How big will the Brazil cardiovascular devices market be in 2034?

Overview of the Brazil Cardiovascular Devices Market:

The Brazil cardiovascular devices market represents a crucial segment in the country’s healthcare ecosystem, addressing one of the leading causes of morbidity and mortality: cardiovascular diseases. Conditions such as heart attacks, stroke, arrhythmias, and heart failure require ongoing medical intervention and advanced heart disease treatment solutions. With the rising prevalence of cardiovascular disorders, demand for comprehensive cardiac care equipment and innovative treatment modalities is increasing. Hospitals and medical professionals are adopting a range of devices, from diagnostic tools and implantable devices to minimally invasive devices, to monitor, manage, and treat cardiac conditions. As per sources, in January 2025, Brazil is advancing medical device innovation, with Law 14.874/24 and RDC 837/2023 enabling trials. Notable cardiovascular studies at IDPC and neurotechnology research at UNIFESP. Moreover, this shift reflects a global trend toward precision medicine, where patient-specific data and advanced devices enable targeted therapies while enhancing procedural safety and improving outcomes.

Medical institutions in Brazil are increasingly transitioning from traditional surgical methods to technology-driven interventions. The adoption of medical devices Brazil supports this evolution, meeting the growing procedural and clinical needs of cardiologists, surgeons, and interventional specialists. Patient preference for faster recovery, reduced complications, and less physical trauma is driving the uptake of minimally invasive devices, often integrated with sophisticated imaging and diagnostic systems. In November 2024, Lenovo, in partnership with InCor, launched TRAdA, an AI-powered wearable for real-time arrhythmia detection in Brazil, enabling remote monitoring and timely cardiovascular interventions. Additionally, modernization of hospital infrastructure, expansion of cardiac centers, and a focus on healthcare innovation are contributing to improved patient monitoring, device design, and treatment effectiveness. Together, these factors position the Brazil cardiovascular devices market as a vital and expanding segment of the healthcare landscape.

Market Size Projection and Growth Forecast to 2034:

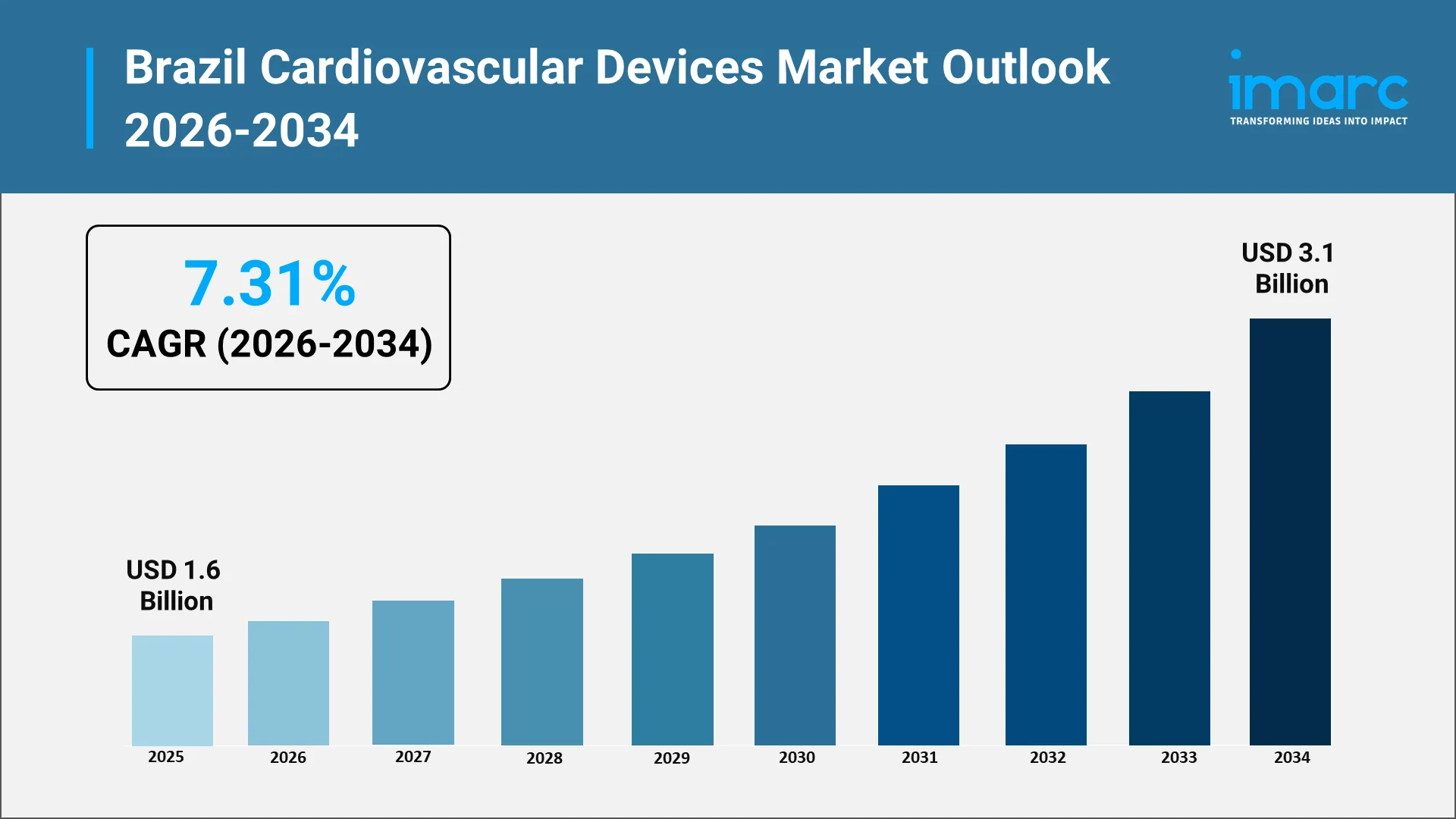

The Brazil cardiovascular devices market is expected to show continued growth in 2034, driven by increasing demand for advanced cardiac care equipment. The Brazil cardiovascular devices market size was valued at USD 1.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 3.1 Billion by 2034, exhibiting a CAGR of 7.31% from 2026-2034. Moreover, the rising burden of cardiovascular disease emphasizes the needs for comprehensive management strategies involving early diagnosis, effective treatment of heart disease, and continuous patient monitoring. In line with technological progress, sophisticated devices for acute and chronic conditions will see greater adaption in hospitals, specialty clinics, and outpatient centers. This shift toward patient-centric care will include priorities for technologies that offer enhanced precision in treatments, lower procedural risks, and improved overall clinical outcomes.

Growth in the market will be directly linked to the adoption of preventive approaches and the acceptance of minimally invasive devices, which reduce the dependence on conventional high-risk surgeries. Innovations in implantable devices, tools for interventional cardiology, and diagnosis systems are driving efficiency and improving patient outcomes. In April 2025, Zydus Medtech signed a global licensing agreement with Brazil’s Braile Biomedica to commercialize its TAVI technology in India, Europe, and select markets, advancing minimally invasive cardiac care. Furthermore, the medical devices Brazil are evolving to meet clinicians' demands for reliability, precision, and integration with advanced imaging and monitoring systems. Minimally invasive techniques are especially gaining traction today due to faster recovery with minimal complications, thus appealing to the demands of patients and the standards of modern healthcare, while fostering broader device adoption. In September 2025, ANVISA granted commercial approval to Concept Medical’s MagicTouch Sirolimus-Coated Balloon for CAD in Brazil, providing a metal-free, minimally invasive option for cardiovascular disease management.

Continued investments by Brazil into healthcare infrastructure, such as hospital upgrades, specialized cardiac units, and intervention labs, will further support wider adoption of next-generation devices. Clinicians are increasingly seeking healthcare innovation in devices that integrate real-time monitoring, smart analytics, and advanced imaging to enhance procedural accuracy. Meanwhile, heightened patient awareness about cardiovascular risks is driving demand for early diagnostics, non-invasive monitoring, and long-term heart disease treatment solutions. These dynamics place the Brazil cardiovascular devices market in a position for expansion, with broader access to therapeutic and diagnostic offerings that improve care quality, optimize outcomes, and ensure cost-effective healthcare delivery across urban and semi-urban centers.

Explore in-depth findings for this market, Request Sample

Key Drivers of Device Adoption and Innovation:

- Growing Burden of Cardiovascular Disease and Adoption of Minimally Invasive Devices: The increasing prevalence of coronary artery disease, arrhythmias, and heart failure in Brazil is driving higher demand for cardiovascular devices. Hospitals are adopting advanced cardiac care equipment and implantable devices to manage acute and chronic conditions effectively. Minimally invasive procedures, such as transcatheter and percutaneous interventions, are gaining popularity due to shorter recovery, fewer complications, and reduced hospital stays. These trends promote patient-centric care, enhance clinical outcomes, and encourage widespread adoption of innovative cardiovascular solutions nationwide.

- Focus on Clinical Outcomes, Patient Safety, and Device Innovation: Brazilian healthcare professionals prioritize precision, reliability, and procedural efficiency in cardiovascular interventions. Innovations in stents, heart valves, and pacemakers offer improved performance, durability, and biocompatibility. Devices designed with advanced materials and functionality reduce surgical risks, enhance patient safety, and improve recovery outcomes. This emphasis on better clinical results drives hospitals to upgrade their cardiac portfolios. Manufacturers are investing in research and development to create next-generation solutions that align with evolving medical standards and the expectations of both clinicians and patients.

- Digital Integration, AI Analytics, and Collaborative Innovation: Integration of AI, smart monitoring systems, and digital technologies is transforming cardiovascular care in Brazil. Devices capable of remote monitoring and real-time analytics enable personalized treatment and early intervention, improving long-term patient management. Companies are investing in R&D to develop such intelligent solutions, while partnerships with healthcare institutions and research centers foster innovation. These collaborations ensure continuous development of next-generation devices, strengthening the Brazil cardiovascular devices market by delivering safer, more efficient, and data-driven cardiac care that meets modern healthcare requirements.

Technological Advancements and R&D Focus:

- Technological Advancements Driving Precision and Outcomes: Technological advancements are central to growth in the Brazil cardiovascular devices market. R&D efforts increasingly focus on devices that enhance procedural precision, improve patient outcomes, and integrate with digital health platforms. The use of advanced materials, miniaturized components, and AI-assisted diagnostics is transforming cardiac care, offering clinicians innovative solutions for managing complex cardiovascular conditions. These developments ensure treatments are more effective, safer, and aligned with modern healthcare expectations, establishing Brazil as a hub for cutting-edge cardiovascular technology.

- Minimally Invasive Devices and Integration with Digital Tools: Minimally invasive cardiovascular devices are leading technological evolution in Brazil. Innovations in catheter-based interventions, robotic-assisted surgery, and percutaneous procedures reduce trauma, shorten recovery time, and provide high-precision treatment. Integration with real-time imaging and digital monitoring tools allows continuous assessment of procedural outcomes. These advancements appeal to both patients and healthcare providers, improving treatment efficiency and safety. Hospitals adopting such solutions can offer faster, less invasive care while enhancing overall clinical performance and patient satisfaction across cardiac treatment centers.

- Smart, Connected Devices and Remote Monitoring: R&D in Brazil increasingly focuses on smart, connected cardiovascular devices enabling remote patient monitoring and chronic disease management. Telemetry-enabled implantable devices detect anomalies early, allowing timely intervention without frequent hospital visits. This enhances patient convenience, improves clinical outcomes, and reduces long-term healthcare costs. With strong investment in R&D, collaboration between private companies and academic institutions, and regulatory support, Brazil continues to advance innovative cardiovascular solutions. This ecosystem promotes continuous device development, clinical testing, and market-ready technologies across the Latin American region.

Healthcare Policies and Patient Awareness:

The Brazil cardiovascular devices market is shaped by two significant determinants: healthcare policies and patient awareness. Various government programs have been put in place to enable access to quality cardiac care, extend health services to prevent diseases, and even subsidize some medical devices; this has helped expand the market. These initiatives increase access to treatment options for heart disease in both urban and rural areas, so more of the population is covered.

Regulatory frameworks also play an important role in market development: clear guidelines on the approval of devices, quality assurance, and clinical evaluation are very important to ensure that only safe, effective, and reliable devices enter the healthcare system. In June 2025, Brazil’s Anvisa officially launched the national UDI system, Siud, with mandatory device registration and standardized UDI labeling starting July 2025, enhancing traceability and patient safety. Moreover, such regulatory oversight fosters confidence in healthcare providers and patients, thus driving adoption of innovative solutions.

Moreover, the growing emphasis on preventive health care and early intervention has elevated the usage of diagnostic devices, wearable monitors, and implantable solutions. These devices help in continuous monitoring of cardiovascular health, early detection of abnormalities, and long-term patient management. In effect, policy support and patient awareness collectively accelerate the growth of the Brazil cardiovascular devices market, positioning it for sustained expansion over the next decade.

Competitive Landscape & Future Outlook:

The competitive landscape of the Brazil cardiovascular devices market is shaped by active engagement from multinational corporations and domestic manufacturers. Companies are focusing on product development, technological innovation, and strategic partnerships to strengthen their market position. Differentiation through device efficacy, minimally invasive devices, and integration with digital health platforms is increasingly defining success. Domestic manufacturers leverage local expertise and regulatory familiarity to create solutions tailored to the needs of Brazilian healthcare, while international companies bring advanced technologies and global best practices. Collaborations with local institutions ensure that a wide range of cardiac care equipment, from diagnostic tools to implantable devices, is accessible to healthcare providers, supporting improved patient outcomes and efficient treatment delivery.

Looking ahead, the Brazil cardiovascular devices market is poised for significant growth due to continuous innovation, increasing patient awareness, and supportive healthcare policies. Emphasis on heart disease treatment, preventive measures, and patient education is driving demand for intelligent monitoring systems, precision treatment tools, and advanced medical devices Brazil. Integration of healthcare innovation into clinical workflows enhances procedural efficiency and long-term care. Hospitals, specialty clinics, and outpatient centers are expected to expand their cardiovascular device portfolios to address diverse patient needs. This convergence of advanced devices, clinical expertise, and digital technologies positions Brazil as a key hub for cardiovascular devices in Latin America, offering vast opportunities for manufacturers and healthcare providers.

Conclusion:

The Brazil cardiovascular devices market is poised for remarkable growth through 2034, underpinned by rising cardiovascular disease prevalence, patient-centric care models, and continuous technological innovation. The increasing adoption of minimally invasive devices and advanced cardiac care equipment reflects a shift toward precision medicine, enhanced procedural safety, and improved patient outcomes. Efforts to expand healthcare access, strengthen policies, and increase patient awareness further drive demand for effective heart disease treatment solutions.

Medical devices Brazil is benefiting from sustained R&D investment, leading to smarter, connected devices that enable remote monitoring, real-time analytics, and predictive care. Collaborations between domestic and international manufacturers, along with the integration of healthcare innovation, ensure a steady pipeline of next-generation cardiovascular solutions. By 2034, the market is expected to evolve into a sophisticated, technology-driven ecosystem where clinical expertise, innovative devices, and patient-centered strategies converge. Brazil is well-positioned to emerge as a key regional hub for cardiovascular devices, offering significant opportunities for manufacturers, healthcare providers, and innovators alike, while transforming the landscape of cardiac care for millions.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

- Data-Driven Market Research: Deepen your knowledge of cardiovascular disease prevalence, treatment approaches, and technological advancements such as minimally invasive devices, implantable solutions, and digital monitoring systems through comprehensive market research reports.

- Strategic Growth Forecasting: Predict emerging trends in cardiac care, from smart diagnostic tools and AI-assisted monitoring devices to policy evolution and public health initiatives.

- Competitive Benchmarking: Analyze competitive forces in the market, review product pipelines, and track breakthroughs in precision medicine and allied care technologies.

- Policy and Infrastructure Advisory: Stay ahead of regulatory frameworks, government-sponsored programs, and reimbursement strategies affecting cardiovascular device adoption.

- Custom Reports and Consulting: Receive tailored insights geared to your organizational objectives—whether launching new cardiovascular devices, investing in digital health ventures, or enhancing healthcare infrastructure for chronic heart conditions.

At IMARC Group, we empower healthcare leaders with the clarity and intelligence required to navigate the evolving cardiovascular landscape, ensuring enhanced patient outcomes and a more innovative healthcare ecosystem.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)