Key Growth Drivers of the Japan Dry Eye Syndrome Industry

Introduction to the Japan Dry Eye Syndrome Industry:

Dry eye syndrome, a disorder characterized by inadequate lubrication on the surface of the eye, has been increasingly gaining importance in Japan because of lifestyle changes, technology, and greater awareness of eye wellness. The condition can manifest as distress, visual impairment, and possible injury to the ocular surface, impacting quality of life and work productivity. Historically, the industry for Japan dry eye syndrome used to be confined to simple treatments like artificial tears and lubricating ointment. But in recent years, the industry has changed dramatically, led by a confluence of demographic changes, evolving medical technology, and general public consciousness.

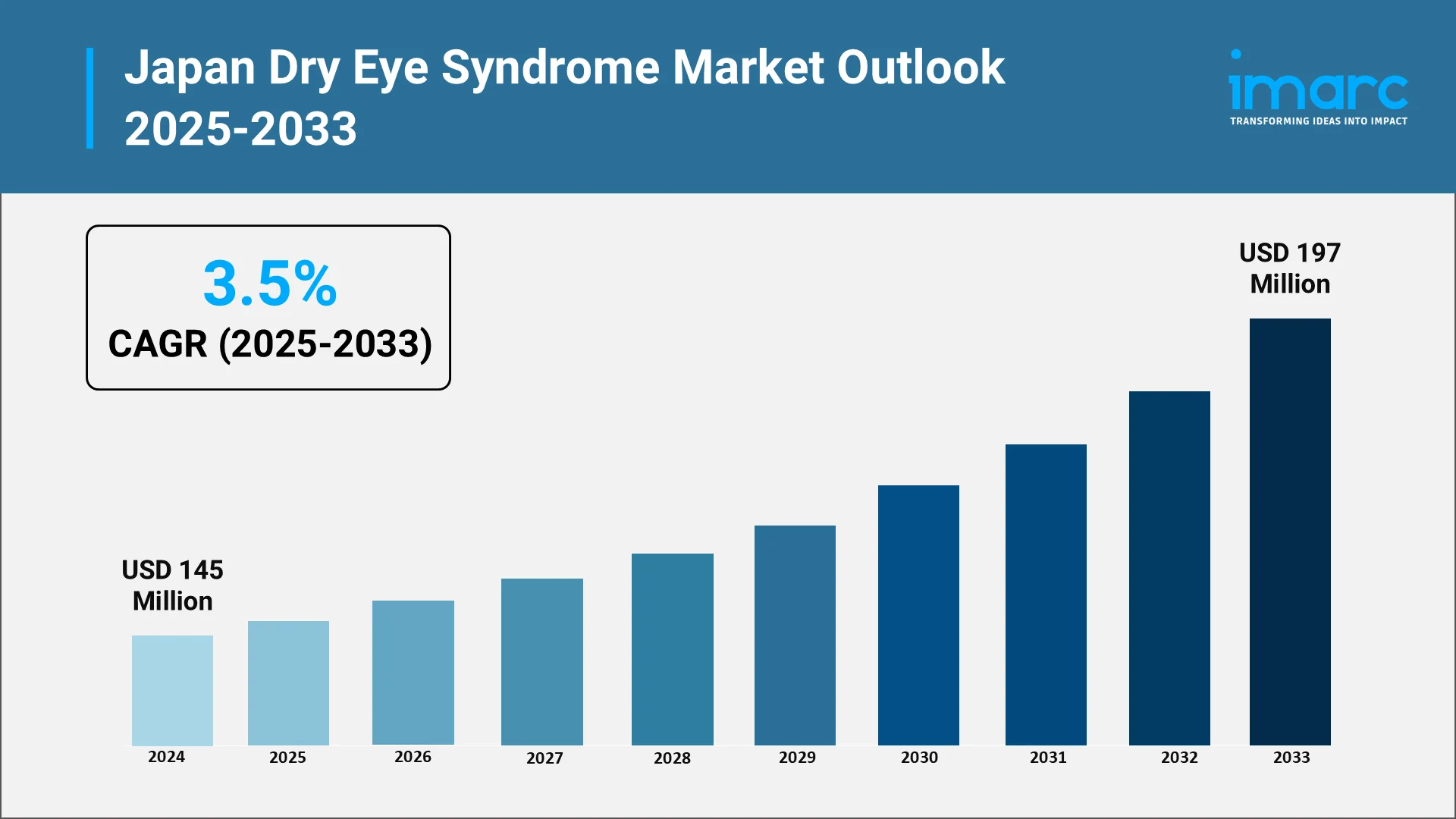

Reflecting this transformation, the Japan dry eye syndrome market reached USD 145 Million in 2024 and is expected to reach USD 197 Million by 2033, with a projected CAGR of 3.5% during 2025-2033. This growth highlights the rising demand for advanced therapies, diagnostics, and preventive care among Japanese patients.

The Japanese healthcare industry has progressively increased its emphasis on eye health, considering that eye ailments not only impact personal well-being but also have broader economic and social implications. The market for dry eye syndrome has expanded from conventional treatments to encompass prescription drugs, sophisticated diagnostic equipment, minimally invasive procedures, and innovative eye care products. Clinics, optometrists, and specialized hospitals increasingly adopt multi-disciplinary approach, integrating ophthalmology, optometry, and lifestyle guidance to address dry eye comprehensively.

Increased awareness of dry eye syndrome as a pervasive health issue has spurred both domestic and international firms to invest in product development and research. This has enriched the portfolio of therapies and preventive products suitable for Japanese patients. The industry is supported not only by treatment demand but also by preventive ophthalmological programs and patient education campaigns emphasizing long-term eye care.

Explore in-depth findings for this market, Request Sample

Rising Prevalence of Lifestyle-Related Eye Disorders:

Perhaps the most prominent growth driver for Japan's market for dry eye syndrome is the increase in the prevalence of lifestyle eye disorders. Contemporary lifestyles more and more consist of extended usage of digital screens like computers, tablets, and smartphones. Long exposure to screens lowers blink frequency, makes tear films unstable, and leads to eye fatigue, all of which are significant causes of dry eye syndrome. A recent study involving 102,582 middle-aged Japanese participants found a significant association between daily visual display terminal (VDT) use and the diagnosis of dry eye disease (DED). The study highlighted that prolonged screen time, especially exceeding 6 hours per day, was linked to a higher prevalence of DED symptoms, emphasizing the impact of digital device usage on ocular health. In urban settings, where technology consumption is widespread, people are subjected to greater rates of visual fatigue and dryness, creating demand for effective remedies.

Environmental aspects of city dwelling, including air pollution, indoor air-conditioned environments, and exposure to artificial light, also worsen the symptoms of dry eyes. Individuals who work in offices develop lower humidity levels and constant exposure to air current, both conditions that promote tear evaporation and eye irritation. These lifestyle and environmental conditions have generated a high demand for products and treatment that not only provide relief from symptoms but also contribute towards the maintenance of continued eye health.

Manufacturers and healthcare professionals are responding with solutions targeting the issues, such as lubricating drops, ointments, and protective eyewear suited for long durations of screen viewing. Furthermore, public awareness campaigns encouraging good screen habits, frequent breaks, and adapting to the surroundings are reducing the risk of long-term dry eye. The coalescence of lifestyle sensitization and therapeutic innovation has been the main driver of growth in the market in Japan.

Impact of Aging Population on Dry Eye Cases:

Japan's aging population is at the center of the growth of the industry for dry eye syndrome. With age, the body undergoes physiological changes in tear secretion and ocular surface health, making it more vulnerable to dry eye. Hormonal changes, decreased lacrimal gland function, and long-term illnesses common in the elderly further contribute to the increased risk of developing dry eye syndrome. According to reports, a 2025 nationwide study reported that over 21% of individuals aged 70 and above are diagnosed with dry eye disease, highlighting the urgent need for age-specific interventions. Therefore, healthcare practitioners and researchers have recognized older adults as one of the critical populations that need special care and targeted treatment approaches.

The ageing population has created increased demand for both therapeutic and preventative interventions. Providers of eye care are now concentrating on total assessment protocols to address issues with ageing changes and co-morbidities like cataracts, glaucoma, and systemic diseases affecting tear output. Clinics are increasingly implementing holistic approaches that integrate artificial tears, prescription medications, nutrition education, and lifestyle changes in order to enhance patient outcomes.

In addition, elderly people tend to search for solutions that focus on comfort, safety, and simplicity of use. This has led to the creation of easy-to-use eye care equipment, extended-release preparations, and minimally invasive treatments. By responding to the demands of an aging population, Japan's dry eye syndrome market has moved beyond traditional therapies to become a comprehensive healthcare market that advocates long-term ocular health.

Advancements in Diagnosis and Treatment Technologies:

Technological advancement has been a key driver of the size of the Japan dry eye syndrome market. Diagnostic devices have become more advanced, enabling clinicians to identify early onset dry eye, track disease progression, and tailor treatment regimens with higher precision. Devices that can evaluate tear film stability, corneal health, and ocular surface inflammation offer clinicians rich information that leads to more successful interventions. In a notable development, Topcon Healthcare launched the Tera Dry Eye Imager in September 2025. This multimodal platform is designed to detect, grade, and manage dry eye disease, enhancing diagnostic accuracy and treatment planning for clinicians in Japan.

On the therapeutic side, advances in medical devices and pharmaceuticals have widened the variety of solutions available. Prescription drugs aimed at the underlying inflammation, tear film instability, and hormonal processes have enhanced patient satisfaction and symptom relief. Minimally invasive surgeries such as punctal plugs, meibomian gland treatments, and thermal therapy provide options for patients who are not sufficiently responsive to traditional treatments.

Formulation science innovations have also improved patient compliance and experience. Eye drops with increased retention times, preservative-free versions, and bioengineered lubricants offer greater relief with fewer side effects. In addition, research into regenerative therapies and tear film repair methods indicates a focus of the industry in pushing treatment beyond symptomatic relief to lasting solutions that restore ocular well-being.

The integration of accurate diagnostics and variable treatment modalities has revolutionized the dry eye scenario in Japan. With more personalized care delivered by clinicians, therapeutic outcomes improve and patient confidence in accessible treatments grows. This technological advancement has reinforced industry attractiveness, inducing investment and creating a dynamic climate for ongoing innovation.

Growing Awareness and Access to Eye Care Solutions:

Growing awareness of dry eye syndrome among the population has been the key driver of market growth. Patients are more aware of symptoms, risk factors, and prevention strategies, and hence make early diagnosis and proactive treatment possible. Health education by healthcare professionals, optometry bodies, and patient associations emphasizes the significance of eye health, supports regular visits to physicians or optometrists, and ensures compliance with prescribed treatments.

Availability of eye care solutions has increased with the growth in specialized clinics, optometry, and online websites that give information as well as offer products. Patients can now receive consultation, advice, and treatment plans from multiple sources, including telemedicine, which is convenient and accessible. This wider availability has increased access and rates of adoption of both therapeutic and preventive interventions.

Consumer behavior has also changed, with people looking for products that have lifestyle needs, are comfortable, and easy to use. Today's market offers a broad spectrum of solutions ranging from over-the-counter lubricants and protective eyewear to prescription therapy and cutting-edge devices. By catering to both treatment and preventive needs, the industry has been able to expand its customer base, offering room for long-term growth.

Supportive Government Policies and Healthcare Initiatives:

Government policies and health programs in Japan have helped to drive the dry eye syndrome market significantly. Regulations favoring safe and effective products, coupled with innovation incentives, have propelled domestic and international firms to invest in R&D activities. Policies to enhance access to healthcare services, especially among elderly populations, have helped increase adoption of eye care solutions across wider populations.

In a recent development, Japan's universal health insurance system, implemented in 1961, ensures equal access to healthcare for all citizens. This system, which requires individuals to pay premiums based on income and cover 30% of medical costs, has been instrumental in providing equitable healthcare access. As Japan's population ages and rural areas experience depopulation, the demand for healthcare services is changing, prompting updates to the medical insurance systems to ensure continued equal access.

Public health initiatives in Japan emphasizing preventive care, early diagnosis, and patient education have strengthened the healthcare infrastructure for eye diseases. Programs embedded in medical check-ups, community campaigns, and workplace health guidelines enable timely detection and management of dry eye, improving patient outcomes and driving demand for therapeutic solutions. Collaboration among health authorities, research institutions, and industry stakeholders fosters innovation, while government support through regulation and investment ensures advancements in diagnostics, treatment, and patient care. This integrated approach has positioned Japan as a progressive and dynamic market for dry eye syndrome management.

Future Outlook for the Japan Dry Eye Syndrome Market:

The prospects for the Japan dry eye syndrome market look bright, fueled by persistent demographic, technological, and societal trends. Ongoing population aging and rising incidence of lifestyle-related eye disease will continue to drive demand for both preventive and therapeutic solutions. Evolution in diagnostics, pharmacology, and medical devices will further improve the efficacy of treatment approaches, drawing patients looking for personalized and holistic care.

With increased public awareness, patient participation in active eye care will go up, driving early detection and regular management. Increased access to eye care services like telemedicine and home-based solutions will further enhance market penetration and acceptance. Manufacturers and providers will increasingly orient themselves toward patient-centric strategies, prioritizing comfort, simplicity of use, and seamless integration into daily routines.

Continued investment in research, along with favorable government policies, will continue to propel the industry's innovation and competitiveness. Interdisciplinary partnerships among healthcare providers, academias, and industry partners will yield new drugs, enhanced diagnostic equipment, and regenerative therapy strategies that cure the root causes of dry eye, not just treat its symptoms.

In addition, the convergence of digital health solutions like artificial intelligence-facilitated diagnostics and treatment platforms based on individualized treatment will redefine the patient experience. Insights through data will allow for personalized care, maximize treatment outcomes, and improve patient satisfaction, leading to long-term expansion and sustainability for the Japan dry eye syndrome market.

In summary, the synergy between lifestyle trends, aging populations, innovations in technology, increased awareness, and conducive government structures presents a strong climate for further expansion. The Japan dry eye syndrome market is transforming into a sophisticated, patient-centered industry with the ability to provide effective, affordable, and innovative treatments, setting it up for sustained growth over the next few years.

Pioneering Progress: IMARC’s Strategic Blueprint for Japan Dry Eye Syndrome Market Growth

IMARC Group equips stakeholders in the ophthalmology and healthcare sector with data-driven strategies to thrive in the expanding Japan dry eye syndrome market. Our research and advisory solutions enable clients to capitalize on emerging opportunities, manage risks, and drive innovation in therapeutic solutions, diagnostic tools, and patient care services.

- Market Insights: Track regional trends shaping the Japan dry eye syndrome market, including rising lifestyle-related eye disorders, increasing awareness of eye health, and the integration of preventive care programs.

- Strategic Forecasting: Predict technological advancements in diagnostics and treatments, regulatory developments, and shifts in patient preferences influencing demand for effective dry eye management solutions.

- Competitive Intelligence: Benchmark strategies of key players, monitor product innovations, and evaluate the development of therapeutics, artificial tears, and diagnostic devices in Japan.

- Policy and Regulatory Analysis: Examine the influence of Japanese healthcare regulations, approval processes for ophthalmic products, and public health initiatives on market dynamics and patient access.

- Tailored Consulting Solutions: Leverage customized strategies for market entry, product development, pricing approaches, and collaboration with healthcare providers. IMARC’s consulting services empower clients to navigate the evolving Japan dry eye syndrome market while staying aligned with technological, regulatory, and patient care trends.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)