Aluminum Sheet, Foil and Cans Production: Detailed Cost Model Analysis

_11zon.webp)

What is Aluminum Sheet, Foil and Cans?

Aluminum sheets, cans, and foils are among the most common types of processed aluminum, serving industries from packaging and construction to transport and consumer products. Aluminum sheets are flat-rolled material manufactured in a range of thicknesses and grades, prized for light weight, corrosion resistance, and ability to be recycled, ideal for use in car body panels, building cladding, roofs, and kitchen appliances.

Key Applications Across Industries:

Aluminum foil, in contrast, is a ductile, thin product mostly utilized in flexible packaging, food storage, pharmaceuticals, and new uses such as lithium-ion battery foils for electric cars. Aluminum cans are amongst the most commonly used packaging for drinks, which are renowned for their strength, mobility, and 100% recyclability without loss of quality. Combined, sheets, foils, and cans demonstrate aluminium's versatility, facilitating innovation in both industrial and consumer products, while aiding global sustainability objectives through circular economy strategies. The industry is expanding as industries look for lightweight, hard-wearing, and sustainable materials.

What the Expert Says: Market Overview & Growth Drivers

The global aluminum sheet, foil and cans market reached 1.7 Million Tons in 2024. By 2033, IMARC Group expects the market to reach 2.5 Million Tons, at a projected CAGR of 3.99% during 2025-2033. The market of aluminum sheets, foils, and cans is led by a combination of industrial needs, sustainability requirements, and technology development.

Increasing beverage consumption, particularly of carbonated drinks, energy drinks, and craft beer, is driving demand for aluminum cans because of their portability and recyclability. Concurrently, increased consumer demand for sustainable packaging and government measures restricting single-use plastics are accelerating adoption of aluminum foil and cans. The automotive and aerospace industries are increasingly tapping aluminum sheets for lightweighting to enhance fuel efficiency as well as lower emissions, while the construction industry employs sheets for green buildings and new infrastructure. Another important upcoming driver is the trend towards electrification, where foils play a key role in lithium-ion batteries for electric vehicles, which is a high-growth niche. Moreover, aluminium's virtually limitless recyclability, with substantial energy savings over primary production, is consistent with worldwide targets for carbon reduction, further propelling demand in end-use markets.

Case Study on Cost Model of Aluminum Sheet, Foil and Cans Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a large-scale aluminum sheet, foil and cans manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed aluminum sheet, foil and cans manufacturing plant in Oman. This plant is designed to produce 50 tons of aluminum sheet, 6.7 tons of foil, and 3.4 aluminum cans per day.

Manufacturing Process: Fabrication of aluminium sheets commences through high-grade aluminium ingots from smelters, which are analyzed for purity and composition. The ingots are initially pre-heated in furnaces to about 500–600°C to enhance malleability and build up for rolling. This is followed by the hot rolling process, where ingots are rolled through a series of rolling mills to decrease thickness and stretch out into sheet dimensions while improving grain structure. For stress relief and increased ductility, the sheets get annealed prior to cold rolling, during which the sheets get further reduced to desired dimensions, strength, and smooth surface finish at room temperature. The rolled sheets are subsequently sheared and cut to exact sizes according to the requirements of customers while maintaining accuracy and minimizing wastage. Surface treatments like cleaning, anodizing, or coating are also performed to enhance corrosion resistance and aesthetics. Then there is strenuous inspection and quality control to ensure that industry standards are met before the sheets are packaged in protective materials and shipped for utilization by industries like automotive, construction, and packaging.

The production of aluminium foil starts with aluminium coils that are made from rolled sheets, which are cleaned and inspected thoroughly to eliminate impurities and oil residue for uniform quality. The coils are initially hot rolled, which reduces thickness and improves the microstructure for enhanced workability. Cold rolling at room temperature comes next, decreasing thickness further while increasing strength, surface finish, and dimensional precision. To regain ductility and avoid cracking in extreme thinning, the material is annealed in precise furnaces. The annealed aluminum is then rolled through precision foil rolling mills, usually in double-roll runs, to get ultra-thin gauges between 0.01 mm and 0.02 mm. Following rolling, the foil is slit into narrower rolls and rewound to customer-specific widths with precise alignment and tension. Stringent inspection guarantees consistent thickness, pinhole-free surfaces, and international standard compliance. Lastly, the processed foil rolls are packaged securely with protective layers, core protection, and labelling prior to shipment to food packaging, pharmaceutical, and household industries.

The production of aluminium cans starts off with high-purity sheets of aluminium that are rolled to the exact thickness required for making cans. Big round blanks, about 5.5 inches in radius, are stamped out of these sheets, the scrap metal being recycled at once to limit waste. Blanks are then drawn shallow cups on a cupper press, followed by a second drawing and ironing operation which elongates them into high, thin-walled cylinders while giving them a domed bottom for greater strength and resistance to pressure. To secure uniformity, the tops are cropped to allow for equal can height to seal and stack. The cans are then subjected to a comprehensive multi-stage cleaning and surface preparation, stripping away lubricants and coating to avoid corrosion. Protective exterior coatings and high-speed printing come next, providing cans with branded appearance and toughness. Necking and flanging are the subsequent process, which constricts the opening of the can and creates a flange for attaching a lid. Lids, produced separately from magnesium-enhanced aluminium, are stamped, scored, and fitted with pull tabs. Both cans and lids undergo leak detection and quality testing before being packed and shipped separately to filling facilities, where they will be assembled and filled with beverages.

_11zon.webp)

Mass Balance and Raw Material Required: The primary raw materials used in the aluminum sheet is aluminum ingot. For a plant producing 1 ton of aluminum sheet, 1.02 ton of aluminum ingot is required.

_11zon.webp)

The primary raw materials used in the aluminum foil is aluminum sheet. For a plant producing 1 ton of aluminum foil, 1.02 ton of aluminum sheet is required.

_11zon.webp)

The primary raw materials used in the aluminum cans is aluminum sheet. For a plant producing 1 ton of aluminum cans, 1.02 ton of aluminum sheet is required.

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

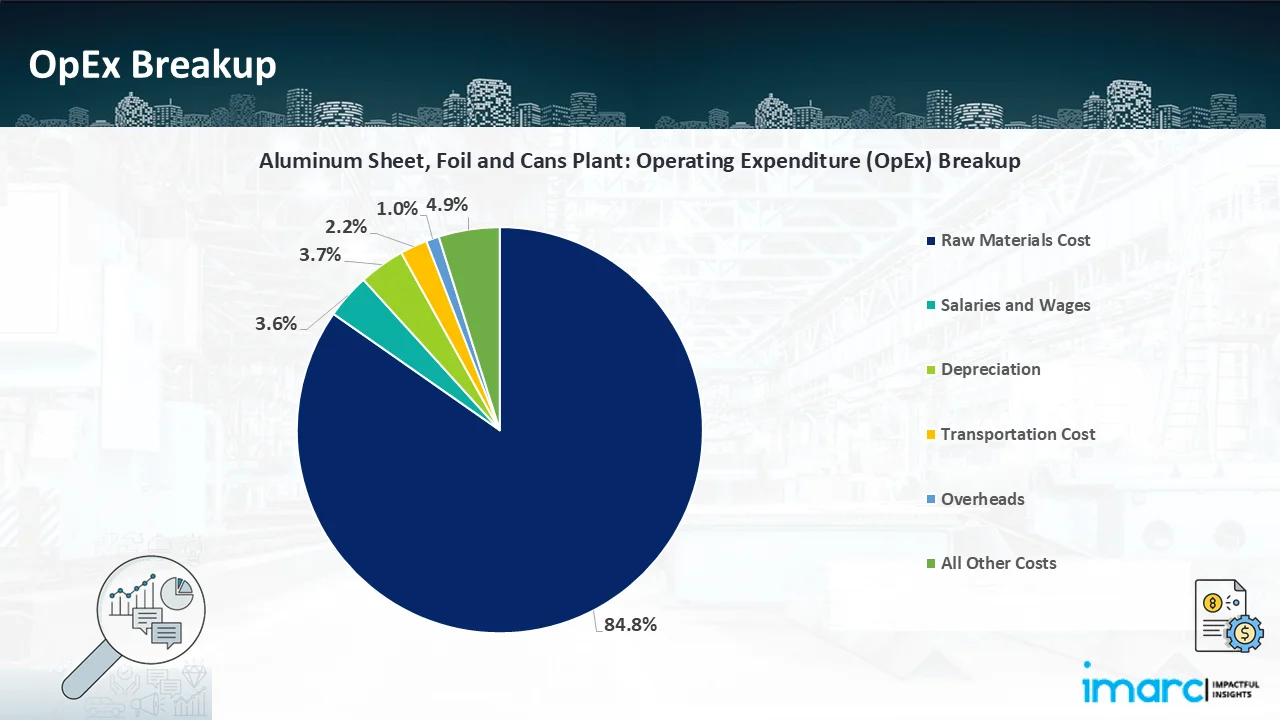

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

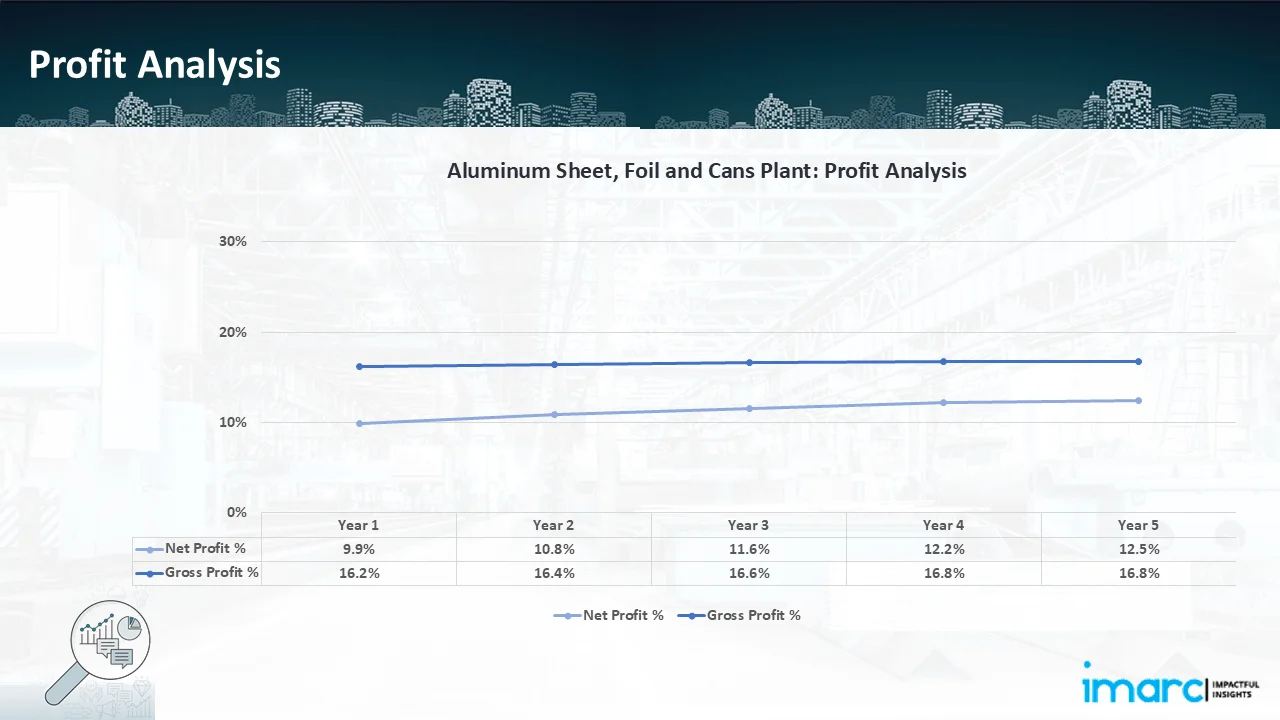

- Profitability Analysis Year on Year Basis: The proposed aluminum sheet, foil and cans plant, with a capacity of 50 tons of aluminum sheet, 6.7 tons of foil, and 3.4 aluminum cans per day, achieved an impressive revenue of US$ 52.3 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins improve from 16.2% to 16.8% by year 5, and net profit rises from 9.9% to 12.5%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the aluminum sheet, foil and cans manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of producing 50 tons of aluminum sheet, 6.7 tons of foil, and 3.4 aluminum cans per day, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In March 2025, Imports of aluminium foil from China are now subject to a provisional anti-dumping tax levied by the Indian Finance Ministry, which has increased the levy from $619 to US$ 873 per metric tonne (MT). According to a gazette notice, the charge would be imposed on aluminium foil up to 80 microns, with non-capacitor applications exempting foil less than 5.5 μ.

- In March 2025, the Swiss major 3A Composites, whose flagship brand is ALUCOBOND®, launched "ALUCODUAL®," an innovative engineered solid sheet that enhances its premier range of technologically advanced, new-age cladding solutions. 3A Composites is a global innovator and a leading manufacturer of high-quality aluminium composite materials.

- In March 2024, Shyam Metalics & Energy announced its plan to expand into a greenfield plant specialising in flat-rolled aluminium products in March 2024. The project is expected to receive an investment of Rs 450 crore from the Group. To close the gap between supply and demand, it will also boost the production of aluminium flat rolled goods, enabling the Shyam Metalics group to become self-sufficient in its raw materials for the aluminium foil industry. The facility would be put up in Odisha.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104