Top Factors Driving Growth in the GCC Construction Market

Introduction to the GCC Construction Industry:

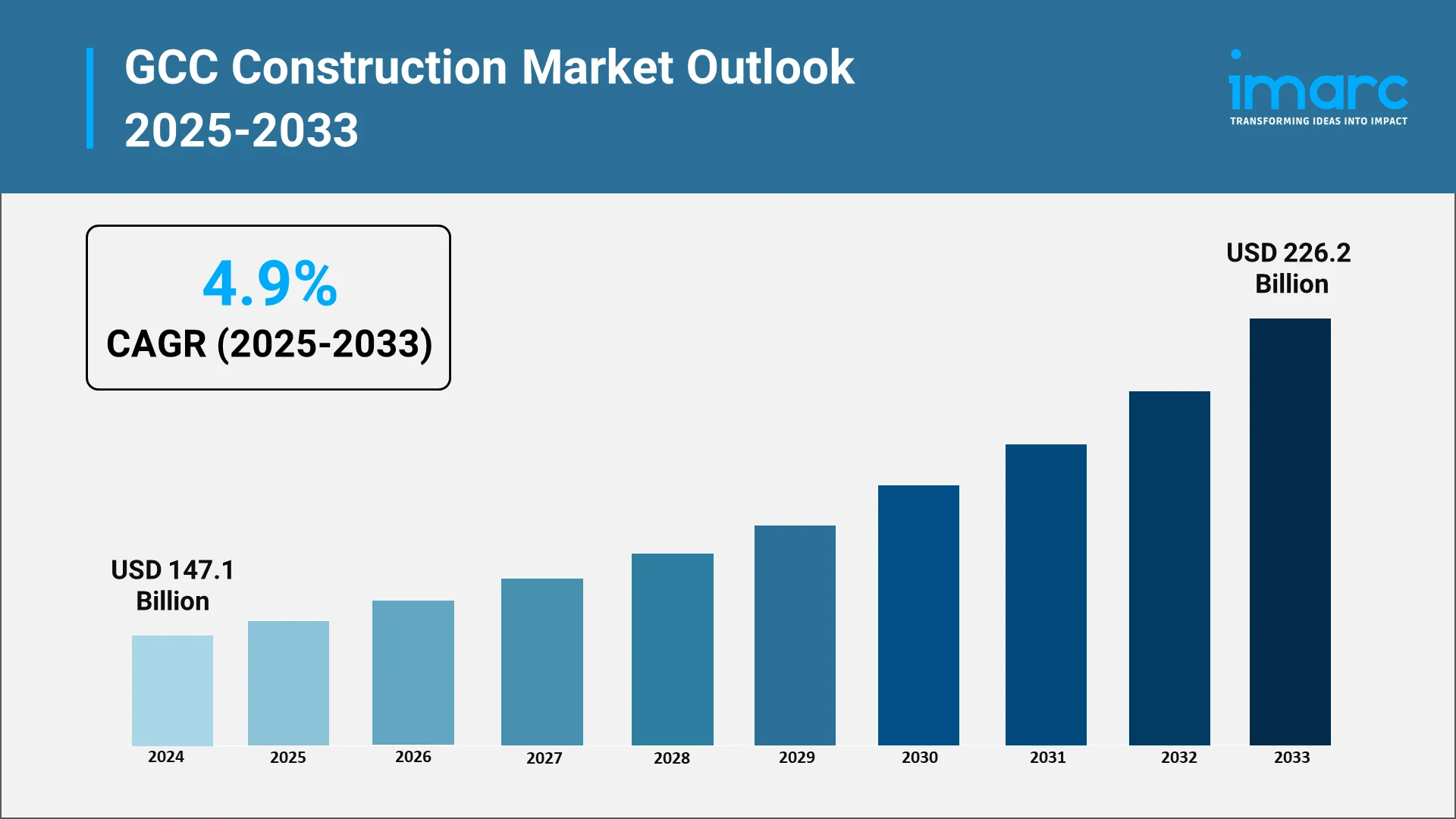

The construction industry across the Gulf Cooperation Council (GCC) member states is at the core of a monumental economic transformation. Far exceeding traditional building activities, the sector now serves as the principal vehicle for national economic diversification strategies, moving these nations beyond reliance on oil revenues. In 2024, the GCC construction market size reached USD 147.1 Billion. The ambitious visions set forth by regional governments—aiming to build futuristic, sustainable, and globally competitive societies—have infused the market with unprecedented momentum. This drive is characterized by large-scale, complex development programs that require massive investment in infrastructure, urban amenities, and high-tech solutions. The resulting expansion affects every part of the regional economy, creating a vibrant landscape of opportunities for domestic and international firms. The sustained and strategic nature of this development trajectory provides a crucial indicator of the fundamental GCC construction market size, which continues to expand rapidly to support the region’s long-term aspirations.

Explore in-depth findings for this market, Request Sample

Rising Investments in Mega Infrastructure and Urban Development Projects:

The single most influential factor propelling the GCC market is the aggressive investment in giga-projects and comprehensive urban masterplans. These developments are designed not merely as construction projects, but as foundational economic pillars intended to attract tourism, global trade, and foreign direct investment. From the creation of entirely new, purpose-built cities to the establishment of vast, high-capacity transport networks—including advanced rail systems, expanded ports, and modernized airports—the focus is on dramatically improving global connectivity and quality of life. This massive pipeline of strategic work demonstrates governmental commitment to reshaping the physical and economic identity of the Gulf region. The execution of these schemes necessitates collaboration between local and global heavyweights, directly impacting the distribution of work across the region and thereby defining the GCC construction market share among the leading industry players. The sustained governmental support ensures that the project momentum remains strong, insulating the sector from many external pressures and guaranteeing a steady flow of contracts for years to come.

Increasing Adoption of Sustainable and Green Building Materials:

Sustainability has emerged as a non-negotiable standard within the GCC construction sphere, evolving rapidly from a desirable feature to a core regulatory requirement. Driven by national climate pledges and the need for more resource-efficient urban environments, there is a widespread pivot toward green building practices. Governments are implementing mandatory green building codes that enforce higher performance standards for energy and water conservation, air quality, and material selection. This focus stimulates demand for innovative, eco-friendly construction materials, such as low-emission concrete, advanced insulation systems, and recycled content. This dedication to responsible development is reshaping supply chains and project specifications across all sectors. The increasing integration of environmental, social, and governance factors into procurement and design criteria is one of the most significant GCC construction industry trends 2024, showcasing a long-term commitment to ecological stewardship. Developers who prioritize sustainable design and lifecycle cost efficiency are gaining a distinct competitive advantage, pushing the entire industry toward a greener and more mature operational model.

Growth in Public-Private Partnership (PPP) Construction Initiatives:

The growing reliance on Public-Private Partnership (PPP) models is a strategic financial and operational shift designed to manage the scale and complexity of the region's development goals. PPPs enable governments to leverage the specialized expertise, efficiency, and private capital of the corporate sector, accelerating the delivery of critical public infrastructure and social amenities. By sharing project risks and responsibilities, this funding model allows large-scale, long-duration projects—such as transportation, utilities, and social facilities—to move forward more reliably and quickly. The framework encourages private entities to focus not just on the initial build, but also on the long-term maintenance and operational excellence of the asset. This structured approach to financing and project delivery is a critical component for any thorough GCC construction market analysis, as it indicates where new opportunities for private participation and investment will arise. The growing acceptance and successful execution of PPP projects across the Gulf signal a sophisticated evolution in project governance and procurement, fostering deeper collaboration between the public and private realms.

Expanding Construction Technology Integration (BIM, Drones, and 3D Printing):

The GCC construction sector is actively undergoing a digital transformation, adopting advanced technologies to boost productivity and manage complexity inherent in giga-projects. Building Information Modeling (BIM) is now widely mandated, serving as a unified digital platform that optimizes design coordination, clash detection, and asset management throughout the project lifecycle. On-site efficiency is being revolutionized by tools like drones, which provide real-time aerial surveying, site progress monitoring, and enhanced safety surveillance. As per Middle East Property and Construction Handbook- MENA economic review 2025, Artificial intelligence (AI)-supported construction approaches, such as generative designs, supply chain management predictive analytics, and improved safety monitoring, are becoming increasingly important in the construction industry. This shows an effort to overcome the industry's historical digitization lag. Furthermore, the region is emerging as a global leader in piloting and scaling up advanced fabrication methods. The adoption of modular construction and large-scale 3D printing accelerates delivery timelines, reduces waste, and addresses labor demands by shifting production off-site. These technological investments are often highlighted in specialized GCC construction market reports to illustrate the market’s commitment to innovation and its move towards industrialized construction. Embracing digital tools and automation is essential for meeting aggressive national development timelines and ensuring that the quality and precision of the final built environment are world-class.

Surge in Residential and Commercial Real Estate Developments across GCC:

Underpinning the large-scale infrastructure work is a continuous and substantial demand for residential and commercial real estate. Rapid urbanization, significant population expansion—including a growing influx of skilled expatriates—and a rising quality of life expectation are fueling this sector. Developers are actively catering to varied consumer segments, launching everything from master-planned, mid-market residential communities to highly luxurious and iconic urban towers. The commercial segment is thriving due to the growth of new business hubs, economic free zones, and a burgeoning tourism and hospitality industry, which requires massive new retail, office, and leisure facilities. This private and consumer-driven demand provides essential diversification and resilience to the overall market. The strong pipeline of housing and commercial projects remains a key indicator for any optimistic GCC construction market forecast, ensuring sustained activity for contractors focused on building and property development. The continuous creation of vibrant mixed-use developments further solidifies the region’s status as a dynamic global center for living and commerce.

Opportunities and Challenges in the GCC Construction Industry:

The GCC construction landscape presents a compelling balance of high-reward opportunities and structural challenges. Navigating these factors is critical for successful market entry and sustained performance. The latest GCC construction industry trends last 6 months emphasize that resilience and adaptability are crucial for firms operating in this fast-paced environment.

Opportunities:

- Decade-Long Project Pipeline: Guaranteed workload across multiple sectors (transport, tourism, utilities) due to strategic national visions.

- Green Building Specialization: High demand for expertise in sustainable materials, energy efficiency retrofits, and smart building technologies.

- Digital Adoption Services: Strong opportunities for firms specializing in BIM implementation, construction software, and automation solutions.

- Localized Manufacturing: Incentives for establishing regional supply chains to reduce reliance on imports and improve cost predictability.

Challenges:

- Skilled Labor Shortages: Persistent difficulty in sourcing and retaining a specialized, highly skilled workforce.

- Supply Chain Volatility: Vulnerability to global material price fluctuations and delays, impacting project budgets and timelines.

- Cash Flow Management: Complex payment structures and delays, requiring robust financial planning and risk mitigation strategies.

- Regulatory Adaptation: Need to continuously adjust to evolving national building codes, sustainability mandates, and localization policies.

Future Outlook for the GCC Construction Industry:

The outlook for the GCC construction industry is defined by ambitious scale, strategic intent, and technological advancement. The market is transitioning into a mature, high-tech sector where sustainability and digitalization are standard operating procedure, not optional extras. Continued, targeted government investment, coupled with the proven effectiveness of PPP frameworks, will ensure a stable foundation for growth. The sustained demand from urbanization and the tourism boom guarantees that both infrastructure and building construction will remain buoyant. The commitment to futuristic projects ensures that the GCC construction market size 2024 will continue to reflect robust expansion, driven by visionary leadership and the necessary capital to realize these monumental national aspirations. Looking forward, IMARC Group expects the market to reach USD 226.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.9% during 2025-2033.

Choose IMARC Group for Unmatched Expertise in the GCC Construction Market:

To successfully capitalize on the expansive opportunities and navigate the unique complexities of the Gulf construction sector, access to deep, authoritative market intelligence is non-negotiable.

- Data-Driven Market Research: Deepen your knowledge of infrastructural investment plans, project pipelines, and the specialized demand for advanced construction materials and services through in-depth market research reports tailored to the region.

- Strategic Growth Forecasting: Predict emerging trends in project financing, procurement models (like PPP), and technological adoption (BIM, modular construction) by region and sector, enabling you to strategically position your firm for future growth.

- Competitive Benchmarking: Analyze competitive forces within the Gulf, review contractor project histories, and monitor breakthroughs in sustainable building practices and large-scale project execution methodologies.

- Policy and Infrastructure Advisory: Stay one step ahead of regulatory paradigms, localization programs, and foreign investment policies affecting project bidding, labor quotas, and operational standards across the GCC.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it entering a new GCC country, investing in specialized construction technology, or building strategic local partnerships for giga-projects.

At IMARC Group, our goal is to empower industry leaders with the clarity and intelligence required to secure and execute successful projects in the world’s most exciting construction market. Join us in shaping the future skyline of the Gulf—because every structure matters. Please visit: https://www.imarcgroup.com/gcc-construction-market, for more details.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)