How Government Policies Are Propelling the Japan Luxury Apparel Market

Introduction to Japan's Luxury Apparel Industry:

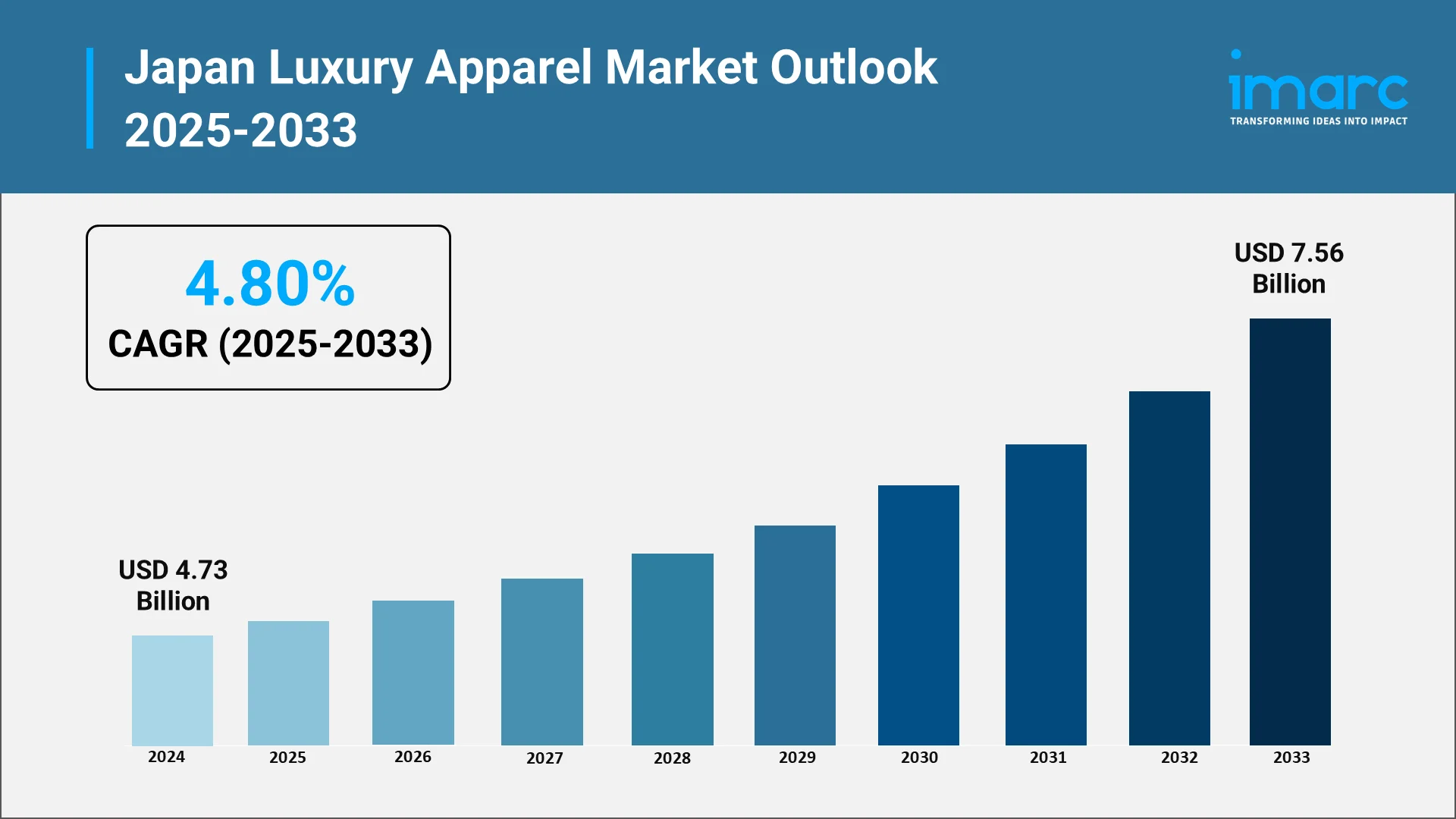

Japan's luxury apparel industry has traditionally been characterized by its profound respect for craftsmanship, quality, and cultural refinement. Japanese consumers have a reverence for art and nuance, preferring items that reflect precision and enduring design over short-lived trends. Over the past decade, Japanese luxury fashion has transcended conventional retailing experiences and assumed a contemporary identity that coalesces international influences with domestic sentiments. The Japan luxury apparel market size reached USD 4.73 Billion in 2024. Looking forward, the market is expected to reach USD 7.56 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025–2033. This growth trajectory is supported by government policies aimed at reinforcing domestic fashion infrastructure, promoting innovation, and aligning the industry with global sustainability and digitalization trends.

Japan's luxury fashion industry is sustained not only by the popularity of upscale overseas brands but also by the rising prestige of domestic designers who blend cultural heritage with contemporary style. State efforts increasingly recognize fashion as both an economic force and a cultural export. Consequently, policies are encouraging local creativity, enhancing trade facilitation, and positioning Japan as a leading global fashion investment destination. These measures have cultivated an enabling environment where luxury fashion houses and homegrown brands can thrive, meeting evolving consumer expectations centered on authenticity, innovation, and ethical values.

Explore in-depth findings for this market, Request Sample

Overview of Government Policies Supporting the Fashion Sector:

The government of Japan has also taken a calculated role in influencing the country's fashion industry. Identifying fashion as a creative sector that can impact tourism, exports, and cultural diplomacy, policies were created to boost the luxury apparel sector's competitiveness and recognition. Through collaborations with industry groups, education, and creative clusters, the government promotes talent creation and knowledge exchange among the fashion community.

Small and medium enterprise policies that promote fashion production have been especially relevant. These initiatives typically include access to capital, mentorship, and global partnership opportunities, enabling aspiring designers and artisans to make the leap from local to global markets. On 19 February 2025, a partnership event titled “A Journey into Japanese Textile Mastery” in Riyadh brought together leading Saudi and Japanese textile manufacturers, designers, and industry experts to explore collaboration in sustainability, innovation, and craft. Regional regeneration initiatives have also called attention to the significance of cultural textiles and crafts to modern fashion, compelling designers to incorporate traditional techniques into high-end collections. This fusion of past and present has become the signature characteristic of Japan's luxury brand identity.

The government also understands that fashion overlaps with other industries like tourism, technology, and sustainability. Through the promotion of cooperation between these industries, policy environments empower fashion businesses to generate engaging consumer experiences, test digital platforms, and extend the global appeal of Japanese luxury beyond Japan. These efforts illustrate that fashion is not just a business enterprise but a technological and cultural endowment that contributes to Japan's larger innovation-led economy.

Trade Arrangements and Import Policies Impacting Luxury Brands:

The trade ecosystem of Japan is central to the dynamics of the luxury clothing sector. The nation has a sound infrastructure of trade agreements that simplify the movement of goods and services across the borders. Such agreements have facilitated the entry and growth of international luxury brands in the Japanese market, as well as providing opportunities for local designers to present their offerings to the world. Reflecting this, LVMH Moët Hennessy Louis Vuitton has recently strengthened its investment in Japan as part of a broader shift in focus toward the region amid a slowdown in China’s luxury demand.

Import controls have come to strike a balance between consumer protection and industrial competitiveness. The government makes sure that luxury items being imported to Japan are of good quality and authentic, maintaining consumer confidence in high-end products. Concurrently, streamlined customs processes and favorable trade regimes have minimized hurdles for global partnerships, allowing luxury fashion brands to function effectively in Japan.

Aside from facilitating trade, Japan's policy landscape promotes fairness and transparency across the apparel supply chain. The promotion of ethical sourcing and manufacturing standards conforms to world expectations for responsible luxury. Consequently, domestic and foreign actors in the market are guided by norms that enhance the prestige of Japan as a center for high-quality, ethically manufactured apparel. These trade frameworks not only draw investment from famous global labels but also place Japanese fashion as a credible and sophisticated sector in the international luxury market.

Sustainability and Ethical Fashion Initiatives by the Government:

Sustainability has become a cornerstone of Japan’s fashion policy landscape, with the government emphasizing ethical strategy, environmental care, and social justice as the future of luxury. Policies encourage brands to adopt circular economy principles, reduce waste, and use low-impact materials. Reflecting this shift, Kering launched its first-ever “Kering Generation Award” in Japan in partnership with CIC Tokyo, offering a ¥10 million prize to startups innovating in sustainable fashion and beauty. This aligns with Japanese consumers’ growing preference for moderation, longevity, and timeless quality over excess, shaping a market where conscious consumption defines prestige.

A key area of government support lies in sustainable production. Efforts to improve textile manufacturing efficiency by cutting energy and water use and minimizing waste have helped luxury brands integrate sustainability into their operations. Public funding also supports research into biodegradable fabrics and eco-friendly dyes, driving innovation in materials that lower the fashion industry’s environmental footprint while maintaining high design standards.

Japan’s policies also promote ethical labor practices and supply chain transparency, fostering consumer trust and enhancing the reputation of its luxury fashion as both beautiful and responsibly made. Collaboration between government bodies, academia, and private enterprises continues to generate innovative solutions blending sustainability with design excellence. For example, Japan aims to achieve a 70% textile recycling rate by 2030 — a major step toward circular fashion and resource efficiency. Through these initiatives, Japan has positioned itself as a global leader in responsible luxury, aligning its fashion sector with national goals of environmental harmony and social progress. This approach ensures the long-term relevance of Japanese luxury in a world where ethical production and mindful consumption increasingly define success.

Support for Innovation, Digitalization, and Local Designers:

Digital transformation and innovation have become defining forces in Japan’s luxury clothing market, with the government actively fostering digitalization in fashion retail and design. Policies encourage brands to integrate advanced technologies such as data analytics, virtual fitting tools, and e-commerce platforms to enhance customer engagement and operational efficiency. These digital strategies not only elevate the consumer experience but also position Japan as a frontrunner in merging technology with high-end fashion. For instance, ZOZO Group (Japan’s leading online fashion group) recently announced the acquisition of the UK-based fashion discovery platform Lyst for US $154 million — a move aimed at combining ZOZO’s technology and Japanese market expertise with Lyst’s global data and AI capabilities, underscoring how local luxury-fashion players are using tech to expand internationally. Small labels and emerging designers particularly benefit from government-backed innovation programs that provide access to infrastructure, allowing experimentation with new materials, digital tools, and production processes. Technologies like 3D modeling and virtual fashion shows have further enabled brands to reach global audiences, expanding their influence beyond geographical boundaries.

Simultaneously, the government is nurturing local talent through initiatives that celebrate Japan’s cultural heritage and creative excellence. Programs highlighting regional craftsmanship, traditional textiles, and modern interpretations of Japanese aesthetics have brought local designers international recognition. Subsidies and incubator projects support these designers from concept to global acclaim, ensuring that Japan’s luxury fashion retains its distinctive cultural identity. Collaboration between technology firms and fashion houses is also encouraged, driving advancements in wearable technology, smart fabrics, and sustainable materials. By combining artistic heritage with scientific innovation, Japan exemplifies how luxury fashion can evolve through digital sophistication and environmental consciousness. This forward-looking approach ensures that Japan’s luxury clothing industry remains both culturally rooted and globally competitive in the era of digital transformation.

Future Outlook: Policy-Led Expansion of Japan's Luxury Fashion Market

The future of Japan’s luxury fashion market is firmly tied to the government’s continued pursuit of innovation, sustainability, and global collaboration. Policy support remains crucial as evolving consumer preferences and intensifying global competition reshape the industry. Initiatives focused on creativity, heritage preservation, and digital transformation are providing a clear roadmap for growth. The integration of sustainability across design, production, and consumption phases is positioning Japan as a leader in ethical luxury, while collaborations between traditional artisans and contemporary designers are enriching the nation’s creative depth and broadening market appeal.

Digitalization will play a defining role in this evolution, with government-backed programs driving investments in artificial intelligence, virtual retail, and advanced manufacturing. These technologies are transforming customer engagement, offering personalized, immersive experiences that blend craftsmanship with innovation. At the same time, education and skill-development initiatives are nurturing future generations of designers and entrepreneurs to thrive at the intersection of art and technology. Japan’s proactive participation in international trade and cultural exchange further strengthens its reputation as a global trendsetter. Through policies that balance innovation with heritage, Japan is cultivating a luxury fashion ecosystem that unites artistry, ethics, and technology—ensuring the market remains dynamic, inclusive, and globally admired.

Partner with IMARC for Unmatched Insights into Japan’s Luxury Apparel Industry:

For comprehensive, data-driven intelligence on Japan’s luxury apparel landscape, IMARC Group stands as the trusted research partner, delivering actionable insights that empower strategic planning, brand development, and investment decisions across this sophisticated and fast-evolving market.

- Extensive Market Coverage: IMARC’s analysis spans the full spectrum of luxury fashion including haute couture, designer ready-to-wear, accessories, and premium footwear, while also examining rising areas such as sustainable fashion, digital retail experiences, and gender-neutral design trends, ensuring a 360° industry perspective.

- Reliable Forecasting and Strategic Outlook: Leveraging advanced forecasting methodologies, our reports integrate economic indicators, evolving fashion preferences, digital adoption, and macroeconomic shifts to produce dependable market projections supporting brand expansion and long-term investment strategies.

- In-Depth Competitive Landscape: IMARC delivers detailed evaluations of key luxury brands, homegrown designers, and emerging fashion tech startups. We assess their product innovations, sustainability initiatives, marketing approaches, and market share positions to help clients benchmark performance and refine their competitive edge.

- Regional and Consumer Insights: Our granular breakdowns by major cities, consumer segments, and distribution channels reveal high-potential markets and emerging demographic trends, enabling brands to design targeted outreach and retail optimization strategies.

- Policy and Innovation Intelligence: IMARC monitors Japan’s government initiatives promoting sustainability, digital transformation, and cultural exports in fashion, offering clarity on policy frameworks and innovation incentives shaping the industry’s evolution.

- Trusted Global Expertise: With a proven record of analytical depth, reliability, and tailored support, IMARC continues to empower global clients with comprehensive market intelligence, helping them navigate Japan’s luxury fashion ecosystem with precision and confidence.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)