Future of the Japan Robo Taxi Industry: Trends and Outlook to 2033

Introduction to Japan’s Robo Taxi Industry:

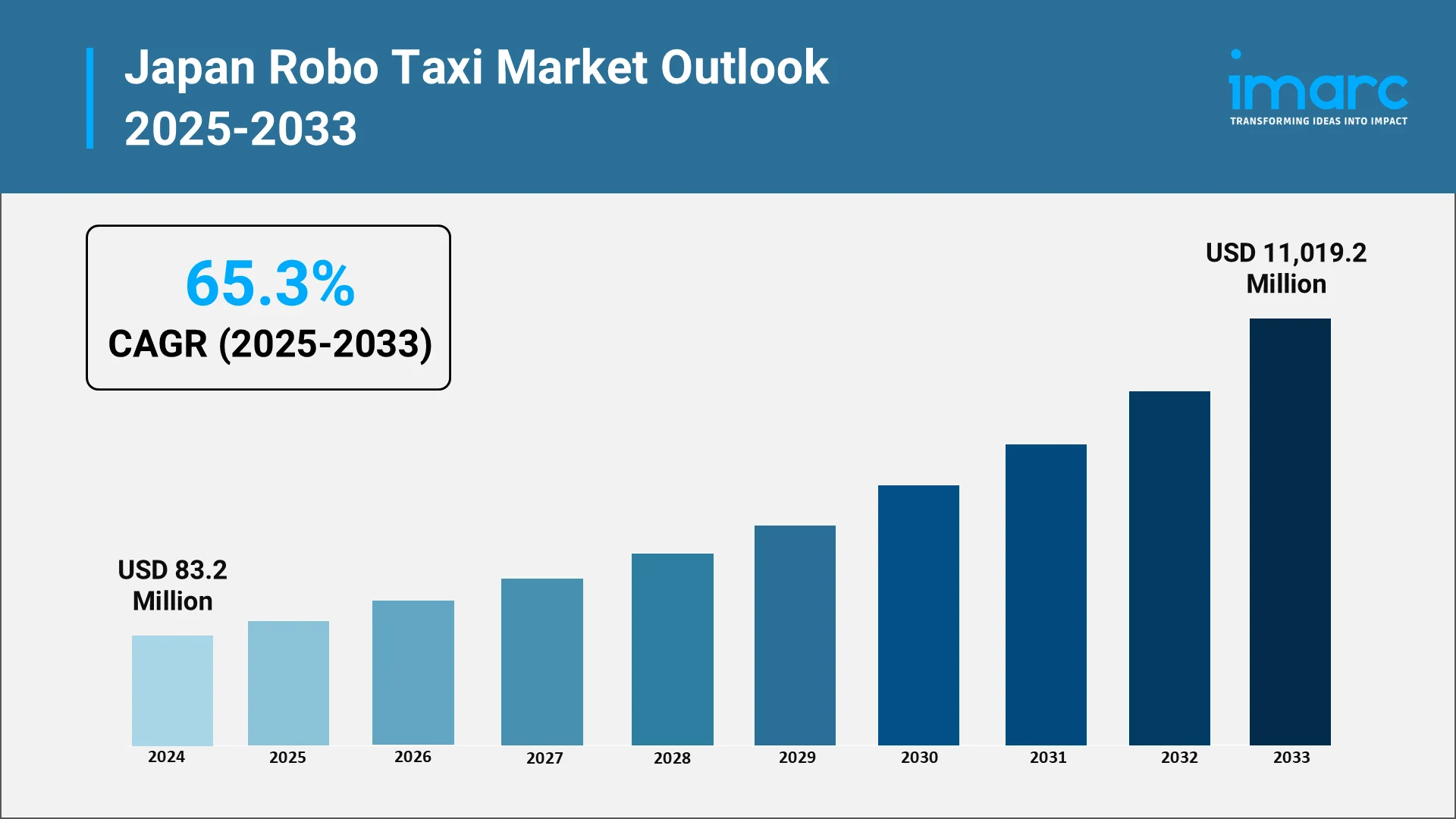

Japan’s transportation landscape is on the brink of a major shift, with robo taxis, autonomous, driverless vehicles designed for passenger and goods transport, emerging as a practical mobility solution. The Japan robo taxi market reached USD 83.2 Million in 2024. This remarkable expansion reflects Japan’s broader move toward smart mobility, sustainability, and automation.

The convergence of artificial intelligence, sensor technology, and electric propulsion is reshaping how people and goods move across urban centers like Tokyo, Osaka, and Nagoya. Rapid urbanization, traffic congestion, and demographic challenges, such as an aging population, are amplifying the demand for autonomous transport. As a result, robo taxis are poised to play a pivotal role in Japan’s future mobility ecosystem, reducing human-error-related accidents, improving accessibility, and supporting carbon-neutral transportation goals.

Market Size and Growth Potential by 2033:

The market is projected to soar to USD 11,019.2 Million by 2033, registering a CAGR of 65.3% during 2025–2033. The market’s projected jump from USD 83.2 Million more than USD 11.0 Billion in less than a decade underscores the depth of investment and regulatory alignment Japan has achieved in autonomous transport. This growth trajectory is supported by pilot programs launched across major regions, notably in the Kanto and Kansai/Kinki areas, where population density and infrastructure readiness are highest.

Passenger applications dominate current deployments, but the goods-transport segment is gaining momentum as logistics companies explore last-mile delivery automation. In 2024, Japan’s Ministry of Land, Infrastructure, Transport and Tourism (MLIT) approved several commercial pilot projects allowing Level 4 autonomous vehicles to operate on designated public routes. The Japanese Ministry of Economy, Trade and Industry selected TIER IV in 2024 to lead mobility digital transformation projects. The government aims to promote Level 4 autonomous transport services across more than 100 municipalities by 2027. These approvals signaled the transition from controlled testing to scalable deployment, establishing Japan as one of the first Asian markets ready for regulated robo taxi services.

Explore in-depth findings for this market, Request Sample

Technological Innovations Driving the Market:

Robo taxis rely on a blend of technologies, LiDAR, radar, high-resolution cameras, and AI-driven navigation systems, that collectively enable precise real-time decision-making. Recent advancements in Japan’s automotive and robotics industries have accelerated their adoption.

Japanese automakers such as Toyota, Nissan, and Honda are leading initiatives to integrate Level 4 and Level 5 autonomy into electric-vehicle platforms. Toyota’s Woven City project in Shizuoka Prefecture serves as a living laboratory for connected autonomous mobility, including electric robo shuttles and station-based fleets. Meanwhile, advances in solid-state battery technology are improving vehicle range and reducing energy costs—key prerequisites for fleet viability.

The integration of AI-based traffic management and edge computing also stands out. These systems allow robo taxis to process high volumes of sensor data locally, improving reaction time and reducing dependence on centralized networks. The result is a more resilient and responsive autonomous-mobility ecosystem that aligns with Japan’s precision-engineering ethos.

Some of the most recent developments in the market include:

- In December 2024, Waymo announced plans to begin testing its autonomous vehicle technology in Tokyo in early 2025, marking the first time its robotaxis will operate on public roads outside the United States. The initiative, launched under Waymo’s “road trips” development program, will introduce a small fleet of self-driving Jaguar I-Pace vehicles operated in partnership with GO and Nihon Kotsu, initially focusing on key Tokyo districts such as Minato, Shinjuku, and Shibuya. This expansion highlights Japan’s growing role in the global robotaxi market, aligning with the country’s ambition to integrate advanced autonomous mobility solutions into dense urban environments.

- In May 2024, Japan-based autonomous driving pioneer TIER IV announced plans to launch its robotaxi service in Tokyo by November 2024, beginning with proof-of-concept operations in the Tokyo Bay Odaiba area. The initiative will initially focus on underserved routes and aims to expand coverage to major Tokyo districts by 2025 and the entire metropolitan area by 2027. TIER IV’s robotaxi, based on its Autoware open-source autonomous driving platform, has already demonstrated safety and reliability in heavy-traffic testing, marking a significant step toward Japan’s large-scale commercial deployment of self-driving taxis.

- In April 2024, Honda, in partnership with General Motors (GM) and Cruise, confirmed plans to launch a fully autonomous taxi service in central Tokyo by early 2026 using the Cruise Origin, a Level 4 self-driving vehicle with no steering wheel or pedals. The project builds on years of technology verification in Tochigi Prefecture, adapting the system for Japan’s traffic environment and regulatory standards. This milestone positions Honda among key players advancing Japan’s robo taxi market, aligning with national efforts to commercialize autonomous mobility and enhance urban transport efficiency.

- In February 2024, Nissan Motor Co. announced that it will commercialize autonomous-drive mobility services in Japan by fiscal year 2027, building on progress made through its long-running Easy Ride autonomous vehicle trials. The initiative uses a Nissan Leaf–based test fleet and aims to integrate Level 4 self-driving technology into public transport systems, focusing on dense urban routes. This plan reinforces Japan’s position as a frontrunner in the robo taxi market, with Nissan expanding its role in deploying safe, scalable, and sustainable autonomous mobility solutions nationwide.

Government Policies and Regulatory Support:

Japan's regulatory framework for autonomous vehicles has evolved through deliberate legislative amendments designed to balance innovation encouragement with public safety mandates. Regulatory support remains one of Japan’s strongest enablers for autonomous mobility. The government’s Strategic Innovation Promotion Program (SIP) and Society 5.0 framework explicitly prioritize self-driving technologies as part of national digital transformation. In 2023, the Road Traffic Act was amended to permit Level 4 autonomous vehicles on public roads under defined operational conditions, providing legal clarity for robo-taxi operators. The Ministry of Economy, Trade and Industry (METI) has championed several programs including a ¥700 million (approx. USD 4.5 Million) grant initiative in 2024 to foster digital transformation in mobility by supporting robotaxi and autonomous truck projects.

Additionally, the MLIT and National Police Agency introduced detailed safety-assessment standards covering remote monitoring, cybersecurity protocols, and liability assignment for autonomous-driving incidents. The government’s National Comprehensive Digital Lifeline Development Plan (June 2024) aims to accelerate autonomous driving implementation, including establishing “autonomous driving service support roads” equipped with local 5G communications to enhance safety and data sharing. These initiatives aim to balance innovation with public safety and trust.

Beyond regulation, Japan’s commitment to decarbonization under the Green Growth Strategy 2050 supports the proliferation of electric and fuel-cell robo taxis. With the government offering incentives for EV adoption and hydrogen infrastructure, the regulatory environment strongly complements the sector’s technological ambitions.

Key Challenges and Barriers to Adoption:

Despite favorable regulatory conditions and technological maturation, Japan's robo taxi industry confronts multifaceted challenges that moderate deployment velocity and constrain near-term scaling potential.

- Infrastructure readiness remains uneven across regions. While metropolitan areas have robust 5G and smart-traffic infrastructure, rural prefectures lack the connectivity required for autonomous-vehicle operations. Building uniform digital infrastructure will be crucial for nationwide rollout.

- Public acceptance and safety perception also present challenges. Surveys conducted in 2024 showed that only about 38% of Japanese consumers expressed comfort with fully autonomous vehicles. Establishing consumer trust will depend on consistent safety records from pilot operations and transparent regulatory oversight.

- High deployment costs—stemming from lidar sensors, AI hardware, and cloud-computing systems—add another layer of complexity. The capital intensity limits small and mid-sized fleet operators from scaling quickly. Moreover, cybersecurity threats and data-privacy concerns around vehicle-to-infrastructure communication highlight the need for rigorous standards and resilient digital architecture.

- Lastly, workforce displacement in traditional taxi sectors remains a sensitive issue, necessitating retraining and transition programs as automation reshapes employment dynamics.

Future Opportunities and Outlook:

Japan’s robo taxi industry sits at the intersection of automation, electrification, and shared mobility—three defining themes of the next decade. The convergence of these forces presents diverse opportunities:

- Fleet Electrification and Sustainability: With Japan targeting carbon neutrality by 2050, the adoption of electric and hydrogen fuel-cell robo taxis will accelerate. Toyota is actively promoting hydrogen fuel-cell taxis in Tokyo, targeting approximately 600 fuel cell taxis by fiscal 2030, with 200 units scheduled for introduction by 2025. This is part of the "TOKYO H2" project led by the Tokyo Metropolitan Government, aiming to establish Tokyo as a global hydrogen leader and boost commercial hydrogen vehicle adoption.

- Urban Mobility-as-a-Service (MaaS): Integration with public-transport networks will enable seamless multi-modal journeys, positioning robo-taxis as connective tissue within Japan's extensive transit infrastructure. Station-based robo-taxi services in the Chubu and Kyushu-Okinawa regions are being designed to complement rail and bus systems rather than compete with them, addressing first-mile and last-mile gaps that conventional transit struggles to serve economically.

- Autonomous Goods Transport: The logistics sector is expected to become a major adopter, using autonomous vans and shuttles to address driver shortages and delivery-cost pressures that threaten service reliability across Japan's e-commerce ecosystem. Warehouse-to-port drayage, urban parcel delivery, and intercity freight corridors represent immediate deployment opportunities where predictable routes and controlled environments simplify autonomous system requirements.

- AI-Enhanced Passenger Experience: Personalized route optimization, dynamic pricing, and in-vehicle infotainment powered by machine learning will distinguish next-generation robo-taxi services from conventional ride-hailing offerings. These systems analyze historical traffic patterns, real-time congestion data, and individual passenger preferences to deliver customized journeys that balance speed, comfort, and cost according to user priorities.

- Cross-Industry Partnerships: Collaborations among automakers, telecom providers, and software firms, will define Japan’s leadership in autonomous-mobility ecosystems. For example, in March 2025, SoftBank Corp. announced the development of a “remote autonomous driving support system” powered by its AITRAS edge AI server, designed to enable safe operation of Level 4 autonomous vehicles during sensor malfunctions or unexpected conditions. The system was tested in collaboration with Keio University’s Shonan Fujisawa Campus, where trials demonstrated successful real-time obstacle recognition and safe stopping performance through 5G-enabled AI processing.

Looking ahead, the market’s 65.3% CAGR through 2033 positions Japan as a global front-runner in regulated, high-density autonomous transport. The transition from pilot to commercial scale will depend on how effectively stakeholders align technological readiness with public trust and sustainable operations. If successful, Japan’s robo-taxi model could become an exportable template for other nations seeking to combine safety, efficiency, and environmental stewardship in urban transport.

Why Choose IMARC for Market Analysis:

IMARC Group’s analysis of the Japan robo taxi industry is grounded in data-driven methodology and sector expertise that help businesses navigate emerging technologies with clarity and precision.

- Data Accuracy and Timely Forecasts: Reliable projections—such as the USD 11.0 billion market forecast and 65.3 % CAGR—reflect IMARC’s consistent validation against industry developments and regulatory updates.

- Holistic Coverage Across Segments: Reports include detailed insights by application, autonomy level, propulsion type, and region, enabling informed decisions for both investors and policymakers.

- Cross-Industry Context: Analyses integrate robotics, AI, electric-vehicle, and transport-infrastructure trends, offering a comprehensive view of how each domain shapes the robo-taxi ecosystem.

- Rigorous Analytical Framework: The firm’s research methodology emphasizes quantitative rigor, transparent assumptions, and validation through primary sources and industry interviews.

- Local Insight with Global Perspective: IMARC’s understanding of Japan’s industrial ecosystem, combined with global benchmarking, ensures that analysis remains both regionally specific and internationally relevant.

Through these strengths, IMARC provides dependable intelligence for organizations evaluating Japan’s autonomous-mobility transformation—supporting evidence-based strategies in one of the world’s fastest-growing transport frontiers.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)