How the Webcams Market is Shaping the Global Digital Communication Industry: Trends, Challenges, and Opportunities

Introduction:

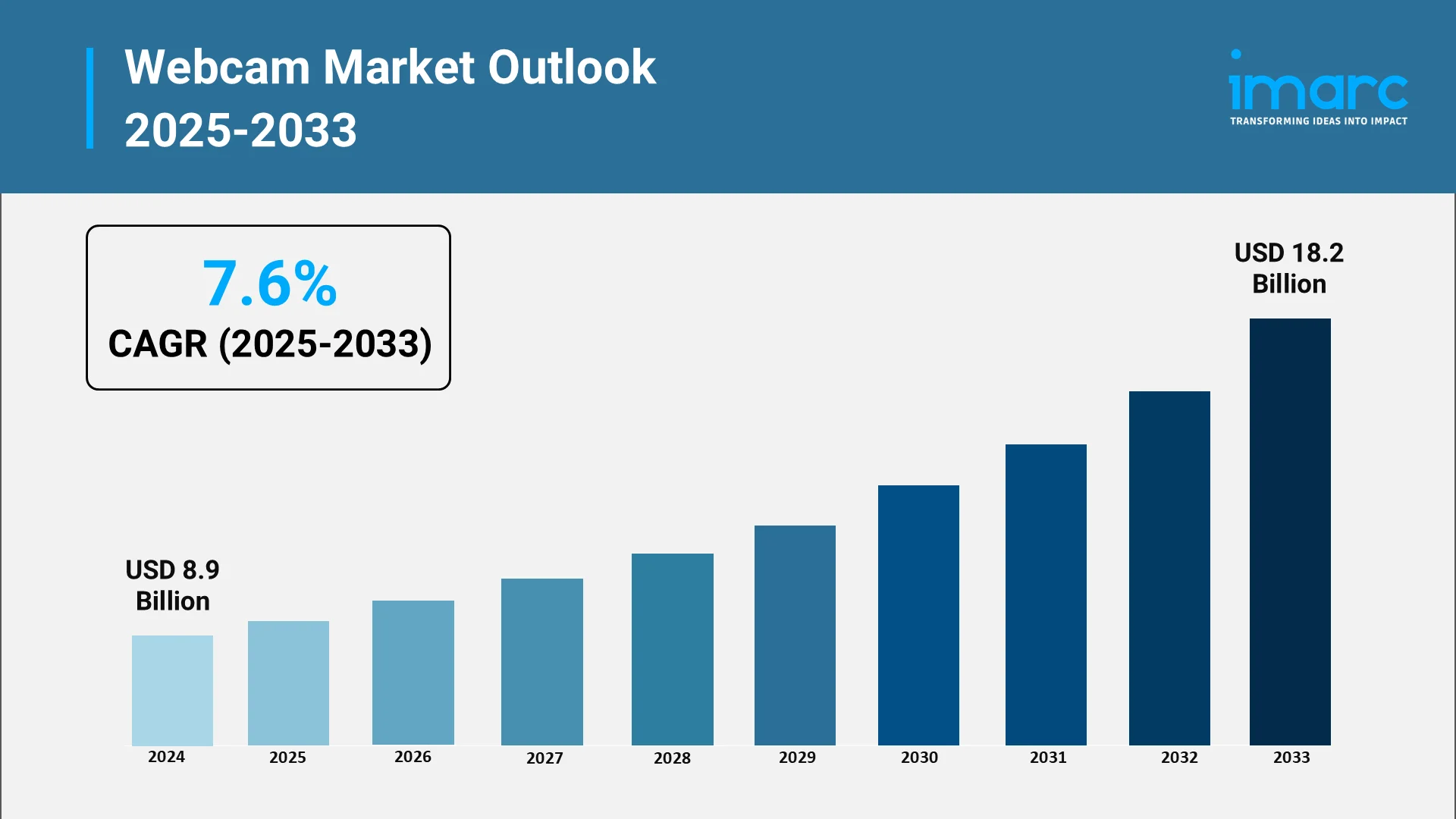

The webcams market is experiencing unprecedented transformation as digital communication becomes the cornerstone of modern business, education, and healthcare. Global webcam industry dynamics are being reshaped by technological innovation and evolving workplace models. The global webcam market size reached USD 8.9 Billion in 2024.

The surge in webcam demand reflects fundamental shifts in how organizations communicate and collaborate in an increasingly interconnected world. From corporate boardrooms to telehealth consultations and content creation studios, webcams have become indispensable tools enabling seamless visual connectivity. This analysis examines the market forces, regulatory frameworks, and strategic opportunities shaping the global webcams industry.

Explore in-depth findings for this market, Request Sample

The Role, Impact, and Benefits of Webcams in the Digital Communication Industry:

Webcams have evolved from simple video capture devices to sophisticated technological solutions powering the digital economy. Modern webcams integrate advanced image sensors and high-definition lenses, supporting resolutions from 1080p to ultra-high-definition 4K video, enabling crystal-clear visual transmission across diverse applications.

The digital communication industry has witnessed transformative benefits from webcam adoption. Organizations leveraging video conferencing technology report employees saving an average of 40 minutes daily in commute time, with remote and hybrid workers demonstrating productivity levels equal to or exceeding office-based counterparts. Video collaboration through webcams supports virtual meetings, online education, telehealth consultations, security surveillance, and live streaming. Educational institutions report retention rates reaching 60%, substantially higher than traditional classrooms.

Webcams offer superior portability and affordability compared to traditional video cameras. Organizations transitioning to digital collaboration save 50-70% on training and operational costs. The plug-and-play functionality of modern USB webcams enables rapid deployment across enterprise environments.

Key Growth Drivers in the Global Webcams Market:

The global webcams market is propelled by interconnected growth drivers reshaping workplace dynamics. Hybrid work models stand as the primary catalyst, with 28.2% of full-time employees operating under flexible arrangements in 2024. Research shows 60% of remote-capable employees prefer hybrid arrangements, creating sustained demand for professional video communication equipment. The remote work paradigm has stabilized at levels 2-5 times higher than pre-pandemic baselines.

Online education expansion accelerates market growth. The global e-learning market reached USD 342.4 Billion in 2024, projecting growth to USD 682.3 Billion by 2033. Over 73.8 million learners engaged with online platforms in 2024, a 900% increase since 2000. With 75% of undergraduates enrolling in at least one online course, webcams are essential infrastructure for virtual education.

The telehealth revolution drives substantial demand. Global telemedicine valuations reached USD 111.4 Billion in 2025, projecting expansion to USD 602.1 Billion by 2034 at a CAGR of 20.62%. Healthcare providers increasingly adopt virtual platforms, with 79% of U.S. hospitals implementing live telehealth capabilities. Patient satisfaction remains high, with majority expressing preference for telemedicine services.

Security and surveillance applications generate market momentum as organizations prioritize safety. Major retailers like Walmart committed substantial resources in 2024 to upgrading surveillance infrastructure with AI-enabled cameras. The commercial segment commands the largest market share across video surveillance applications.

Content creation and live streaming expand rapidly. The online entertainment segment's 16.38% projected growth rate from 2026 to 2034 reflects surging demand from gamers, influencers, and broadcasters requiring broadcast-quality video production capabilities.

Regulatory Framework and Policy Landscape in the Webcams Industry:

The webcams industry operates within an increasingly complex regulatory framework addressing privacy protection and data security. The Electronic Communications Privacy Act (ECPA) establishes foundational privacy protections, while the Federal Communications Commission (FCC) mandates technical compliance certifications for wireless webcams.

Comprehensive state privacy laws have proliferated dramatically, with 14 states enacting data protection legislation by 2024. California's Consumer Privacy Rights Act (CPRA) and similar statutes impose stringent requirements on businesses collecting personal information through video systems, mandating transparent privacy notices and data minimization practices.

Biometric data regulations present particular significance for webcam applications with facial recognition capabilities. The National Defense Authorization Act (NDAA) Section 889 addresses national security by prohibiting federal agencies from utilizing surveillance technology from designated foreign manufacturers, creating preference for NDAA-compliant equipment. The Federal Trade Commission (FTC) maintains active enforcement regarding data security, while state regulations like the Texas Data Security Act mandate AES-256 encryption for cloud-stored camera footage.

Government Support / Initiatives for the Webcams Market:

Government agencies worldwide have implemented strategic initiatives supporting digital communication infrastructure development. The Health Resources and Services Administration (HRSA) expanded telehealth funding programs, with healthcare facilities receiving federal support for technology infrastructure upgrades directly supporting webcam procurement. The extension of Medicare telehealth flexibilities through September 30, 2025, sustains policies encouraging video-enabled healthcare services.

Educational technology initiatives provide significant support. K-12 schools accessed an average of over 2,500 edtech tools per district in 2023, compared to 895 tools in 2018-2019, necessitating investment in video communication hardware. Smart city and public safety programs drive webcam adoption for surveillance, with urban security upgrades receiving over USD 1.2 billion in funding during 2024.

International governmental bodies advance digital communication policies. The World Health Organization's Global Digital Health Strategy 2020-2025 promotes telehealth accessibility, while India's Ayushman Bharat Digital Mission (ABDM) issued over 800 million health IDs by August 2025, establishing digital infrastructure requiring video consultation capabilities.

Top Webcams Manufacturing Companies Worldwide:

The global webcams market features intense competition among technology leaders. Logitech International S.A. maintains market leadership through comprehensive product portfolios. In March 2024, Logitech unveiled the MX Brio, featuring Ultra HD 4K resolution, 70% larger pixels than previous models, and AI-enhanced image quality delivering 2x better face visibility in challenging lighting. The innovative Show Mode enables users to tilt the camera 90 degrees for document presentation. In January 2025, Logitech announced the Rally Camera Streamline Kit, a USD 2,199 PTZ solution for hybrid learning environments.

Cisco Systems, Inc. delivers comprehensive video conferencing solutions. Cisco unveiled the Room Bar BYOD at Cisco Live Amsterdam in February 2025, enabling collaboration through USB-C connectivity and AI-powered capabilities including voice commands, facial recognition, and real-time transcription. Microsoft Corporation maintains strong presence through Microsoft Teams integration, while Razer Inc. targets gaming and content creation with 4K video capture capabilities. Sony Corporation, Canon Inc., and Lenovo Group Limited leverage imaging expertise for premium market segments.

Opportunities and Challenges in the Global Webcams Market:

The webcams market presents substantial growth opportunities driven by technological innovation. Artificial intelligence integration represents a transformative opportunity, with AI-powered features including automatic framing, noise cancellation, and facial recognition enhancing experiences.

Wireless webcam adoption constitutes another significant opportunity, with consumers preferring cable-free setups. Advancements in Wi-Fi 6 and Bluetooth connectivity enable seamless integration across platforms. The expansion of hybrid work models creates sustained enterprise demand, with organizations requiring multiple webcams per employee for home offices and corporate workspaces. The Asia-Pacific region, particularly China and India, demonstrates rapid adoption, collectively accounting for majority of regional demand.

However, challenges require strategic navigation. Several security as well as privacy concerns remain utmost important, compelling robust security protocols including hardware privacy shutters and encrypted transmission. The 500+ healthcare data breaches affecting 82.6 million individuals in 2023 underscore security importance. Technological commoditization presents competitive pressure as basic functionality becomes standardized. Manufacturers must differentiate through advanced features and superior quality. Regulatory compliance complexity across 14 U.S. states and international frameworks including GDPR requires sophisticated compliance programs.

Conclusion:

The global webcams market stands at a pivotal juncture where technological innovation, regulatory evolution, and workplace transformation converge to create unprecedented opportunities. Market projections indicate market revenue to grow at 7.6% during 2025-2033, reaching USD 18.2 Billion by 2033, reflecting robust demand drivers spanning remote work, online education, telehealth, and security applications.

Strategic success requires manufacturers to prioritize innovation, security, and user-centric design while navigating regulatory landscapes and competition. The future trajectory appears exceptionally promising, supported by irreversible shifts toward hybrid work models, continued digitalization of education and healthcare, and expanding applications in artificial intelligence ecosystems. Webcams will remain essential infrastructure enabling human connection and productivity in our interconnected digital world.

IMARC Group’s Unmatched Expertise and Core Services:

IMARC Group empowers technology leaders and market participants with comprehensive intelligence needed to navigate the rapidly evolving webcams industry. Our specialized services deliver actionable insights supporting strategic decision-making across this dynamic sector.

- Data-Driven Market Research: Access in-depth analysis of global webcams market size, growth trajectories, competitive landscapes, and emerging technology trends including 4K video, AI integration, wireless connectivity, and hybrid work solutions through comprehensive market research reports.

- Strategic Growth Forecasting: Anticipate market developments across video collaboration, security surveillance, online education, telehealth applications, and content creation segments with detailed regional analysis covering North America, Europe, Asia-Pacific, and emerging markets.

- Competitive Benchmarking: Evaluate competitive positioning of leading manufacturers including Logitech, Microsoft, Cisco, Razer, Sony, and emerging innovators through product pipeline analysis, pricing strategies, and technological differentiation assessments.

- Policy and Infrastructure Advisory: Stay ahead of evolving regulatory frameworks including comprehensive state privacy laws, NDAA compliance requirements, cybersecurity mandates, and international data protection regulations affecting webcam deployment and usage.

- Custom Reports and Consulting: Obtain tailored insights aligned with your organizational objectives—whether launching new product lines, evaluating strategic partnerships, assessing market entry opportunities, or optimizing supply chain strategies in the webcams and digital communication sectors.

At IMARC Group, our mission is to equip business leaders with clarity and intelligence required to capitalize on opportunities in the transformative webcams market. Partner with us to drive strategic growth—because clear vision creates competitive advantage.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)