How are Self-checkout Systems Market Shaping The Future of Modern Infrastructure?

Introduction:

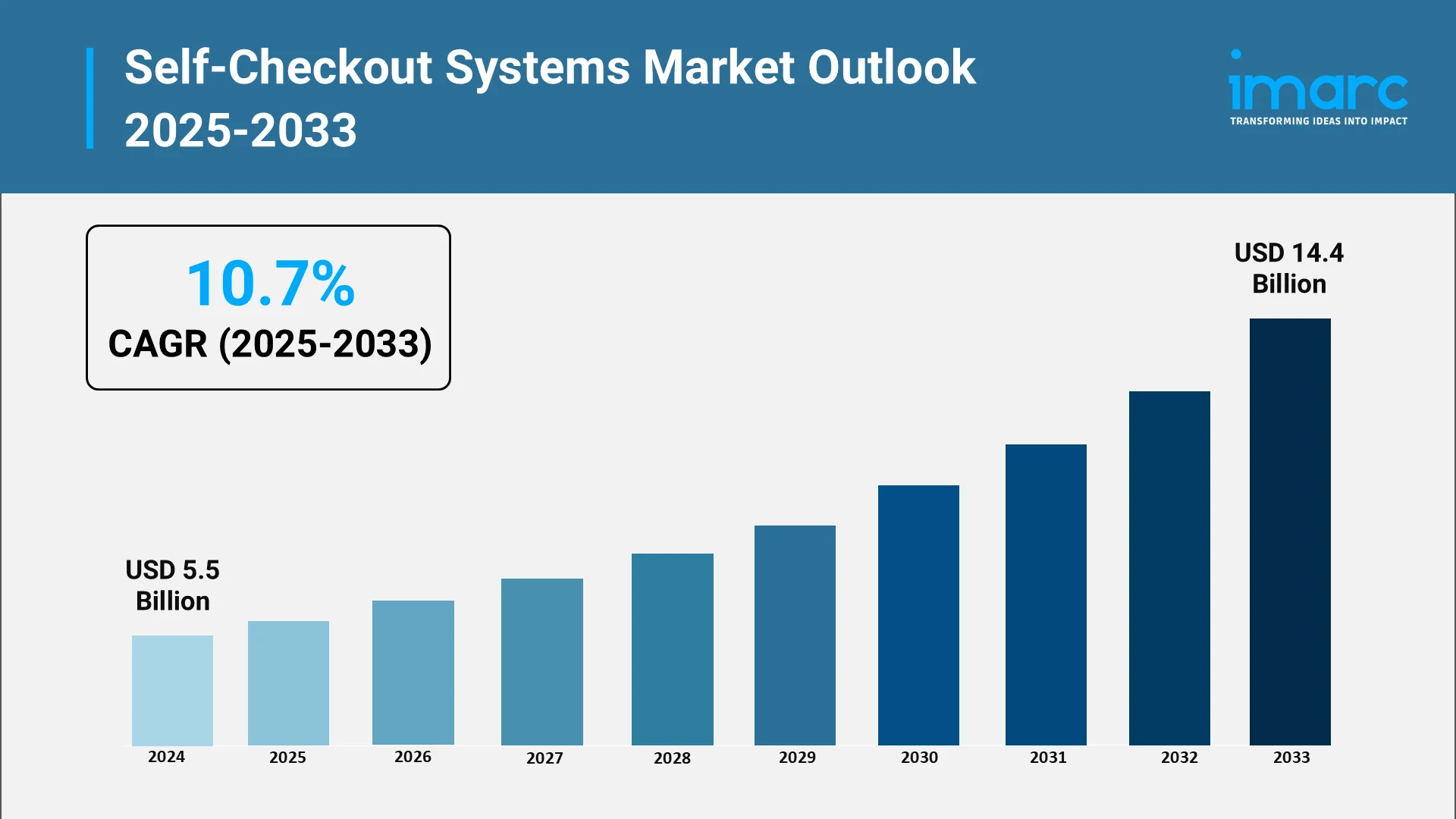

The retail landscape is experiencing a profound transformation as self-checkout systems emerge as critical infrastructure components reshaping consumer experiences and operational efficiency globally. These automated solutions enable customers to independently scan, bag, and pay for purchases without cashier assistance, representing a fundamental shift in modern commerce. The global self-checkout systems market size reached USD 5.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 14.4 Billion by 2033, exhibiting a growth rate (CAGR) of 10.7% during 2025-2033.

North America dominates the market, followed by strong adoption across Europe and rapidly emerging Asia Pacific markets. As retailers worldwide navigate evolving consumer preferences and workforce challenges, self-checkout technology has become essential infrastructure supporting modern commerce operations.

Explore in-depth findings for this market, Request Sample

The Role, Impact, and Benefits of Self-Checkout Systems in the Retail Industry:

Self-checkout systems deliver multifaceted benefits enhancing retail operations and customer experiences. These solutions comprise specialized hardware including multi-touch screens, barcode scanners, integrated payment terminals, and receipt printers, coupled with sophisticated software enabling seamless transactions.

From an operational perspective, self-checkout technology addresses critical labor challenges. Ongoing workforce shortages and rising labor costs compel retailers to adopt automation strategies optimizing staff deployment while maintaining service quality. Consumer benefits are equally compelling as industry research shows 77% of shoppers prefer self-checkout for faster transactions, while 36% cite shorter waiting lines and 43% value autonomy in bagging items.

The automated checkout demand extends beyond retail. In June 2024, Delhi International Airport launched Self-Service Bag Drop technology, becoming India's first airport implementing such advanced infrastructure, demonstrating versatility across hospitality, transportation, and healthcare sectors.

Key Growth Drivers in the Global Self-Checkout Systems Market:

Multiple converging factors propel the global self-checkout industry expansion. The accelerating shift toward cashless and contactless payment technologies stands as a primary catalyst, with digital wallet spending projected to exceed USD 10 trillion in 2025.

Artificial intelligence integration represents a transformative growth driver. In January 2024, Diebold Nixdorf introduced its Vynamic Smart Vision Shrink Reduction solution, leveraging AI and computer vision to address retail shrinkage while enhancing checkout speed. NCR Voyix launched its innovative Halo Checkout system in November 2024, recognizing up to 20 products simultaneously through Everseen's technology, processing shopping baskets in approximately eight seconds.

Labor market dynamics continue driving automated checkout demand. Persistent workforce shortages coupled with rising wages have intensified economic pressures on retailers to optimize costs. The post-pandemic emphasis on contactless interactions has permanently altered consumer behavior, with shoppers increasingly preferring minimized physical touchpoints during transactions.

Regulatory Framework and Policy Landscape in the Self-Checkout Systems Industry:

The regulatory environment encompasses consumer protection, data privacy, payment security, and accessibility standards. In China, government emphasis on cybersecurity and data localization shapes how self-checkout solutions handle consumer information.

Payment Card Industry Data Security Standards (PCI DSS) govern how terminals process payment information, mandating encryption, secure transmission, and regular security audits. Accessibility regulations ensure systems accommodate customers with disabilities through appropriate design features and assistive technologies.

Age verification regulations have driven innovation in AI-powered solutions. In April 2024, EDEKA Jaeger introduced Diebold Nixdorf's Vynamic Smart Vision Age Verification at Stuttgart Airport, enabling automated age recognition for alcohol purchases.

Government Support and Initiatives for the Self-Checkout Systems Market:

Government policies actively support retail automation and digital transformation. In Asia Pacific, particularly China, government-backed digitalization programs and smart city initiatives substantially enhance the retail technology landscape.

In Japan, majority of large-format retail stores are deploying self-checkout solutions due to cashless trends and labor shortages. North American governments support retail automation through tax incentives for capital equipment investments and regulatory frameworks enabling digital payment innovation.

Top Self-Checkout System Providers Worldwide:

The global self-checkout industry features intense competition among established technology leaders. NCR Voyix Corporation commands the largest market share, accounting for nearly one-third of global deliveries in 2023. NCR's January 2024 Next Generation Self-Checkout Solution integrates barcode scanning, computer vision, and RFID technologies.

Diebold Nixdorf increased market share by 5 percentage points, overtaking Toshiba as the second-largest global supplier. Toshiba Global Commerce Solutions focuses on adaptability with flexible interfaces and touchless payment options. Fujitsu Limited specializes in RFID-enabled solutions reducing checkout times while enhancing accuracy.

ITAB Group secured a major contract in January 2024 to supply 7,200 self-checkout units valued at USD 16.63 million. VusionGroup partnered with StrongPoint in December 2024 to drive physical commerce digitalization.

Opportunities and Challenges in the Global Self-Checkout Systems Market:

Opportunities:

Technological advancement through AI and computer vision creates unprecedented capabilities. AI-powered self-checkouts demonstrate 27% reductions in theft incidents while improving accuracy. The AI in Retail Market is projected to expand from USD 14.16 Billion in 2024 to USD 76.44 Billion by 2033 at 18.70% CAGR.

Challenges:

Theft and shrinkage represent the most significant challenge. Retailers with self-checkout systems experience loss rates of approximately 4%, more than double the industry average. Self-checkout accounts for 23% of retailers' unknown store losses.

Importantly, 52% of self-checkout shrinkage is unintentional, caused by customer confusion and system interface challenges rather than deliberate theft. High initial investment costs constrain adoption for small and medium retailers. While 79.3% of consumers use self-checkout regularly, certain demographics remain resistant.

Conclusion:

Self-checkout systems are fundamentally reshaping modern retail infrastructure, delivering compelling benefits in operational efficiency and customer experience while presenting challenges demanding strategic solutions. The market's robust growth projections underscore strong confidence in the technology's value proposition. Success requires retailers to adopt holistic strategies balancing technology investment with workforce development, security measures with customer convenience, and automation with human touchpoints preserving service quality.

Choose IMARC Group for Unmatched Expertise in Self-Checkout Systems Market Intelligence:

- Data-Driven Market Research: Enhance your understanding of self-checkout technology adoption patterns, market valuation trends, and growth forecasts through comprehensive reports covering regional dynamics and technological evolution.

- Strategic Growth Forecasting: Anticipate emerging trends in retail automation including AI-powered recognition, computer vision integration, and contactless payment proliferation by analyzing market trajectories and policy developments.

- Competitive Benchmarking: Evaluate competitive dynamics, monitor technology provider strategies, and assess market share shifts among leading vendors including NCR Voyix, Diebold Nixdorf, and Toshiba Global Commerce Solutions.

- Policy and Infrastructure Advisory: Navigate regulatory frameworks governing payment security, data privacy, and accessibility standards while staying informed about government initiatives supporting retail digitalization.

At IMARC Group, our mission is empowering retail leaders, technology providers, and investors with strategic intelligence required to succeed in the rapidly evolving self-checkout systems landscape. Partner with us to leverage comprehensive market insights driving informed decision-making and competitive advantage.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)