Top Factors Driving Growth in the Japan Personal Luxury Goods Industry

Introduction to Japan’s Personal Luxury Goods Market:

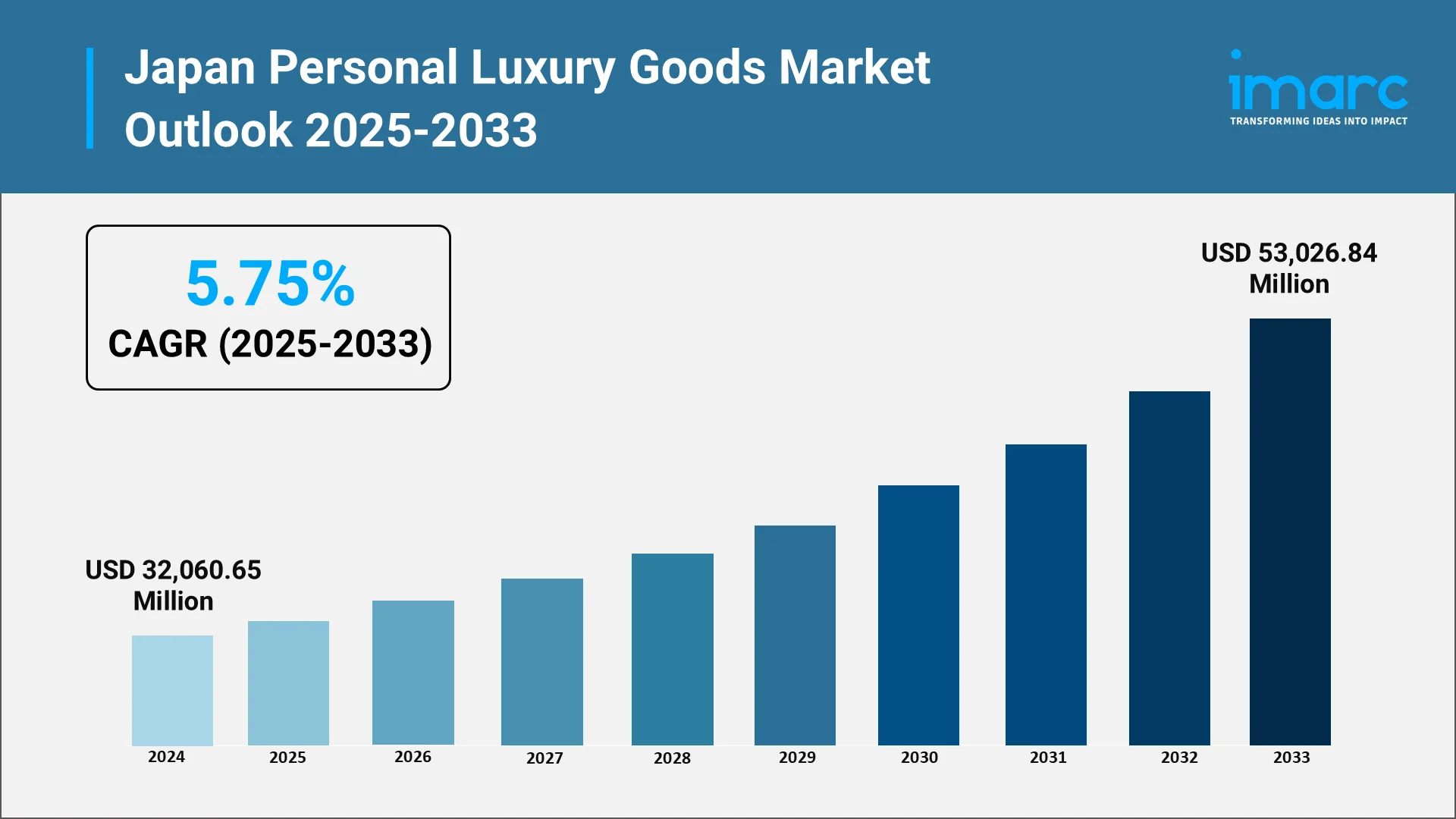

The Japan personal luxury goods industry stands as one of the world’s most crucial and dynamic markets, consistently ranking among the top three globally, alongside the United States and China. In 2024, Japan personal luxury goods market size reached USD 32,060.65 Million in 2024. Historically, Japan was instrumental in the global expansion and "democratization of luxury," pioneering a culture where high-end goods, once exclusive to the elite, became aspirational badges for a vast, affluent middle class. With an established love for craftsmanship, heritage, and quality, Japanese consumers have long boasted some of the highest per capita spending on luxury worldwide.

However, the market today is far from its bubble-era origins. It is a nuanced landscape where traditional values intersect with hyper-modern demands. Post-pandemic recovery, coupled with a surge in inbound tourism and fundamental shifts in local consumer psychology, has positioned Japan for a period of robust growth. This comprehensive analysis, targeting a market outlook toward 2033, delves into several pivotal factors—from rising domestic affluence to the power of digital commerce—that are collectively fueling the expansion of the Japan personal luxury goods industry.

Explore in-depth findings for this market, Request Sample

Rising Affluence and Changing Consumer Preferences:

The primary domestic engine for the luxury market is the evolving behavior of Japan's affluent population, characterized by two major shifts: a move from "Conspicuous Consumption" to "Conscious Consumption," and the emergence of a highly discerning, quality-focused younger demographic.

The Shift from 'Brand as Badge' to 'Individualized Expression':

For decades, luxury in Japan was synonymous with overt status—the "brand as badge" mentality where logo visibility was paramount. This has undergone a fundamental transformation. Today’s Japanese luxury consumer, particularly in metropolitan areas, seeks items that offer deeper personal meaning, exceptional functionality, and a narrative of heritage, rather than just an ostentatious display of wealth. This shift favors brands that can deliver:

- Understated Luxury (Quiet Luxury): A preference for high-quality, logo-minimalist items where the value resides in the materials, craftsmanship, and exclusivity rather than aggressive branding.

- A Focus on Craftsmanship and Monozukuri: Japan’s cultural reverence for meticulous production (monozukuri) means consumers prioritize product durability and quality more severely than almost anywhere else. This translates to a willingness to invest in items perceived as having long-term value, viewing luxury as an investment asset, a trend exemplified by the increasing popularity of collectible luxury watches.

- The Power of Self-Reward: As the population structure continues to age, the financially secure older demographic, along with single professional women in their 20s and 30s (often referred to as 'parasite singles' but possessing substantial disposable income), represent key segments engaging in luxury purchases as a form of self-reward and self-expression, independent of societal status signaling.

The Discerning Younger Consumer:

While older generations exhibit strong brand loyalty, the younger "Yutori generation" (Millennials and Gen Z) are driving change. They are highly attuned to global trends and digital culture, yet they are also value-conscious and scrutinize quality. Although some have resorted to lower-priced goods during economic downturns, they still prioritize durability and a high level of service. This segment's preferences for individualism and authentic connection compel luxury brands to engage with them through personalized, experiential retail.

Influence of Tourism and Duty-Free Retail Expansion:

The second major driver of growth is the resurgent and strategically important luxury shopping tourism segment. The influx of international visitors, especially post-pandemic, has created an enormous windfall for domestic luxury sales, complementing the spending of local residents.

The Inbound Tourism Boom:

The Japanese government’s initiatives to boost tourism, coupled with the favorable exchange rate resulting from the depreciation of the Yen, have made luxury purchases in Japan highly attractive to international travelers.

- Currency Advantage: A weaker Yen effectively lowers the price of luxury goods for visitors holding stronger currencies (e.g., US Dollar, Euro, Yuan), making Japan a price-competitive luxury destination compared to other global shopping hubs.

- Key Consumer Groups: While Japanese travelers have historically been significant buyers of luxury goods overseas, a critical mass of inbound shoppers, particularly from China and South-East Asia, are now bolstering domestic sales. This group is essential, as emerging market consumers have been responsible for the vast majority of global luxury market growth in recent years.

- The Travel Retail Ecosystem: The expansion of duty-free and travel retail channels—in airports, major shopping districts, and through dedicated tourist concessions—is vital. This channel offers attractive discounts and a guarantee of product authenticity, enhancing the overall tourist shopping experience. The strategic development of luxury shopping tourism is a conscious effort by both government bodies and local stakeholders to improve infrastructure and offer fiscal arrangements like tax reductions to attract international brands. The projection of international tourist arrivals reaching over 1.2 million by 2033 further underscores the long-term impact of this driver.

Growing Demand for Sustainable and Ethical Luxury Brands:

A critical, global mega-trend now significantly influencing the Japan personal luxury goods industry is the escalating consumer demand for sustainability, ethical sourcing, and corporate responsibility.

Conscious Consumption and Value Perception:

Japanese consumers, like their global counterparts, are increasingly aware of environmental and social governance (ESG) issues, though this awareness is not uniform across all demographics. The post-pandemic era has accelerated this shift, with consumers making decisions more responsibly and valuing high quality, durability, and adherence to sustainable principles.

- The Search for Sustainable Value: In the luxury context, sustainable luxury is defined by values like rarity, craftsmanship, and longevity, which inherently align with a philosophy of anti-fast-fashion and durability. Consumers are looking for brands that transparently demonstrate commitment to ethical production, reduced environmental impact (e.g., organic materials), and fair labor practices.

- The Rise of Circularity: A notable development is the increasing acceptance and interest in circular economy models, particularly in luxury fashion. Research in Japan has focused on consumer behavior toward both recycled clothing and secondhand clothing, recognizing the different motivations and perceived values associated with each. This willingness to embrace high-end pre-owned goods not only addresses sustainability concerns but also provides access to luxury for value-conscious consumers.

- Brand Imperative: Luxury companies are now compelled to integrate sustainability into their core value proposition and marketing storytelling. For brands, this means moving beyond simple quality claims to offering proof of ethical sourcing and responsible supply chain management to maintain trust and loyalty among modern Japanese consumers.

Digitalization and the Role of E-Commerce in Luxury Sales:

The digital revolution has irrevocably changed the landscape of luxury consumption, making digitalization and e-commerce a key growth pillar. While Japan’s e-commerce penetration has historically lagged behind other major economies, the luxury sector is rapidly catching up, driven by the shift in consumer behavior during and after the global pandemic.

The Omnichannel Imperative:

The modern luxury purchase journey in Japan is no longer a linear path exclusively through department stores or flagship boutiques; it is an integrated, omnichannel experience.

- E-Commerce Adoption: Online shopping is gaining traction, with platforms like Rakuten and Amazon Japan increasing in popularity. For luxury, this involves proprietary e-boutiques and official brand platforms, which allow for better control over brand image and customer experience—a crucial aspect of luxury retail.

- New Digital Engagement Tools: Brands are embracing advanced technologies to bridge the gap between physical exclusivity and digital accessibility:

- Augmented Reality (AR) and Virtual Reality (VR): Implementing AR/VR tools for virtual try-ons or immersive brand experiences appeals to the digitally savvy Japanese consumer.

- Video Content and Storytelling: Video platforms like YouTube and TikTok are popular in Japan, making them critical for brands to convey their heritage, craftsmanship, and unique value through compelling digital storytelling.

- Social Media and Search: Search engines remain the top channel for Japanese internet users to discover new brands or products, followed by traditional media. This mandates sophisticated Search Engine Optimization (SEO) strategies tailored to the Japanese market.

- Data and Personalization: Digital technology allows luxury brands to work with customer data to offer highly personalized services and communication, reinforcing the sense of exclusivity and individual recognition that the new consumer desires.

Future Outlook: Market Growth Potential Toward 2033

The Japan personal luxury goods market will be defined by resilience, innovation, and a dual-growth strategy: catering to a hyper-local, quality-focused domestic consumer base while strategically leveraging the massive volume and currency advantages presented by inbound tourism. The growth will be more qualitative than quantitative, prioritizing brand experience, authenticity, and ethical positioning over raw volume sales. IMARC Group expects the market to reach USD 53,026.84 Million by 2033, exhibiting a growth rate (CAGR) of 5.75% during 2025-2033.

Key indicators for growth through 2033 include:

- Sustained Inbound Tourism: The continuation of favorable currency rates and a government commitment to tourism infrastructure will ensure that luxury purchases by international visitors remain a substantial revenue stream.

- Increased Investment in Experiential Retail: Luxury houses will continue to invest heavily in Japanese flagship stores and unique experiential retail formats that combine the best of Japanese service (omotenashi) with digital integration.

- Maturation of Sustainable Demand: As Gen Z's purchasing power grows, the luxury secondhand and rental markets will continue to gain legitimacy and scale, demanding greater transparency from primary market brands regarding their ESG credentials.

The Japan personal luxury goods market size is set not just for expansion, but for a fundamental evolution into a smarter, more responsible, and digitally interconnected ecosystem, securing its position as a global trendsetter in luxury retail for the next decade.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

To navigate the intricacies and opportunities within this sophisticated market, industry leaders need clarity and deep, fact-based intelligence. IMARC Group provides the specialized expertise required to capture the next wave of growth in the dynamic Japan personal luxury goods industry.

- Data-Driven Market Research: Deepen your knowledge of Japanese consumer spending patterns, brand performance, and emerging product categories through in-depth market research reports tailored to the luxury segment.

- Strategic Growth Forecasting: Predict emerging trends in luxury retail, from personalization strategies and experiential commerce to shifts in demographic spending by key global regions impacting Japan.

- Competitive Benchmarking: Analyze competitive forces in the Japan personal luxury goods industry, review market share of key players, and monitor breakthroughs in omnichannel integration and supply chain excellence.

- Policy and Infrastructure Advisory: Stay one step ahead of tourism regulations, duty-free retail policies, and import/export strategies affecting luxury brand accessibility and profitability in Japan.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it launching a new luxury line in Japan, optimizing your retail footprint, or building a sustainable sourcing strategy.

At IMARC Group, our goal is to empower luxury brand executives with the clarity and intelligence required to master the dynamic Japan personal luxury goods market. Join us in securing your brand's future success—because every luxury purchase is a strategic investment. Click here: https://www.imarcgroup.com/japan-personal-luxury-goods-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)