Top Market Trends Shaping the Bio-Lubricant Industries

Bio-Lubricants Market Overview: Market Momentum, Policy Push, and Leading Innovators

Bio-lubricants are derived primarily from renewable sources, such as vegetable oils and animal fats. These lubricants offer excellent performance while minimizing environmental impact. Their high biodegradability, low toxicity, and compatibility with modern machinery make them ideal for industries seeking eco-friendly solutions. As global focus shifts toward greener operations, bio-lubricants are emerging as a vital component in responsible industrial practices.

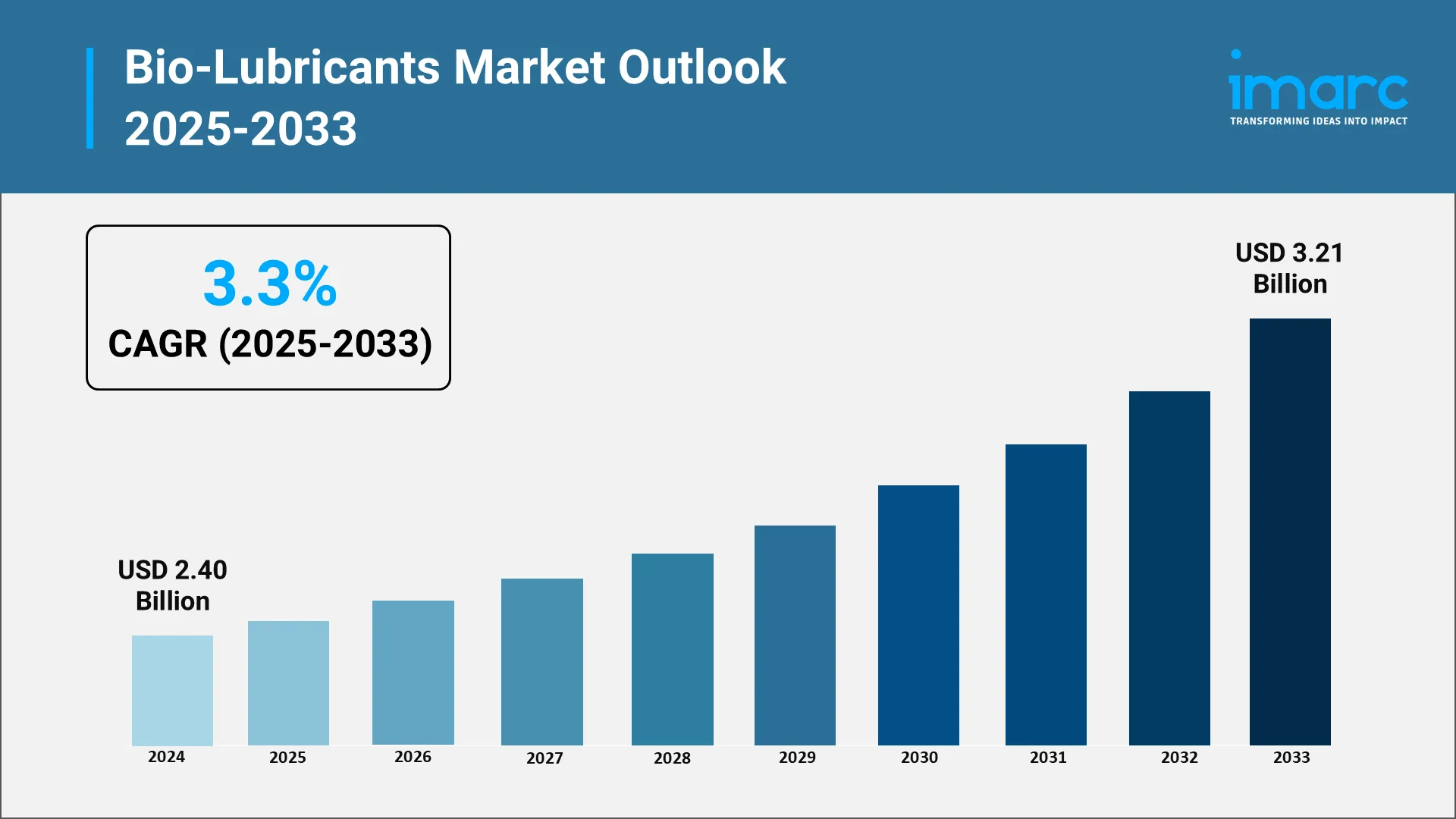

The global bio-lubricants market is undergoing a robust transformation, fueled by the worldwide shift toward sustainable industrial practices, stringent environmental regulations, and the increasing demand for biodegradable and low-toxicity alternatives to conventional petroleum-based lubricants. According to IMARC Group, the global bio-lubricants market reached a value of USD 2.40 Billion in 2024. With expanding applications in automotive, industrial machinery, marine, metalworking, and agriculture, bio-lubricants are now central to eco-conscious procurement and operations worldwide.

Explore in-depth findings for this market, Request Sample

Greening the Industry: Bio-Lubricants in Modern Industry

In response to growing environmental scrutiny and tightening emission norms, bio-lubricants are emerging as a compelling alternative in both the public and private sectors. These lubricants are redefining sustainability in industrial operations by supporting closed-loop resource systems and enhancing energy efficiency at the equipment level. Unlike conventional lubricants, bio-lubricants often possess superior lubricity, which reduces friction and heat generation, leading to lower power consumption and extended machinery lifespan. Adding momentum to this shift, researchers at the Institute of Advanced Study in Science and Technology (IASST) in Guwahati announced a new breakthrough on May 9, 2025. They developed an eco-friendly lubricant made from bio-based castor oil combined with specialized carbon-based nanomaterials. This new lubricant significantly reduces friction and wear in machines, handles high temperatures better, and is safer for the environment. It offers a greener, more efficient alternative to traditional oils used in industries. Such innovations align with broader industry efforts to cut down on fossil-based inputs and transition to products compatible with biodegradable packaging and zero-waste manufacturing. Also, bio-lubricants naturally degrade into non-toxic byproducts, they reduce the need for expensive cleanup in areas prone to leaks or spills. They can also lower life cycle greenhouse gas emissions by as much as 40–60%, helping companies reduce their environmental impact and meet long-term climate targets. Collectively, these factors are augmenting the usage of bio-lubricants in the industry landscape.

Key Industry Trends Redefining the Bio-Lubricants Market:

Bio Fluids on the Fast Track: Auto and Industrial Sectors Shift

The automotive and industrial sectors are increasingly prioritizing environmental sustainability, leading to a marked shift toward the use of bio-lubricants. In the automotive domain, the growing adoption of electric and hybrid vehicles is positively impacting the market. As per industry reports, global electric vehicle (EV) sales in 2025 are projected to surpass 20 Million units, accounting for over 25% of total car sales worldwide. The first quarter of 2025 alone witnessed a 35% year-on-year increase, with all major markets recording their highest-ever Q1 sales figures. This is expected to increase the demand for lubricants that exhibit high thermal stability, biodegradability, and compliance with stringent emission targets. Apart from that, the operational advantages of bio-lubricants, such as reduced ecological toxicity, are further reinforced by the evolving corporate responsibility mandates and environmental certifications. As a result, bio-lubricants are becoming a strategic component in aligning manufacturing and mobility operations with global carbon-reduction frameworks.

Nature Meets Performance: The Surge in Veg-Based Lubricant Innovations

Recent innovations in vegetable oil chemistry are significantly enhancing the viability of bio-lubricants for demanding industrial applications. Through advanced chemical modification processes, such as hydrogenation, esterification, and epoxidation, base oils derived from rapeseed, soybean, sunflower, and canola have achieved improved oxidative stability, thermal resistance, and extended service life. Apart from this, the development of additive systems tailored for vegetable oils has further mitigated previous limitations, such as cold-flow challenges. This progress is enabling bio-lubricants to offer comparable and superior performance relative to petroleum-based alternatives.

Compliance with Catalyst: Global Policies Pushing Bio-Lubricants Forward

The regulatory landscape is playing a pivotal role in shaping the growth trajectory of the global bio-lubricants market. Government agencies have established strict limits on the use of hazardous additives and non-biodegradable formulations in industrial lubricants. Notably, the EU Ecolabel issued by the European Commission requires that any lubricant marketed as “bio-based”, or “bio-lubricant” must contain at least 25% bio-based carbon. This content must be verified using standardized methods such as EN 16807, ASTM D6866, or EN 16785-1. These requirements stay in effect through December 31, 2024. These measures are pushing manufacturers toward the adoption of environmentally preferable alternatives. Additionally, initiatives such as carbon taxation, extended producer responsibility (EPR) frameworks, and green procurement mandates are promoting the use of bio-based lubricants across both public and private sectors. These policies not only support environmental protection goals but also provide economic incentives for manufacturers and end-users to transition toward compliant, sustainable lubrication solutions in alignment with circular economy principles.

Partnering for Progress: Research and Alliances Driving Market Breakthroughs

Research and development (R&D) activities are central to improving the performance and marketability of bio-lubricants across diverse industrial applications. Leading companies are investing in advanced formulation techniques, including the integration of anti-oxidation, anti-wear, and anti-corrosion additive packages designed specifically for bio-based feedstocks. Innovations are further supported through strategic partnerships with biotechnology firms and OEMs. Concurrently, investments to increase oilseed production are contributing to the market development. As per industry reports, the global oilseed output for the 2025-26 marketing year is projected to rise by 14.9 Million metric tons, reaching nearly 692 Million metric tons. This anticipated growth in oilseed availability will strengthen the feedstock supply for vegetable oil-derived bio-lubricants, enhancing scalability and cost-efficiency in production. As the industry evolves, such multidisciplinary efforts are vital for bridging the performance gap with conventional lubricants, thereby enhancing product differentiation and securing long-term competitiveness in both developed and emerging markets.

Pioneering the Green Shift: Industry Titans to Watch

The competitive landscape of the market is characterized by rising innovations, sustainability-driven differentiation, and regional expansion strategies. Major bio-based lubricant companies are focusing on enhancing product performance, such as oxidation stability and low-temperature fluidity, to compete with conventional lubricants. Regulatory compliance with bio-based content standards and eco-labeling is also emerging as a key differentiator in the market. Additionally, companies are investing in production capacity to meet the growing demand for biodegradable and non-toxic alternatives. Moreover, collaborations and acquisitions with raw material suppliers and industries like automotive, agriculture, and marine, alongside strategic partnerships among largest bio-lubricant manufacturers are increasingly shaping market dynamics. A significant development in the bio-lubricants market was observed in April 2024 with the introduction of Savsol Ester 5, a biodegradable lubricant derived from edible oil-based fatty acids, designed for use in the automotive and rail sectors. This innovation marks a significant shift away from traditional petroleum-based lubricants. Developed entirely through domestic expertise, the product represents a notable advancement in sustainable lubrication.

Some of the top bio-lubricants market companies in the market include Bechem, Castrol Limited, Cortec Corporation, Emery Oleochemicals, Fuchs, Kluber Lubrication, Kuwait Petroleum, Polnox Corporation, Shell plc, and TotalEnergies.

- BECHEM introduced its new BECHEM Nexus Technology on April 3, 2025, a PFAS-free lubricant formulation that fully eliminates PTFE while maintaining high performance and delivering excellent load-carrying capability across varied temperature ranges. These greases achieve a significantly lower carbon footprint, supporting environmental protection of soil, water, and air. By proactively aligning with anticipated EU REACH restrictions and regulatory tightening, BECHEM positions itself for strategic advantage through early PFAS elimination, reduced compliance risks, and enhanced industrial competitiveness.

- Klüber Lubrication announced an investment of INR 142 Crore in 2024 to expand its Mysore manufacturing facility, which currently covers 17,000 m². Scheduled for completion by early 2027, the expansion will add cutting-edge production capabilities, strengthen research and development (R&D) infrastructure, and secure vital certifications such as IATF (for automotive applications) and ISO 21469 (for food-grade lubricants). This initiative reinforces the company's commitment to the "Make in India" program, enabling faster product rollouts and seamless integration of global innovations into the Indian market.

- Lubrication Engineers, Inc. (LE) formally acquired RSC Bio Solutions on May 6, 2025. The company is a recognized provider of biodegradable, high-performance lubrication technologies. Strengthening its sustainable product portfolio with the integration of RSC's FUTERRA® and EnviroLogic® lines, the acquisition also reinforces LE's strategic presence in environmentally sensitive marine and industrial markets. This move is poised to accelerate innovation and global distribution of eco-friendly synthetic lubricants.

- RSC Bio Solutions introduced its FUTERRA™ Compressor Oils, a new line of high-performance synthetic lubricants engineered for marine and industrial air compressor applications, on October 24, 2024. Formulated with renewable, sustainable base stocks and advanced synthetic technology, the oils deliver enhanced thermal stability, improved resistance to oxidation, and longer drain intervals of up to 8,000 hours, while remaining inherently biodegradable. The launch underscores the company's commitment to providing environmentally responsible solutions for sectors such as offshore energy and marine operations, without compromising performance or operational efficiency.

- Shell Marine, on June 10, 2025, launched new offshore lubricant storage tanks in Busan, South Korea, to strengthen supply efficiency for major shipyards in Geoje and Ulsan. The facility enables faster order fulfilment within 48 hours and enhances Shell's marine lubricant logistics in the region. This move supports South Korea's shipbuilding sector with timely, high-quality lubricant delivery.

- The United Soybean Board, through its Soy Checkoff program, partnered with DEWALT® and Dynamic Green Products to launch a soy-based Bar & Chain Biodegradable Oil. As announced on March 21, 2024, the product is now available at over 1,300 Home Depot stores across the United States. Formulated with U.S.-grown soybean oil, the product offers high-performance lubrication while supporting environmental sustainability in sensitive areas.

- TotalEnergies Lubrifiants introduced its first-ever range of premium lubricants formulated from regenerated base oils on June 25, 2024. The company unveiled the Quartz EV3R line for passenger cars and Rubia EV3R for heavy-duty trucks. Embracing a circular economy, these lubricant formulations and their packaging (50% recycled plastic bottles) aim to deliver high performance with a reduced environmental footprint. Developed in synergy with TotalEnergies' recent acquisition of RRBO specialist Tecoil, the initiative is positioned to help customers decarbonize without compromising on OEM-approved lubricant quality.

Bio-Lubricants Market Breakdown: Segmentation Mapped Out

By Application:

- Automotive: Bio-lubricants are gaining traction in the automotive sector. A research article highlights that the bio-lubricant formulated from desert date seed oil exhibited notable properties, such as a high kinematic viscosity of 67.54 mm²/s, a specific gravity of 1.876, a flash point of 120°C, and a pour point of −5°C, indicating strong low-temperature performance suitable for automotive use. Their superior biodegradability and low volatility make them suitable for reducing environmental impact while enhancing vehicle longevity.

- Industrial Machinery: In industrial settings, bio-lubricants are used extensively in hydraulic systems, air compressors, and gearboxes. Their high lubricity and oxidative stability ensure efficient performance under heavy loads and varying temperatures. These products also minimize downtime caused by fluid leaks or contamination, especially in ecologically sensitive zones. Industries are adopting these alternatives to reduce lifecycle emissions.

- Marine: In the marine sector, bio-lubricants are used in stern tubes, thrusters, deck equipment, and hydraulic systems, offering excellent water resistance and corrosion protection. Moreover, a global carbon tax targeting an entire industry has been introduced, set to take effect in 2028. Under this regulation, the maritime sector will be required to either transition to low-emission fuels or incur financial penalties based on their carbon output. In this context, the adoption of bio-lubricants in marine applications becomes increasingly critical. As ship operators seek to reduce their environmental footprint and avoid additional carbon-related costs, bio-lubricants offer a practical solution.

- Agriculture Equipment: The agriculture sector utilizes biodegradable lubricants in tractors, harvesters, chainsaws, and irrigation systems. These include chain oils, hydraulic fluids, and multi-functional greases that ensure smooth operation in harsh outdoor environments. Since spills are common in field operations, bio-lubricants reduce the ecological risk to soil and crops.

- Metalworking Fluids: Bio-based metalworking fluids are used in cutting, grinding, milling, and forming processes where high precision and surface quality are critical. These fluids offer superior cooling, lubricity, and lower mist generation, contributing to safer workplaces and reduced tool wear. These lubricants are particularly valuable in aerospace, medical device, and electronics manufacturing, where both environmental compliance and process efficiency are essential.

By Region:

- North America: The market in the region is led by strong regulatory frameworks, including the EPA's VGP and USDA's BioPreferred Program. The U.S. government's preference for bio-based products in federal procurement has boosted institutional demand. Additionally, consumer awareness about environmental hazards and rising green investments in the U.S. and Canada have encouraged automotive and industrial players to adopt sustainable lubrication solutions.

- Europe: Europe remains the global frontrunner in bio-lubricant adoption, with Germany and Nordic countries showcasing advanced market maturity. The region's strict REACH regulations and increasing carbon pricing mechanisms have compelled industries to shift away from petroleum-based lubricants. Moreover, partnerships between OEMs and lubricant formulators are fostering innovations in high-performance biodegradable formulations. Public infrastructure projects also prioritize bio-based products in alignment with the EU Green Deal objectives.

- Asia-Pacific: Asia-Pacific is emerging as a high-growth region, with China, India, and Japan leading due to expanding industrial bases and proactive environmental mandates. China's push for eco-friendly manufacturing and India's bio-economy policy are creating new demand across the automotive, construction, and agriculture sectors. For instance, over 800 major Chinese enterprises have committed to achieving carbon neutrality by the year 2050. Japan's focus on circular economy practices further drives investments for the sector. The bio-lubricant manufacturers are also increasingly engaging in joint ventures with Western bio-lubricant firms.

- Latin America: In Latin America, countries like Brazil and Mexico are witnessing the rising adoption of bio-lubricants, particularly in agriculture and transportation. Brazil's vast oilseed base, including castor and soybean, is also enabling domestic production of bio-lubricants. In the current marketing year, soybeans constitute most of the Brazil's oilseed production, representing nearly 96% of the total volume. Government-led sustainability programs and growing awareness among end-users are expected to further fuel regional demand.

The Road Ahead for Bio-Lubricants: Market Forecast and Emerging Growth Drivers (2025–2033)

According to IMARC Group, the global bio-lubricants market is projected to reach USD 3.21 Billion by 2033, exhibiting a growth rate (CAGR) of 3.3% during 2025-2033. The key drivers of growth include:

- Eco-label Certifications: Globally recognized certifications (e.g., EU Ecolabel, USDA BioPreferred) are boosting trust and accelerating the adoption of bio-lubricants across industries.

- Electrification of Transport: The rise of EVs and hybrid fleets is driving demand for clean, high-performance lubricants.

- Corporate Sustainability Goals: Carbon neutrality targets are pushing industries to replace conventional lubricants with bio-based alternatives.

- Government Incentives: Supportive policies in emerging economies are fueling bio-lubricant uptake in the energy and infrastructure sectors.

Untapped Potential: Growth Prospects in Underdeveloped Markets

Emerging economies present significant untapped potential for the bio-lubricants market. As countries ramp up investments in green infrastructure, urban mobility, and agricultural modernization, bio-lubricants emerge as a cost-effective and environmentally friendly alternative to conventional oils. Regions such as India, Brazil, and Southeast Asia are poised for large-scale deployment over the coming decade, driven by supportive government policies, rising environmental awareness, and increasing demand for low-toxicity lubricants in public and industrial sectors. Additionally, the expansion of manufacturing hubs in these markets is prompting demand for sustainable maintenance solutions, further amplifying growth prospects.

IMARC’s Strategic Vision: Empowering Stakeholders in the Bio-Lubricants Era

As the market evolves, IMARC Group empowers stakeholders across the bio-lubricants value chain, from raw material suppliers to end users, with strategic research and future-ready insights. Our industry intelligence aids in navigating regulatory changes, identifying new opportunities, and optimizing product portfolios to meet changing global demands.

How IMARC Adds Value:

- Market Intelligence: Tracking global and regional trends in renewable lubricants.

- Innovation Monitoring: Evaluating new bio-feedstock technologies and ester formulations.

- Regulatory Guidance: Navigating global compliance—from EPA and REACH to ISO 15380.

- Strategic Forecasting: Identifying where demand will rise across sectors and geographies.

- Partner Mapping: Connecting manufacturers with OEMs, distributors, and institutional buyers.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)