Key Challenges and Opportunities Shaping the Japan Power Electronics Industry

Introduction to the Japan Power Electronics Market:

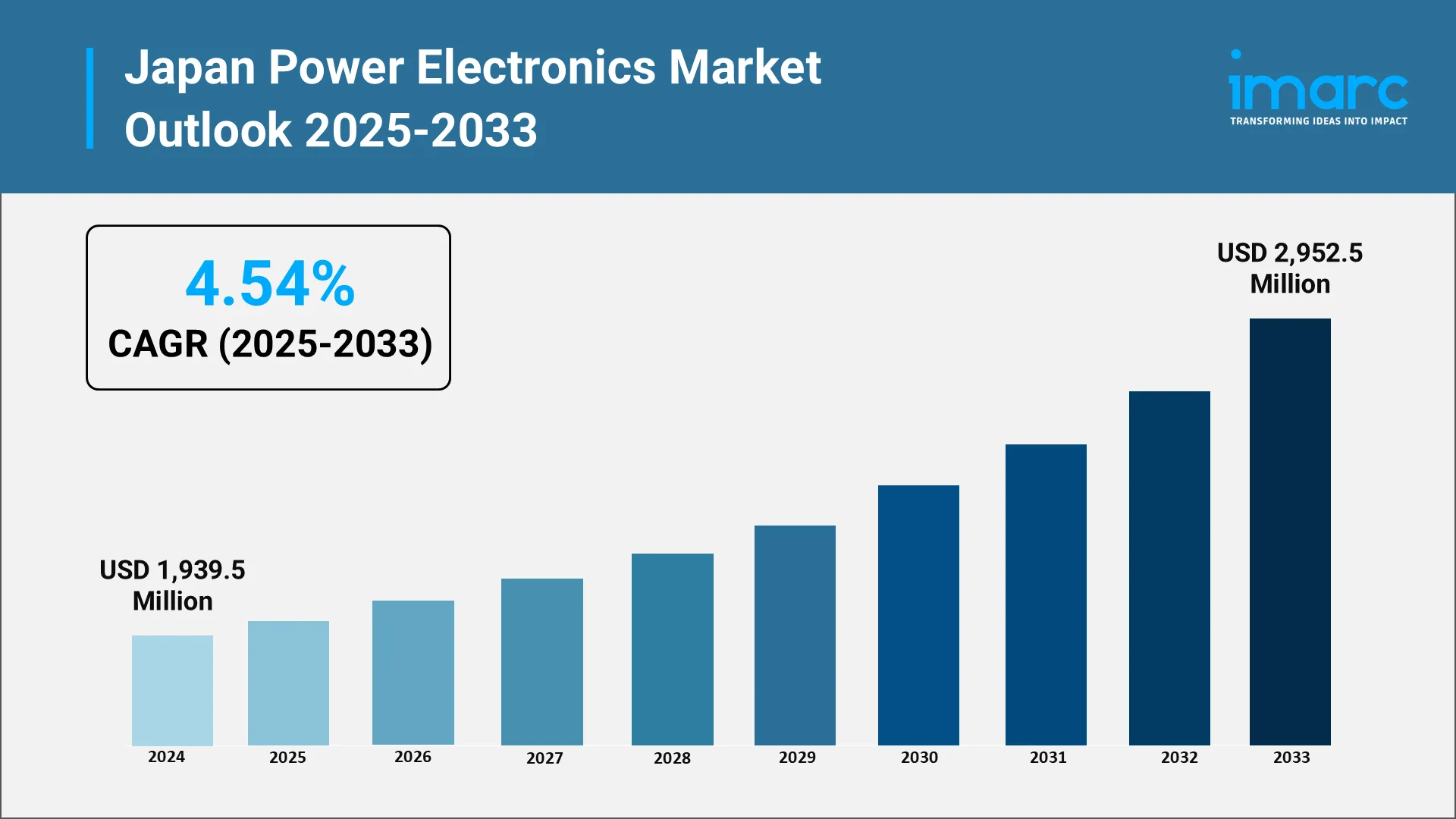

The Japan power electronics market is poised to grow substantially, driven by rising demand in automotive, energy, industrial automation, and infrastructure sectors. According to IMARC Group, the Japan power electronics market is studied from 2019 to 2024 with projections extending to 2033.

Power electronics — covering devices such as inverters, converters, power modules, discrete switches, and integrated power ICs — serve as essential building blocks for energy conversion, regulation, and control. Japan’s unique mix of domestic demand (highly automated factories, advanced transport) and national commitments to decarbonization create both challenge and opportunity for players in this domain.

Explore in-depth findings for this market, Request Sample

Rising Demand Across Automotive and Industrial Applications

- Automotive Electrification Driving Growth

The shift toward electric vehicles (EVs) is reshaping the power electronics landscape worldwide. Japan’s automotive industry—home to major OEMs and tier-1 suppliers—is pushing aggressively into electrification. Power inverters, DC–DC converters, onboard chargers (OBCs), and battery management systems (BMS) all depend heavily on advanced power electronics.

Globally, the power electronics market is forecast to grow from a revenue of about USD 32.96 Billion in 2024 to USD 52.38 Billion by 2033. Japanese firms are well positioned to capture parts of that growth, given their existing expertise in automotive electronics and reliability demands. Domestic automakers and suppliers increasingly demand components with higher efficiency, lower losses, smaller footprints, and greater thermal robustness.

- Industrial Automation, Robotics, and Process Electrification

Japan is a leader in robotics, factory automation, semiconductor manufacturing, precision equipment, and high-end industrial machinery. All of these systems increasingly depend on power conversion, motor drives, variable frequency drives (VFDs), and real-time power control. The global power electronics trends highlight that industrial motor drives remain a major volume driver.

In semiconductor fabs or data centers, power electronics must manage high current densities, maintain low electromagnetic interference, and handle fast switching. Japan’s strengths in precision manufacturing, thermal design, and reliability give it an edge—but only if innovation keeps pace.

- Infrastructure & Grid Edge Demand

Japan has also begun integrating power electronics deeply into grid infrastructure, such as static VAR compensators, grid-tied inverters for renewable plants, and energy storage interface systems. As Japan liberalizes its electricity market and opens new grid services, demand for advanced converters, grid controllers, and power conditioning systems will follow.

Technological Advancements and Innovation in Power Devices:

- Wide Bandgap Semiconductors (SiC, GaN) as Enablers

One of the strongest trends is a shift from silicon-based devices (IGBTs, MOSFETs) to wide bandgap (WBG) materials such as silicon carbide (SiC) and gallium nitride (GaN). WBG devices offer lower conduction and switching losses, higher temperature operation, and greater switching speeds. Japan’s research institutions, semiconductor firms, and device fabs are investing in these areas.

- Advanced Packaging, Thermal and Reliability Engineering

As switching speeds rise, thermal management and packaging become bottlenecks. Japan’s semiconductor and materials firms are exploring advanced packaging techniques (e.g. chip-scale packaging, substrate materials, 3D interconnect) and cooling methods (liquid cooling, heat pipes, novel substrates) to keep performance stable over long life cycles. The challenge is to design packaging that maintains reliability under harsh temperature cycling, vibration, and long-term drift.

- Integration and System-Level Intelligence

Pure device innovation is no longer enough: system integration, smart sensing, and control loops are becoming differentiators. Embedding real-time diagnostics, adaptive switching control, and predictive maintenance (e.g. self-healing, fault detection) into power modules is gaining traction. Japanese firms can leverage strength in sensor integration, AI, and control.

- Materials, Nanotechnology, and Alternative Substrates

Beyond SiC/GaN, Japan’s materials science base is exploring novel materials, substrates, and dielectric compounds to reduce parasitic inductance, improve breakdown voltage, and reduce device footprint. Research in wide bandgap alloys, ultra-low loss dielectrics, and next-gen packaging materials matters more as demands scale.

Government Policies and Energy Efficiency Regulations:

- National Targets: GX, Decarbonization, Strategic Energy Plans

In February 2025, Japan approved the Seventh Strategic Energy Plan. It aligns with a national goal to reduce greenhouse gas emissions by about 73 % by FY2040 (versus FY2013). The plan supports stable energy supply, economic growth, and decarbonization via policies dubbed “GX” (Green Transformation).

Under GX, Japan is pushing investments in renewables, hydrogen, energy storage, and energy efficiency. Power electronics is at the heart of many of these solutions.

- Energy Efficiency Legislation & Benchmarking

The cornerstone policy is the Act on the Rational Use of Energy, known informally as Japan’s energy conservation law, first passed in 1979. This is supplemented by programs like the Top Runner program (which enforces efficiency standards on appliances and devices) and industrial benchmarking measures.

METI (Ministry of Economy, Trade and Industry) continually revises energy efficiency standards for transformers, inverters, and other power equipment. Utilities and manufacturing facilities (especially large energy users) must file periodic reports and adhere to benchmarking targets.

- Incentives, Subsidies, and Regulation

To spur green transformation, incentives, grants, and subsidies are provided for renewable deployment, storage, smart grid trials, and energy-efficient equipment. JETRO notes that FIT (feed-in tariffs), FIP (feed-in premiums), and local government programs help support renewable and storage rollouts. On the regulation front, utilities are being deregulated, retail markets liberalized, and grid access rules reformed.

The stricter efficiency standards and regulation push OEMs and power electronics firms to meet tighter loss targets, higher reliability, and lower parasitic values. These requirements escalate R&D and capital burden, especially for smaller players.

Key Challenges: High Costs and Supply Chain Constraints

- High Manufacturing and Material Costs

Wide bandgap devices, advanced substrates, and premium packaging technologies come with high initial costs, and yields are often low in early fabrication. Many Japanese firms must contend with capital-intensive fabs, expensive materials, and small margins in the early phases of adoption.

Cost competition from foreign players—especially from China, South Korea, and Taiwan—is intense. Maintaining performance leadership while managing cost pressure is a delicate balance.

- Supply Chain Disruptions and Rare Materials

Input dependencies are a serious threat. For instance, SiC wafers, GaN epitaxy, specialized substrates, hermetic packaging materials, rare metals, and precision ceramics may depend on limited global supply or critical material imports. Global supply chain shocks (pandemic, geopolitical friction, shipping delays) can upend procurement. The power electronics industry globally is reinforcing resilience across supply chains.

- Thermal, Packaging, and Reliability Bottlenecks

As switching speeds and power densities rise, thermal and packaging constraints become harder to overcome. Aging, reliability under harsh environments, and field failures can damage reputation and market trust. The margin for error narrows.

- Fragmentation and Regulatory Complexity

Domestic regulation, energy efficiency norms, import/export controls, safety certifications (e.g. for automotive), and grid interconnection standards vary by region or utility. Navigating this regulatory patchwork increases cost and time. In addition, companies often must localize designs to meet Japanese quality and safety standards, which can slow time-to-market.

- Market Saturation and Intense Competition

The Japan electronics ecosystem is crowded. Established firms like Toshiba, Mitsubishi Electric, Hitachi Power Semiconductor Device already compete heavily. New entrants must differentiate technologically or via cost-efficiency. Rapid innovation cycles and short product life spans demand continuous investment.

Additionally, some domestic demand is met by imports due to lower production costs abroad. Competing with low-cost foreign components while maintaining Japanese reliability standards is a constant struggle.

Emerging Opportunities in Renewable Energy and Smart Grids:

- Grid-Tied Inverters, Energy Storage, Microgrids

Japan plans to dramatically expand renewable capacity. To integrate intermittent wind and solar generation, advanced power electronics will be needed: grid-tied inverters, power conditioning units, control systems, battery interface, bidirectional converters, and microgrid controllers.

Energy storage systems (ESS) combined with renewables demand efficient converters and charge/discharge controllers. As costs decline, the pairing of solar-plus-storage becomes economically viable and presents scale opportunities.

- Smart Grid, Demand Response, and Power Electronics as Grid Asset

Japan’s power market liberalization (with full retail liberalization since 2016 and T&D unbundling as of 2020) opens doors for grid services, demand response, and distributed energy integration. In this regime, power electronics can act as active grid assets — supporting voltage regulation, frequency stability, reactive power control, and grid resilience.

Japan also plans to increase electricity output by 35–50 % by 2050 to meet demands from AI, chip fabs, and data centers. That means large-scale infrastructure, more renewables, and higher stress on grid edge electronics.

- Electrification Beyond EVs: Marine, Rail, Aviation

Power electronics opportunities extend beyond cars. Rail systems, electric ferries, aircraft auxiliary systems, and electric buses all call for high-efficiency converters and power modules. Japan’s transport ambitions and decarbonization goals position these segments for growth.

- Export Potential and Global Partnerships

Japan’s leadership in quality, miniaturization, reliability, and materials research gives it export advantage. Collaboration with foreign OEMs, joint ventures, and cross-border acquisitions can help Japanese firms tap into global EV and renewable markets. A partner strategy combining Japanese quality and global scale could be compelling.

- Innovation in Grid-Edge Electrification, Solid-State Transformers

Research interest in solid-state transformers, bidirectional power flow, and real-time reconfigurable grids opens a pathway for cutting-edge device makers in Japan to lead. Integration with AI for grid optimization, vehicle-to-grid (V2G) support, and predictive energy load management is a potential differentiator.

Choose IMARC Group as your trusted partner in the power electronics sector:

- Data-Driven Market Research: Deepen your understanding of device trends, adoption rates in automotive, industrial electrification, and renewable power systems through rigorous, custom research reports.

- Strategic Growth Forecasting: Predict emerging shifts — from SiC/GaN device uptake to grid-scale inverter deployment and smart grid architectures — across geographies.

- Competitive Benchmarking: Compare product pipelines, techno-roadmaps, and reliability performance of leading power electronics players in Japan and globally.

- Policy and Infrastructure Advisory: Stay ahead of evolving Japanese energy regulations, efficiency mandates, grid liberalization, and subsidy regimes in the power and energy sectors.

- Custom Reports and Consulting: Get bespoke insights aligned with your goals — whether entering Japan’s power electronics space, investing in device manufacturing, or scaling system integration.

At IMARC Group, we aim to empower decision-makers in the electronics and energy industries with clarity, foresight, and actionable intelligence. Partner with us to navigate the evolving power electronics landscape by clicking on the link: https://www.imarcgroup.com/japan-power-electronics-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)