Future of the Japan Electric Truck Industry: Growth Trends and Outlook to 2033

Introduction to Japan's Electric Truck Market:

The Japan electric truck market is experiencing transformative growth as the nation accelerates toward sustainable transportation and carbon neutrality. As a leading automotive manufacturing hub, Japan is witnessing unprecedented momentum in commercial vehicle electrification, driven by stringent environmental regulations, technological innovation, and strategic government support. The electric truck industry represents a critical component of Japan's commitment to achieving 100% electrified vehicle sales by 2035 and carbon neutrality by 2050.

Electric trucks leverage advanced battery packs, electric motors, and regenerative braking systems to deliver zero local emissions, reduced operational costs, and enhanced energy efficiency. Major Japanese manufacturers including Mitsubishi Fuso, Toyota, Hino Motors, and Isuzu are pioneering innovations that position Japan as a global leader in electric commercial vehicle development.

Market Size and Growth Forecast to 2033:

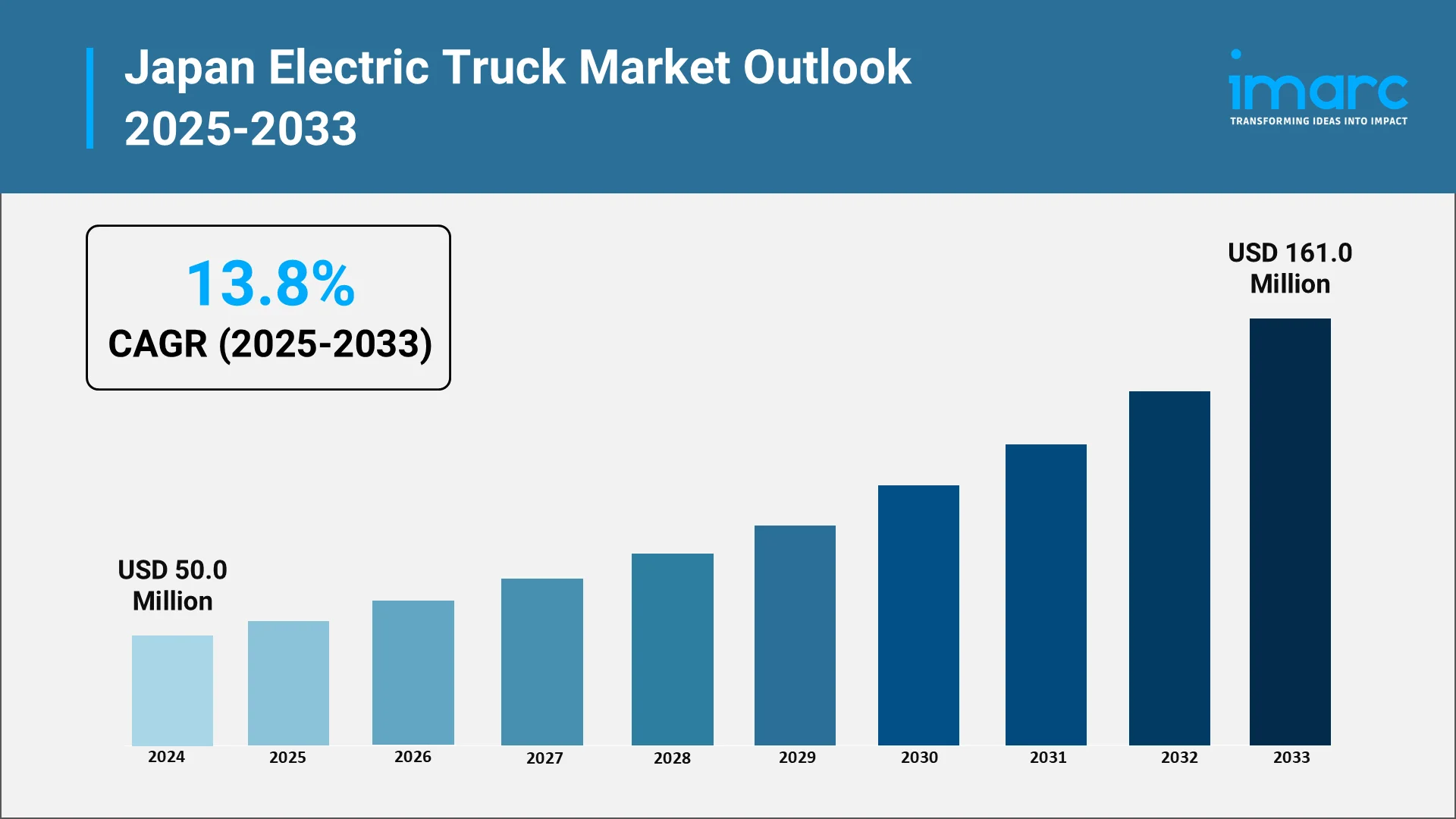

The financial outlook for Japan's electric truck sector demonstrates exceptional expansion potential. Market research indicates that Japan electric truck market size reached USD 50.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 161.0 Million by 2033, exhibiting a growth rate (CAGR) of 13.8% during 2025-2033.

Light-duty electric trucks are a growing segment in urban delivery and last-mile logistics, driven by compelling economic and operational benefits. While pioneers like the Mitsubishi Fuso eCanter have been influential, the market is highly competitive, with a wide array of manufacturers like BYD, Rivian, and Daimler leading deployments.

Explore in-depth findings for this market, Request Sample

Key Trends Driving Adoption of Electric Trucks:

Several transformative trends are accelerating electric truck adoption across Japan's commercial vehicle sector.

- Battery Technology Advancements: Innovations in battery technology represent the most critical enabler of electric truck viability. Modern electric trucks feature advanced lithium-ion battery systems with improved energy density and thermal management. The next generation eCanter from Mitsubishi Fuso offers multiple battery configurations while maintaining zero local emissions. Regenerative braking technology captures energy during deceleration, improving efficiency by 10-15% in urban conditions.

- Battery Swapping Innovation: In 2025, Mitsubishi Fuso Truck and Bus Corporation, Mitsubishi Motors Corporation, Ample Inc., and Yamato Transport announced a major initiative deploying over 150 battery-swappable commercial electric automobiles as well as 14 modular battery swapping stations in Tokyo. This multi-year pilot program targets battery exchange times of just five minutes through fully automated processes, minimizing vehicle downtime and eliminating peak demand charges from fast charging.

- Fleet Electrification Economics: Electric trucks deliver substantial savings through reduced fuel expenses, lower maintenance requirements, and extended component longevity. Electric drivetrains have fewer moving parts than internal combustion engines, reducing maintenance intervals and repair costs.

- Strategic Manufacturer Collaborations: In September 2025, Isuzu Motors and Toyota Motor Corporation agreed to jointly develop next-generation fuel cell route buses for commercialization. The production for the same is scheduled to begin in fiscal year 2026. These collaborations pool technological expertise and share development costs, accelerating time-to-market for advanced vehicle platforms.

Government Policies and Infrastructure Support:

Japan's government has established comprehensive policy frameworks supporting electric vehicle adoption through regulatory mandates, financial incentives, and infrastructure investments.

- Regulatory Targets: The government's target to achieve 100% electrified vehicle sales for new passenger vehicles by 2035 creates ecosystem effects benefiting commercial vehicles. The policy framework aims for a 46% reduction in CO2 emissions by fiscal year 2030, with commercial vehicle electrification identified as a strategic priority for achieving carbon neutrality by 2050.

- Clean Energy Vehicle (CEV) Subsidies: The total budget for CEV subsidies in fiscal year 2024 reached millions of yen. These subsidies significantly reduce upfront cost barriers for commercial operators.

- Tax Incentives: Vehicles achieving 80% of Japan's energy-saving target receive a 50% vehicle weight tax reduction starting January 2024 but the requirements are set to become stricter in May 2025. The government plans to provide a 10-year tax incentive for large-scale production in strategic fields, including electric vehicles, with companies receiving up to significant corporate income tax reduction per fiscal year.

- Charging Infrastructure: The Ministry of Economy, Trade and Industry released "Guidelines for Promoting the Development of EV Charging Infrastructure" in October 2023. The Japan electric vehicle charging station market size was valued at USD 1,047.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 20,258.2 Billion by 2033, exhibiting a CAGR of 39.0% from 2025-2033.

Challenges Facing the Electric Truck Industry in Japan:

Despite favorable conditions, Japan's electric truck industry confronts several challenges that must be addressed for mass market adoption.

- Infrastructure Limitations: While expanding rapidly, Japan's charging infrastructure represents only a small percentage of the 2030 target. A 2025 study identified that the southwestern and northeastern Tokyo Metropolitan Areas face greater charging gaps, requiring targeted expansion. Fast-charging stations grow at only steady annually, and many commercial operators lack dedicated facilities for overnight charging.

- High Capital Costs: Electric trucks command significant price premiums compared to diesel equivalents, creating adoption barriers for cost-sensitive operators. The price differential is most pronounced in medium and heavy-duty segments where battery capacity requirements drive substantial cost increases.

- Range Constraints: Current battery-electric trucks typically offer operational ranges of 100-300 kilometers per charge, adequate for urban delivery but insufficient for long-haul freight operations. Cold weather reduces range by 20-30%, creating seasonal operational challenges.

- Supply Chain: Japan faces challenges securing adequate supplies of critical battery materials, particularly lithium, cobalt, and rare earth elements. Limited domestic mineral resources necessitate complex international supply chains vulnerable to geopolitical disruptions.

Future Opportunities and Market Outlook:

The Japan electric truck market presents exceptional opportunities across the 2025-2033 forecast period.

- Last-Mile Delivery: This segment represents the most economically compelling opportunity, with e-commerce growth, urban zero-emission zones, and favorable operational profiles creating ideal conditions. Major logistics providers including Yamato Transport are actively expanding electric truck fleets, providing sustained demand that supports manufacturing scale-up.

- Battery Swapping Expansion: The successful Tokyo battery swapping initiative launched in 2025 provides a model for broader deployment. If pilots demonstrate expected efficiency gains, infrastructure could expand to Osaka, Nagoya, and Fukuoka by 2027-2028, unlocking medium and heavy-duty applications.

- Fuel Cell Vehicles: The joint development program by Isuzu and Toyota for next-generation fuel cell buses, with production beginning in fiscal year 2026, exemplifies growing manufacturer commitment. As production costs decline and fueling networks expand, fuel cell trucks could capture significant market share in long-haul freight by the early 2030s.

- Autonomous Integration: Electric trucks provide ideal platforms for autonomous driving technology. Mitsubishi Fuso's eCanter SensorCollect demonstrates potential for SAE Level 2 automation to enhance operational efficiency, with the convergence of electrification and automation representing transformative opportunities by 2030-2033.

- Vehicle-to-Grid Integration: Electric truck batteries represent substantial distributed energy storage resources. V2G-enabled fleets could help stabilize grid operations while reducing electricity costs through demand response participation, transforming trucks into active grid infrastructure components.

- Global Competitiveness: Japanese manufacturers are positioning to compete globally, leveraging technological expertise and quality. Mitsubishi Fuso's eCanter has delivered vehicles across Japan, Europe, North America, Australia, and New Zealand, demonstrating international competitiveness as production scales.

Conclusion:

The Japan electric truck market stands at the threshold of transformative growth, supported by robust government policies, accelerating technological innovation, expanding infrastructure networks, and evolving market economics. The projected CAGR of 14.35-14.64% through 2033 reflects fundamental shifts in commercial vehicle paradigms, as electric trucks transition from niche applications to mainstream deployment.

Success requires coordinated action across stakeholders. Manufacturers must advance battery technology and reduce production costs. Government agencies must maintain supportive policies and accelerate infrastructure investments. Fleet operators must embrace total cost of ownership perspectives. Infrastructure providers must deploy comprehensive charging networks optimized for commercial requirements.

As Japan progresses toward its 2035 target for 100% electrified vehicle sales and 2050 carbon neutrality goals, the electric truck sector will play an indispensable role in decarbonizing transportation and demonstrating Japan's continued leadership in automotive innovation.

Partner With IMARC Group for Strategic Electric Truck Market Intelligence:

As Japan's commercial vehicle landscape undergoes unprecedented transformation, strategic decision-makers require authoritative market intelligence to capitalize on emerging opportunities while managing transition risks.

- Data-Driven Market Research: Deepen your understanding of electric truck adoption patterns, technology trajectories, and competitive dynamics through comprehensive analysis of market segmentation by vehicle type, propulsion technology, operational range capabilities, and end-use applications across all Japanese regions.

- Strategic Growth Forecasting: Anticipate market developments through predictive analytics examining battery system roadmaps, charging infrastructure expansion, hydrogen fueling networks, and autonomous driving integration timelines by synthesizing regulatory developments and manufacturer product pipelines.

- Competitive Benchmarking: Analyze strategic positioning of major players including Mitsubishi Fuso, Toyota, Hino Motors, Isuzu, and emerging competitors. Track product portfolios, technological capabilities, manufacturing capacity, distribution networks, and partnerships reshaping industry dynamics.

- Policy and Infrastructure Advisory: Stay ahead of regulatory changes, government incentive programs, and infrastructure initiatives affecting electric truck economics. Navigate subsidy programs, tax incentives, charging infrastructure guidelines, zero-emission zones, and renewable energy integration strategies.

- Custom Reports and Consulting: Access tailored research addressing your specific strategic requirements for market entry, investment opportunities, fleet electrification business cases, or long-term product roadmaps with actionable recommendations grounded in data-driven analysis.

At IMARC Group, we empower business leaders, investors, and policymakers with intelligence required to make confident decisions in Japan's transforming commercial vehicle sector. Partner with us to navigate the electric truck revolution and position your organization for success in the zero-emission transportation future.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)