Japan Pharmaceutical Industry Outlook: Key Growth Factors and Regulatory Support

Introduction to the Japan Pharmaceutical Industry:

The pharmaceutical industry in Japan is among the most advanced globally, recognized for combining innovation, high-quality standards, and patient-centered care. Its extensive value chain includes drug discovery, clinical trials, manufacturing, distribution, marketing, and post-market surveillance. Serving both domestic and international markets, Japanese pharmaceutical companies are respected for regulatory compliance, safety, and reliability, establishing them as trusted global collaborators in drug development.

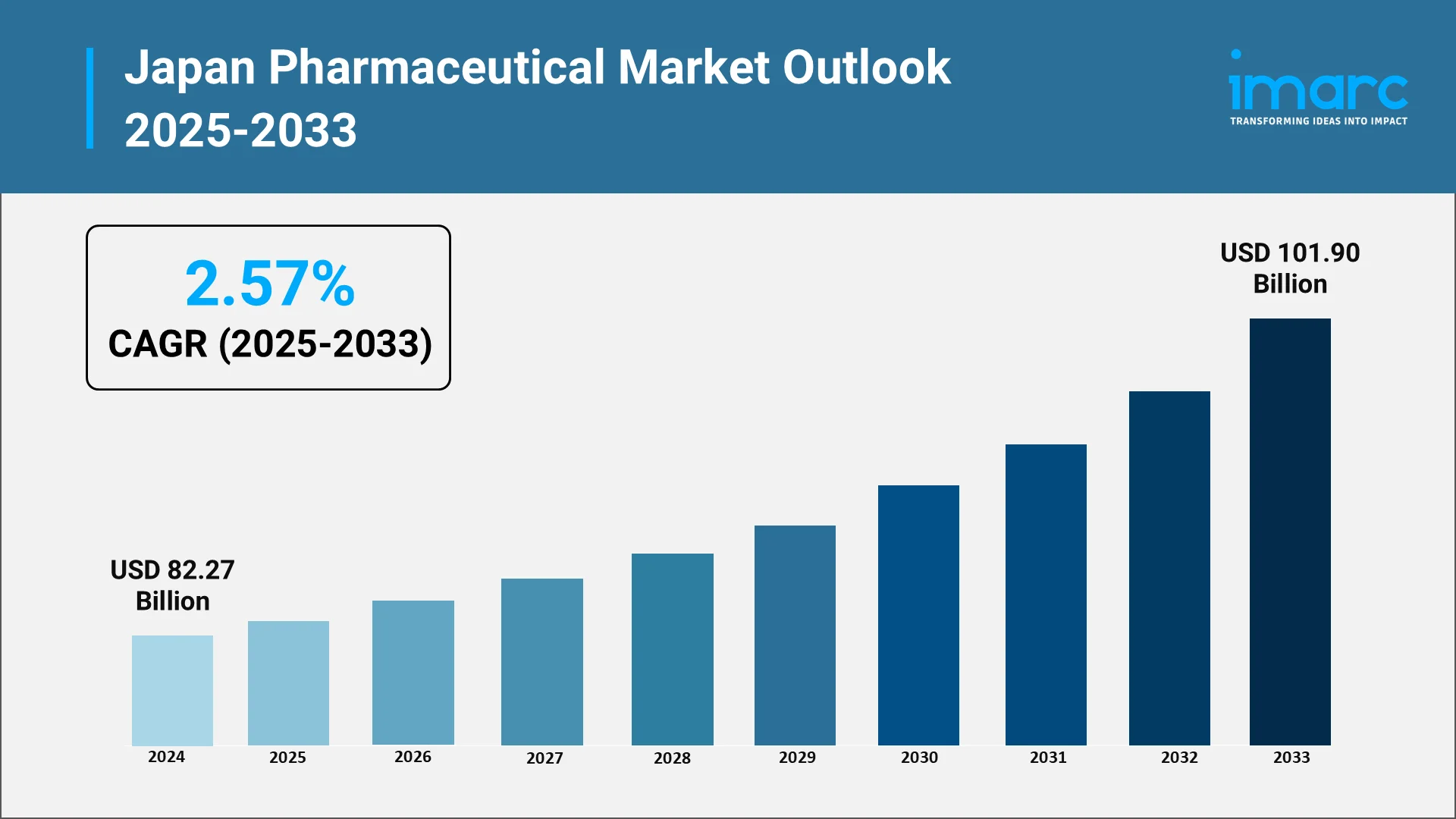

Strategically, the sector is vital to Japan’s economy and technological landscape. It addresses the healthcare needs of geriatric population while generating export revenue and facilitating international collaborations. As per sources, the Japan pharmaceutical market size reached USD 82.27 Billion in 2024. The market is projected to reach USD 101.90 Billion by 2033, exhibiting a growth rate (CAGR) of 2.57% during 2025-2033. Moreover, its role in innovation and biotechnology strengthens Japan’s position as a hub for advanced drug development. Economically and socially, the industry enhances public health outcomes and quality of life through innovative therapies and patient-focused care. It contributes to employment, research investment, and exports, reinforcing Japan’s leadership in biotechnology and pharmaceuticals on the global stage.

Explore in-depth findings for this market, Request Sample

Current Market Landscape and Trends:

Market Composition

- Japan's pharmaceutical industry consists of domestic drug makers, biopharmaceutical companies, and multinational players in both generic and specialty drug markets. The industry has over-the-counter drugs, prescription medicines, biologics, and high-value specialty therapeutics. This array guarantees that the industry can provide routine healthcare needs while at the same time confronting complicated therapeutic problems, including rare and chronic diseases. In September 2025, Otsuka and Lundbeck received a Complete Response Letter from the U.S. FDA for the sNDA of REXULTI® (brexpiprazole) with sertraline for adult PTSD, citing insufficient evidence of efficacy.

Specialty Drugs and Rare Disease Focus

- One of the strongest trends is the increasing need for specialty drugs and orphan drugs. Japan's geriatric population, along with rising incidence of chronic diseases, fuels demand for biologics, immunotherapeutics, and gene therapies. As per sources, in September 2024, Japan approved Eli Lilly’s donanemab (Kisunla) for Alzheimer’s, slowing cognitive decline by 29%, providing an additional treatment option amid rising dementia cases in the geriatric population. Moreover, the drug industry is investing in precision medicine and patient-specific therapies, which not only yield better clinical responses but also bring in high-value revenues.

Oncology and Chronic Disease Management

- Oncology, cardiovascular, and metabolic disorders are key therapeutic categories driving market expansion. The growing prevalence of cancer and lifestyle-related chronic diseases has spurred the development of targeted medicines, combination therapies, and immunomodulatory therapies. Pharmaceutical firms are now more concentrated on individualized modes of treatment attuned to patient-specific genetic and clinical fingerprints, prioritizing efficacy as well as safety. In March 2025, Japan approved Dupixent as the first-ever biologic for adults with COPD, based on phase 3 BOREAS study results, marking a new treatment approach after more than a decade.

Digital Transformation in the Industry

- The inclusion of digital technologies has emerged as a major trend in the Japanese pharmaceutical industry. Artificial intelligence (AI), machine learning, big data analytics, and cloud computing enhance drug discovery, reduce clinical trial procedures, and enhance predictive modeling. As per sources, in June 2025, Japan’s AI tool KIBIT by FRONTEO emerged as a breakthrough in drug discovery, using AI to reduce R&D costs and accelerate target identification in preclinical and clinical stages. Moreover, digital health platforms, such as telemedicine platforms, electronic health records (EHRs), and remote monitoring devices, enable real-time patient data collection, enhanced adherence, and evidence-based clinical decisions. These technologies shorten the development cycles, enhance operational efficiency, and improve patient engagement.

Strategic Partnerships and Collaborations

- Partnerships and collaborations are a characteristic feature of Japan's pharmaceutical sector. Local firms increasingly collaborate with multinational pharmaceutical companies, biotech players, and research centers to co-develop drugs. These partnerships enable knowledge sharing, risk reduction, and accelerated cycles of innovation. As per sources, in June 2025, Mitsubishi Research Institute and Astellas Pharma partnered under Japan’s MEDISO initiative to support drug-discovery startups, providing lab access, mentorship, and global commercialization guidance. Furthermore, joint ventures, licensing deals, and co-development projects are especially significant for high-value and high-complexity therapies, allowing companies to work through regulatory and technology problems efficiently.

Key Factors Driving Growth in the Japan Pharmaceutical Industry:

- Demographic Drivers: Pharmaceutical market expansion in Japan is driven by demographic trends. Japan boasts one of the world's oldest populations, and consequently, its healthcare demands are on the increase for chronic and geriatric diseases. Long-term care, preventive treatments, and the management of age-related illnesses, such as dementia, osteoporosis, and cardiovascular disease, fuel steady demand for specialty and innovative drugs.

- Increasing Chronic and Lifestyle Diseases: Urbanization, lifestyle modifications, and sedentary life have contributed to an increased incidence of lifestyle disorders, such as diabetes, complications arising from obesity, and hypertension. Companies are directing their efforts towards drug development that targets these diseases, such as combination therapy, targeted therapy, and prophylactic drug treatment, in accordance with public health goals.

- Technological Advancements: Technological advancement is an important growth driver. Progress in drug delivery systems, regenerative medicine, biotechnology, and digital health is revolutionizing treatment paradigms. New drug formulations enhance patient compliance, treatment effectiveness, and clinical outcomes. Artificial intelligence and predictive analytics further improve R&D productivity and decision-making efficiency.

- Government Support and Incentives: The Japanese government facilitates pharmaceutical innovation through various initiatives. Accelerated approval of drugs, R&D tax breaks, clinical trial funding, and orphan drug programs alleviate the investment climate for local and foreign players. These actions decrease the development risk, stimulate investment in high-value therapeutic areas, and foster innovation in niche and complex disease segments. In 2024, Japan’s MHLW plans a U.S.-based PMDA office and introduces a “premium for rapid introduction” in drug pricing, reducing drug lag and supporting foreign biotech market entry.

- Globalization and Export Potential: International collaboration is a key strategy for development in Japanese pharmaceutical companies. Licensing deals, joint ventures, and co-development initiatives provide entry into global markets, vary revenue streams, and lower operating risks. International collaborations also allow for knowledge transfer, implementation of best practices, and quicker commercialization of innovative treatments.

- Healthcare Infrastructure and Economic Stability: Japan's universal healthcare system provides stable demand for pharmaceuticals. Effective distribution networks, reimbursement systems, and compliance with quality standards ensure a business-friendly environment. Economic stability also facilitates longer-term R&D investments and operational growth.

Role of Innovation, R&D, and Biotechnology:

- Research and Development investment: R&D expenditure is at the core of Japan's pharma strategy. The companies invest considerable resources in genomics, molecular biology, immunotherapy, regenerative medicine, and personalized medicine. All these interventions facilitate the creation of new drugs, biologics, and sophisticated delivery systems specific to complex and chronic disorders.

- Biotechnology and Advanced Therapeutics: Biotechnology fuels innovation in the pharmaceutical industry in Japan. The technologies of recombinant DNA, monoclonal antibodies, cell therapies, and gene therapies offer solutions for orphan and complex diseases. Biotechnology also facilitates the manufacture of biosimilars and biologics, widening the range of available therapies, enhancing patient outcomes, and contributing to sustainable industry growth.

- Academic and Industry Collaboration: Partnerships with universities, research organizations, and international partners drive innovation. Academic research creates core scientific breakthroughs, and pharmaceutical firms convert discoveries into commercially viable treatments. Co-development deals, knowledge-transfer schemes, and joint ventures facilitate commercialization, increase efficiency, and lower risk.

- Digital Integration in R&D: Digital solutions, AI, and data analysis maximize drug discovery, trial design, and outcome prediction. Remote monitoring of patients, real-time data gathering, and predictive modeling maximize trial efficiency and minimize costs. Digitalization boosts R&D productivity and enhances the chances of successful regulatory approvals.

- Intellectual Property Protection: Protection of intellectual property promotes innovation and investment. Regulatory protections and patents ensure commercial success for novel therapies, stimulating high-value R&D. Robust IP regimes support Japan's global leadership in the pharmaceutical and biotech industries.

- Emerging Therapeutic Areas: Emerging fields like regenerative medicine, gene therapy, immuno-oncology, and microbiome therapeutics are gaining attention. Japanese pharmaceutical companies are investing largely in these fields to capture unmet medical needs, enhance patient benefits, and increase global competitiveness.

Impact of Government Policies and Regulatory Framework:

Regulatory Supervision and Safety Standards

- The Pharmaceuticals and Medical Devices Agency (PMDA) regulates drug approvals, clinical trials, and post-market surveillance. Its strict regulatory system ensures product quality, efficacy, and safety. Conforming to the rules increases public confidence and global market credibility.

Expedited Approvals and Conditional Pathways

- Accelerated approval processes, priority review requests, and conditional approvals for breakthrough drugs shorten regulatory timelines. These actions facilitate faster patient access to crucial treatments while offering firms a competitive advantage in high-value therapeutic markets. In FY 2024–25 (April 2024–March 2025), Japan’s PMDA approved 148 drugs, including 66 new active ingredients and 82 lifecycle updates, with orphan-drug priority reviews benefiting rare diseases and key therapeutic areas (August 2025).

Financial Incentives and R&D Support

- Tax credits, grants for clinical trials, and orphan drug development incentives encourage research and innovation investment. Financial assistance mitigates operation costs, stimulates R&D in specialized therapeutic markets, and increases development of high-value treatments. As per sources, In January 2025, Japan’s MHLW launched a 10-year government fund to support innovative drug development, strengthen R&D capabilities, and enhance the country’s pharmaceutical ecosystem, bolstering global competitiveness.

Quality Assurance and Pharmacovigilance

- Adherence to Good Manufacturing Practices (GMP), stringent quality assurance systems, and pharmacovigilance systems guarantees the efficacy and safety of drugs. Overemphasis by the government on quality furthers the image of Japanese drugs abroad, enhancing export and cooperation drives.

International Harmonization and Global Standards

- Japan is an active player in international regulatory frameworks like the International Council for Harmonisation (ICH). Harmonization of standards makes international clinical trials, collaborative research programs, and cross-border regulatory licenses possible. This process enhances the global competitiveness of Japanese pharmaceutical companies and ensures compliance with the best in international practices.

Future Outlook for the Japan Pharmaceutical Industry:

The Japanese pharmaceutical industry is poised for robust growth, driven by demographic trends, innovation, and supportive government policies. Oncology and immuno-oncology therapies are expected to lead near-term expansion, with rising cancer incidences and approvals of advanced treatments sustaining pipeline depth. Biopharmaceuticals present significant growth potential, as domestic companies continue to expand capabilities in new modalities, bridging gaps with global peers.

Corporate pipelines signal strong future performance, with late-stage development of multiple molecular entities positioning firms for sustained revenue growth. Manufacturing capacity expansions, such as Shionogi’s antiviral production lines and Eisai’s neurological treatment facilities, reflect confidence in long-term demand. International collaborations and biotechnology partnerships facilitate technology transfer, knowledge exchange, and market access, reinforcing competitiveness.

Digital health integration enhances clinical trials, real-world evidence collection, and patient engagement, while regulatory evolution streamlines approvals and aligns standards globally. Collectively, these factors indicate a dynamic, innovation-driven outlook for Japan’s pharmaceutical sector over the coming decade.

Conclusion:

The Japanese pharmaceutical industry is strategically positioned for sustained growth, driven by demographic trends, technological innovation, and a supportive regulatory environment. Its evolution from a domestic-focused market to a global hub for advanced therapies underscores the sector’s resilience and adaptability. Investment in R&D, biotechnology, and precision medicine continues to fuel innovation, while robust corporate pipelines and manufacturing expansions ensure capacity to meet growing domestic and international demand.

Government policies, including expedited approvals, tax incentives, and alignment with global regulatory standards, provide a conducive environment for innovation and market competitiveness. Strategic collaborations, both domestic and international, facilitate knowledge exchange, technology transfer, and access to emerging markets. Integration of digital health technologies enhances clinical trials, patient engagement, and real-world evidence collection, improving therapeutic outcomes. Collectively, these factors reinforce Japan’s position as a global leader in pharmaceutical innovation, delivering high-quality, patient-centric therapies while maintaining long-term economic and societal impact.

Choose IMARC Group As We Offer Unmatched Expertise and Core Services:

- Data-Driven Market Research: Enhance your understanding of Japan's pharmaceutical landscape, including market dynamics, therapeutic area trends, regulatory developments, and technological innovations such as antibody-drug conjugates, biosimilars, regenerative medicine, and precision therapeutics through comprehensive market intelligence reports.

- Strategic Growth Forecasting: Anticipate emerging opportunities in pharmaceutical development, from advanced immunotherapies and cell-based treatments to policy reforms and reimbursement changes, with detailed regional and therapeutic area analysis for strategic decision-making.

- Competitive Benchmarking: Evaluate competitive dynamics in Japan's pharmaceutical market, assess product pipelines, monitor breakthrough innovations in biotechnology and specialty pharmaceuticals, and track strategic partnerships shaping industry evolution.

- Policy and Infrastructure Advisory: Navigate complex regulatory frameworks, government initiatives promoting innovation, PMDA approval pathways, and National Health Insurance pricing mechanisms affecting drug development, approval timelines, and market access strategies.

- Custom Reports and Consulting: Obtain tailored insights aligned with your organizational objectives, whether introducing innovative therapeutics, investing in biopharmaceutical ventures, establishing manufacturing facilities, or developing market entry strategies for Japan's unique pharmaceutical ecosystem.

At IMARC Group, our mission is to empower pharmaceutical leaders with the clarity and intelligence required to succeed in Japan's dynamic market environment. Partner with us to transform market insights into strategic advantage—because informed decisions drive sustainable growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)