How Large Will the UK Autonomous Vehicles Market Be in 2033?

Overview of the UK Autonomous Vehicle Industry:

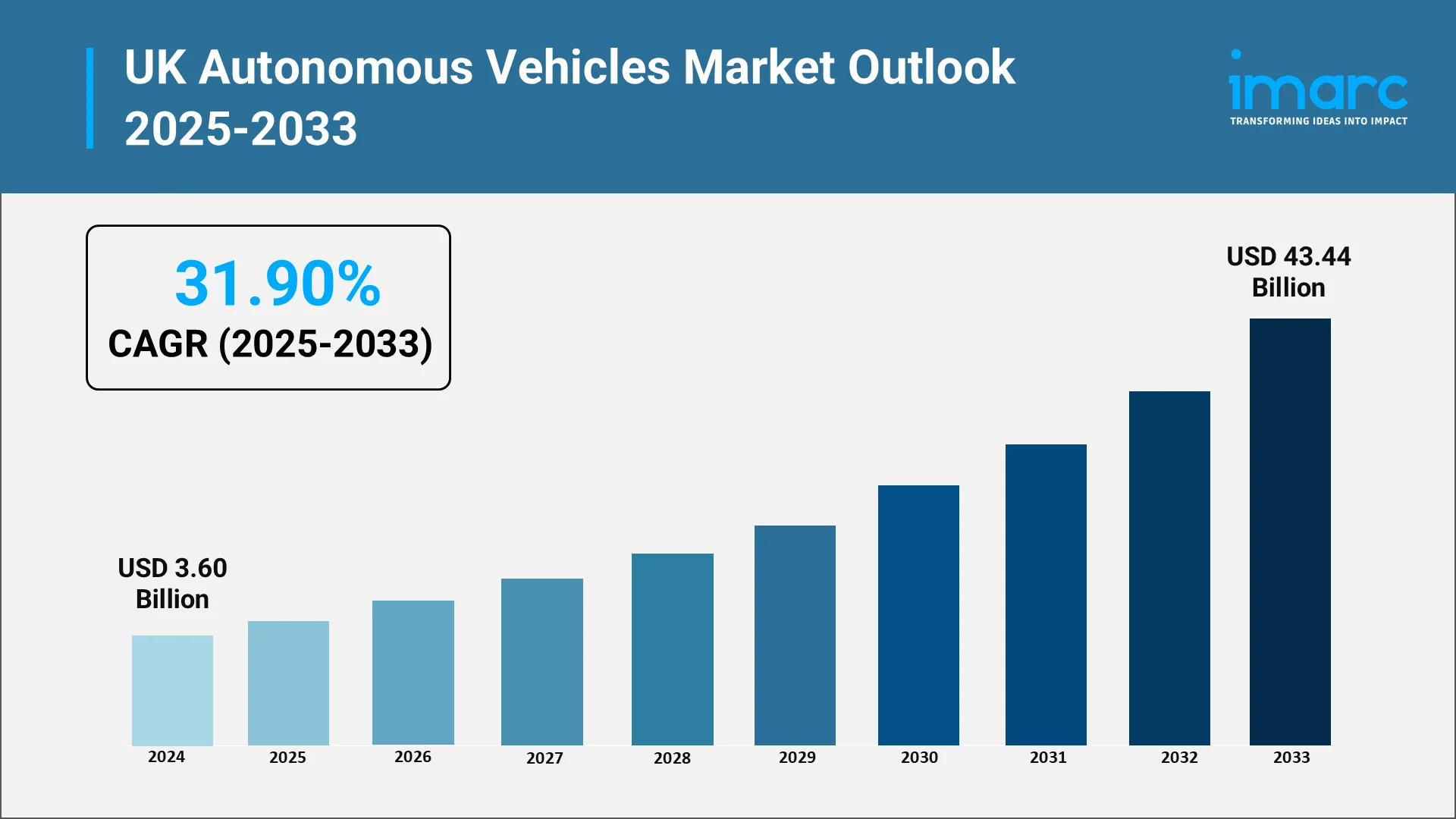

The UK is rapidly evolving into a dynamic hub for autonomous vehicle research, testing, and early-stage deployments. A strong ecosystem comprising academic institutions, technology start-ups, automakers, and mobility service providers fosters continuous innovation. Supported by a skilled workforce specializing in software, sensing, robotics, and transportation systems, the nation has become a fertile ground for experimentation. The UK autonomous vehicles market size reached USD 3.60 Billion in 2024. Looking forward, the market is expected to reach USD 43.44 Billion by 2033, exhibiting a growth rate (CAGR) of 31.90% during 2025–2033. Urban testbeds, innovation districts, and industry consortia provide real-world environments where prototypes advance into demonstrators and pilot services, accelerating the commercialization of self-driving technologies across various mobility domains.

Explore in-depth findings for this market, Request Sample

The country’s autonomous ecosystem extends beyond car manufacturers to include infrastructure operators, telecommunication providers, mapping companies, insurers, and municipal authorities. These stakeholders collectively build an interconnected network where vehicle software stacks, simulation laboratories, and data platforms form the foundation of progress. Applications range from autonomous ride-hailing and shared mobility to last-mile logistics and long-distance freight automation, all supported by electric powertrain platforms and advanced sensor systems. In a recent development, Wayve and Uber announced in June 2025 that they will begin public-road trials of Level 4 autonomous vehicles in London by 2026, marking a major milestone in the UK’s efforts to scale real-world autonomous mobility. As a result, the UK’s autonomous vehicle market is shifting from a product-driven model toward a service-oriented mobility value chain, blending hardware and software innovation to enhance efficiency, safety, and sustainability across the nation’s transport landscape.

Market Size Projection Through 2033:

Projecting the market size qualitatively requires attention to adoption curves and value capture across the ecosystem. Over the coming decade, the UK Autonomous Vehicles Market is likely to shift from an experimental and pilot-rich phase to a much broader commercialization phase. Early adopters in limited urban zones and logistics corridors will validate business models and operational processes, while mainstream adoption will spread as technologies mature and costs decline.

Rather than meeting on headline figures, think in terms of directional expansion across three dimensions. First, vehicle deployment: the makeup of the vehicle fleet will skew towards models designed from the ground up for autonomy or thoroughly retrofitted with sensors and compute. Second, layers of service: mobility-as-a-service subscriptions, autonomous logistics deals, and compute software subscriptions will account for an increasing share of market value. Third, enabling infrastructure: spends on communications, map updates, and roadside infrastructure will generate regular revenue streams for operators and municipalities.

At the end of the decade, the market will be complex and stratified. Consumer mobility services, commercial logistics deals, enterprise software licenses, and operational services will all play a large part. The final result will be a market wider than merely vehicle sales: value will be ever-more extracted from operating platforms, data monetisation, and bundled service offerings.

Key Drivers of Market Expansion:

Several structural forces are shaping the growth of the UK Autonomous Vehicles Market, spanning technology, consumer behavior, policy, and economics. Consumer acceptance remains a crucial factor, as growing familiarity with ride-hailing apps and driver-assist features builds trust in machine-driven mobility. Convenience, safety, accessibility, and cost efficiency will make autonomous transport particularly appealing to users who face challenges with traditional car ownership. In a notable development, the UK government published its draft strategy titled “Connected and Automated Mobility 2025: Realising the benefits of self-driving vehicles”, outlining that “by 2025 the UK will begin to see deployments of self-driving vehicles that will be used confidently by businesses and the public alike.

From an economic perspective, fleet operators stand to gain significantly. Autonomous systems combined with shared mobility models can reduce labor and operating expenses, while in logistics, automation can improve route optimization, asset utilization, and delivery flexibility. In dense urban areas, autonomous fleets can better serve high-frequency routes, offering both economic and operational efficiency advantages.

Additionally, the synergy between electrification and autonomy strengthens this ecosystem. Electric vehicles’ simpler mechanics and consistent power profiles align well with automated systems, while centralized charging infrastructure complements autonomous fleet operations. Technological advancements in AI, sensing, and simulation are accelerating deployment readiness, lowering entry barriers for new software developers. Meanwhile, supportive public policies, permissive testing frameworks, and infrastructure investments are acting as key enablers, fostering confidence and collaboration between industry and government to scale autonomous mobility across the UK.

Regulatory Framework and Safety Standards:

A robust regulatory framework is essential for the widespread adoption of autonomous vehicles in the UK. The government’s approach has been pragmatic, encouraging controlled real-world trials to refine standards and legislation while prioritizing safety and accountability. Developers must demonstrate the reliability of perception and decision-making systems across varied traffic and environmental conditions, supported by extensive simulations and real-world validation. Safety case submissions and independent audits are expected to become standard practice as commercial deployment advances. According to reports, the UK Parliament passed the Automated Vehicles Act in May 2024, establishing a comprehensive legal foundation for self-driving vehicles, including mandatory safety assurance and operator accountability.

Evolving liability, insurance, and data governance frameworks will further shape the ecosystem. Traditional driver-based insurance is giving way to models centered on manufacturers and software providers, incentivizing stronger engineering and accountability. Simultaneously, data protection and cybersecurity regulations will safeguard the vast information generated by autonomous systems, ensuring privacy and resilience against threats. Establishing common communication protocols between vehicles and infrastructure will also be critical to enable scalable, interoperable deployment across regions.

Technological Advancements and Partnerships:

Technological innovation remains the cornerstone of the self-driving technology UK narrative. Advances in sensors, computing hardware, machine learning, and simulation tools have mitigated key technical challenges while fostering commercialization through new business models and cross-sector collaboration. Modern sensor systems integrate cameras, lidar, radar, and ultrasonic sensing with high redundancy, while compute platforms are now optimized for neural network processing and real-time control. Parallel development of open-source and commercial software stacks further accelerates iteration, testing, and shared learning within the ecosystem. In a recent example, the UK’s Centre for Connected and Autonomous Vehicles (CCAV) launched the £18.5 million “Commercialising Connected and Automated Mobility” programme to support projects developing advanced self-driving technologies and real-world deployment trials.

Simulation and digital twin technologies have become essential for testing rare but critical safety scenarios, enabling developers to scale evaluations without endangering the public. Collaboration continues to be pivotal—automakers work with technology firms for mapping and perception, telecom companies enable low-latency connectivity, and city authorities coordinate infrastructure planning. Beyond business partnerships, academic, industrial, and safety organizations are uniting to develop shared datasets, benchmarking standards, and best practices that strengthen industry-wide progress and reduce duplication of effort.

Competitive Landscape and Future Roadmap:

The UK’s autonomous vehicle landscape is highly competitive, featuring established automakers, mobility start-ups, software firms, and tech giants all vying for value within a complex ecosystem. The market is evolving toward specialization, where some players focus on vehicle hardware, others on AI and perception systems, and others on fleet operations and service design. This modular approach allows top-tier suppliers to integrate their solutions into larger systems, fostering collaboration and innovation. A notable example is Wayve’s recent partnership with Microsoft and BP, announced in early 2024, to accelerate the development and deployment of AI-driven autonomous driving technologies using cloud-based simulation and energy-efficient fleet management solutions.

Platform integration will be a key differentiator. Companies that combine strong software capabilities, scalable fleet management, and user-friendly interfaces will capture recurring revenue and valuable operational data. Likewise, manufacturers designing vehicles purpose built for autonomy with optimized sensor layouts and modular architectures will offer significant advantages to fleet operators seeking efficiency and reliability.

Beyond vehicle makers, adjacent sectors like mapping, cloud computing, cybersecurity, and telematics are becoming crucial contributors. Their competitiveness will depend on data accuracy, low latency, and integration reliability. Success will ultimately hinge on customer experience and adaptability, as firms that deliver trusted, efficient services and build strong local partnerships will scale most effectively across diverse urban and regulatory environments.

Conclusion:

The question of how large the UK Autonomous Vehicles Market will be by the target date is less about a quantified number and more about qualitative change. The next decade will transform transport from an automobile-centric industry to a service-oriented mobility system. Autonomous technology UK projects will meet with electrification plans to create safer, cleaner, and more autonomous fleets. Market value will permeate through vehicles, software, services, and infrastructure, where recurring operating revenues and data-based services take prominence.

Achievement will rest on a collaborative effort between technology developers, vehicle makers, service operators, regulators, and local communities. Those operators who excel at integration, combining strong technical systems with reliable operations and sensitive public involvement, will deliver the most value. For the UK, the challenge is to build a balanced mobility future in which innovation enhances access, lessens environmental footprint, and improves urban resilience. The final state will be one where the market is not defined by the number of self-driving units on the road but by the level to which autonomous capabilities are integrated into daily mobility, logistics, and urban life.

Driving the Future: IMARC’s Strategic Insights into the UK Autonomous Vehicles Revolution

IMARC Group delivers in-depth research and strategic advisory services to empower stakeholders within the UK autonomous vehicles ecosystem. Our expertise helps clients identify market opportunities, address regulatory and safety challenges, and harness emerging technologies to drive innovation, efficiency, and competitiveness across the mobility landscape.

- Market Insights: Explore evolving trends shaping the UK autonomous vehicles market, including electrification, connected mobility, and advancements in AI-driven perception, mapping, and control systems that underpin self-driving technology adoption.

- Strategic Forecasting: Stay informed on developments in autonomous fleet deployment, vehicle-to-infrastructure (V2I) communication, and integration with smart city initiatives and sustainable transport networks.

- Competitive Intelligence: Evaluate strategies of key OEMs, tech firms, and mobility service providers, assess collaboration models between automakers and software developers, and analyze partnerships advancing autonomous ride-hailing, logistics automation, and sensor innovation.

- Policy and Regulatory Analysis: Understand the impact of the UK’s evolving legal frameworks, safety assurance standards, and government-backed testbed programs shaping commercialization and consumer trust.

- Customized Consulting Solutions: Access tailored consulting support for market entry, technology partnerships, investment decisions, and strategic positioning in the autonomous mobility value chain. IMARC’s research and consulting services enable stakeholders to navigate the UK’s transformative shift toward a self-driving future with confidence, precision, and sustainable growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)