Key Challenges and Opportunities Shaping the Japan Agritourism Industry

Introduction to Japan's Agritourism Industry:

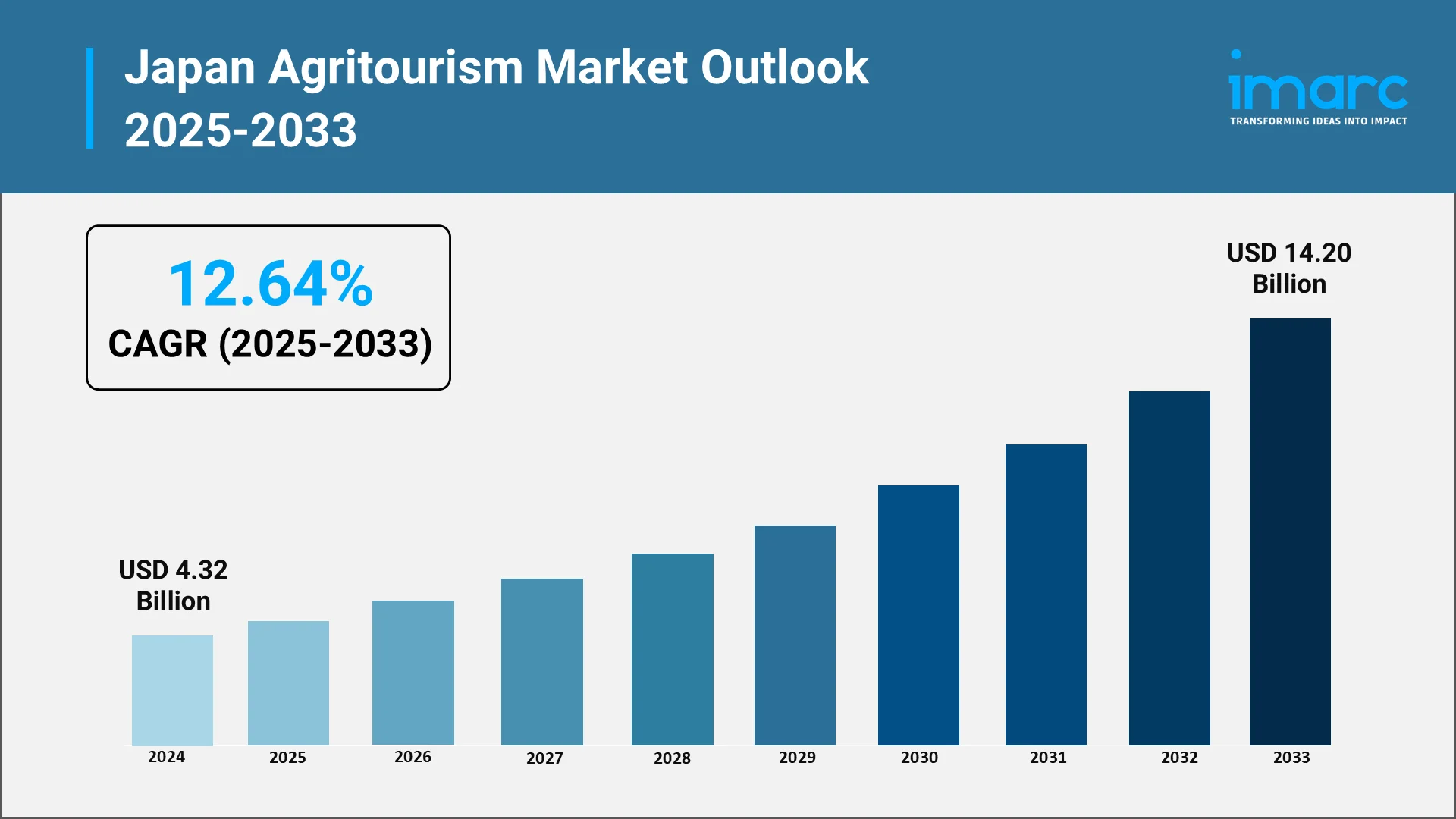

The Japan agritourism industry is experiencing remarkable transformation as travelers increasingly seek authentic connections with rural landscapes and agricultural traditions. Agritourism represents a dynamic fusion of agriculture and tourism, offering visitors immersive experiences through farm stays, hands-on agricultural activities, and cultural immersion in Japan's countryside. This emerging sector has gained significant momentum as both domestic and international tourists look beyond urban centers to discover the nation's agricultural heritage and sustainable farming practices. The Japan agritourism market size reached USD 4.32 Billion in 2024. The sector encompasses diverse activities including farm stays, educational workshops, outdoor recreation, and direct agricultural product sales, creating multifaceted value for rural communities and visitors alike.

The rise of sustainable tourism Japan initiatives reflects changing consumer preferences toward experiential travel that supports local economies while preserving cultural and environmental heritage. As overtourism challenges major metropolitan areas like Tokyo and Kyoto, agritourism presents viable solutions for distributing tourist flows more evenly across the country. Japan's unique agricultural landscapes, ranging from Hokkaido's dairy farms to terraced rice paddies in mountainous regions, offer distinctive experiences that resonate with global travelers seeking authenticity and meaningful connections with host communities.

Explore in-depth findings for this market, Request Sample

Growing Interest in Rural and Sustainable Tourism:

International interest in rural tourism Japan has surged dramatically, driven by global trends emphasizing sustainability, wellness, and authentic cultural experiences. However, most tourists have historically concentrated on the Golden Route spanning Tokyo, Osaka, Kyoto, and Kobe, creating infrastructure strain and overcrowding in these urban centers.

Travelers from around the world are demonstrating heightened interest in sustainable tourism and contributing to local communities beyond traditional sightseeing. According to Japan's White Paper on Tourism 2024, international tourists increasingly seek experiences rooted in traditional Japanese culture and everyday rural life, not merely famous landmarks and shopping districts. This shift represents significant opportunities for rural regions to attract visitors through agricultural experiences, local cuisine, and cultural preservation activities.

The COVID-19 pandemic accelerated demand for outdoor, nature-based tourism experiences that offer social distancing and health benefits. Agritourism activities provide pollution-free environments, fresh agricultural products, and recreational opportunities that align with wellness tourism trends. Farmers across Japan have begun recognizing agritourism's potential to diversify income streams while sharing their agricultural knowledge and traditions with urban populations increasingly disconnected from food production systems.

Farm stays and agricultural experience tourism allow visitors to participate directly in farming activities including rice planting, vegetable harvesting, and traditional food preparation. These hands-on experiences foster deeper understanding of agriculture's cultural significance in Japanese society while creating memorable travel moments. Regional specialties such as Hokkaido's dairy products, Aomori's apples, and various prefectural cuisines create natural attractions for culinary-focused travelers exploring Japan's diverse agricultural landscape.

Government Initiatives Promoting Agritourism Development:

The Japanese government has implemented comprehensive strategies to promote agritourism development as part of broader rural revitalization efforts. The Farm Stay Promotion Plan was introduced by the Ministry of Agriculture, Forestry, and Fisheries (MAFF) with the lofty goal of 700,000 guest nights on farm stays per year by 2025. In rural areas, which make up 65% of Japan's geographical area, this project seeks to welcome return visitors, promote longer stays, and draw in first-time travelers.

Government support extends through multiple policy frameworks addressing rural depopulation and agricultural sector challenges. While primarily focused on production, these reforms recognize agritourism's role in supporting farmer income diversification and rural economic vitality.

The Japan Tourism Agency published the Japan Sustainable Tourism Standard for Destinations and provides support to regions working to create sustainable tourism regions through expanded training programs and international certification promotion. As of 2024, eight Japanese towns have been designated as Best Tourism Villages by the United Nations World Tourism Organization, including Nishikawa in Yamagata Prefecture and Amagi in Kagoshima Prefecture. These designations recognize achievements in rural tourism development, community empowerment, and heritage preservation through tourism activities.

In 2024, the government announced preparations for a Smart Agriculture Promotion Act aimed at reducing barriers to smart farming solution adoption. While focused on production efficiency, these technological advancements indirectly support agritourism by improving farm productivity, allowing farmers to allocate time and resources to tourism activities without compromising agricultural operations.

Key Challenges: Infrastructure, Awareness, and Seasonal Limitations

Despite promising growth trajectories, Japan's agritourism industry faces significant challenges requiring strategic attention and investment. Infrastructure limitations in rural areas present substantial obstacles to tourism development, particularly regarding transportation accessibility, accommodation quality standards, and digital connectivity. Many agricultural regions lack convenient public transportation links to major urban centers, making rural areas difficult for international tourists without rental vehicles to access independently.

The aging farmer population represents a fundamental challenge, with the average age of Japanese farmers exceeding 67 years and many farmers over 70 years old. This demographic reality creates labor shortages and limits capacity for farmers to manage both agricultural production and tourism operations simultaneously. Young people continue migrating toward metropolitan areas, creating workforce gaps that constrain rural tourism service delivery and hospitality capabilities.

Awareness and marketing challenges persist as many international travelers remain unfamiliar with agritourism opportunities beyond major cities. Limited English language information, insufficient online booking platforms tailored to international markets, and inadequate digital marketing strategies restrict global visibility for rural tourism offerings. Farmers often lack hospitality training, customer service experience, and marketing expertise necessary to attract and manage international visitors effectively.

Seasonal limitations significantly impact agritourism viability, with many agricultural activities concentrated in specific planting and harvesting periods. This seasonality creates uneven visitor distribution throughout the year, making consistent revenue generation challenging for farm-based tourism operations. Weather dependency further compounds operational uncertainties, as typhoons, excessive rainfall, or extreme temperatures can disrupt planned agricultural activities and visitor experiences.

Regulatory barriers including zoning laws, licensing requirements, and environmental regulations create additional hurdles for farmers entering tourism operations. Small-scale operators often struggle navigating complex regulatory frameworks while lacking capital for necessary infrastructure investments in accommodation facilities, safety equipment, and visitor amenities. Quality assurance and service standardization across diverse agritourism operations remain inconsistent, potentially affecting visitor satisfaction and repeat visitation rates.

Opportunities for Farmers and Local Communities:

The agritourism sector presents transformative opportunities for Japanese farmers seeking income diversification amid declining agricultural profitability and market volatility.

Educational tourism emerges as the fastest-growing segment within Japan's agritourism market, reflecting increasing consumer interest in learning about sustainable agriculture, traditional farming techniques, and food production processes. Farmers can capitalize on this trend by developing structured educational programs, workshops, and demonstration activities that showcase agricultural knowledge while generating supplementary income. These programs appeal particularly to families with children, school groups, and urban residents seeking reconnection with agricultural origins.

Direct sales opportunities through farm-to-table experiences, on-site farm shops, and u-pick operations allow farmers to capture higher margins compared to traditional wholesale distribution channels. Agritourism facilitates direct relationships between producers and consumers, enabling farmers to communicate product quality, sustainable farming practices, and regional agricultural heritage. This direct engagement builds brand loyalty and creates recurring customer relationships extending beyond single farm visits.

Technology integration offers farmers powerful tools to enhance agritourism operations through online booking platforms, social media marketing, and digital payment systems. Accessible technology enables small-scale operators to reach global audiences, manage reservations efficiently, and collect customer feedback for continuous improvement. Partnerships with travel agencies, tourism platforms, and regional tourism organizations amplify marketing reach while providing professional support for operational development.

Collaboration opportunities within rural communities enable resource sharing, joint marketing initiatives, and comprehensive visitor experiences spanning multiple farms and attractions. Regional agritourism networks can coordinate seasonal activities, share best practices, and collectively invest in common infrastructure improvements. These collaborative approaches enhance destination appeal while distributing costs and risks among multiple stakeholders.

Future Outlook: Enhancing Japan's Agritourism Potential by 2033

The future of agritourism in Japan appears exceptionally promising, with market projections indicating sustained growth through 2033 driven by global trends favoring experiential, sustainable, and culturally immersive travel. Japan's agritourism market is projected to reach USD 14.20 Billion by 2033, exhibiting a growth rate (CAGR) of 12.64% during 2025-2033. This trajectory positions agritourism as a significant contributor to Japan's overall tourism economy and rural development strategies.

Technological innovation will fundamentally reshape agritourism delivery and marketing over the coming decade. Artificial intelligence-driven travel planning tools, virtual reality farm tours for pre-visit engagement, and enhanced digital infrastructure in rural areas will improve accessibility and visitor experiences. Smart agriculture technologies including IoT sensors, automated farming equipment, and precision agriculture systems will enable farmers to manage tourism operations more efficiently alongside primary agricultural activities.

The integration of sustainability principles into agritourism operations will become increasingly critical as environmentally conscious travelers prioritize low-impact tourism choices. Japan's commitment to sustainable tourism development, demonstrated through initiatives like the Japan Sustainable Tourism Standard for Destinations, will guide agritourism evolution toward practices minimizing environmental footprints while maximizing local community benefits. Organic farming experiences, renewable energy demonstrations, and conservation-focused activities will differentiate Japanese agritourism offerings in competitive global markets.

Luxury and premium agritourism segments present significant growth opportunities as affluent travelers seek exclusive, high-quality rural experiences. High-end farm stays featuring gourmet farm-to-table dining, private agricultural workshops with master farmers, and luxury accommodations in renovated traditional farmhouses appeal to travelers willing to pay premium prices for exceptional experiences. This market segment offers superior revenue potential while requiring corresponding investments in service quality and facility standards.

International collaboration and knowledge exchange will accelerate agritourism development as Japan learns from mature markets like Europe while sharing its unique cultural approaches with emerging agritourism destinations across Asia. Cross-border partnerships, international marketing initiatives, and participation in global agritourism networks will enhance Japan's competitive positioning while attracting diverse international visitor segments.

The projected growth requires coordinated action across multiple stakeholders including government agencies, agricultural cooperatives, tourism organizations, and individual farmers. Strategic investments in infrastructure, training programs, marketing initiatives, and quality standards will determine how effectively Japan captures emerging opportunities. By 2033, agritourism can become a cornerstone of rural Japanese economies, preserving agricultural heritage while creating sustainable livelihoods for future generations.

Choose IMARC Group for Unmatched Expertise and Core Services in Agritourism Intelligence:

As Japan's agritourism grows, stakeholders need sophisticated intelligence to navigate challenges and opportunities. IMARC Group provides comprehensive research and consulting, empowering farmers, investors, and operators with actionable, sector-specific insights.

- Data-driven market research provides quantitative and qualitative insights on global/Japan agritourism trends, visitor preferences, and regional demand. We analyze market dynamics and consumer behavior, enabling informed strategic decisions for market entry and operational optimization.

- Strategic growth forecasting predicts emerging opportunities in segments like eco-tourism and luxury farm stays. Forecasts analyze policy, demographics, and technology disruptions, incorporating macroeconomic factors to guide long-term investment and operational planning.

- Competitive benchmarking analyzes successful domestic and international agritourism models. We evaluate competitor positioning, pricing, and customer satisfaction to identify best practices, helping clients differentiate offerings and capture market share.

- Policy and regulatory advisory keep clients informed on government support, funding opportunities, and regulations at national/prefectural levels. We ensure compliance, help navigate complex environments and align operations with evolving policy frameworks.

- Custom reports and consulting services address specific organizational objectives (launching, expanding, or investing). We deliver tailored insights and practical recommendations that support implementation through every development stage.

Our goal is to empower stakeholders with the clarity and intelligence required to build sustainable, profitable rural tourism enterprises. Join us in supporting Japan's agricultural communities and creating memorable traveler experiences. For detailed information, click: https://www.imarcgroup.com/japan-agritourism-market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)