Top Factors Driving Growth in the India Ayurvedic Products Industry

India's Ayurvedic products market is experiencing remarkable transformation as consumers increasingly prioritize holistic wellness and natural remedies over conventional alternatives. The convergence of traditional healing wisdom with modern consumer preferences has created a dynamic landscape where herbal medicines, chemical-free personal care products, and immunity-boosting supplements are becoming household staples. As lifestyle diseases become more prevalent and consumers seek preventive healthcare solutions, Ayurveda's holistic approach resonates deeply with India's health-conscious population.

Shift Toward Herbal Medicines and Chemical-Free Personal Care:

The movement away from synthetic ingredients toward plant-based formulations represents one of the most significant trends reshaping India's consumer goods landscape. Urban and semi-urban households are increasingly scrutinizing product labels, seeking transparency about ingredients and manufacturing processes. This heightened awareness stems from concerns about long-term side effects associated with chemical-laden products and a growing appreciation for Ayurveda's preventive health philosophy.

Herbal syrups have emerged as popular alternatives to conventional cough remedies, with formulations containing tulsi, ginger, and honey gaining widespread acceptance across demographic segments. Similarly, Ayurvedic oils for hair care and massage are displacing synthetic alternatives, particularly among consumers experiencing hair loss, dandruff, or stress-related ailments.

The natural personal care segment has witnessed particularly strong traction, with herbal face creams, cleansers, and body care products finding favor among millennial and Gen Z consumers. These demographics value sustainability, ethical sourcing, and cruelty-free testing practices—values that align seamlessly with traditional Ayurvedic principles. Brands emphasizing botanical ingredients like neem, turmeric, sandalwood, and aloe vera are capitalizing on this preference shift, offering products that promise both beauty and wellness benefits.

Herbal supplements addressing specific health concerns—digestive health, stress management, hormonal balance, and metabolic support—are gaining mainstream acceptance. Consumers are moving beyond viewing Ayurveda as merely traditional medicine, recognizing it as a comprehensive wellness system capable of addressing modern lifestyle challenges.

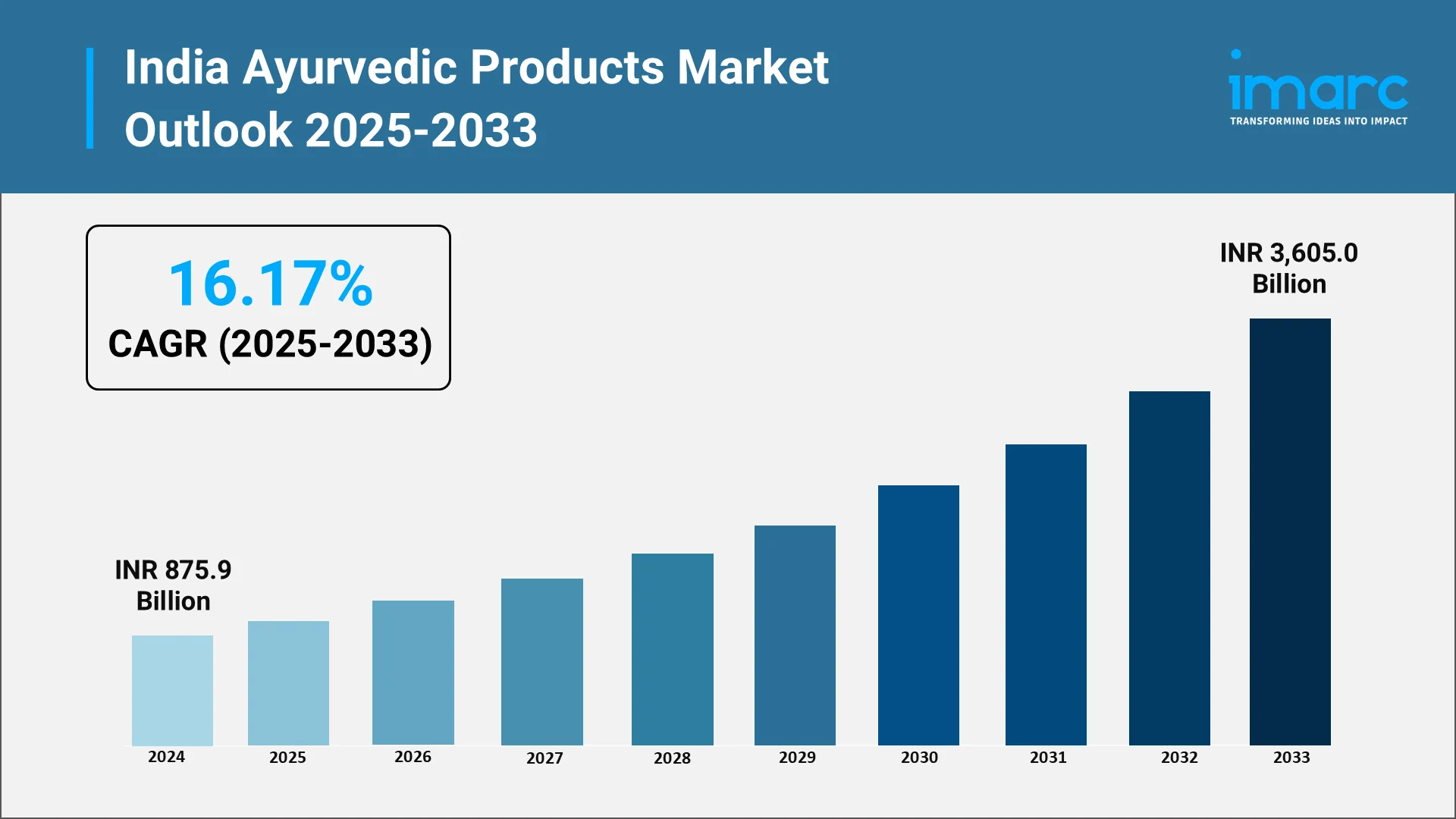

Market Size and Growth Opportunity:

India's Ayurvedic products industry presents substantial expansion potential, fueled by demographic advantages, cultural affinity, and supportive government policies. The market's foundation rests on India's rich heritage of traditional medicine, with Ayurveda deeply embedded in cultural practices across generations. The India ayurvedic products market size reached INR 875.9 Billion in 2024. The market is projected to reach INR 3,605.0 Billion by 2033, exhibiting a growth rate (CAGR) of 16.17% during 2025-2033.

Urban households are demonstrating particularly strong uptake of premium Ayurvedic products, driven by higher disposable incomes and greater exposure to wellness trends through digital media. Metropolitan consumers are willing to pay premium prices for certified organic formulations, sustainably sourced ingredients, and innovative delivery formats.

Semi-urban and rural markets represent untapped growth frontiers, where traditional Ayurvedic practices already enjoy cultural acceptance, but modern packaged products have limited penetration. As distribution networks expand and digital commerce reaches deeper into smaller towns, these markets offer significant volume growth potential.

The wellness tourism sector is creating additional demand vectors, with international visitors seeking authentic Ayurvedic experiences and taking products back to their home countries. This cross-border interest is positioning Indian Ayurvedic brands for global expansion, particularly in Western markets where interest in alternative medicine and natural products continues growing.

Explore in-depth findings for this market, Request Sample

Recent Government Initiatives Accelerating Growth:

The Government of India has undertaken transformative initiatives to strengthen the Ayurvedic sector. On January 5, 2025, Prime Minister Narendra Modi laid the foundation stone of the Central Ayurveda Research Institute in Rohini, describing it as "Ayurveda's next big leap." This state-of-the-art facility will advance research, standardization, and global dissemination of Ayurvedic knowledge.

In a groundbreaking move on March 17, 2025, the Ministry of AYUSH incorporated Artificial Intelligence (AI) into undergraduate and postgraduate curricula to modernize the Indian Systems of Medicine. This initiative equips students with traditional medicine foundations while integrating cutting-edge technological advancements to improve healthcare delivery and research capabilities.

The Ministry of AYUSH's Union Budget allocation for FY26 witnessed a significant increase to Rs. 3,992.9 Crore, marking a robust growth trajectory that underscores governmental commitment to promoting traditional medicine systems.

Immunity-Boosting Products Driving Mass Sales:

The heightened focus on immune system strengthening has propelled specific Ayurvedic immunity boosters to unprecedented popularity across Indian households.

- Chyawanprash, a time-honored herbal jam formulation, has transcended its traditional positioning to become a mass-market preventive health product consumed by families across socioeconomic strata.

- Kadha (herbal decoctions) have experienced remarkable mainstreaming, transitioning from grandmother's remedies to commercially packaged instant mixes and ready-to-consume beverages. The convenience of pre-mixed formulations containing ginger, tulsi, cinnamon, and black pepper has democratized access to this traditional immune-boosting preparation.

- Giloy, recognized in Ayurveda as an immunity-enhancing herb, has gained significant consumer mindshare through intensive marketing and scientific validation of its immunomodulatory properties. Available in multiple formats including juices, tablets, capsules, and powder, giloy products appeal to consumers seeking targeted immune support.

- Herbal tablets and capsules formulated with ashwagandha, tulsi, neem, and other immunity-supporting botanicals have carved substantial market share in the preventive healthcare segment. These products offer convenient, standardized dosing that fits seamlessly into daily routines.

The sustained demand for immunity-boosting Ayurvedic products reflects a fundamental shift in consumer health philosophy toward proactive wellness strategies that emphasize strengthening the body's natural defense mechanisms.

E-commerce and D2C Ayurvedic Brands Growing Quickly:

The digital commerce revolution has fundamentally transformed how consumers discover, evaluate, and purchase Ayurvedic products. E-commerce platforms provide unprecedented access to diverse brands and product variants, breaking geographical barriers that previously limited consumer choice.

- Direct-to-consumer (D2C) Ayurvedic brands are leveraging digital channels to build authentic relationships with customers, bypassing traditional retail intermediaries. This direct engagement enables brands to educate consumers about Ayurvedic principles, product usage protocols, and expected outcomes.

- Subscription models for Ayurvedic products address the challenge of maintaining consistent wellness routines by automating replenishment and offering curated combinations targeting specific health goals. Monthly wellness kits containing complementary products—herbal supplements, teas, and personal care items—simplify consumer decision-making while encouraging comprehensive Ayurvedic lifestyle adoption.

- Home delivery convenience has proven particularly valuable for Ayurvedic products, which often require sustained usage over extended periods. Fast delivery timelines and hassle-free return policies reduce perceived purchase risk, encouraging trial among consumers new to Ayurvedic alternatives.

- Digital platforms enable personalized product recommendations based on individual health concerns, body constitution (prakruti), and lifestyle factors—core principles of Ayurvedic practice.

- Social media marketing and influencer partnerships have accelerated awareness and trial, particularly among younger demographics initially skeptical of traditional medicine.

Top Companies in India Ayurvedic Products Market:

The Indian Ayurvedic products industry features a competitive landscape where established heritage brands coexist with innovative new entrants. Leading companies have successfully scaled traditional formulations for mass production while maintaining quality standards and therapeutic efficacy.

- Amrutanjan Health Care Ltd. is a century-old leader in pain management, famous for its Ayurvedic balms and roll-ons. The company has successfully diversified into cold relief, women’s hygiene, and functional beverages.

- Biotique (Bio Veda Action Research Co.) integrates traditional Ayurveda with modern Swiss biotechnology. It offers high-end, preservative-free skin and hair care products, emphasizing organic purity, clinical safety, and sustainable, eco-friendly packaging.

- Charak Pharma Pvt Ltd., established in 1947, focuses on standardized, evidence-based Ayurvedic formulations. It operates WHO-GMP certified facilities, providing researched-backed herbal healthcare solutions for chronic ailments, women's health, and general wellness.

- Dabur Ltd., world’s largest Ayurvedic company, boasts a massive portfolio including Chyawanprash and Honey. It blends traditional wisdom with modern science across healthcare, personal care, and food categories.

- Emami Ltd is a major FMCG player with iconic Ayurvedic brands like Zandu and BoroPlus. Emami specializes in therapeutic personal care, pain relief, and digestive health, maintaining a strong global distribution network.

- Herbal Hills Wellness is a specialized manufacturer focusing on organic herbal supplements and classical Ayurvedic formulations. They offer a diverse range of powders, capsules, and juices targeted at immunity, detoxification, and vitality.

- Himalaya Wellness Company is a globally recognized brand pioneering "head-to-heel" wellness. Himalaya combines pharmaceutical-grade research with Ayurveda to offer a wide array of personal care, baby care, and specialized herbal medicines.

- Maharishi Ayurveda is focused on "Consciousness-based" healing, this company offers authentic Rasayanas and supplements. It bridges ancient Vedic texts with modern quality controls, serving global markets with premium, clinically-tested wellness products.

- Patanjali Ayurved Limited is a disruptive force in the Indian market, Patanjali offers a vast range of affordable Ayurvedic medicines and FMCG goods. It emphasizes Swadeshi principles and traditional herbomineral processing.

- Shahnaz Husain Group is a pioneer in Ayurvedic beauty care, the group is world-renowned for its organic salon treatments and formulations. It specializes in premium herbal cosmetics, blending ancient traditions with innovative techniques.

- Viccolabs is an iconic brand famous for its "Vajradanti" oral care and "Turmeric" skin cream. Vicco focuses on pure Ayurvedic ingredients, maintaining a legacy of trusted, chemical-free personal care solutions.

Choose IMARC Group for Unmatched Market Intelligence:

IMARC Group delivers actionable Ayurvedic market insights that drive strategic decisions and competitive advantage. Our comprehensive intelligence reports decode consumer trends, competitive dynamics, and untapped opportunities across India's booming wellness sector.

We forecast emerging opportunities in herbal supplements, natural personal care, and immunity products—helping you stay ahead of market shifts. Our competitive benchmarking reveals winning strategies from market leaders, positioning your brand for accelerated growth.

Navigate AYUSH regulations, organic certifications, and quality standards with confidence through our expert advisory. Whether you're launching breakthrough formulations, expanding internationally, or strengthening distribution networks, our custom consulting delivers results.

Partner with IMARC Group—where Ayurvedic insights become your competitive edge. Click here for more details: https://www.imarcgroup.com/india-ayurvedic-products-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)