Australia’s Bus Industry: Recent News & Development, Government Initiatives

Introduction:

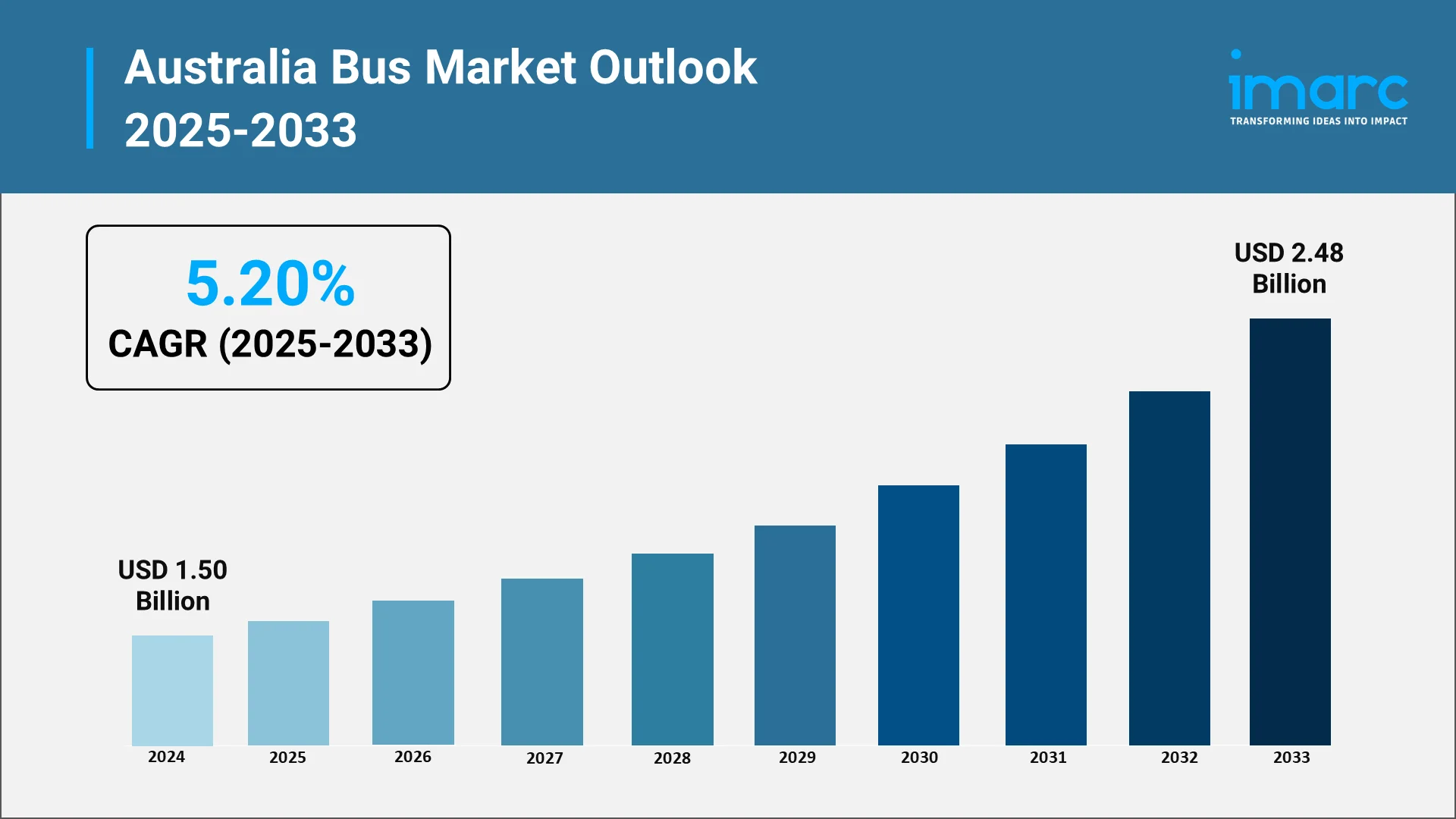

The bus industry in Australia is an important sector of the national public transport system, conveying people in urban and regional settings. It has recently gone through a remarkable expansion due to fast urbanization and the growth of population in major cities. With such factors, the demand for public transportation with considerable sustainable and effective mass transit solutions has surged noticeably. The Australia bus industry was valued at USD 1.50 Billion in 2024. Buses still remain one of the affordable, eco-friendly, and flexible means of transportation, and they are considered as a more viable alternative to private vehicles in several aspects, as they help decrease traffic congestion and carbon dioxide emissions.

Recent trends reflect the gradual movement to electrification and the adoption of advanced technologies. Government policies, consumer expectations for low-emission public transport, and improvements in battery and electric vehicle technologies propel this transformation. Australia's bus operators are increasingly considering electric and hybrid models as ways to cut operational costs, comply with environmental regulations, and ensure better service reliability.

The industry has also witnessed the impact of technological innovations like AI-enabled route optimization, telematics, predictive maintenance, and integrated fleet management solutions. Such technologies enhance operational efficiency, ensure less downtime, and provide a better passenger experience. Moreover, the industry continues to see deeper cooperation among private operators, government agencies, and technology enablers of sustainable transport initiatives.

This growth is likely to be driven by investments in infrastructure, evolving consumer expectations, and the move towards electric buses and smart fleet management solutions. This transformation offers strategic opportunities for investors, manufacturers, and service providers while at the same time bringing challenges in terms of technology adoption, regulatory compliance, and market competition.

Explore in-depth findings for this market, Request Sample

Role of AI, Impact, and Benefits in the Australian Bus Industry:

Artificial intelligence (AI) is transforming the Australian bus industry by enabling smart and data-driven operations across fleet management, safety systems, and passenger services. AI applications in the sector range from predictive maintenance to route optimization enhancing both operational efficiency and cost-effectiveness. Real-time monitoring of vehicle health allows operators to schedule maintenance proactively reducing unplanned downtime, extending the service life of buses, and lowering overall operational expenses while driving innovation within the Australia electric vehicle market.

AI-driven route planning systems utilize traffic patterns, passenger demand forecasts, and environmental factors to determine the most efficient schedules and routing strategies. This optimizes fuel consumption, reduces travel times, and enhances the reliability of public transport services. Telematics data integrated with machine learning algorithms enables precise monitoring of driver behavior, vehicle performance, and energy utilization ensuring safety and efficiency across large fleets.

In addition, AI enhances passenger experience through smart ticketing solutions, predictive arrival notifications, and personalized travel information. Data analytics can identify usage trends, peak hours, and regional demand allowing operators to deploy resources more effectively. For electric bus fleets, AI also manages battery health, charging cycles, and energy consumption patterns to maximize efficiency and minimize operational disruptions.

Overall, AI integration strengthens the competitiveness of Australian bus operators by reducing operational costs, improving reliability, enhancing safety, and providing actionable insights for strategic decision-making. The benefits extend to both public and private stakeholders, facilitating smarter and more sustainable urban mobility solutions.

Government Initiatives / Support in the Australian Bus Industry:

- Electrification Incentives: The Australian government has introduced subsidies and incentives to encourage the adoption of electric buses and hybrid fleets. These programs provide financial support for fleet modernization, reducing upfront costs and accelerating the transition toward low-emission transport. Funding is allocated for battery procurement, charging infrastructure, and pilot programs allowing operators to experiment with electric buses while mitigating financial risks. This initiative aligns with national climate goals reducing carbon emissions and supporting sustainable urban mobility while also advancing the Australia electric commercial vehicles market.

- Public Transport Modernization: Federal and state governments are investing in upgrading public transport networks, including bus terminals, depots, and smart infrastructure. In June 2025, Kempower, Charge Hub, Addelec, and Swan Group announced its plans to construct a large electric bus depot in Bayswater, Perth, with capacity for 132 buses. The project, utilizing advanced DC charging technology, supports Western Australia's transition to electric public transport, enhancing infrastructure for future fleet scalability. Operations are set to begin in mid-2026. This modernization focuses on integrating real-time passenger information systems, digital ticketing, and AI-assisted scheduling. By enhancing operational efficiency and passenger convenience, these programs improve service reliability, increase ridership, and encourage the shift from private vehicles to public transit.

- R&D Support and Innovation Programs: The government is promoting research and development in vehicle electrification, battery technology, and fleet management solutions. Grants and collaborative projects with universities and industry partners aim to advance the Australia electric bus market. These programs accelerate innovation, improve vehicle performance, and ensure Australian operators remain competitive globally.

Recent Market News & Major Research and Development:

- In October 2024, Volgren launched its first hydrogen-powered bus, developed in partnership with Northern Ireland’s Wrightbus, marking a significant step in Australia’s zero-emission transport. This follows Volgren’s 2019 debut of battery-electric buses. A second hydrogen bus is in production, contributing to local job creation and sustainable public transport solutions.

- In November 2025, FlixBus announced its plans to launch in Australia, offering budget-friendly fares starting at USD 9.99 for rides between Sydney and Melbourne, with stops in Canberra and Albury. The service will provide two daily trips and features amenities like free Wi-Fi and reclining seats, promoting sustainable travel options.

- In November 2025, Volgren, Australia's leading bus manufacturer, partnered with SugarCRM to enhance its sales and service operations using the Sugar Precision Selling Platform. This AI-driven solution aims to improve sales productivity, streamline quoting processes, and boost customer satisfaction, ultimately driving significant revenue growth and competitive advantage for Volgren.

Opportunities and Challenges in the Australian Bus Industry:

Opportunities:

- Electrification and Low-Emission Adoption: The growing demand for electric buses and hybrid fleets provides significant growth opportunities. Transitioning to electric fleets allows operators to reduce carbon emissions, comply with regulatory mandates, and attract environmentally conscious consumers. Investments in charging infrastructure and battery technology can optimize operational efficiency and reduce long-term costs, positioning companies competitively in the market.

- Technological Integration and AI: The adoption of AI and smart fleet management solutions offers opportunities for efficiency gains, predictive maintenance, and enhanced passenger experience. AI-driven route optimization, energy management for electric buses, and data analytics for ridership patterns allow operators to make informed decisions, reduce operational costs, and improve service reliability. Technological innovation strengthens brand differentiation and market positioning.

- Public-Private Partnerships and Infrastructure Investment: Collaborative projects with government agencies and private stakeholders create opportunities for network expansion, infrastructure development, and fleet modernization. Access to funding and policy support enables operators to adopt advanced vehicles, develop charging stations, and implement smart systems, supporting sustainable growth.

Challenges:

- High Capital Expenditure: Transitioning to electric and hybrid fleets requires significant investment in vehicles, charging infrastructure, and supporting technologies. Smaller operators may face financial constraints, making fleet modernization and technological adoption challenging. Managing capital costs while maintaining service quality is a critical operational concern.

- Regulatory Compliance: Operators must navigate complex federal and state regulations related to vehicle safety, emissions standards, and licensing requirements. Compliance requires continuous monitoring, staff training, and process adaptation, creating operational and administrative challenges for both large and small operators.

- Supply Chain and Technology Adoption: Dependence on specialized components, battery supply, and advanced technologies exposes operators to supply chain vulnerabilities. Delays in component availability, limited access to high-performance batteries, or integration challenges with AI systems can impact fleet deployment, operational efficiency, and service consistency.

Future Outlook: Australian Bus Industry

The market is projected to reach USD 2.48 Billion by 2033, exhibiting a CAGR of 5.20% during 2025-2033, driven by urbanization, environmental policies, and technological innovation. Adoption of electric buses and hybrid fleets will continue to accelerate, supported by government incentives, funding programs, and infrastructure development. AI integration and smart fleet management will enhance operational efficiency, reduce downtime, and optimize energy consumption.

Sustainability will remain a central focus, with operators investing in eco-friendly practices, renewable energy-powered charging infrastructure, and low-emission vehicles. Consumer expectations for reliable, efficient, and environmentally responsible public transport will drive continued innovation in service delivery and operational management.

The market is expected to witness consolidation among manufacturers and operators, along with increased public-private collaboration for infrastructure and fleet modernization. Expansion into regional areas, adoption of emerging technologies, and participation in global knowledge-sharing initiatives will further strengthen the competitiveness of the Australian bus industry.

Overall, the industry is poised for long-term growth, providing opportunities for investors, operators, and technology providers, while addressing challenges through strategic investment, innovation, and regulatory alignment. The Australian bus industry is transitioning toward a more sustainable, efficient, and technologically advanced future, underpinned by electrification, AI adoption, and government support.

How IMARC Group is Driving Strategic Insights in the Australian Bus Industry:

IMARC Group provides stakeholders across the Australian bus ecosystem with critical insights to navigate the evolving market, identify opportunities, and drive innovation. Our services empower operators, investors, and manufacturers to make informed decisions in a dynamic, technology-driven environment.

- Market Insights: Analyze trends shaping the Australian bus industry, including electrification, AI-powered fleet management, smart infrastructure adoption, and shifting consumer demand for low-emission, efficient public transport. We provide comprehensive insights into market dynamics, regulatory developments, and emerging technologies such as electric buses, hybrid fleets, and hydrogen-powered solutions.

- Strategic Forecasting: Plan for the future with data-driven projections, including fleet electrification, integration of AI systems, and infrastructure development. Our forecasts guide stakeholders in capital allocation, technology adoption, and operational planning to stay competitive in the rapidly evolving transport sector.

- Competitive Intelligence: Monitor innovations and strategic initiatives in fleet management, vehicle manufacturing, and infrastructure projects. We analyze advancements in electric and hybrid buses, public-private partnerships, and digital solutions, helping clients benchmark against industry trends and optimize market positioning.

- Regulatory and Policy Analysis: Understand the implications of federal and state regulations on emissions, licensing, and safety standards. Our analysis supports compliance strategies, risk mitigation, and long-term operational planning.

- Customized Consulting Solutions: From fleet modernization strategies to technology adoption roadmaps, we offer tailored consulting services aligned with your organizational objectives. Whether expanding into electrified fleets, implementing AI solutions, or navigating regulatory frameworks, our expertise ensures strategic advantage.

With the Australian bus market projected to witness significant growth, IMARC Group remains a trusted partner, providing insights, driving innovation, and informing decisions that shape the future of public transportation. For detailed data-driven forecasts, market trends, and strategic recommendations, explore the complete report on the Australian Bus Industry here: https://www.imarcgroup.com/australia-bus-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)