AI-Powered Transformation in the Global Endoscopy Devices Market

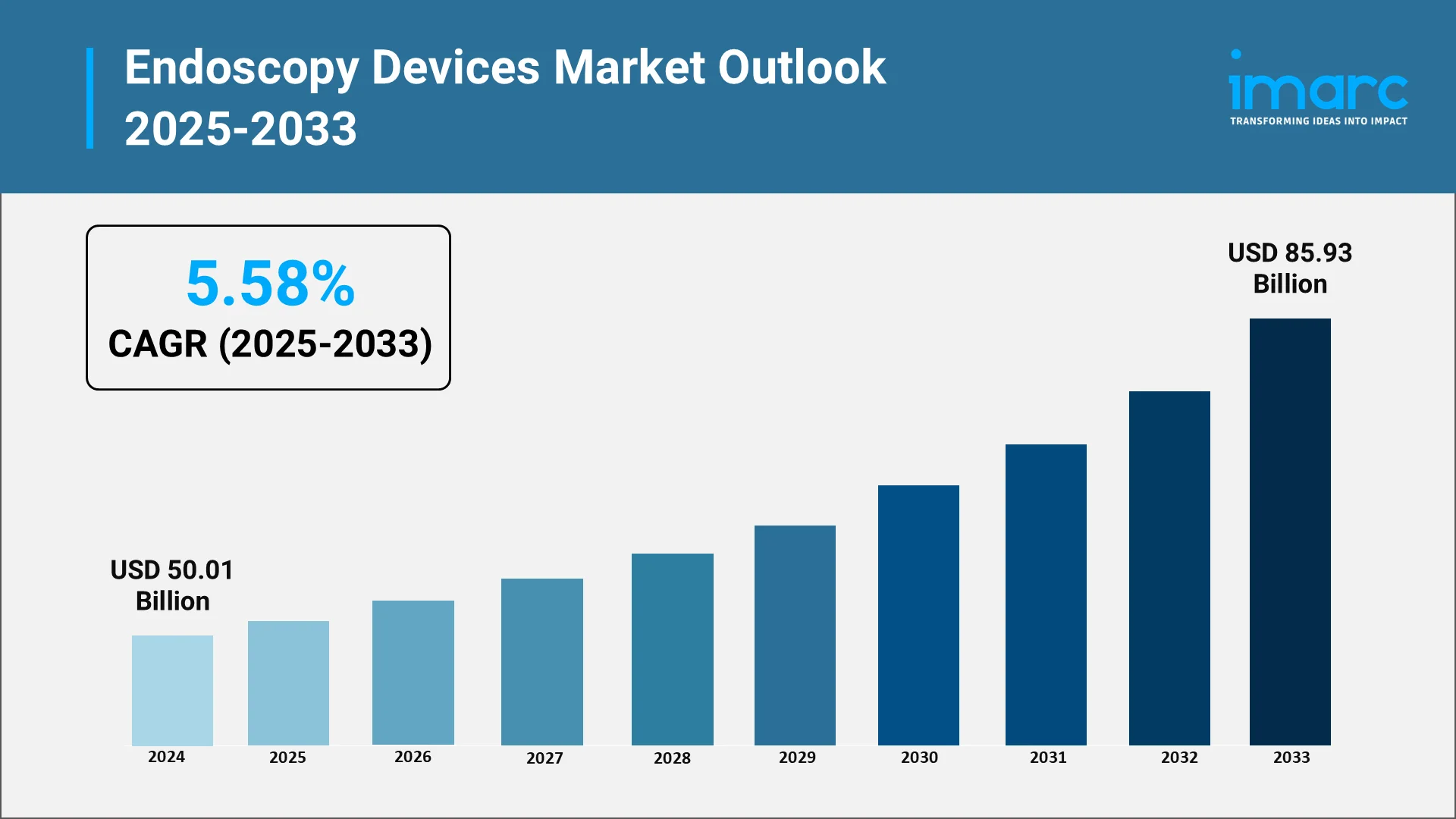

The global endoscopy devices market is on a sharp growth path, fueled by the shift toward minimally invasive procedures, the need for early diagnosis, and cutting-edge imaging technologies. IMARC Group reported the market hit USD 50.01 Billion in 2024, underscoring its worldwide acceptance. Momentum continues to build as aging populations, rising chronic disease cases, and rapid strides in precision technology push demand for advanced endoscopic solutions across healthcare systems. Artificial intelligence (AI) is driving a new era in the endoscopy devices market, powering sharper clinical decisions, smarter imaging, and real-time detection. From AI-assisted diagnostics to breakthrough technologies, it is redefining patient care, delivering better outcomes, and shaping the future of minimally invasive treatment. The integration of AI in healthcare devices is further accelerating innovation, enabling next-generation solutions that enhance accuracy, efficiency, and patient safety.

Explore in-depth findings for this market, Request Sample

Tech-Driven Transformation: The Impact of AI and Innovation in Endoscopy Devices

AI is transforming the endoscopy devices market by utilizing sophisticated computational abilities to enhance visualization, refine decision-making, and aid minimally invasive techniques. Its function encompasses enhanced diagnostics, surgical assistance, and workflow optimization, promoting innovation and influencing the future of endoscopic treatment globally.

- AI-Powered Precision in Gastrointestinal Care: The incorporation of cloud-centered AI systems in endoscopy is supporting the market growth by boosting diagnostic accuracy, facilitating immediate decision-making, and enhancing patient results without introducing additional procedural risks or delays. A prime example of this trend is Olympus showcasing its OLYSENSE™ Platform with the CADDIE™ computer-aided detection device at the Digestive Disease Week (DDW) in San Diego in 2025. This cloud-based AI solution helps gastroenterologists detect suspected polyps during colonoscopy. The platform is part of Olympus' broader portfolio of technologies aimed at enhancing clinical decision-making in gastrointestinal care.

- Versatility as a Catalyst for Adoption: Advancements in adaptable, multi-purpose endoscopy instruments are accelerating adoption by enhancing procedural precision, minimizing equipment requirements, and bolstering clinical trust, thereby driving the demand for sophisticated minimally invasive options. Underlining the role of versatile instruments in boosting adoption and clinical confidence, Creo Medical commercially launched its SpydrBlade™ Flex, a versatile endoscopic tool, in the UK and EU in 2025. St Mark's Hospital in NW London led the way as the first adopter, showcasing how introducing new products boosts adoption, builds clinical confidence, and speeds up market growth in advanced healthcare areas.

- Revolutionizing Diagnostics with Intelligent Imaging: Imaging tools driven by AI are revolutionizing gastrointestinal diagnostics by enhancing sensitivity, minimizing interpretation time, and boosting accuracy, providing major opportunities for wider adoption and expansion of advanced endoscopy technologies globally. Further demonstrating the revolutionary impact of intelligent imaging on diagnostics, AnX Robotica received FDA de novo clearance in 2024 for its AI-assisted endoscopy tool, NaviCam ProScanwhich significantly enhanced small bowel capsule endoscopy for detecting gastrointestinal bleeding. The tool used convolutional neural networks (CNNs) for improved sensitivity and faster readings compared to conventional methods. This breakthrough was expected to advance GI diagnostics, with AI playing a pivotal role in medical imaging growth.

Key Growth Drivers in the Global Endoscopy Devices Industry:

According to IMARC Group’s projections, the global endoscopy devices market is projected to grow at a CAGR of 5.58% from 2025 to 2033, reaching USD 85.93 Billion by 2033. The growth will be supported by the following factors:

- Growing Burden of Chronic Diseases: The increasing incidence of gastrointestinal diseases, cancers, and respiratory conditions is driving the need for innovative diagnostic and treatment technologies. Endoscopy instruments are essential for facilitating early diagnosis and prompt actions, greatly enhancing patient treatment and results. The American Association for Cancer Research states that around 18.6 million cancer survivors resided in the United States as of January 1, 2025, highlighting the essential importance of advanced endoscopy solutions in addressing chronic conditions and aiding long-term healthcare requirements.

- Aging Population: The rising geriatric population, which is more prone to gastrointestinal, urological, and respiratory issues, is leading to a heightened dependence on diagnostic and therapeutic endoscopy. Increased life expectancy and growing healthcare needs among seniors are fueling continuous demand for sophisticated endoscopy equipment. The World Health Organization (WHO) estimates that by 2030, one in six people will be over 60, highlighting the increasing demand for advanced endoscopy technologies to successfully tackle age-related conditions and enhance patient quality of life.

- Enhanced Imaging and Workflow Efficiency: Improvements in endoscopy systems that offer enhanced imaging, streamlined workflows, and advanced therapeutic options are driving market expansion by increasing procedural safety, enhancing efficiency, and improving diagnostic accuracy for improved patient results. For example, in 2025, FUJIFILM launched the ELUXEO® 8000 endoscopy system in Europe, featuring enhanced therapeutic capabilities, exceptional imaging, and workflow tools. The Amber-Red Color Imaging improves visibility, and the combination of X-ray and ultrasound technologies provides safer, quicker treatments and enhanced diagnostic capabilities for clinicians.

Behind the Guidelines: Understanding the Regulatory Landscape of Endoscopy Devices

The regulatory framework dictates the development, approval, and oversight of endoscopy devices to guarantee safety, efficacy, and compliance. Rigorous regulations concerning device design, sterilization, and clinical validation ensure patient safety while allowing manufacturers to synchronize innovations with global standards for international acceptance.

- Strict Device Approval Protocols: Endoscopy instruments need to go through thorough assessments prior to being released in the market. Regulatory bodies stress the importance of thorough testing, validating designs, and providing clinical performance data, ensuring these technologies meet global safety and quality standards to protect patients and healthcare workers.

- Role of Reimbursement Policies: Reimbursement models directly influence the adoption rates of endoscopic technologies. Supportive reimbursement motivates healthcare providers to adopt advanced systems, whereas restrictive or ambiguous reimbursement reduces accessibility, especially in cost-sensitive areas where affordability significantly impacts technology adoption.

- Harmonization of Sterilization Procedures: Stringent regulations govern sterilization and reprocessing procedures to reduce infection risks linked to reusable endoscopes. Transparent regulatory standards compel manufacturers to create safer, more effective solutions while assisting healthcare providers in adhering to compliance during the use and management of devices.

- Data Protection and Digital Integration: With the integration of digital technologies in endoscopy, regulators highlight the importance of robust cybersecurity and data protection practices. Policies guarantee the confidentiality of patient data, secure connectivity of devices, and the safe operation of AI-driven systems, enhancing trust in advanced endoscopy platforms around the world.

- Impact of Worldwide Standardization Initiatives: Initiatives to harmonize global regulatory standards facilitate product approvals and compliance across borders. Harmonization simplifies processes for manufacturers, speeds up international distribution, and guarantees that uniform safety and performance standards are maintained across various healthcare markets globally.

Catalysts of Change: Government Initiatives Driving the Endoscopy Market Forward

Government programs and healthcare initiatives are playing a pivotal role in shaping the growth of the industry. Through infrastructure investment, public health programs, and collaborative partnerships, policymakers are ensuring greater accessibility, affordability, and innovation in minimally invasive technologies worldwide.

- Investment in Healthcare Infrastructure: Governments around the globe are funding the modernization of hospitals, diagnostic centers, and surgical facilities, facilitating greater access to advanced endoscopy equipment. For example, in 2025, Ontario announced the expansion of publicly funded private surgical and diagnostic centers, with an investment of $155 million over two years. The plan includes 35 new MRI and CT scan centers and 22 endoscopy centers, aimed at reducing hospital wait times. These efforts enhance healthcare capacity, boost service delivery, and promote the use of minimally invasive technologies in various medical fields.

- Public-Private Partnerships (PPP) and Innovation Support: Partnerships between public entities and private companies are enhancing innovation, cost-effectiveness, and availability in the endoscopy devices sector. Government incentives, grants, and targeted research financing are propelling technological progress, encouraging the creation of safer and more effective tools. These collaborations also simplify distribution channels, guaranteeing that advanced diagnostic and therapeutic tools are accessible to larger patient groups. By merging public health goals with private skills, such partnerships speed up the adoption and promote fair access to advanced endoscopic solutions globally.

- National Screening and Preventive Programs: Numerous nations are launching expansive screening initiatives for gastrointestinal cancers and associated ailments, generating substantial demand for sophisticated endoscopy tools that facilitate early diagnosis, efficient treatment, and enhanced patient outcomes throughout healthcare systems. These initiatives enhance the significance of endoscopy in preventive health by encouraging regular procedures and increasing accessibility. In 2025, Apollo Cancer Centres launched “ColFit,” an all-encompassing colorectal cancer screening initiative aimed at early detection and prevention, emphasizing how specialized efforts can boost the use of advanced technologies in public health systems.

Pioneers of Precision: Leading Endoscopy Device Companies Reshaping Market

Major participants in the market are focusing on innovation, broadening product ranges, and enhancing their presence in both developed and emerging areas. They are making significant investments in research activities to improve imaging technologies, robotics, and minimally invasive techniques while increasing safety, efficiency, and patient results. For instance, in 2025, FUJIFILM India launched the advanced ELUXEO 8000 Therapeutic Endoscopy Solution at the 22nd MUMBAI LIVE Endoscopy 2025. The system features cutting-edge imaging technologies like Amber-red Color Imaging, Triple Noise Reduction, and Extended Dynamic Range Image Processing. It aims to enhance diagnostic and therapeutic capabilities for complex endoscopic procedures in India. Strategic alliances, mergers, and collaborations are being sought to enhance global distribution systems and expand clinical acceptance. Businesses are concentrating on cost efficiency, enhancing reprocessing protocols, and implementing single-use devices to tackle issues related to infection control. With technological progress, they are also adapting to changing regulatory frameworks and reimbursement structures to ensure lasting competitiveness and sustainability in the market.

The Endoscopy Frontier: Unveiling Opportunities Amidst Market Challenges

The worldwide market for endoscopy devices is poised for significant expansion due to increasing demand for minimally invasive procedures, early diagnosis of diseases, and outpatient services. Enhancing healthcare infrastructure in developing countries creates chances for manufacturers to bolster their international presence and collaborations. Technological progress like AI-aided imaging, robotics, and single-use endoscopes generates fresh revenue opportunities. Further contributing to the market growth and capitalizing on technological progress, Olympus launched two new bronchoscopes as part of the EVIS X1 Endoscopy System in 2024. These bronchoscopes offered slim diameters, large working channels, and advanced imaging technologies, designed to enhance diagnostic and therapeutic procedures.

The endoscopy devices market holds notable growth potential, yet it contends with challenges such as elevated equipment expenses, strict regulatory standards, and safety issues associated with device reprocessing. Restricted reimbursement, gaps in training, and reluctance to embrace advanced technologies further hinder adoption. Tackling these challenges necessitates ongoing investment, preparedness for compliance, and cooperation among stakeholders to guarantee safe, accessible, and sustainable adoption on a global scale. These challenges collectively influence the pace of innovation, adoption, and long-term sustainability within the global medical devices industry.

Pioneering Progress: IMARC’s Strategic Blueprint for Global Endoscopy Market Growth

IMARC Group equips stakeholders in medical devices and minimally invasive technologies with data-driven strategies to thrive in the fast-growing endoscopy devices market. Our research and advisory solutions help clients capture opportunities, reduce risks, and drive innovation across diagnostic, surgical, and therapeutic endoscopy applications.

- Market Insights: Monitor global and regional trends shaping endoscopy devices, including the adoption of minimally invasive procedures, integration of imaging technologies, AI-enabled visualization, and the rise of single-use devices.

- Strategic Forecasting: Anticipate advancements in device design, 3D imaging, robotics-assisted endoscopy, and global healthcare policies influencing demand for advanced endoscopic solutions.

- Competitive Intelligence: Benchmark leading players’ strategies, track product pipelines, and assess innovations in flexible, rigid, and capsule endoscopes alongside visualization systems and accessories.

- Policy and Regulatory Analysis: Assess the impact of international medical device regulations, sterilization standards, and reimbursement frameworks on product approvals, compliance, and global distribution.

- Tailored Consulting Solutions: Leverage customized strategies for market entry, technology adoption, pricing models, and international collaborations. IMARC’s consulting services enable clients to design scalable business roadmaps in a market expanding with innovation, regulation, and patient demand for minimally invasive care.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)