GCC Cold Storage Construction Market Dynamics: Supporting Food Security Through Modern Storage Development

Introduction:

The GCC cold storage construction market represents critical infrastructure underpinning regional food security, pharmaceutical distribution, and temperature-sensitive logistics across the Arabian Peninsula. As Gulf Cooperation Council nations diversify their economies and reduce hydrocarbon dependence, robust cold chain infrastructure has emerged as a cornerstone of sustainable development planning. The arid climate, limited agricultural output, and heavy reliance on imported food products position cold storage facilities as essential assets in maintaining supply chain integrity.

The expanding scope of food imports across Saudi Arabia, the United Arab Emirates, Qatar, Kuwait, Bahrain, and Oman necessitates sophisticated temperature-controlled storage solutions capable of preserving product quality from arrival at regional ports to final retail delivery. Simultaneously, the pharmaceutical sector demands increasingly specialized cold room configurations to accommodate vaccine storage, biologics, and temperature-sensitive medical products requiring precise environmental controls.

Modern cold storage construction in the GCC incorporates cutting-edge materials science, sustainable building practices, and digital integration technologies. High-performance insulation panels, ammonia-based refrigeration alternatives, solar-assisted cooling systems, and Internet of Things connectivity represent standard specifications in newly commissioned projects.

How Vision 2030 is Transforming GCC Cold Storage Construction Industry:

The transformative economic diversification programs encapsulated within Vision 2030 frameworks across GCC member states are fundamentally reshaping cold storage construction priorities and investment patterns. Saudi Arabia's ambitious Vision 2030 agenda explicitly identify food security enhancement and logistics sector development as strategic imperatives, channeling significant capital toward integrated cold chain infrastructure. By 2030, Saudi Arabia wants to localize 85% of its food processing in 11 domestic clusters. Meanwhile, the Saudi Public Investment Fund and US agriculture firm AeroFarms have partnered to establish and run indoor vertical farms throughout the Middle East and North Africa. The UAE's parallel diversification strategy emphasizes positioning Dubai and Abu Dhabi as global logistics hubs, requiring world-class cold storage infrastructure to complement port facilities and free trade zones serving transcontinental supply chains.

Explore in-depth findings for this market, Request Sample

Key Industry Trends:

- Increasing Investment in Temperature-Controlled Warehousing for Food and Beverage Imports

The fundamental dependence of GCC nations on imported food products creates sustained demand for expanded temperature-controlled warehousing capacity across major port cities and inland distribution centers. Fresh produce, dairy products, frozen meats, seafood, and processed food items traverse increasingly complex supply chains, requiring consistent cold chain integrity.

With the help of a $3.8 Billion investment in food technology throughout the Gulf Cooperation Council, a new, unified GCC regional food security strategy seeks to create agricultural, livestock, and fishing initiatives that will achieve food security and sustainability, contributing roughly $30.5 Billion to the Gulf economy.

Investment flows toward food and beverage cold storage facilities reflect strategic calculations regarding population growth, tourism expansion, and evolving consumer preferences favoring fresh products. The hospitality industries of Dubai, Doha, and Riyadh generate substantial demand for premium perishable ingredients.

- Rising Demand for Pharma-Grade Cold Rooms and Vaccine Storage Infrastructure

The pharmaceutical cold storage segment represents a specialized construction category experiencing pronounced expansion across GCC healthcare systems. Vaccine distribution requirements, particularly those associated with mRNA-based products demanding ultra-cold storage capabilities, have catalyzed significant infrastructure investments designed to strengthen regional resilience against future pandemic scenarios.

Pharma-grade cold room construction adheres to stringent regulatory frameworks established by national health authorities and international pharmaceutical distribution standards. Biologic therapies, insulin products, blood plasma derivatives, and diagnostic reagents require precisely controlled environments throughout storage durations.

- Adoption of Energy-Efficient Insulation Materials and Sustainable Refrigeration Systems

Environmental sustainability considerations increasingly influence cold storage construction decisions across GCC markets, where extreme ambient temperatures create substantial energy consumption challenges. Progressive construction practices emphasize high-performance building envelopes featuring advanced insulation materials that minimize thermal transfer.

Located in the Jebel Ali Free Zone in Dubai, Americold's brand-new, cutting-edge cold storage facility has 27 docks, advanced monitoring systems, and energy-efficient rooftop solar panels. It was specifically designed to optimize regional and domestic distribution.

Polyisocyanurate panels, vacuum insulation technologies, and thermally broken structural connections represent contemporary approaches substantially outperforming legacy construction techniques. Refrigeration system selection increasingly favors natural refrigerants including ammonia and carbon dioxide over synthetic alternatives.

- Growth of Automated Warehousing and IoT-Enabled Temperature Monitoring Solutions

Automation technologies are transforming cold storage facility design throughout GCC markets, where labor availability constraints and efficiency imperatives drive adoption of robotic systems, automated storage and retrieval equipment, and conveyor-based material handling solutions.

Internet of Things connectivity permeates contemporary cold storage construction, with embedded sensor networks continuously monitoring temperature, humidity, door status, and equipment performance. Cloud-based platforms aggregate sensor data streams, enabling real-time visibility across geographically distributed cold chain networks.

- Expansion of E-Commerce-Driven and Last-Mile Cold Storage Facilities

The rapid proliferation of online grocery platforms and quick-commerce delivery services across GCC urban centers generates demand for specialized cold storage facilities positioned to support accelerated fulfillment timelines. Small and medium-sized businesses and startups are finding the food industry more and more appealing; in the first half of 2025, new memberships increased by 42.2% over the same time in 2024.

Last-mile cold storage construction emphasizes compact footprints suitable for integration within mixed-use urban developments and commercial zones. Modular cold room technologies enable rapid deployment of standardized units that can be configured and scaled according to evolving demand patterns.

Market Segmentation and Regional Insights:

Storage Type Insights:

- Bulk Stores: Bulk storage facilities serve as primary hubs for consolidating imported food commodities and frozen goods across GCC markets. These large-scale warehouses support wholesale distribution networks, enabling efficient inventory management for regional supermarket chains, food service operators, and industrial food processors.

- Ports: Port-based cold storage facilities are strategically positioned at major maritime hubs including Jebel Ali, Jeddah Islamic Port, and King Abdulaziz Port. These facilities provide critical import-export capabilities, connecting global food producers with GCC markets while ensuring cold chain integrity during transshipment operations.

- Production Stores: Production-integrated cold storage facilities support food processing and manufacturing operations throughout the GCC region. These specialized facilities enable seamless temperature control between production lines and storage areas, serving dairy processors, meat packers, seafood operations, and prepared food manufacturers.

- Others: This segment encompasses specialized cold storage applications including retail distribution centers, dark stores for e-commerce fulfillment, and micro-fulfillment facilities supporting quick-commerce platforms. Last-mile cold storage nodes are expanding rapidly to meet growing online grocery demand across urban centers.

Warehouse Type Insights:

- Private and Semi-Private Warehouse: Private and semi-private cold storage warehouses serve dedicated corporate clients including multinational food manufacturers, pharmaceutical distributors, and major retail chains. These facilities offer customized temperature configurations, enhanced security protocols, and exclusive capacity allocation for proprietary inventory management requirements.

- Public Warehouses: Public cold storage warehouses provide shared temperature-controlled space accessible to multiple tenants and logistics operators. These facilities offer flexible leasing arrangements, enabling small and medium enterprises to access professional cold chain infrastructure without substantial capital investment in dedicated facilities.

End User Insights:

- Food and Beverages: The food and beverage sector dominates GCC cold storage demand, driven by substantial import requirements for fresh produce, dairy, frozen meats, and seafood. Rising tourism, expanding hospitality industries, and evolving consumer preferences for fresh products sustain strong construction activity across this segment.

- Pharmaceuticals: Pharmaceutical cold storage construction is accelerating across GCC healthcare systems to accommodate vaccine distribution, biologic therapies, and temperature-sensitive medical products. These facilities require stringent regulatory compliance, validated monitoring systems, and redundant refrigeration equipment meeting Good Distribution Practice standards.

- Chemicals: Chemical sector cold storage facilities serve specialized requirements for temperature-sensitive industrial compounds, laboratory reagents, and petrochemical derivatives. These facilities incorporate enhanced safety features, hazardous material handling capabilities, and segregated storage zones to ensure regulatory compliance and operational safety.

- Others: This segment includes cold storage facilities serving cosmetics, floriculture, and specialty retail applications requiring temperature-controlled environments. Growing demand for premium beauty products and fresh flowers across GCC luxury retail markets drives construction activity within this diversified segment.

Country Insights:

- Saudi Arabia: Saudi Arabia leads GCC cold storage construction, driven by Vision 2030 food security initiatives and substantial population growth. Major projects concentrate around Jeddah Islamic Port and Riyadh metropolitan distribution hubs, supported by government-backed agricultural development programs and strategic commodity stockpiling requirements.

- United Arab Emirates: The UAE maintains sophisticated cold storage infrastructure supporting Dubai's re-export trading activities and Abu Dhabi's emerging food processing industries. Jebel Ali Free Zone hosts significant cold storage concentrations, while innovative facilities incorporate solar power and automation technologies advancing regional sustainability objectives.

- Qatar: Qatar's cold storage construction activity supports import requirements for its affluent consumer market and expanding hospitality sector. Strategic investments focus on Hamad Port facilities and integrated logistics zones, positioning the nation as a nimble gateway for Gulf-wide temperature-controlled distribution networks.

- Kuwait: Kuwait's cold storage market development reflects growing domestic consumption requirements and strategic food reserve initiatives. Construction activity emphasizes modernizing existing infrastructure while developing new facilities capable of supporting expanded import volumes and enhanced pharmaceutical distribution capabilities across the nation.

- Oman: Oman's cold storage construction aligns with economic diversification strategies and emerging agricultural technology initiatives. Investments in Asyad-run logistics clusters and port-adjacent facilities support the nation's ambitions to become a regional logistics hub connecting Asian and African markets.

- Bahrain: Bahrain's compact geography drives focused cold storage development within its streamlined gateway infrastructure. Strategic partnerships between public and private sectors support construction of modern temperature-controlled facilities serving the nation's food processing industries and pharmaceutical distribution requirements.

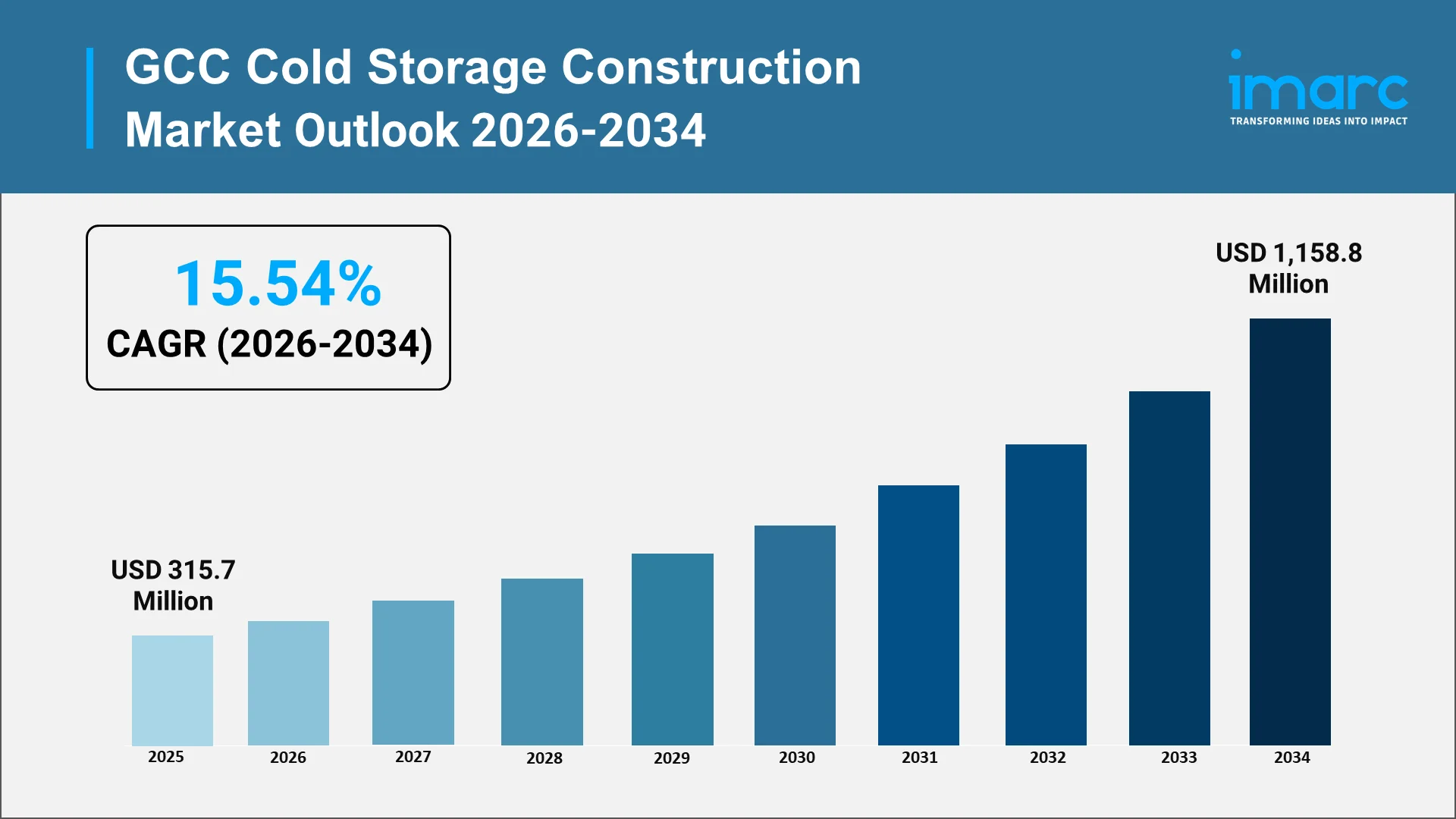

Forecast: 2025–2033

The GCC cold storage construction market size is expected to reach USD 1,145.0 Million by 2033, exhibiting a growth rate (CAGR) of 15.39% during 2025-2033, reflecting sustained demand drivers rooted in structural characteristics of regional economies and deliberate policy choices prioritizing food security and logistics sector competitiveness. Population growth projections, tourism sector expansion plans, and healthcare system modernization programs provide foundational demand visibility.

Expansion of food import and re-export activities represents a primary demand driver, as GCC nations strengthen their positions as regional distribution hubs connecting global production zones with consumption markets across the Middle East, North Africa, and South Asia.

Growth of pharmaceutical and healthcare logistics emerges as an increasingly significant construction catalyst. Government food security programs translate policy priorities into tangible construction investments, with national food reserve initiatives and strategic commodity stockpiling programs driving demand for purpose-built cold storage facilities.

Conclusion:

The GCC cold storage construction market occupies a strategic position within regional development priorities, serving as critical infrastructure supporting food security objectives and logistics sector competitiveness. Vision 2030 frameworks channel sustained investment toward temperature-controlled warehousing capacity, driving construction activity incorporating advanced technologies and sustainable design principles.

Key trends including expanded food import handling, pharmaceutical-grade storage development, energy-efficient construction practices, and automation adoption collectively shape market evolution through the forecast period.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

- Data-Driven Market Research: Deepen your knowledge of cold storage construction trends, temperature-controlled logistics developments, and technological advancements such as automated warehousing, sustainable refrigeration systems, and IoT-enabled monitoring platforms through comprehensive market research reports.

- Strategic Growth Forecasting: Predict emerging trends in cold chain infrastructure development, from modular construction technologies and energy-efficient designs to policy changes and food security interventions by global regions.

- Competitive Benchmarking: Analyze competitive forces in the cold storage construction market, review project pipelines, and monitor breakthroughs in insulation materials, refrigeration technologies, and facility automation systems.

- Policy and Infrastructure Advisory: Stay one step ahead of regulatory paradigms, government-sponsored programs, and investment strategies affecting cold storage development and food import logistics.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it developing new cold storage facilities, investing in temperature-controlled logistics ventures, or building supply chain infrastructure for perishable goods distribution.

At IMARC Group, our goal is to empower industry leaders with the clarity and intelligence required to capitalize on GCC cold storage construction opportunities. Join us in supporting regional food security—because reliable cold chain infrastructure matters. For more detailed report, please visit: https://www.imarcgroup.com/gcc-cold-storage-construction-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)