Philippines Gaming Industry Embraces AR and VR Technologies with New Investment Trends

Introduction:

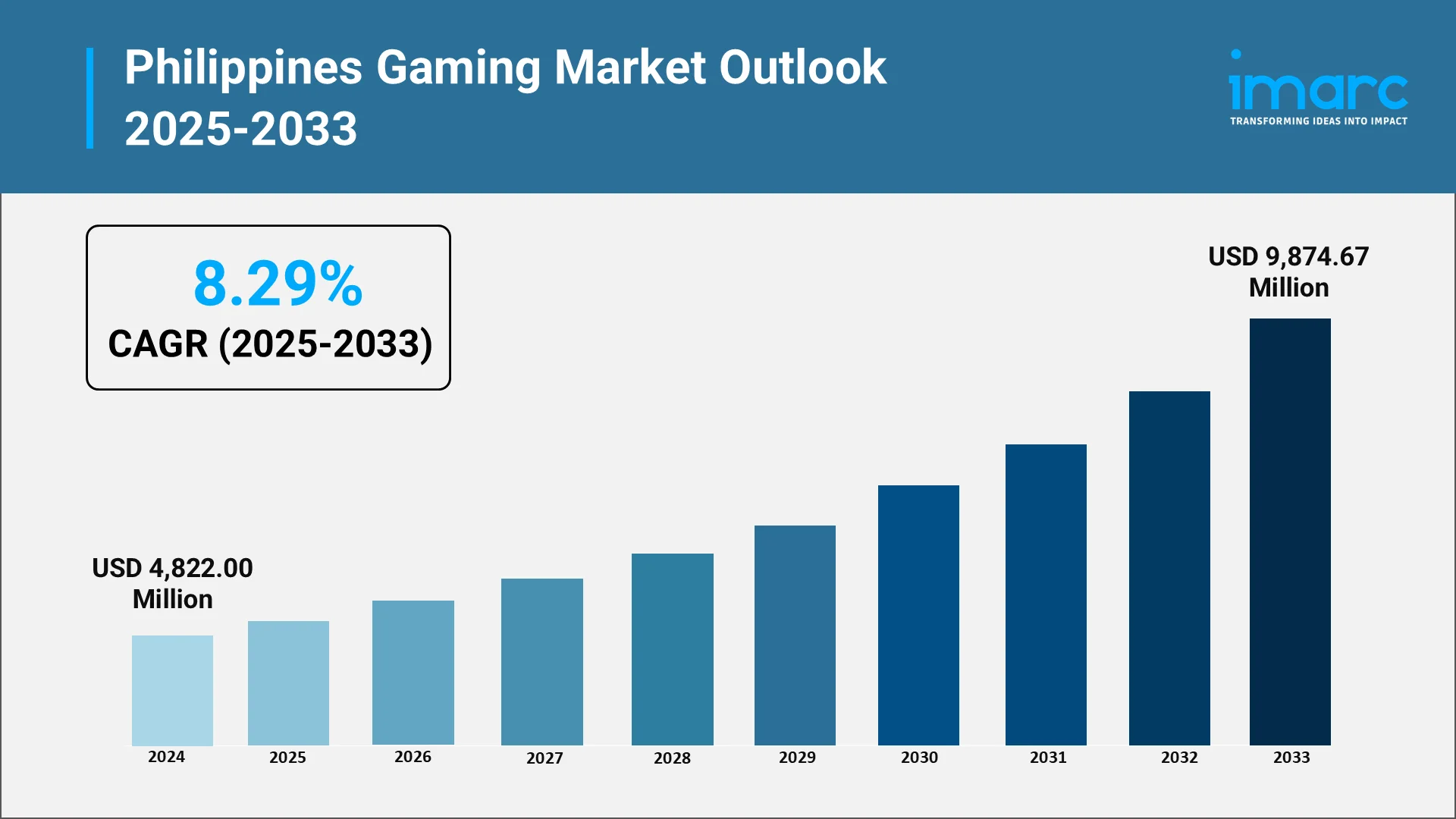

The Philippines gaming industry has emerged as Southeast Asia's fastest-rising digital entertainment powerhouse, achieving USD 4,822.00 Million in gross gaming revenue for 2024. This explosive growth signals a fundamental transformation in how Filipinos engage with interactive entertainment, driven by the rapid adoption of augmented reality (AR) and virtual reality (VR) technologies.

Electronic games and e-bingo command highest market share of gaming revenue, surpassing traditional casinos. In Q1 2025, digital formats demonstrate the irreversible shift toward immersive, technology-driven experiences. From mobile-first platforms to esports betting infrastructure, the Philippines leverages cutting-edge AR/VR technologies to capture domestic enthusiasm and international investment.

Explore in-depth findings for this market, Request Sample

Role of AI, Impact, and Benefits in the Philippines Gaming Industry:

Artificial intelligence is transforming the Philippines gaming sector, with the AI market projected to reach $1,025 Million in 2025, growing at 27.75% CAGR to $3,487 Million by 2030. This technological revolution directly fuels gaming innovation across development, player engagement, and operational efficiency.

AI-powered decision-making enables opponents in strategy games to evaluate risks and execute human-like actions, while procedural generation AI creates vast, varied game environments using algorithmic rules. This allows smaller Filipino studios—representing a significant portion of 101 gaming startups—to compete globally without massive resource investments.

Machine learning algorithms analyze player behavior to deliver customized content, with DigiPlus Interactive Corp. exemplifying success through its 50% market share and 40 million users. AI-driven personalization improves conversion rates and average revenue per user by adapting recommendations in real-time based on gameplay patterns.

Game studios use AI for testing and balancing, simulating scenarios to optimize difficulty and discover bugs before launch. AI-based noise cancellation in gaming smartphones filters background noise during voice chat, enabling clear communication in popular titles like Mobile Legends and PUBG Mobile—games dominating the Filipino market.

Philippine esports teams including Bren Esports and Blacklist International benefit from AI-powered matchmaking and analytics tools that ensure fair competition and strategic optimization. With 86% of AI chat users in the Philippines adopting Microsoft Copilot in 2024, PAGCOR emphasizes ethical AI deployment, balancing innovation with accountability and data protection.

Recent Market News and Major Research and Development:

- PAGCOR implemented strategic reforms in early 2025 to sustain this growth, significantly slashing licensing fees from 55% to 30% for land-based operators and 25% for integrated resorts. Chairman Alejandro Tengco also announced new third-party vendor accreditation rules in April 2025, strengthening industry integrity. These measures encourage regulated digital expansion.

- In February 2025, PAGCOR launched iGames, an online platform offering traditional casino games alongside new virtual formats. Major casinos are now integrating AR gaming that overlays digital elements onto slot machines and VR gaming that offers fully immersive environments, directly leveraging the technologies discussed in this report.

- International Confidence and Local Innovation: The government's approval of nearly $6 Billion in casino infrastructure investments over five years and the Philippines' removal from the Financial Action Task Force’s grey list in February 2025 restored international investor confidence. Simultaneously, Filipino startups like Yield Guild Games continue to explore blockchain DAOs investing in NFTs for virtual worlds, a high-growth segment supported by government DICT initiatives that provide cutting-edge VR tools and state-of-the-art facilities.

Opportunities and Challenges in the Philippines Gaming Industry:

Growth Opportunities:

- Mobile-First Gaming: With 96% internet penetration and widespread smartphone adoption, mobile games commanding 45% of global revenue position Filipino developers to capitalize on locally-relevant content resonating with Southeast Asian audiences.

- Esports Expansion: Esports betting projected to exceed PHP 22.1 Million in 2025 with double-digit growth potential. International championship victories by Bren Esports and Blacklist International create natural synergy between competitive play and betting infrastructure.

- AR/VR Integration: $5 Million projected investment in AR/VR gaming offers immersive experiences attracting younger demographics. Early movers will establish competitive advantages as hardware becomes affordable and content libraries expand.

- Blockchain Gaming: Play-to-earn models and NFT-based economies present opportunities for innovative experiences offering real economic value, with Yield Guild Games demonstrating viability within Filipino gaming culture.

- International Markets: Companies like DigiPlus expanding into Brazil demonstrate global potential, leveraging English-speaking talent, competitive development costs, and proven technical expertise.

- Government Support: $6 billion in infrastructure investments over five years, combined with DICT initiatives providing VR tools and startup facilities, creates a supportive innovation ecosystem.

Industry Challenges:

- Hardware Costs: High-quality AR/VR devices remain expensive for average consumers, limiting market penetration despite growing interest. Average ARPU of $4.5 reflects affordability constraints.

- Content Standardization: Limited locally-relevant AR/VR content and lack of standardized development platforms create significant hurdles for developers balancing cultural resonance with global compatibility.

- Regulatory Complexity: Navigating licensing, anti-money laundering obligations, responsible gaming standards, and advertising restrictions demands substantial resources despite PAGCOR's reforms.

- Cybersecurity: Digital transactions and data collection require continuous security investment. Maintaining player trust while leveraging analytics for personalization presents ongoing challenges.

- Talent Competition: Rapid sector growth creates intense competition for skilled professionals. Brain drain to international markets and competition from other tech sectors constrain talent availability.

- Infrastructure: Ensuring consistent low-latency connections for competitive gaming and VR experiences remains challenging. Geographic disparities between Metro Manila, Cebu, Davao, and rural areas create uneven opportunities.

Future Outlook: Philippines Gaming Industry

The Philippines gaming industry is poised for monumental growth through 2030, driven by technological convergence, demographic advantages, and strategic global positioning. The market is expected to reach USD 9,874.67 Million by 2033, exhibiting a growth rate (CAGR) of 8.29% during 2025-2033.

- Technological Evolution

- Next-generation AR/VR will create fully immersive virtual worlds blending entertainment, social interaction, and commerce.

- AI-driven hyper-personalization will enable smaller studios to compete through superior engagement rather than massive marketing budgets.

- Blockchain and play-to-earn models will mature into sustainable economic systems, with the Philippines leading Southeast Asian development through existing YGG strengths.

- 5G rollout across major cities will enable cloud gaming, eliminating hardware barriers and democratizing AAA experiences on modest devices.

- Regulatory Development

- PAGCOR's long-term transition into a purely regulatory body creates a level playing field and encourages international investment by eliminating the conflict of interest between operator and regulator.

- Enhanced cooperation between regulators, GDAP, and educational institutions will produce robust talent pipelines and industry standards.

- Government initiatives will likely expand to include tax incentives for AR/VR development and dedicated innovation hubs.

- Competitive Positioning

- The Philippines' youthful population, English proficiency, and vibrant gaming culture ensure sustained demand. Esports success inspires new generations of gamers and developers, creating virtuous talent cycles.

- Industry consolidation will intensify as successful startups attract acquisition interest, while venture capital investment grows for companies demonstrating strong engagement metrics and innovative monetization.

The convergence of traditional gaming, esports, AR/VR immersion, blockchain economies, and AI personalization creates unprecedented opportunities. Companies successfully navigating regulatory requirements, technological disruption, and evolving consumer preferences will help define the global gaming revolution.

Transform Your Gaming Strategy with IMARC Group's Market Intelligence:

- Data-Driven Market Research: Deepen your understanding of gaming market dynamics, player demographics, technology adoption patterns, and competitive landscapes through comprehensive market research reports covering AR/VR integration, mobile gaming trends, esports ecosystems, blockchain gaming economies, and regional growth drivers across the Philippines and Southeast Asia.

- Strategic Growth Forecasting: Predict emerging trends in gaming technology, from immersive AR/VR experiences and AI-driven personalization to metaverse platforms, play-to-earn models, 5G-enabled cloud gaming, and regulatory developments affecting digital entertainment across global markets and consumer segments.

- Competitive Benchmarking: Analyze competitive forces within the gaming industry, review product pipelines of leading developers and publishers, monitor breakthrough innovations in game design, monetization strategies, esports infrastructure, and immersive technology platforms reshaping player engagement and revenue models.

- Policy and Regulatory Advisory: Stay ahead of evolving regulatory frameworks, licensing requirements, responsible gaming standards, data protection regulations, anti-money laundering compliance, and government policies affecting gaming operations, digital entertainment platforms, and esports tournament organization.

- Custom Reports and Consulting: Obtain tailored insights aligned with your organizational objectives—whether launching new gaming titles, investing in esports ventures, evaluating AR/VR technology adoption, expanding into emerging markets, or developing digital entertainment infrastructure for next-generation gaming experiences.

At IMARC Group, our mission is to empower gaming executives, developers, investors, and platform operators with the clarity and intelligence required to navigate the dynamic Philippine gaming landscape and seize opportunities in the rapidly evolving digital entertainment sector. Join us in shaping the future of interactive entertainment—because every player matters.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)