Top Factors Driving Growth in the Wi-Fi Market

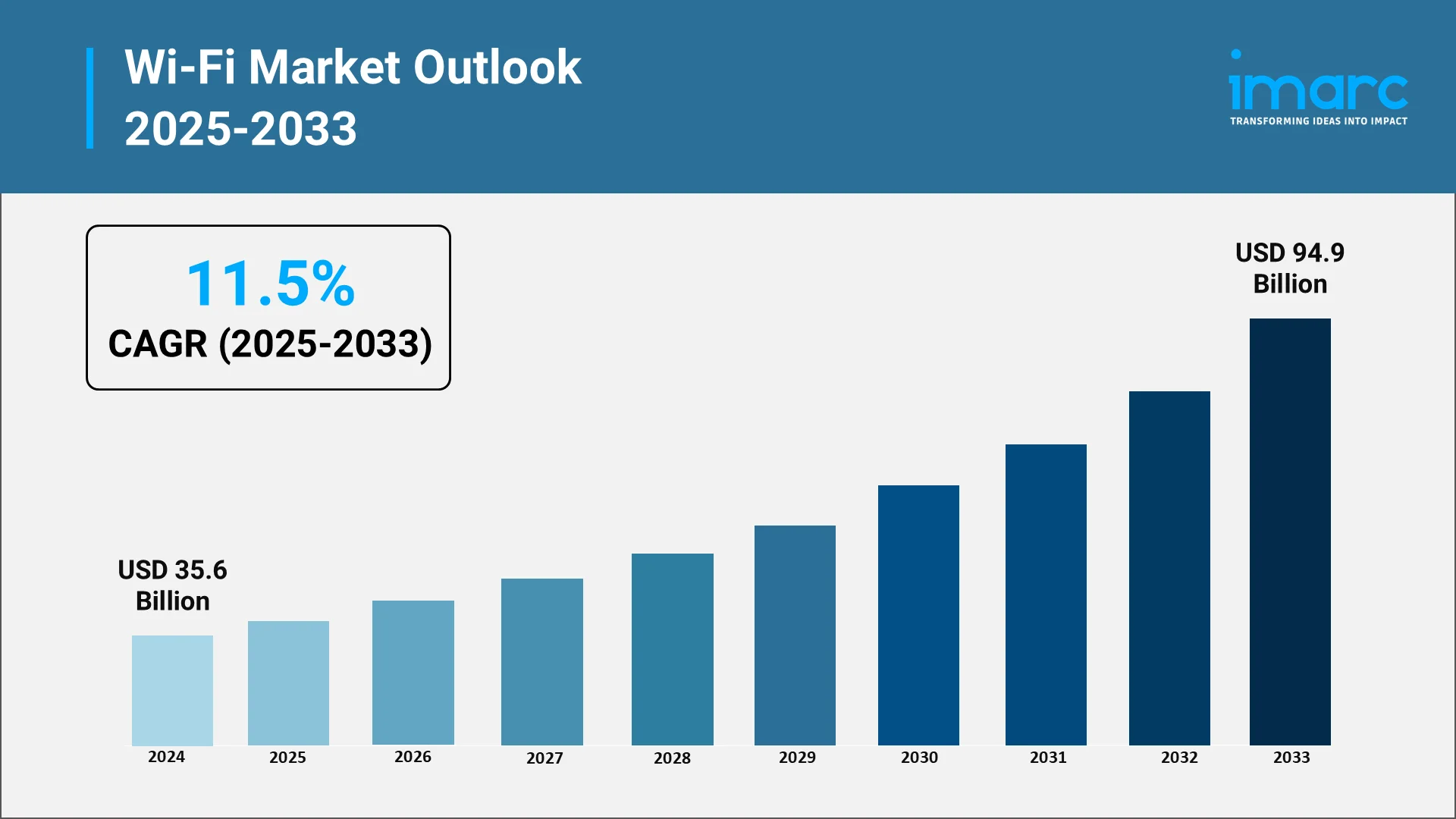

The global Wi-Fi infrastructure market is experiencing unprecedented expansion, fundamentally reshaping how organizations operate and consumers interact with technology. According to Wi-Fi Alliance, the official industry certification body, 4.1 Billion Wi-Fi devices are forecast to ship in 2024, contributing to 45.9 Billion cumulative Wi-Fi shipments over the technology's 25-year lifetime. This remarkable growth reflects the increasing criticality of wireless connectivity across all sectors of the economy. According to IMARC Group, the global Wi-Fi market size reached USD 35.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 94.9 Billion by 2033, exhibiting a growth rate (CAGR) of 11.5% during 2025-2033.

The Wi-Fi ecosystem now supports 21.1 Billion Wi-Fi devices in use across diverse environments, from smart locks and thermostats in homes to cloud computing and telepresence in enterprise settings, and factory monitoring in industrial applications. This massive installed base demonstrates the technology's maturation from a convenience to an essential infrastructure component supporting modern digital operations.

Explore in-depth findings for this market, Request Sample

Remote Work and Hybrid Work Models Expansion:

The transformation of work patterns represents one of the most significant drivers of Wi-Fi infrastructure growth. According to the U.S. Bureau of Labor Statistics, the percentage of workers primarily working from home increased dramatically during the pandemic and has remained elevated. In 2024, a significant share of workdays were performed remotely, as compared to before the pandemic, representing a four-fold increase that has fundamentally altered enterprise connectivity requirements.

Government research from the Bureau of Labor Statistics confirms a positive relationship between remote work adoption and productivity across 61 industries. The pandemic triggered a massive experiment in full-time remote work for most workers and firms. This sustained elevation in remote work has driven enterprise investment in Wi-Fi infrastructure to support distributed workforces. The majority of remote-capable employees currently work in a hybrid or exclusively remote arrangement, with six in ten employees with remote-capable jobs wanting a hybrid work arrangement. This transformation has created unprecedented demand for enterprise-grade Wi-Fi solutions that can extend network performance and security to remote locations.

The Federal Communications Commission's latest broadband reports indicate that enterprise demand for high-speed internet connectivity has increased substantially as organizations adapt to permanent hybrid work models. The shift has created unprecedented demand for enterprise-grade Wi-Fi solutions in both traditional office environments and home office settings, driving adoption of advanced Wi-Fi technologies including Wi-Fi 6 and Wi-Fi 7 standards that provide the enhanced performance and device capacity required for professional remote work applications.

IoT Device Proliferation and Smart Home Adoption:

- The exponential growth of IoT devices represents a fundamental driver of Wi-Fi infrastructure expansion. Smart home connectivity has emerged as a particularly significant growth driver within the IoT ecosystem. Recent industry reports indicate that Wi-Fi makes up 31% of all IoT connections globally, making it the dominant wireless technology for IoT applications. The industry association reports that Wi-Fi IoT device shipments accounted for 37% of all Wi-Fi devices in 2022 and are predicted to exceed 40% by 2027.

- The growing demand for high-speed, low-latency wireless connectivity is reshaping enterprise and consumer networks. The new standard is providing foundational connectivity for augmented reality, virtual reality, extended reality applications, ultra-high definition video streaming, and Industrial IoT deployments, with Wi-Fi 6 adoption accelerating rapidly. This demonstrates the expanding scope of IoT applications driving Wi-Fi infrastructure demand beyond traditional computing devices.

- Statistics show that over 47 million Wi-Fi 6 enabled devices (including Wi-Fi 6E) will ship for IoT applications in 2024, demonstrating the industry's transition to higher-performance wireless standards to support smart home requirements. The technology transition has been remarkable, with three-quarters of Wi-Fi-enabled devices shipped globally in 2023 equipped with Wi-Fi 6 and Wi-Fi 6E technologies. These latest standards provide the enhanced speed, reliability, and device capacity needed to support multiple connected devices simultaneously in smart home environments.

5G Network Rollout and Wi-Fi 6/6E Technology Advancement:

The convergence of 5G and Wi-Fi integration represents a transformative trend reshaping wireless connectivity infrastructure. The Federal Communications Commission has taken significant action to support this convergence by making 6 GHz band available for unlicensed Wi-Fi use, enabling Wi-Fi 6E and Wi-Fi 7 deployments with enhanced performance capabilities. The adoption of Wi-Fi continues accelerating across enterprise environments. This growth reflects enterprise recognition of the enhanced performance capabilities these technologies provide.

The Wi-Fi Alliance's release of Wi-Fi CERTIFIED 7™ in January 2024 has accelerated enterprise adoption of next-generation wireless infrastructure. The new standard offers multigigabit data rates, deterministic latency, and increased reliability to support stringent connectivity requirements of modern applications including AI workloads, real-time automation, and immersive technologies. According to FCC regulations, the 6 GHz band allocation enables up to seven 160-megahertz channels or three 320-megahertz channels for Wi-Fi operations, providing the spectrum resources necessary to support high-bandwidth applications. The Commission's 2024 updates to 6 GHz regulations further expand unlicensed device operation capabilities across the entire band. Major technology companies are accelerating Wi-Fi 7 deployments.

Increasing Demand for High-Speed Internet and Bandwidth:

Enterprise bandwidth requirements have increased substantially, reflecting growing demand for high-speed connectivity. According to FCC data from the latest Measuring Broadband America report, consumer internet usage has shifted from web browsing to video consumption dominance, with consumers regularly streaming video for entertainment and education purposes. This growth reflects enterprise recognition of the need for enhanced network infrastructure to support digital operations.

Wireless access points are experiencing substantial growth as organizations prepare for Wi-Fi 7 deployment. Wi-Fi Alliance reports that 147.2 million Wi-Fi 6E access points shipped in 2024, along with 23.12 million Wi-Fi 7 access points, demonstrating enterprise investment in next-generation wireless infrastructure capable of supporting future bandwidth requirements. The Federal Communications Commission's broadband progress reports indicate that approximately 26 million Americans in rural communities lack access to broadband infrastructure, while about one-third of Americans do not subscribe to broadband even when available. This digital divide drives continued investment in wireless infrastructure to provide connectivity alternatives.

Digital Transformation Across Industries:

Digital transformation initiatives across industries continue driving substantial demand for advanced Wi-Fi infrastructure. Artificial intelligence applications have proven particularly network-intensive, requiring robust wireless connectivity infrastructure to support real-time data processing and machine learning workloads.

- Healthcare organizations are prioritizing high-reliability secure networks for remote patient monitoring, telehealth, and digital records management. Advanced wireless infrastructure enables seamless connectivity for medical devices, patient tracking systems, and critical healthcare applications that require zero-downtime performance.

- Educational institutions are upgrading to Wi-Fi 6 technology to support e-learning platforms, digital collaboration tools, and campus-wide connectivity. The technology's high device density capabilities accommodate hundreds of simultaneous connections while maintaining consistent performance for interactive learning applications.

- Manufacturing and industrial facilities are implementing Wi-Fi solutions to enable IoT sensors, automated machinery, and AI-driven predictive maintenance systems. These deployments support real-time monitoring, quality control automation, and seamless integration between operational technology and information technology systems.

- Retail and hospitality sectors are investing in advanced wireless infrastructure to enhance customer experiences through mobile payments, location-based services, and personalized digital interactions. Modern Wi-Fi deployments enable seamless guest connectivity while supporting back-office operations and inventory management systems.

- Financial services organizations are modernizing branch networks with secure, high-performance Wi-Fi to support digital banking services, mobile transactions, and customer self-service applications. These implementations require enterprise-grade security features and consistent connectivity to maintain regulatory compliance and customer trust.

Increasing Demand for High-Speed Internet and Bandwidth:

Enterprise bandwidth requirements have increased substantially, reflecting growing demand for high-speed connectivity. According to FCC data from the latest Measuring Broadband America report, consumer internet usage has shifted from web browsing to video consumption dominance, with consumers regularly streaming video for entertainment and education purposes. DE-CIX, a leading global Internet Exchange (IX) operator, announced a new milestone for 2024, with over 3,400 connected networks exchanging more than 68 exabytes of data traffic across its worldwide locations.

The Federal Communications Commission's broadband progress reports indicate that approximately 26 million Americans in rural communities lack access to broadband infrastructure, while about one-third of Americans do not subscribe to broadband even when available. This digital divide drives continued investment in wireless infrastructure to provide connectivity alternatives.

Enterprise Network Modernization and Cloud Migration:

Enterprise network modernization initiatives represent crucial drivers of Wi-Fi infrastructure growth. In August 2025, NTT DATA and Cisco published an IDC InfoBrief to guide enterprises on network modernization in the AI era. The study shows over 78% of organizations view networking as critical for GenAI infrastructure, driving demand for secure, high-speed, adaptive networks. Through their partnership, NTT DATA and Cisco help clients replace legacy systems with AI-powered, intelligent infrastructure to boost operational performance and security. Cloud migration trends are accelerating enterprise Wi-Fi infrastructure investment. Technology companies report that hybrid cloud deployments and edge computing applications require robust wireless connectivity to support distributed computing environments and real-time data processing requirements. Recent developments include:

- In September 2025, GDIT announced a USD 1.5 Billion enterprise IT modernization contract for the U.S. Strategic Command, covering a base year plus six options. The initiative leverages digital engineering, artificial intelligence, and advanced cyber capabilities to enhance strategic deterrence and transition operations to a hybrid cloud environment. GDIT will implement zero trust security, integrate real-time analytics, and increase efficiency across global defense missions.

- In September 2025, 4iG Group selected Nokia as its strategic partner to modernize and unify Hungary’s IP access and DWDM transport backbone networks. This next-generation system will deliver fast, stable, and secure connectivity to support AI and data center growth, consolidating legacy networks for efficiency and sustainability. The project will establish an energy-efficient, cloud-native, and future-proof infrastructure to meet rising digital service and capacity demands.

- In August 2025, Ceragon secured an USD 8 Million contract to upgrade a power utility’s private network across EMEA with advanced microwave technology. The modernization project replaces end-of-life systems and delivers high-capacity connectivity using full indoor and split mount radios. This solution supports the utility’s nationwide backbone, streamlining operations and positioning Ceragon for future expansion phases.

Conclusion:

The Wi-Fi infrastructure market's robust growth trajectory reflects fundamental changes in work patterns, technology adoption, and enterprise digital strategies.

The convergence of hybrid work models, IoT proliferation, 5G integration, digital transformation initiatives, bandwidth demands, and cloud migration creates a compelling growth environment for wireless infrastructure providers. Industry data indicates this growth will continue accelerating, driven by emerging technologies such as artificial intelligence, augmented reality, and industrial automation requiring ultra-reliable, high-capacity wireless connectivity.

For organizations seeking comprehensive market intelligence and strategic guidance in this rapidly evolving landscape, IMARC Group delivers unparalleled value.

Why Choose IMARC Group:

- Decades of Technology Market Expertise: Deep understanding of wireless infrastructure trends and digital transformation dynamics

- Rigorous Research Methodology: Proven analytical frameworks that deliver actionable insights for strategic decision-making

- Authoritative Data Sources: Access to government databases, industry associations, and verified company reports

- Track Record of Success: Consistent delivery of market intelligence that drives business growth and competitive advantage

- Strategic Investment Guidance: Expert analysis for navigating market opportunities and assessing competitive positioning

- Future-Focused Analysis: Forward-looking insights that position clients ahead of emerging technology trends

- Comprehensive Coverage: End-to-end market intelligence from technology adoption to revenue impact assessment

As the Wi-Fi infrastructure market continues its dynamic evolution, organizations that leverage IMARC Group's expert market research and strategic insights will be best positioned to capitalize on the substantial growth opportunities ahead. The fundamental drivers of Wi-Fi market expansion show no signs of slowing, making this an opportune time for strategic investment and market participation.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)