Medical Imaging Market Trends: Advancing AI-Driven Diagnostics and Future-Ready Healthcare Systems

.webp)

Introduction:

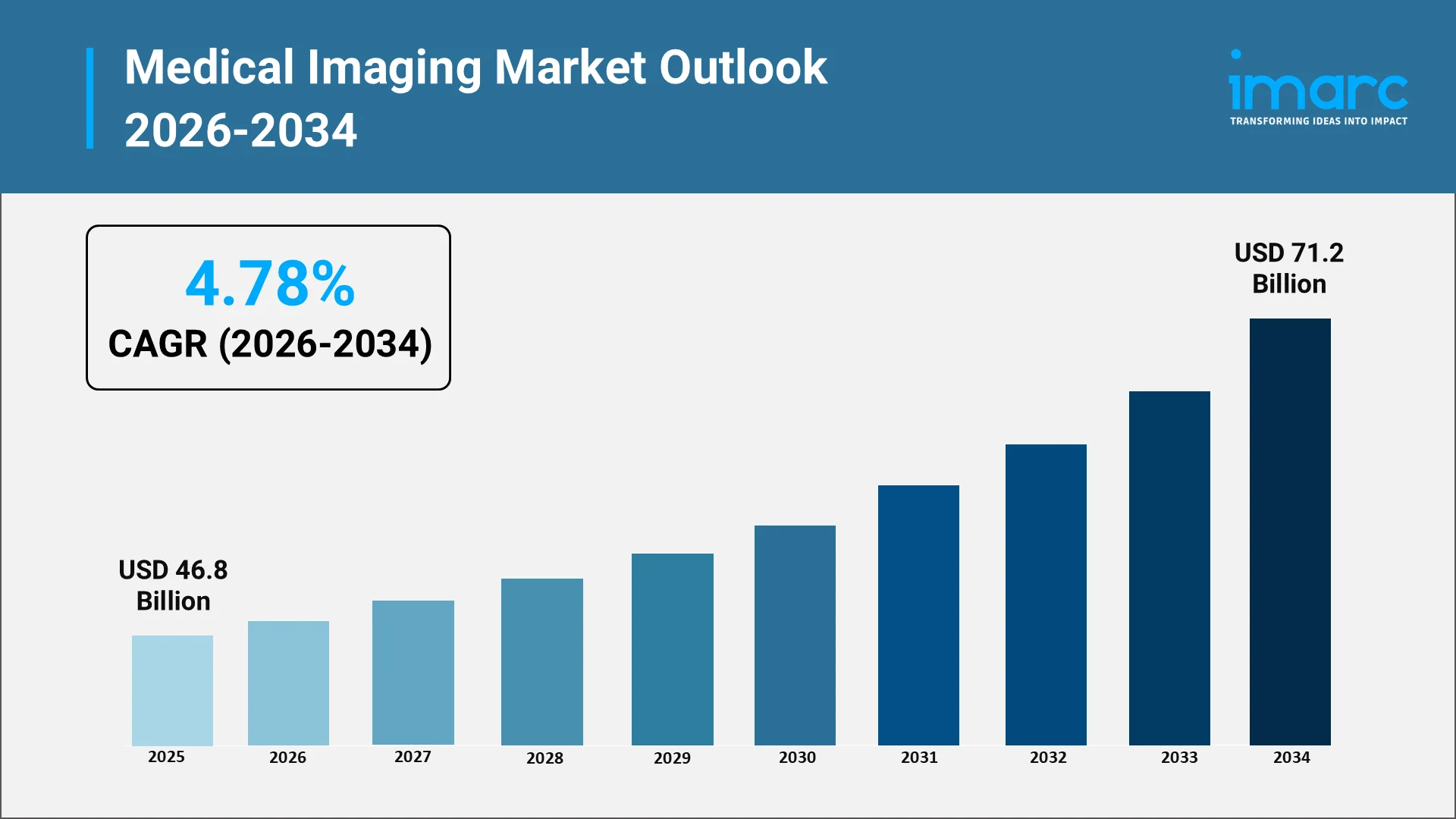

The medical imaging market has reached a transformational phase, driven both by rapid technological advancements and growing demands for precision-driven diagnostics. As health systems worldwide come under increasing pressure to improve patient outcomes while minimizing procedural risks and optimizing clinical workflows, medical imaging has become one of the most important cornerstones of modern medicine. The global medical imaging market size reached USD 46.8 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 71.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.78% during 2026-2034. The various studies conducted on the medical imaging market have brought to the forefront the ever-increasing adoption of advanced imaging modalities and integrated solutions for early detection, diagnosis, and personalized care strategies. Whether through hospitals and diagnostic centers, outpatient clinics, or through teleradiology services, it continues to redefine the way healthcare professionals visualize, analyze, and interpret internal body structures and disease progressions.

The factors driving the market include increased usage in the case of rising chronic diseases, technological innovations, and the pursuit of minimally invasive procedures, which act as motivating factors for growth in the global medical imaging market. Advanced medical imaging systems allow clinicians to visualize human anatomy in unparalleled ways, with the ability to visualize and quantify in real time for treatment planning. For example, in 2024, GE HealthCare received FDA clearance for its SIGNA MAGNUS 3.0 T head-only MRI system, which is optimized for neuroimaging and promises better detection of neurological, oncological, and psychiatric conditions. These factors make the market for diagnostic imaging equipment more crucial than ever to help healthcare professionals provide quality care to patients while easing certain operational bottlenecks. Moreover, the segments in medical imaging systems include MRI, CT, PET, X-ray, ultrasound, and other applications, representing the diverse needs of clinical practice and patient populations.

Medical imaging extends beyond diagnostics, enhancing patient outcomes by guiding therapy, monitoring treatment, and supporting minimally invasive procedures. High resolution imaging, AI assisted analysis, and advanced post processing allow early detection of abnormalities, improving prognoses and reducing diagnostic errors. Integration into clinical workflows boosts efficiency and strengthens value based care. Modern solutions from portable and hybrid devices to cloud enabled platforms combine technological sophistication with accessibility, ensuring widespread diagnostic excellence. Reflecting both innovation and patient centered design, medical imaging market segmentation positions these systems as strategic enablers of next generation healthcare, shaping treatment decisions and advancing the future of clinical care.

Explore in-depth findings for this market, Request Sample

Key Industry Trends:

Adoption of AI and Advanced Analytics in Imaging Diagnostics

Medical imaging has taken a new dimension with AI and machine learning, shifting the practice from interpretive to a data-driven and predictive practice. AI algorithms improve the precision and speed of image analysis, reduce human error, and support complex decision-making by clinicians. Advanced analytics allow for automatic pathology detection, tissue changes quantification, and risk stratification across patient populations. This is the intersection of technology and clinical expertise that is now redefining the medical imaging systems market and allowing providers to offer precision diagnostics that were previously unattainable.

By incorporating AI, imaging modalities are now able to provide multi-dimensional views from MRI, CT, and PET, promoting early disease diagnosis and monitoring of treatment responses. For this reason, deep learning models, trained on large datasets, facilitate the detection of subtle abnormalities often invisible to the human eye. The diagnostic imaging equipment market has increasingly adopted AI-enabled solutions as a result, which positions medical imaging at the leading edge of precision medicine.

Growing Demand for Portable and Point-of-Care Imaging Devices

Healthcare delivery is being driven toward decentralized and patient-centric models. Portable and point-of-care imaging devices are used for real-time diagnosis outside traditional hospital environments, from the emergency room to home-based care. Such devices improve access by facilitating swift assessment of critical conditions, which reduces time-to-treatment. For instance, GE HealthCare launched its Venue Sprint tablet-based ultrasound in 2024, which pairs its Venue software with wireless Vscan Air dual probes — enabling high-quality imaging in critical care, emergency medicine, and even during medical transport. Portable ultrasound units, mobile X-ray systems, and handheld scanners are becoming increasingly integral to clinical workflows and form one of the big trends in medical imaging market research.

The proliferation of point-of-care devices also addresses the growth in the need for imaging in remote or otherwise underserved areas. With reduced dependence on centralized facilities, these technologies broaden healthcare access while facilitating quicker decision-making and better patient satisfaction. To healthcare providers, portable imaging signifies both operational efficiency and strategic differentiation in the competitive market.

Hybrid Imaging Systems: Expanding the Clinical Use of PET/CT and PET/MRI

Hybrid systems, integrating various modalities into one, such as PET/CT and PET/MRI, will continue to redefine diagnostic precision. These provide comprehensive anatomical and functional information in one session. This enhances the accuracy for disease staging, therapy planning, and response evaluation. The integration of hybrid systems into medical diagnostic practice is a key trend in the medical imaging systems market, driven by requirements for comprehensive diagnostic insights without additional burdens on patients. For example, in December 2024, Siemens Healthineers introduced its Biograph One PET/MR at RSNA, which combines a 3T MR platform with a digital PET detector to enable high-resolution, time-of-flight PET/MRI scans with faster acquisition times and AI-powered workflows.

Hybrid imaging offers comprehensive visualization of metabolic activity coupled with structural anatomy, thereby supporting various specialities such as oncology, cardiology, and neurology. Integration decreases the number of procedures a patient will need while minimizing exposure to recurrent imaging, thus optimizing workflow efficiency. Hospitals and diagnostic centers continue to invest in hybrid platforms, given the increasing demands at the clinical level coupled with value-based care objectives.

Rise of Cloud-Based Medical Imaging and Tele-Radiology Solutions:

Cloud technology and tele-radiology have turned medical imaging into a globally accessible and collaborative practice. Clinicians can securely store, share, and interpret imaging data remotely, thus enabling real-time consultations across geographies. For example, in November 2024, Philips deepened its strategic collaboration with AWS to host its integrated diagnostics portfolio — including radiology, digital pathology and cardiology — on the cloud, thereby unifying workflows and improving access across regions. This trend is therefore reshaping the segmentation in the medical imaging market, offering scalable solutions to support both large hospitals and small diagnostic centers.

Cloud-based platforms decrease IT infrastructure costs, improve data security, and allow better integration of data with electronic health records. Tele-radiology, specifically, makes sure that expert interpretations are delivered on demand, assuring that the gaps in radiologist availability are covered and supporting quick diagnosis. For example, in February 2025, Philips expanded its HealthSuite Imaging cloud-based radiology informatics services across Europe, hosted on Amazon Web Services — enabling secure, anywhere access to imaging studies and AI-enabled workflows. By integrating cloud and telecommunication technologies, healthcare providers can make their operations efficient while offering quality patient care.

Shift to Low-Dose, High-Resolution Imaging and Patient-Friendly Designs

Safety and comfort of the patient remains the top priority in modern medical imaging. The industry is increasingly moving toward low-dose imaging protocols, high-resolution visualization, and ergonomic designs that minimize anxiety among patients. Techniques such as iterative reconstruction, dose optimization software, and patient-centered imaging devices symbolize the evolution of the diagnostic imaging equipment market toward safer and more effective solutions. Additionally, Canon Medical Systems in 2024 enhanced its CT offering (Aquilion ONE / INSIGHT Edition) with deep-learning reconstruction (DLR) via its Precise IQ Engine, enabling ultra-low-dose imaging without sacrificing resolution.

Patient-friendly imaging systems enhance adherence to diagnosis schedules while minimizing the incidence of repeat scans. Besides, high-resolution imaging allows clinicians to spot minor pathological changes earlier, thereby enhancing treatment planning and outcomes. This trend signifies the commitment of the medical imaging sector towards striking a balance between technological innovation and patient-oriented care.

Market Segmentation & Regional Insights:

Within the medical imaging market research, there are various segments by modality, application, end-user, and geography. The main modalities comprise MRI, CT, PET, X-ray, and ultrasound, all with different clinical applications and drivers of growth. For example, MRI is a preferred modality for soft tissue imaging and neurological studies, while CT allows for fast and high-resolution imaging of complex structures. In oncology and cardiology, PET imaging is important, often used in hybrid systems combined with CT or MRI. Ultrasound and X-rays continue to dominate routine diagnostics and point-of-care applications due to their ease of accessibility and reasonable cost.

The end-users vary from hospitals and diagnostic centers to outpatient clinics and home care facilities. Hospitals continue to be the major adopters of advanced imaging systems due to their high volume of patients and their special services. Diagnostic centers and outpatient facilities are increasingly using portable and AI-enabled devices to increase accessibility and efficiency. Also, point-of-care imaging is expanding in home healthcare, emergency response, and remote monitoring, basically reflecting a trend of decentralization of medical services.

The growth of the medical imaging market is geographically different, with differences in regions regarding healthcare infrastructure, venture investment, and the acceptance of technology. North America and Europe remain the largest markets due to their state-of-the-art infrastructure, sound regulatory environments, and awareness among patients. Asia-Pacific is seeing the fastest adoption of medical imaging because of increasing healthcare investments, a rise in the prevalence of chronic diseases, and improving demand for quality diagnosis. Developing areas like Latin America, the Middle East, and Africa offer unexploited potential, where portable devices, cloud-based solutions, and teleradiology are well-placed to bridge the gaps in accessibility.

Outlook (2026-2034):

The growth of the global medical imaging market is expected to be high throughout the forecast period, due to continuous technological innovations, increased healthcare demand, and expanding clinical applications. The projected CAGR underscores sustained investments being made in imaging infrastructure, AI integration, and hybrid systems. Segmentation in the medical imaging market will continue to evolve with modality convergence and new solutions for specific clinical needs.

Key demand drivers shaping this growth include:

- Imaging demand driven by chronic diseases: Increasing cases of cancer, cardiovascular conditions, and neurological disorders are driving the demand for advanced imaging for diagnosis and monitoring.

- Increasing investment in healthcare infrastructure: Funds are being invested by various hospitals, diagnosis centres, and outpatient facilities in imaging technologies to develop their service capabilities and increase patient access.

- AI and advanced technology boost access to imaging: Intelligent imaging platforms and cloud-enabled systems provide faster interpretation, full workflow optimization, and high-quality diagnostics accessible in various settings of healthcare.

- Early detection requires the adoption of advanced imaging systems: The various initiatives in preventive care and early intervention propel the adoption of high-resolution, hybrid, and AI-enabled imaging systems that can detect diseases in their initial stages.

By 2034, the medical imaging systems market is expected to see significant growth in all modalities, with the hybrid, portable, and AI-integrated solutions as primary growth segments. Advancements in the field of diagnostic imaging will drive forward innovation, increasing automation, and the development of patient-centered designs focused on safety and comfort.

Conclusion:

The medical imaging industry stands at the intersection of technology, patient-centric care, and operational efficiency. Driven by AI adoption, hybrid system integration, proliferation of portable devices, and cloud-enabled solutions, medical imaging market research underlines the transformative potential of the sector. Clinicians now have tools that help them move toward early detection, support minimally invasive procedures, and manage clinical workflows for better patient outcomes and healthcare delivery.

The trends in the evolution of medical imaging systems and diagnostic imaging equipment further mark a larger movement toward precision medicine and future-ready health systems. By adopting advanced imaging modalities, low-dose technologies, and patient-friendly designs, healthcare providers across the globe are moving to meet international standards of care while tackling the increasingly strong demand for access and accuracy in diagnostics. As the global growth of the medical imaging market proceeds, all stakeholders-from hospitals to policymakers-need to be abreast of emerging trends, technological changes, and opportunities for investment, so that maximum benefit from imaging in modern medicine is achieved.

IMARC Group: Your Medical Imaging Market Insight Partner

The fast-evolving medical imaging landscape requires actionable insights, data-driven analysis, and strategic guidance. IMARC Group helps healthcare and technology stakeholders with comprehensive market intelligence, enabling well-informed decision-making and growth planning. Our services include:

- Data-driven Market Research: In-depth analysis of industry trends, market sizing, segmentation, and competitive landscapes.

- Strategic Growth Forecasting: Intelligence to predict market trends, emerging technologies, and investment opportunities.

- Competitive Benchmarking: Assess market positioning, performance indicators, and innovation strategies for key players.

- Policy and Infrastructure Advisory: Guidance on regulatory compliance, healthcare policy shifts, and infrastructure investments.

- Custom Reports and Consulting: Solutions tailored to unique business challenges, strategies for market entry, and initiatives for growth.

In collaboration with IMARC, one is assured of dependable, actionable intelligence to deliver success in the burgeoning medical imaging systems market. The complete medical imaging market report will give insights to help gain a competitive advantage, anticipate trends, and shape future-ready healthcare solutions.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)