emerging ecosystem of makers and suppliers are driving this market shift. Electric cars are now viewed not as niche products but mainstream options that provide long-term benefits. According to industry reports, in February 2025, electric vehicle registrations in India stood at 1.47 lakh units in 2024, increasing by over double from 73,000 units in 2023, representing the highest growth in the annual EV segment.

India electric vehicle sales have been growing steadily, especially in the two- and three-wheeler segments, given their congruence with daily commute and urban transportation requirements. As per reports, electric two-wheelers comprised 57.5% and electric three-wheelers 37% of India's overall 19.49 lakh EV sales in calendar year 2024. Moreover, increasing usage of AI in electric vehicles India is also driving this shift, with automation, data analytics, and machine learning (ML) transforming vehicle behavior, maintenance, and efficiency. From smart route guidance to intelligent diagnostics, AI is serving a pivotal role in making EVs more user-friendly and operationally feasible.

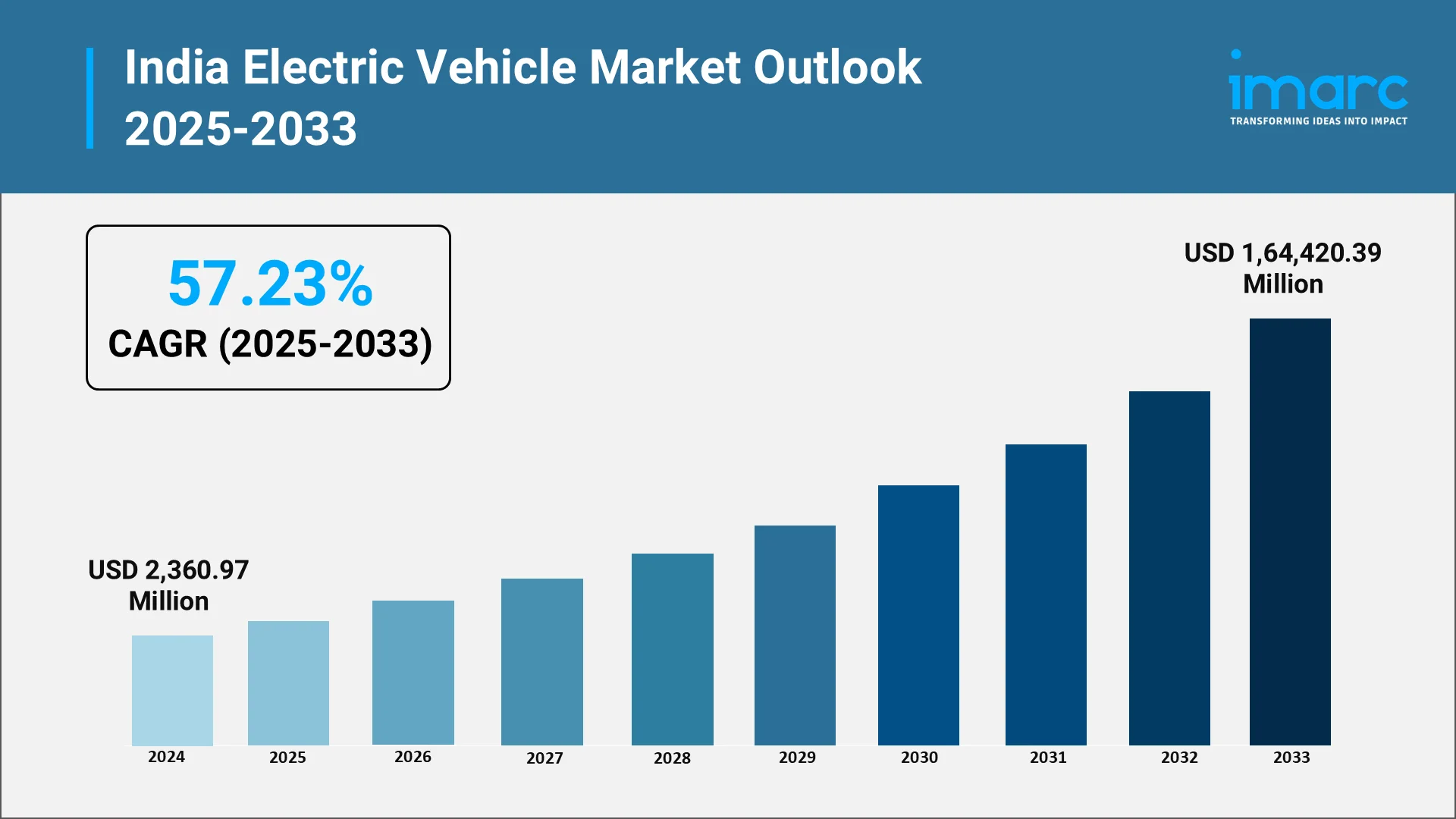

Market Size Projections and Forecast (2025–2033):

The India EV market forecast envisions long-term aligned with national energy and sustainability goals. According to IMARC, the India electric vehicle market size was valued at USD 2,360.97 Million in 2024., estimating the market to reach USD 1,64,420.39 Million by 2033, exhibiting a CAGR of 57.23% during 2025-2033. Moreover, this transition is anticipated to cut across urban and rural markets, increasing green mobility access to various income groups and application areas. Government measures, declining battery prices, and rising consumer awareness are collectively creating a scenario in which electric vehicles constitute a significant proportion of new automobile sales.

Urban areas are highly using EVs for private ownership, public transportation, and business delivery services. In November 2024, Flipkart expanded its EV delivery fleet in India to 10,000 electric vehicles, boosting last-mile delivery efficiency by 20% and lowering hub-level cost per order significantly. Furthermore, rural and peri-urban regions are also starting to follow suit, mainly through electric two- and three-wheelers. With increasing product offerings and diversity, this trend is likely to continue across geographies and economic classes.

Market projection also takes into consideration the emergence of domestic manufacturing and the local production of key EV components. This shift aligns with national goals for self-reliance, export growth, and global competitiveness in electric mobility. The changing ecosystem also indicates a deeper convergence of consumer aspirations, green objectives, and industrial policy, paving the way for sustained growth and innovation.

Explore in-depth findings for this market, Request Sample

Major Factors Driving Sales of the India EV Industry:

Government Incentives & Policies

- Public policy has played a key role in facilitating electric vehicle adoption in India. In September 2024, the Government of India sanctioned the INR 10,900 crore PM E-DRIVE Scheme (S.O. 4259 E) by the Ministry of Heavy Industries to promote 28,87,079 EVs from October 2024 to March 2026. Furthermore, governments at the center and the states have launched various schemes to reduce the cost of owning an EV. These schemes include subsidies for the purchase of EVs, exemptions from taxes, and low-interest loans. These initiatives have reduced the entry point for new buyers and made EVs a feasible option for daily usage and business use.

- On the manufacturing side, incentives for local production of batteries and EV components have catalyzed domestic investment and innovation. This support structure extends to startups and technology providers, facilitating a multi-dimensional growth environment. As the policy landscape becomes more stable and predictable, it continues to instill confidence in both consumers and industry players.

Rising Fuel Prices & Cost Savings on Operation

- The economics of running electric vehicles provide a strong argument for their use. Conventional fuel prices are still volatile and tend to add to the burden on domestic and business budgets. Compared to this, EVs give a stable and much lower per-kilometer expense, making for better budget planning and long-term gains. In June 2025, a report showed that electric vehicles in Indian logistics offered a 15–20% lower cost of total ownership compared to diesel, with electric 3-wheelers at INR 2.5–INR 3.1/km and small 4-wheelers at INR 7.5–INR 9/km.

- Fleet operators, logistics companies, and personal commuters increasingly see EVs as an affordable option. Reduced maintenance needs and lower mechanical complexity also tip the balance in favor of moving away from internal combustion and towards electric powertrains. Cost-effectiveness, combined with improved user experience, has turned EVs into a rational and environmentally friendly mobility option.

Key Industry Trends:

Record-Breaking EV Sales in India

- More consumers are switching to EV’s in different segments. Two-wheelers dominate the market with their light weight, low cost, and suitability for urban routes with heavy traffic. Three-wheelers used for the last-mile connectivity and goods delivery have also gained popularity among small business owners and transport aggregators.

- The growth in India electric vehicle sales reflects growing confidence in the technology, enhanced product offerings, and improved user experience. As per the reports, in April 2025, India logged a record 167,629 electric vehicle sales, its highest-ever monthly volume due to sky-high fuel prices and growing operational cost advantages, a 45% year-on-year increase. Moreover, charging infrastructure and service networks are also changing in step, making EVs more convenient for daily use. This consumer-driven momentum supports rapid market expansion and broader adoption across regions and demographics.

Artificial Intelligence Transforming the EV Landscape

- AI in electric vehicles in India is building a more intelligent and responsive environment. AI-powered vehicles can track battery health, suggest optimal driving practices, and give real-time system diagnostics. According to reports, in July 2025, MediaTek revealed plans to expand its presence in India's EV market, tapping local AI brains and increasing demand for high-performance auto SoCs and intelligent computing solutions. Additionally, predictive models for maintenance reduced unscheduled breakdowns, and energy-efficient algorithms contribute to range extension and optimal power usage.

- AI enables personalization, allowing cars to learn the habits and preferences of users. Navigation systems leverage machine learning to recommend optimal routes based on traffic, charging points, and terrain. In business use, AI helps with fleet management, route optimization, and driver monitoring, enhancing operational efficiency and safety.

- This technological revolution makes EVs smart systems, transforming them from mere transport modes into integrated digital ecosystems. The convergence of electric mobility and AI is among the most revolutionary drivers that are reshaping India's transport sector future.

Government Push for Localized EV Ecosystem

- The shift toward self-reliance is a cornerstone of India’s EV growth strategy. Programs aimed at promoting local production of batteries, motors, and control systems are reducing dependence on imported technology. As per the reports, in July 2025, the Ministry of Heavy Industries unveiled AMP 2047, a 20-year masterplan to make India an EV and auto manufacturing powerhouse globally under the 'Viksit Bharat @2047' vision. Moreover, this localization not only drives down costs but also fosters innovation tailored to Indian road conditions, climate, and usage patterns.

- Manufacturers are increasingly procuring components locally, opening up new business prospects throughout the supply chain. Research and development activities also in India are centered on energy storage, thermal management, and light-weight materials. These help increase the durability, efficiency, and responsiveness of products to Indian consumers' expectations.

- The thrust for localization enhances the overall competitiveness and resilience of the electric vehicle market in India. It also strengthens India’s position in the global EV market.

EV Financing and Insurance Innovation

- Access to low-cost finance has been a bottleneck for most EV customers, especially those in lower-income groups. Banks are now introducing tailored loan products and payment schedules to fill this gap. Solutions like Battery-as-a-Service (BaaS) and lease-to-own arrangements lower the initial cost and provide more flexibility.

- AI is also impacting insurance by enabling usage-based pricing. Vehicle usage, driver habits, and environmental data in real-time enable insurers to craft customized policies with enhanced risk estimates. It enhances transparency and brings EV insurance within reach for a broader customer base.

- Financing and insurance innovations are paramount to mass adoption. They give more individuals the ability to view EVs as affordable and sensible, opening up market reach and accessibility.

Expanding Charging Infrastructure

- A strong and widespread charging network is critical for making EVs mainstream. In India, there has been a steady rise in the number of public and private charging stations driven by government initiatives and private sector investment. These charging stations are increasingly becoming part of digitized platforms for payment, booking, and navigation. According to reports, in February 2025, Tata Motors announced it would expand its EV charging network by more than two times to 400,000 points over two years, comprising 30,000 public chargers and 500 fast-charging 'Mega Charger' locations.

- Innovative smart charging technology is also on the horizon, with AI-powered chargers that can perform load balancing, dynamic pricing, and energy optimization. These aspects provide an improved user experience while minimizing grid stress, particularly during peak demand times. Infrastructure for charging is also made increasingly available in residential apartment complexes, office premises, and public areas.

- The growth in infrastructure has a direct support towards Electric Vehicle Adoption in India by minimizing the range anxiety and enhancing the convenience. With more and more cars on roads, investment in this segment will be necessary again to make sure that the EV ecosystem is seamless and scalable.

Market Segmentation & Participant Insights:

Segmentation By Vehicle Type:

- Two-Wheelers: These are the most affordable mode of electric mobility in India. Suitable for everyday commutes and short-distance travel, electric two-wheelers are being embraced quickly by young working professionals, students, and gig economy workers.

- Three-Wheelers: This category is going through accelerated electrification, particularly in urban and semi-urban pockets. Often employed for shared transport and delivery services, electric three-wheelers provide an economical and efficient option compared to fossil-fuel-based models.

- Passenger Cars: Electric vehicles are slowly gaining popularity among urban families and environmentally aware consumers. Both compact city vehicles and luxury models are now being launched with improved range, intelligent features, and competitive costs.

- Commercial Vehicles: This encompasses electric buses and light trucks used for public transport and last-mile logistics that are now being employed more and more. Fleet electrification is gaining traction among logistics companies and municipal authorities.

This segmentation highlights the diverse use cases and consumer preferences shaping the Electric Vehicle Market in India. Each category contributes uniquely to the broader electrification journey, creating a balanced and inclusive growth story.

Top India Electric Vehicle (EV) Companies & Manufacturers:

India's Electric Vehicle (EV) ecosystem has a multiplicity of major players fueling growth across segments. Major OEMs, such as Tata Motors, Ola Electric, Ather Energy, Mahindra Electric, and Hero Electric are building portfolios in electric cars, scooters, and three-wheelers. For instance, in March 2025, Mahindra & Mahindra launched its electric SUV, the BE.06, and the XUV.e9 on its INGLO platform. Both vehicles are equipped with Monroe's CVSAe smart suspension and Mahindra's MAIA AI technology, a major leap for the company's EV product lineup. Moreover, startups like Bounce Infinity, Revolt Motors, and Euler Motors are disrupting battery-swapping, AI-based bikes, and cargo mobility. Charging and battery providers, like Exide, Amara Raja, Sun Mobility, and ChargeZone facilitate the EV ecosystem with high-end energy solutions. Tech enablers are also levergaing AI and telematics to improve fleet management, connectivity, and efficiency in India's expanding electric mobility landscape.

Growth Drivers:

A number of structural drivers are propelling the continued growth of the EV industry in India:

- Central and state government policy support coupled with targeted financial incentives.

- Innovation in technologies to improve battery performance, reduce costs, and improve vehicle range.

- The adoption of AI and data-driven decision-making in product design, service delivery, and user engagement.

- Growing urbanization and e-commerce growth, which require efficient and sustainable transportation solutions.

- ESG requirements and corporate sustainability objectives that challenge companies to invest in electricity-driven fleets and decrease emissions.

These growth catalysts represent a convergence of innovation, market demand, and policy positioning India's EV sector for sustainable transformation and global clean mobility leadership in the years to come.

Conclusion:

IMARC Group empowers stakeholders across the electric vehicle and advanced mobility ecosystem with data-driven insights and strategic foresight to thrive in India’s rapidly evolving EV market. As electric mobility gains accelerating momentum and AI reshapes automotive innovation, our research enables clients to navigate disruption and lead with confidence through:

- Market Intelligence: Assess India Electric Vehicle Adoption trends, battery lifecycle innovation, and Artificial Intelligence use in vehicle operations, diagnostics, and fleet management.

- Strategic Forecasting: Assess long-term India EV Market Forecast scenarios considering consumer behavior, localization policies, and the intensification of clean transport infrastructure.

- Competitive Benchmarking: Track smart mobility developments, autonomous EV features, and Artificial Intelligence-driven charging networks influencing India electric vehicle industry trends.

- Regulatory & Policy Mapping: Interpret central and state-level EV policies, incentives, GST benefits, and localization mandates that directly impact India Electric Vehicle Sales and manufacturing priorities.

- Customized Advisory: Offer tailored solutions—from AI integration in connected EV platforms and digital twin applications to battery innovation strategy, market entry planning, and supply chain localization.

As India races toward a greener, tech-enabled automotive future, IMARC Group stands as a trusted partner, helping businesses harness the power of innovation, policy alignment, and consumer shifts to drive sustainable growth in the electric vehicle market in India.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

-(1)_11zon.webp)