Saudi Arabia Road Freight Transport Market Trends: Navigating Logistics Expansion and Evolving Supply Chain Dynamics

Introduction:

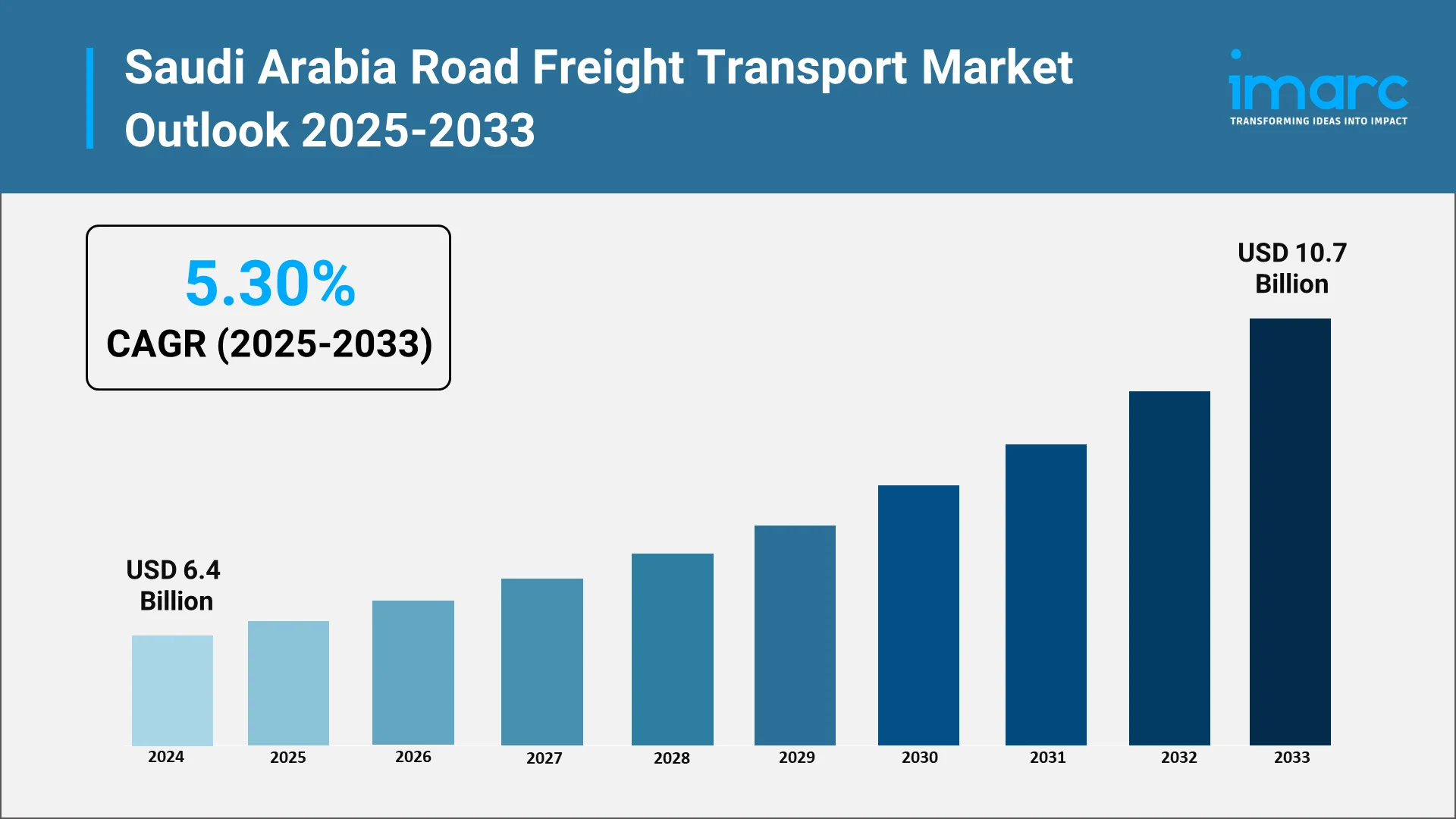

The Saudi Arabia road freight transport market represents one of the key building blocks of the economic infrastructure in the Kingdom, providing for cargo movement across various domestic supply chains. It also involves road freight operations, which allow for the distribution of goods-from manufactured goods, consumer goods, and industrial supplies to agricultural produce-across its large and wide geography. The industry has a varied ecosystem of fleet operators, logistics service providers, freight forwarders, and specialized transportation companies that work in unison to provide seamless connectivity between production centers, distribution hubs, retail networks, and end-consumers. In 2024, Saudi Arabia road freight transport market size reached USD 6.4 Billion.

As Saudi Arabia advances its economic transformation agenda, the road freight transport industry is witnessing significant evolution backed by infrastructure modernization, digital adoption, regulatory reforms, and shifting trade patterns. The sector plays an indispensable role in underpinning the Kingdom's ambitious diversification objectives by guaranteeing seamless movement of goods across industrial zones, commercial districts, and emerging economic cities. Fleet operators and logistics companies in the industry are increasingly investing in advanced vehicle technologies, route optimization systems, and integrated supply chain solutions to cater to growing demands. The Saudi Arabia road freight transport market growth reflects broader economic development patterns and responds to evolving customer expectations for quicker delivery, improved visibility, and sustainable transportation practices.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming the Saudi Arabia Road Freight Transport Industry:

Vision 2030 serves as the fundamental catalyst reshaping the Saudi Arabia road freight transport market, introducing comprehensive reforms that enhance logistics efficiency, infrastructure connectivity, and operational competitiveness. The national transformation blueprint positions the Kingdom as a global logistics hub connecting three continents, necessitating substantial upgrades to road freight capabilities and service standards. The National Transport and Logistics Strategy (NTLS), operating as a core component of Vision 2030, establishes ambitious targets for improving logistics performance, reducing transportation costs, and elevating the Kingdom's position in international logistics competitiveness indices.

The transformation agenda prioritizes development of integrated logistics zones, expansion of highway networks, modernization of border crossings, and implementation of intelligent transportation systems that collectively enhance road freight operational efficiency. Strategic initiatives focus on attracting private sector investment in logistics infrastructure, encouraging fleet modernization programs, and fostering adoption of digital technologies throughout the transportation ecosystem. Regulatory reforms streamline licensing procedures, standardize safety protocols, and establish quality benchmarks that elevate industry professionalism while ensuring compliance with international logistics standards.

Key Industry Trends:

- Rising Demand for Domestic Goods Movement Across Manufacturing, FMCG & Retail Sectors

The Saudi Arabia road freight transport market experiences robust demand growth driven by expanding manufacturing activities, flourishing fast-moving consumer goods distribution, and dynamic retail sector development. Manufacturing facilities across petrochemical complexes, food processing plants, construction material production units, and consumer goods factories generate substantial outbound freight volumes requiring reliable transportation networks. FMCG companies operating sophisticated supply chain networks rely extensively on road transport for maintaining inventory levels across retail outlets dispersed throughout urban and rural areas. Retail sector expansion, characterized by growing shopping mall developments and franchise operations, further amplifies road freight requirements for regular inventory replenishment.

In February 2025, DHL eCommerce entered the Saudi Arabian market through acquiring a minority stake in AJEX Logistics Services, positioning itself to capitalize on the anticipated double-digit growth rate in the Kingdom's parcel market as logistics serves as a key growth pillar of Vision 2030.

- Expansion of Logistics Infrastructure Under Vision 2030 & National Transport and Logistics Strategy

Infrastructure development initiatives fundamentally reshape the operational landscape for the Saudi Arabia road freight transport market share, introducing world-class facilities that enhance cargo handling efficiency and network connectivity. The NTLS framework guides systematic expansion of highway networks, construction of modern truck terminals, development of inland container depots, and establishment of integrated logistics parks equipped with advanced cargo handling technologies. Major corridor development projects improve connectivity between primary commercial centers, industrial zones, port facilities, and border crossings.

In July 2025, the Royal Commission for Riyadh City launched property acquisition for the second phase of its Road Corridors Development Program, comprising eight road development projects with total investment exceeding SAR 8 Billion to improve inter-district connectivity and accommodate transit flows.

- Growing Adoption of Digital Freight Platforms and Fleet Management Technologies

Digital transformation emerges as a defining characteristic of the Saudi Arabia road freight transport market trends, with technology platforms revolutionizing traditional freight booking, tracking, and management processes. Digital freight marketplaces connect shippers directly with available truck capacity, introducing transparency in pricing, improving asset utilization, and reducing empty running ratios through efficient load matching algorithms. Fleet management systems incorporating telematics devices, GPS tracking solutions, and real-time monitoring dashboards empower logistics companies to enhance operational visibility and optimize fuel consumption patterns. Cloud-based transportation management systems facilitate seamless coordination between dispatchers, drivers, and customers while providing shipment visibility throughout the transportation lifecycle.

- Increasing Investments in Cold Chain & Temperature-Controlled Road Transportation

Specialized transportation requirements drive significant growth in temperature-controlled road freight services, reflecting expanding demand from pharmaceutical, food, and perishable goods sectors. Cold chain logistics networks ensure product integrity for vaccines, biologics, fresh produce, dairy products, and frozen foods throughout distribution channels. Investment in refrigerated truck fleets equipped with advanced cooling systems enables operators to maintain precise temperature ranges while ensuring regulatory compliance. The pharmaceutical sector imposes stringent cold chain requirements for medication distribution, while food retail expansion necessitates sophisticated cold chain capabilities connecting ports, distribution centers, and retail outlets.

- Shift Toward Fuel-Efficient & Environment-Friendly Heavy Commercial Vehicles

Sustainability considerations increasingly influence fleet acquisition decisions, driving adoption of fuel-efficient and environmentally conscious commercial vehicle technologies. Modern truck models incorporating aerodynamic designs, advanced engine technologies, and lightweight materials deliver substantial fuel economy improvements. Fleet operators recognize that fuel represents a significant operational cost component, making fuel-efficient vehicles economically attractive while simultaneously reducing environmental footprint. Interest in alternative fuel vehicles, including compressed natural gas trucks and electric commercial vehicles, reflects growing environmental consciousness within the logistics sector.

- Rapid Growth of E-Commerce Driving Express & Last-Mile Road Freight Services

E-commerce expansion fundamentally transforms urban freight patterns, creating explosive demand for express delivery services and sophisticated last-mile logistics solutions. Online retail platforms require rapid order fulfillment capabilities, frequent delivery schedules, and flexible routing arrangements that accommodate diverse customer locations. Last-mile delivery operations emerge as the most complex and cost-intensive segment of e-commerce logistics requiring specialized operational capabilities. Express courier services, parcel delivery networks, and on-demand logistics providers proliferate to meet growing customer expectations for same-day or next-day delivery options.

In September 2025, FedEx completed its transition to direct-serve presence in Saudi Arabia and launched FedEx Logistics division offering comprehensive freight forwarding services across air, road, and ocean freight, strengthening connectivity between the Kingdom and key markets in the GCC, South Asia, and Africa.

- Fleet Modernization Supported by Telematics, GPS Tracking & Route Optimization Solutions

Technological advancement fundamentally enhances fleet management capabilities, introducing sophisticated tools that improve operational efficiency and safety performance. Telematics systems installed in commercial vehicles capture comprehensive data on vehicle location, speed, fuel consumption, and driver behavior, providing fleet managers with actionable insights. Route optimization algorithms analyze multiple variables including delivery locations, traffic conditions, and vehicle capacity to generate optimal route plans that minimize transportation costs. Electronic logging devices automate driver hour recording, ensuring regulatory compliance while eliminating manual paperwork.

- Cross-Border Road Transport Strengthening Trade Links with GCC Region

Regional trade integration drives substantial growth in cross-border road freight operations, facilitating commercial exchanges between Saudi Arabia and neighboring Gulf Cooperation Council member states. Highway networks connecting the Kingdom with United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman enable efficient land-based cargo movement. Cross-border freight services offer competitive advantages for time-sensitive shipments, consolidated cargo loads, and goods requiring multiple delivery points. Border crossing efficiency improvements through infrastructure modernization and regulatory harmonization enhance cross-border freight competitiveness.

Market Segmentation & Regional Insights:

IMARC Group has categorized the Saudi Arabia road freight transport market based on temperature control, product type, distance, containerization, destination, and end user.

Temperature Control Insights:

The report has provided a detailed breakup and analysis of the market based on the temperature control. This includes controlled and non-controlled.

Temperature-controlled freight transport maintains specific thermal conditions throughout transit to preserve perishable goods, pharmaceuticals, and other temperature-sensitive products requiring refrigeration or climate management systems. Non-controlled freight transport involves ambient temperature cargo movement for general merchandise, dry goods, and materials that do not require specialized thermal management during transportation.

Product Type Insights:

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes liquid goods and solid goods.

Liquid goods transportation encompasses the movement of petroleum products, chemicals, beverages, edible oils, and other fluid cargo requiring specialized tanker vehicles with appropriate safety and containment systems. Solid goods transportation covers the movement of packaged products, raw materials, manufactured items, construction supplies, and other non-fluid cargo using standard trucks, flatbeds, and specialized vehicles.

Distance Insights:

The report has provided a detailed breakup and analysis of the market based on the distance. This includes long haul and short haul.

Long-haul freight transport involves cargo movement exceeding 500 kilometers, typically connecting major cities, ports, and industrial centers across distant regions within the Kingdom and neighboring countries. Short-haul freight transport covers cargo movement within 500 kilometers, primarily serving local distribution, urban delivery, and regional connectivity between nearby cities and facilities.

Containerization Insights:

A detailed breakup and analysis of the market based on the containerization have also been provided in the report. This includes containerized and non-containerized.

Containerized freight utilizes standardized shipping containers for secure, efficient cargo handling and intermodal transport compatibility between road, rail, and maritime modes. Non-containerized freight involves loose cargo, bulk materials, oversized equipment, and goods transported using conventional trucks, flatbeds, or specialized vehicles without standardized container units.

Destination Insights:

The report has provided a detailed breakup and analysis of the market based on the destination. This includes domestic and international.

Domestic freight transport facilitates cargo movement exclusively within Saudi Arabia's borders, serving internal supply chains, distribution networks, and inter-city commerce across the Kingdom's regions. International freight transport involves cross-border cargo movement connecting Saudi Arabia with neighboring Gulf Cooperation Council countries and other international markets through land corridors and border crossings.

End User Insights:

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

Agriculture, fishing and forestry segment encompasses transportation of agricultural produce, livestock, fishing products, and forestry materials requiring timely delivery from production areas to processing facilities, distribution centers, and markets. Construction sector freight transport involves movement of building materials, cement, steel, aggregates, machinery, and equipment supporting infrastructure development and real estate projects across the Kingdom. Manufacturing segment freight services facilitate inbound raw material delivery and outbound finished goods distribution for industrial facilities producing consumer goods, chemicals, automotive parts, and other manufactured products. Oil and gas, mining and quarrying segment covers specialized transportation of petroleum products, refined fuels, minerals, extracted resources, and industrial materials from production sites to refineries, processing plants, and export terminals. Wholesale and retail freight transport supports consumer goods distribution from warehouses and distribution centers to retail outlets, supermarkets, shopping centers, and e-commerce fulfillment operations.

Regional Insights:

The Northern and Central Region, anchored by Riyadh, serves as the Kingdom's primary economic and administrative hub, generating substantial freight volumes from government activities, retail distribution, manufacturing operations, and serving as a central logistics gateway connecting all major regions. The Western Region, encompassing Jeddah and Makkah, represents a critical freight corridor driven by major port operations, religious tourism logistics, commercial activities, and serving as the primary gateway for international trade entering the Kingdom. The Eastern Region, home to major industrial facilities, petrochemical complexes, and port infrastructure, generates significant freight volumes from oil and gas operations, manufacturing activities, and maritime trade connecting to international markets. The Southern Region features diverse freight requirements serving agricultural production, border trade with Yemen, tourism development, and regional distribution supporting economic growth initiatives aligned with Vision 2030 objectives.

Forecast (2025-2033):

The Saudi Arabia road freight transport market size is anticipated to reach USD 10.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033, driven by multiple converging factors. Growth in industrial production across manufacturing sectors generates consistent freight volumes requiring reliable transportation networks. Retail sector development amplifies distribution requirements connecting warehouses with diverse retail touchpoints. E-commerce penetration introduces additional freight volumes while demanding specialized last-mile delivery capabilities. Infrastructure development under Vision 2030 initiatives progressively improves highway connectivity and logistics facility availability. Regional trade integration and cross-border commerce expansion introduce additional growth dimensions as the Kingdom strengthens its position as a regional logistics hub.

Conclusion:

The Saudi Arabia road freight transport market trends reveal a dynamic industry experiencing comprehensive transformation driven by economic diversification, infrastructure modernization, technological innovation, and evolving customer requirements. Vision 2030 initiatives fundamentally reshape the logistics landscape through strategic investments and regulatory reforms that elevate industry standards. Key trends spanning manufacturing growth, e-commerce expansion, cold chain development, and regional integration collectively strengthen market fundamentals while introducing new service opportunities.

Transform Your Logistics Strategy with IMARC Group's Unmatched Intelligence:

- Decode Market Dynamics: Access comprehensive research revealing freight demand patterns, technological disruptions, and emerging service models reshaping Saudi Arabia's transportation landscape.

- Forecast Strategic Opportunities: Anticipate infrastructure developments, regulatory shifts, and technology adoption trends from electric vehicles to autonomous logistics platforms across regional corridors.

- Benchmark Competitive Performance: Evaluate fleet modernization strategies, service innovations, and market positioning tactics driving competitive differentiation in the evolving freight sector.

- Navigate Policy Frameworks: Stay ahead of transportation regulations, safety mandates, infrastructure investments, and cross-border trade facilitation initiatives shaping operational landscapes.

- Secure Customized Solutions: Receive tailored intelligence supporting logistics service launches, infrastructure investments, or supply chain optimization aligned with your strategic imperatives.

IMARC Group empowers logistics leaders with precision intelligence that converts market complexity into competitive advantage—because informed decisions drive sustainable growth. Click on this link for more information: https://www.imarcgroup.com/saudi-arabia-road-freight-transport-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)