Impact of AI in Transforming the Global Guacamole Market

Guacamole’s Rise: From Traditional Dip to Global Health Staple

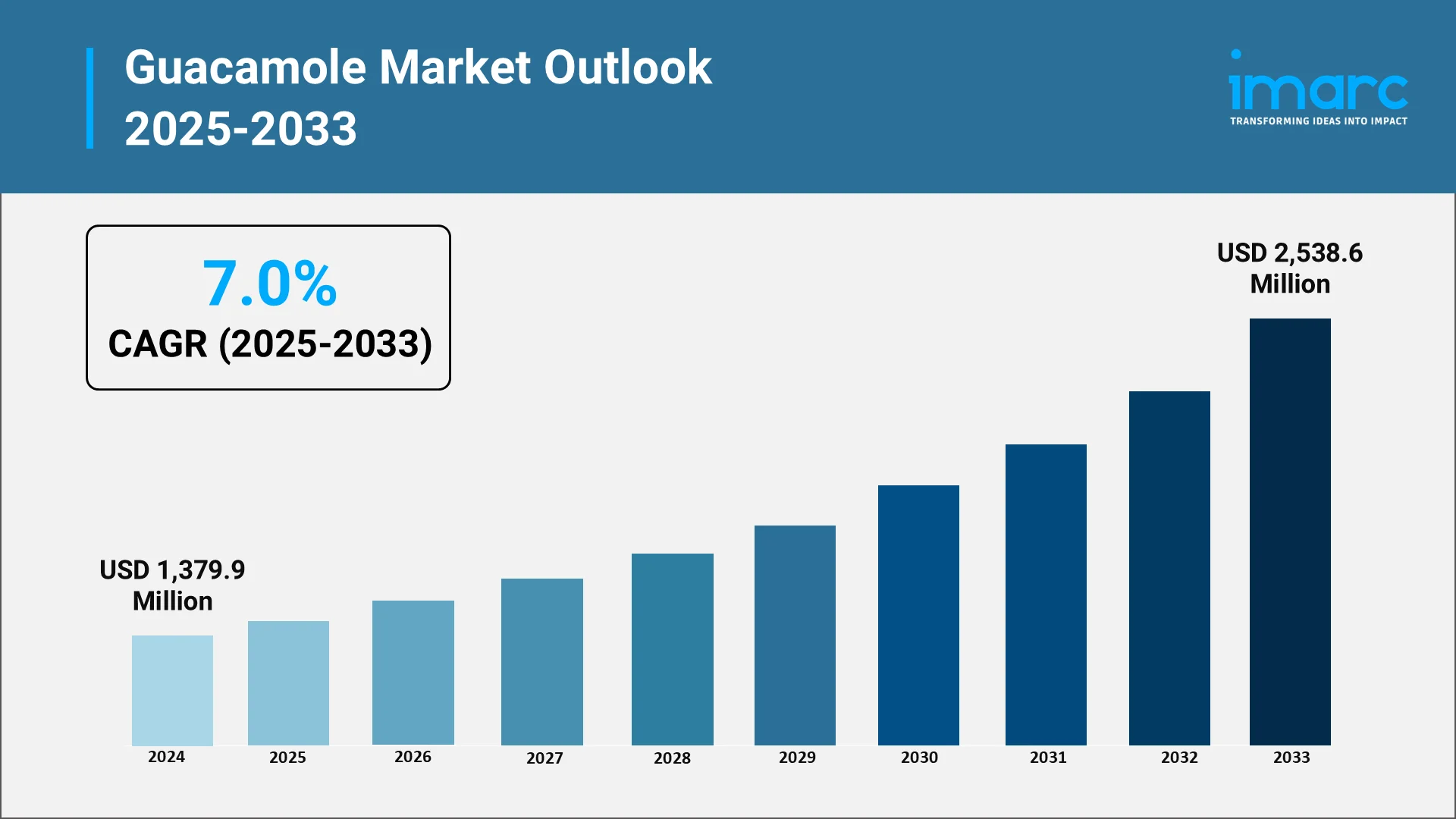

The guacamole market is experiencing a notable change, primarily fueled by an increasing consumer preference for healthy, convenient, and natural food choices. In 2024, the market was valued at USD 1,379.9 Million. Guacamole is a creamy avocado-based dip originating from Mexican cuisine has grown into a globally popular food product recognized for its nutritional value and versatility. Rich in healthy fats, fiber, and essential nutrients it aligns with modern dietary trends such as plant-based eating, keto, and Mediterranean diets as well as the increasing demand for clean-label products. This is further bolstered by innovative flavors and packaging solutions introduced by top guacamole companies to cater to various consumer preferences. As this vibrant sector expands across foodservice, retail, and ready-to-eat segments, a new catalyst is emerging: Artificial Intelligence (AI). AI is not merely optimizing existing processes but fundamentally reshaping the entire guacamole value chain, from farm to table. While North America continues to be the largest market demand is steadily gaining momentum across Europe, Asia-Pacific, and Latin America.

Explore in-depth findings for this market, Request Sample

Innovation and Demand: Trends Redefining Guacamole

- Rising Popularity of Plant-Based and Vegan Snack Options: Guacamole naturally aligns with the increasing interest among vegan and vegetarian consumers providing a tasty and nutritious alternative.

- Growth of Organic and Non-GMO Avocado-Based Products: There is a rising demand for transparency and clean labels as consumers prioritize organic and non-genetically modified avocado products.

- Expansion of Guacamole in Global Fast Food and Casual Dining Menus: The versatility of guacamole is leading to its adoption across a broader range of culinary applications extending beyond traditional Mexican dishes to include items like burgers, sandwiches, bowls, and salads.

- Enhanced Shelf-Stability Through HPP and Clean-Label Preservatives: Innovations in processing methods particularly high-pressure processing are improving guacamole's shelf life while preserving its fresh flavor and nutritional value making it appealing to consumers and retailers alike.

- Increasing Adoption of AI and IoT in Avocado Sourcing and Production: This emerging trend capitalizes on technology to boost efficiency and quality within the supply chain.

- Growing Emphasis on Sustainable Avocado Farming and Traceable Supply Chains: Increased environmental consciousness is driving a focus on sustainable avocado farming practices and ensuring traceability from the source to the consumer.

From Vision to Precision: AI’s Influence on Guacamole Quality

Artificial Intelligence is rapidly reshaping the guacamole industry, offering transformative benefits across the value chain. From farm to fork, AI technologies are enhancing product quality, improving operational efficiency, and reducing waste.

- AI-Powered Avocado Quality Grading

Computer vision and AI-based image recognition are enabling accurate grading of avocados based on size, color, and defects. This automation minimizes human error and ensures consistent quality in guacamole production. By identifying optimal ripeness and eliminating substandard inputs early in the process, producers achieve greater efficiency, reduce waste, and deliver a more uniform final product to consumers.

- Predictive Analytics for Shelf Life and Ripeness

Predictive models powered by AI examine both historical and current data to accurately estimate the ripeness and shelf life of avocados. This helps suppliers and producers plan harvests, transportation, and processing schedules efficiently. For instance, in February 2023, Neolithics, an Israeli startup, introduced groundbreaking technology for predicting the shelf life of fresh produce, including avocados. Utilizing hyperspectral imagery, this innovation helps minimize food waste by accurately assessing quality and shelf life, benefiting farmers and distributors while addressing global food insecurity and climate change. By reducing spoilage and improving timing, predictive analytics enhance supply chain reliability while ensuring that guacamole products reach shelves at peak freshness.

- Automated Production for Consistency and Efficiency

AI and robotics are streamlining guacamole production lines by automating peeling, mashing, and mixing processes. These systems maintain consistent texture, flavor, and hygiene standards, even at scale. Automation reduces manual labor costs, minimizes variability, and increases throughput—critical for meeting growing demand across retail and foodservice channels with high-quality, uniform products. For instance, in September 2024, Chipotle began testing new automation technologies, including an "autocado" robot for guacamole production and a bowl-and-salad maker, in California. These initiatives aim to increase efficiency and support workers as the chain adapts to rising labor costs.

- AI in Supply Chain Forecasting and Inventory Optimization

AI-powered demand forecasting tools analyze consumption patterns, seasonality, and market signals to improve inventory planning. By aligning supply with actual market needs, producers avoid overstocking and shortages. Logistics are also optimized through AI algorithms that reduce transit times and costs, enabling a more responsive and efficient guacamole supply chain from farm to shelf.

- Smart Cold Chain Monitoring with AI

Smart sensors and AI systems are transforming cold chain management by continuously tracking temperature, humidity, and handling conditions during avocado transport and storage. These tools send real-time alerts to prevent spoilage and maintain product integrity. Improved cold chain visibility ensures guacamole reaches consumers in optimal condition, reducing waste and enhancing brand reputation.

As AI adoption accelerates, global guacamole industry leaders gain a competitive edge through smarter processes and more sustainable practices. These innovations streamline production and strengthen the industry's ability to meet rising global demand with precision and consistency.

Breaking Down the Market: Product Categories and Regional Trends:

From Classic to Contemporary: Key Guacamole Products Shaping the Market

- Classic Guacamole

Classic guacamole remains the most widely consumed variant, favored for its simple, traditional recipe of avocado, lime, and salt. Its appeal spans across retail and foodservice segments, driven by familiarity and versatility. Often used as a dip, topping, or spread, classic guacamole continues to anchor the category’s growth across both developed and emerging markets.

- Spicy/Flavored Guacamole

Spicy and flavored guacamoles are gaining popularity among younger and adventurous consumers. Variants infused with jalapeño, chipotle, garlic, or herbs add culinary diversity and global flair. These products appeal to consumers seeking bolder tastes and contribute to product premiumization, helping brands expand their product range.

- Organic Guacamole

Organic guacamole appeals to health-conscious and eco-aware consumers prioritizing clean-label and sustainably sourced products. For instance, in June 2025, GoVerden launched its Premium Homestyle Guacamole, now available exclusively at Sam’s Club. Crafted by third-generation avocado farmers, this all-natural product combines fresh avocados, tomatoes, onions, and jalapeños for a homemade taste. Typically made from certified organic avocados without synthetic additives or preservatives, it caters to premium segments in retail and specialty foodservice.

- Packaged Guacamole (Single-Serve/Multi-Serve)

Convenient packaged formats, including single-serve and multi-serve tubs, drive consumption in on-the-go and at-home snacking segments. Single-serve options suit health-focused consumers seeking portion control, while larger packs are favored for gatherings.

- Foodservice Bulk Guacamole

Bulk guacamole is in high demand across fast food chains, casual dining, and catering services. Offered in larger packs, it supports operational efficiency and cost savings for commercial kitchens. With rising use in burgers, salads, wraps, and breakfast menus, this segment fuels volume growth.

Geographic Breakdown: Key Markets and Growth Hotspots

- North America

North America dominates the global guacamole market with a share of 40.3%, while the US alone contributes 85.00% within the North America market, making it the leading national market. According to the data published by the United States Department of Agriculture, US avocado imports from Mexico reached 1.07 MMT in 2024. The U.S. accounts for over 80% of Mexico’s avocado exports. Demand typically peaks from December to February, notably around the Super Bowl, driving projected growth to 1.34 MMT by 2025. The region benefits from strong demand across retail and foodservice channels, driven by health-conscious consumers and rising plant-based food trends. Major guacamole market players have established robust supply chains and product innovations in this region, supporting sustained market dominance.

- Europe

Europe’s guacamole market is expanding steadily, led by the UK and Germany. Rising awareness about avocado’s health benefits, increasing vegetarian and flexitarian diets, and broader availability in supermarkets and foodservice are fueling growth. Premium and organic segments are also gaining traction, and product localization is helping brands connect with diverse consumer preferences.

- Asia-Pacific

Asia-Pacific’s guacamole market is in its early growth stage but gaining momentum in urban centers of Japan and South Korea. Rising exposure to Western cuisines, increased snacking culture, and the premium appeal of avocados contribute to adoption. Retailers and cafes are introducing guacamole as part of fusion dishes, boosting its presence in metropolitan markets.

- Latin America

As the native home of avocados, Latin America holds cultural and culinary significance for guacamole. Mexico leads production and domestic consumption, while Chile plays a growing role in exports. While local demand is stable, the region’s primary opportunity lies in supplying guacamole to global markets, supported by cost-effective farming and processing capabilities.

- Middle East & Africa

In the Middle East and Africa, guacamole adoption is emerging in premium retail outlets and international restaurant chains. Rising expatriate populations, growing interest in global flavors, and increasing avocado imports support market development. While consumption is currently niche, the region holds potential for future expansion as cold chain infrastructure and awareness improve.

Guacamole Market Outlook 2025–2033: Forecast, Growth Catalysts, and Strategic Opportunities Driving Global Expansion:

Guacamole Market CAGR and Projected Revenue:

The global guacamole market is projected to reach USD 2,538.6 Million by 2033, registering a compound annual growth rate (CAGR) of 7.0% during the forecast period from 2025 to 2033. This growth is fueled by rising health awareness, increasing demand for natural convenience foods, and expanding international interest in avocado-based products.

Growth Drivers:

- Demand For Clean-Label and Nutrient-Dense Snacking

Consumers are increasingly seeking clean-label snacks with transparent ingredients and functional health benefits. Guacamole, made primarily from avocados, fits this demand as it offers healthy fats, fiber, and essential nutrients without artificial additives—positioning it as a preferred option among health-conscious individuals and those following plant-based or keto diets.

- Expansion of Global Avocado Supply Chains

Improved logistics, cold chain infrastructure, and expanded avocado cultivation across regions like Latin America and Africa are ensuring year-round availability. This supply chain expansion is enabling manufacturers to scale guacamole production, reduce costs, and maintain consistent quality—supporting market growth and facilitating product penetration into newer regions and consumer segments.

- Product Innovation in Guacamole Flavors and Packaging

Brands are developing flavored guacamole variants such as spicy, zesty lime, and herb-infused options to appeal to diverse palates. For instance, in September 2024, MegaMex Foods expanded its WHOLLY® Guacamole line for foodservice with three innovative flavors: Jalapeño Garlic, Serrano Lime, and Cilantro Lime. These new chunky varieties enhance menu offerings while providing convenience, made with 100% real Hass avocados and no artificial additives, ensuring fresh and flavorful options for operators. Alongside flavor innovation, advancements in sustainable, resealable, and single-serve packaging formats are enhancing shelf life, portability, and consumer convenience—broadening usage occasions and driving incremental category growth.

Opportunities:

- Rising Adoption in Asian Cuisines and QSR Menus

Guacamole is increasingly being integrated into Asian fusion dishes and gaining popularity in quick-service restaurant (QSR) offerings. Its versatility as a topping or dip is helping global and regional QSR brands expand menu diversity, while introducing guacamole to newer audiences and accelerating acceptance in non-traditional culinary markets.

- Growth of E-Commerce Grocery Platforms and Home Delivery Models

The expansion of online grocery platforms and rapid home delivery services is reshaping how consumers access fresh dips like guacamole. With the convenience of doorstep delivery and digitally driven marketing campaigns, brands are able to reach a wider customer base and boost sales through direct-to-consumer and omnichannel strategies.

- Strategic Collaborations with AI and Agritech Startups

Guacamole producers are partnering with AI and agritech firms to enhance avocado quality monitoring, improve supply chain transparency, and ensure sustainable sourcing. These collaborations enable real-time tracking of ripeness, reduce spoilage, and assure consumers of ethical and traceable farming practices—strengthening brand trust and operational efficiency across the value chain.

Impact of AI in Global Guacamole Market: How IMARC Group Is Guiding Innovation in a Dynamic Landscape

IMARC Group empowers stakeholders across the global guacamole market with forward-looking insights that highlight the growing influence of artificial intelligence (AI) in transforming production, distribution, and consumer engagement. As AI continues to reshape food processing, logistics, and demand forecasting, our research helps businesses identify opportunities, mitigate risks, and stay competitive in an evolving landscape.

- Market Insights: We analyze key trends in the guacamole industry, including the integration of AI in quality control, shelf-life optimization, and flavor innovation. AI-driven analytics also enhance consumer behavior tracking, enabling brands to tailor offerings in real time.

- Strategic Forecasting: Our data-driven forecasts capture the potential of AI to streamline supply chains, reduce food waste, and improve inventory planning. We provide insights into how smart packaging and automated sorting are shaping the future of guacamole production and retail.

- Competitive Intelligence: IMARC tracks how leading guacamole brands are using AI to gain a market edge—from predictive analytics in sales strategies to machine learning applications in R&D. This intelligence supports faster innovation and improved go-to-market strategies.

- Policy and Regulatory Analysis: We assess the implications of food safety regulations and data governance in the use of AI across food processing and retail. Our research supports compliance strategies while encouraging responsible innovation.

- Tailored Consulting Solutions: Whether integrating AI into production workflows or exploring smart retail expansion, our customized solutions align with your business goals. We help stakeholders leverage AI technologies to boost efficiency, sustainability, and customer satisfaction.

With AI accelerating transformation in the guacamole market, IMARC Group remains a trusted partner—delivering actionable intelligence, shaping innovation, and enabling strategic decision-making across the global food value chain.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)