Australia Fertilizer Industry: Sustainable Trends, Economic Impact, and Opportunities

Introduction:

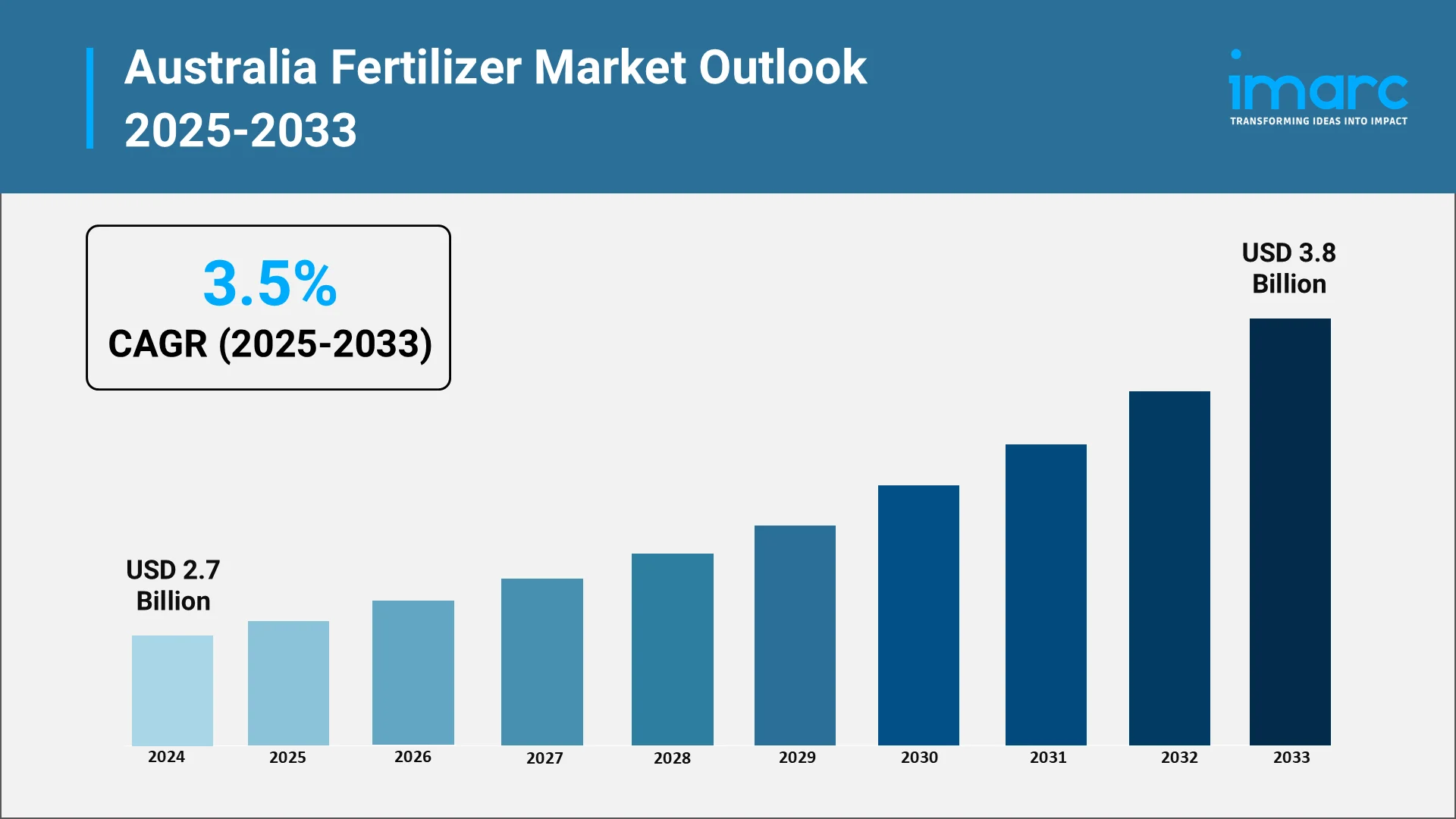

Australia fertilizer industry is one of the key pillars of the country's farm setup. Fertilizers are a critical input in soil productivity, boosting crop output and the uniform production of food and other farm products. Australia has a wide and varied agricultural scene with grain growing horticulture, livestock, and specialty crops. Every industry depends upon fertilizers to optimize production and ensure soil fertility, especially in areas where the natural soil nutrients are nil or climatic conditions are unsuitable. The Australia fertilizer market size reached USD 2.7 Billion in 2024, and looking forward, it is expected to reach USD 3.8 Billion by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025–2033.

Apart from their value in agriculture, fertilizers also have wider economic importance. They underpin rural livelihoods, add value to the chain through supply and logistics networks, and drive research and development work in farm science. In 2024, Australian farmers began adopting Lono, an innovative fertilizer by Levity Crop Science, to enhance sustainability and crop yield. With environmental pressure increasing worldwide, the industry is increasingly being challenged to innovate and embrace sustainable methods that reduce ecological footprint without sacrificing productivity. This double emphasis on agricultural performance and environmental sustainability is defining the course of the fertilizer sector in Australia, generating new opportunities for expansion and innovation.

Sustainability has become the underlying theme, as stakeholders look for options that minimize environmental impacts but do not come at the expense of crop yields. The sector is slowly moving away from traditional chemical fertilizers to higher-value products, such as controlled-release fertilizers, nutrient-efficient formulations, and bio-based or organic inputs. These innovations are aimed at enhancing the efficiency of nutrient uptake, reducing wastage, and mitigating greenhouse gas emissions and soil degradation concerns. As a result, the Australian fertilizer industry is transforming into a more technologically oriented, environmentally friendly, and robust business that responds to existing agricultural needs as well as future ecological objectives.

Explore in-depth findings for this market, Request Sample

Recent Market Trends and Substantial Research and Development:

The Australian fertilizer market has experienced significant research, innovation, and uptake of technology, with a strong focus on efficiency and sustainability. There has been a drive towards researching fertilizers with enhanced nutrient use efficiency, including controlled-release products and nutrient-stabilizing additives, that improve crop yield with less adverse impact on the environment through water pollution and greenhouse gas emissions.

Other fertilizer sources, such as organic fertilizers and biofertilizers, are also becoming popular because they enhance soil structure, increase microbial activity, and facilitate slow, long-term nutrient release. These biologically based materials supplement traditional fertilizers in a way that supports an integrated, sustainable soil management strategy in keeping with contemporary agricultural farming methods.

Precision agricultural technology has also revolutionized fertilizer use. Devices such as soil sensors, satellite photography, and data analysis allow for focused nutrient delivery, waste minimization, cost reduction, and increased yield. Accompanied by policies to reduce carbon emissions and greenhouse gases, these innovations mark a fertilizer sector increasingly focused on sustainability, science, and pragmatic, green solutions.

Government Policy Support:

Policies of the government are responsible for influencing Australia's fertilizer sector by offering regulatory guidelines, technical advice, and monetary benefits that support sustainability. Effective regulations guarantee product quality and safety and mitigate hazards like heavy metals in products and chemical residues, while conserving soil and water resources without sacrificing agricultural output. In 2024, the Australian government announced $63 million to support emissions reductions in the agriculture and land sector, highlighting its commitment to sustainable farming practices and climate-smart initiatives.

In addition to regulation, government programs support more sustainable farming practices by promoting climate-smart initiatives, technical assistance, and advisory services that assist farmers in maximizing the use of nutrients while preserving soil quality. Economic incentives, such as research funding and subsidies, promote innovation in nutrient-efficient fertilizers and low-carbon products, while extension programs and knowledge transfer programs support uptake of best practices, building a support system for a sustainable and resilient fertilizer industry.

Top Companies in the Australia Fertilizer Industry:

The Australian fertilizer market is marked by the existence of a number of prominent companies dominating production, distribution, and the development of fertilizer products. These businesses specialize in various segments, such as nitrogen-based, phosphorus-based, potassium-based, and specialty fertilizers. Their business models tend to emphasize enhancing crop nutrition, enhancing soil health, and exploring research and development undertakings for the creation of innovative and sustainable products. In 2024, Nutrien Ag Solutions commenced work on a new modern and efficient bulk fertilizer distribution center in Rockingham, Western Australia, following a fire at its Kwinana facility. This $70 million investment aims to serve farmers and enable food production for both Western Australia and export markets.

Sustainable business is practiced by numerous top companies to minimize environmental footprint and address increasing consumer demands for ethical agricultural inputs. For instance, there is an emphasis on controlled-release formulations, nutrient-efficient fertilizers, and bio-based inputs. Strategic partnerships with agricultural research centers, technology suppliers, and farming communities allow these companies to introduce innovations that are practical as well as scientifically proven.

The sector comprises a combination of local and international companies, with a range of products to cater to the diversified requirements of Australian farming. There are those that deal with traditional chemical fertilizers, with affordable options for mass-scale crop cultivation. Others deal with high-priced specialty fertilizers, ranging from micronutrient mixes and organic products, for horticulture, specialty crops, and environmentally friendly farming systems.

Sustainability is growing at the heart of corporate policy for leading fertilizer market participants. Research investment, process improvement, and new product line development not only secure market share but also enable the universal objective of sustainable agricultural development. As the industry continues to transform itself, these players will be key contributors to developing the uptake of sophisticated fertilization methods and enhancing the resilience of Australia's agriculture sector.

Opportunities and Challenges in the Australia Fertilizer Industry:

Opportunities

The Australian fertilizer sector is positioned to take advantage of opportunities triggered by advances in technology, concerns over the environment, and changing market demands. The implementation of precision agriculture technologies presents a notable growth area with the ability of farmers to utilize fertilizers more effectively, minimize wastage, and maximize nutrient management. Technologies like soil mapping, satellite imagery, and sophisticated data analytics enable precision fertilization, enhancing crop yields while reducing environmental impact. In 2024, Incitec Pivot announced plans to divest its fertilizer business, including the sale of its distribution assets and the closure of several manufacturing facilities. This strategic shift aims to focus on its explosives division and reflects broader industry trends toward consolidation and specialization. In parallel, the growing organic and biofertilizer market is huge in potential. Increasing consumer demand for sustainably produced, chemical-free farm products is fueling interest in bio-based fertilizers, microbial inoculants, and slow-release organic formulations, providing opportunities for businesses to innovate and serve this emerging segment.

Collaboration and strategic partnerships further boost growth opportunities for the sector. By collaborating with research institutions, technology suppliers, and policymakers, fertilizer firms can speed up innovation, gain access to advanced knowledge, and create solutions tackling contemporary agricultural issues. Such partnerships also facilitate knowledge transfer and the uptake of sophisticated fertilization practices by farmers. In addition, Australian fertilizer manufacturers can seek opportunities for exports, providing products suited to various crop systems, soils, and sustainability levels within regional and international markets. By incorporating technological innovation, sustainability, and expansionary strategy, the sector is likely to meet both economic development and environmental care.

Challenges

In spite of the abundance of growth possibilities, the Australian fertilizer sector encounters some challenges that need strategic consideration. Environmental issues are a top priority, since overuse or improper use of fertilizers can lead to nutrient runoff, water pollution, and enhanced greenhouse gas emissions. Mitigating these effects requires investment in cleaner production technology, precision delivery systems for nutrients, and sustainable application practices. Firms need to reconcile productivity with environmental conservation, so that sustainability becomes a part of both product planning and operational strategies. This emphasis not only reduces environmental risks but also supports larger national and international efforts fostering climate action and sustainable agriculture.

Aside from environmental forces, competition in the market is a major challenge. Local and foreign competitors intensely vie for market share, compelling the need for ongoing innovation, efficiency gains, and cost control in order to sustain profitability. Supply chain weaknesses, such as irregularities in raw material supply and transportation logistics, make production and distribution stability more challenging. Compliance with changing environmental regulations, product quality control, and safety guidelines adds to the complexity. Investment in monitoring, reporting, and technology enhancements are needed to address these necessities. Successfully overcoming these challenges requires strategic planning, stakeholder coordination, and a focus on sustainable practices in all operations to provide long-term resilience and competitiveness for the Australian fertilizer industry.

Future Outlook: Australia Fertilizer Industry

The future of the Australian fertilizer industry will be influenced by sustainability, technological innovation, and policy frameworks that are supportive. Growing focus on environmentally friendly fertilizers is propelling the use of controlled-release formulations, nutrient-efficient products, and bio-based products. These innovations allow farmers and firms to produce high productivity while reducing ecological footprints. Concurrently, the incorporation of digital technologies, data analysis, and precision farming methods is reshaping nutrient management, optimizing application, and improving decision-making. Those companies that utilize these technologies will be well-positioned to meet changing market requirements and strict regulation demands.

Government assistance will remain a key driver of the industry's expansion. Policies promoting sustainable agriculture, innovation and development, and knowledge sharing ensure a conducive environment for innovation and cooperation. These help businesses deal with environmental and operational issues while venturing into local and export markets. Generally, the Australian fertilizer industry is well-positioned to become a more sustainable, technology-based, and resilient industry. Through driving innovation, building partnerships, and embedding environmental stewardship in business, the industry can sustain agricultural productivity, improve rural economies, and respond to the challenges of an increasingly changing global context.

Advancing Growth: IMARC’s Strategic Insights into the Australia Fertilizer Market

IMARC Group equips stakeholders in the agriculture and fertilizer industry with data-driven strategies to excel in the evolving Australia fertilizer market. Our research and advisory services help clients identify growth opportunities, manage risks, and foster innovation in product development, nutrient management solutions, and sustainable farming practices.

- Market Insights: Track regional trends shaping the Australia fertilizer market, including increasing demand for precision agriculture, eco-friendly fertilizers, and crop-specific nutrient solutions.

- Strategic Forecasting: Anticipate advancements in controlled-release fertilizers, digital soil analysis, automated application technologies, and regulatory shifts impacting production, labeling, and distribution.

- Competitive Intelligence: Benchmark leading players’ strategies, monitor product innovations, and assess the integration of technology-driven solutions such as smart farming platforms, farm management software, and customer engagement tools.

- Policy and Regulatory Analysis: Evaluate how Australian agricultural policies, environmental guidelines, and sustainability mandates influence fertilizer usage, market accessibility, and product innovation.

- Customized Consulting Solutions: Access tailored guidance for market entry, product portfolio expansion, pricing strategies, and partnerships with distributors, agri-tech platforms, and farm cooperatives. IMARC’s consulting services enable stakeholders to navigate the dynamic Australia fertilizer market while remaining environmentally responsible, technologically adept, and aligned with farmer needs.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)