Australia Sportswear Industry: Athleisure Surge, Economic Impact, and Opportunities

Introduction:

The Australia sportswear industry is experiencing unprecedented momentum, transforming into a multi-billion-dollar powerhouse where fashion, fitness, and lifestyle converge. As health consciousness sweeps the continent and athleisure becomes a wardrobe staple, the Australian market leads a global revolution in performance apparel. From Sydney's coastal paths to Melbourne's fitness studios, sportswear has evolved beyond gymnasiums into everyday Australian life.

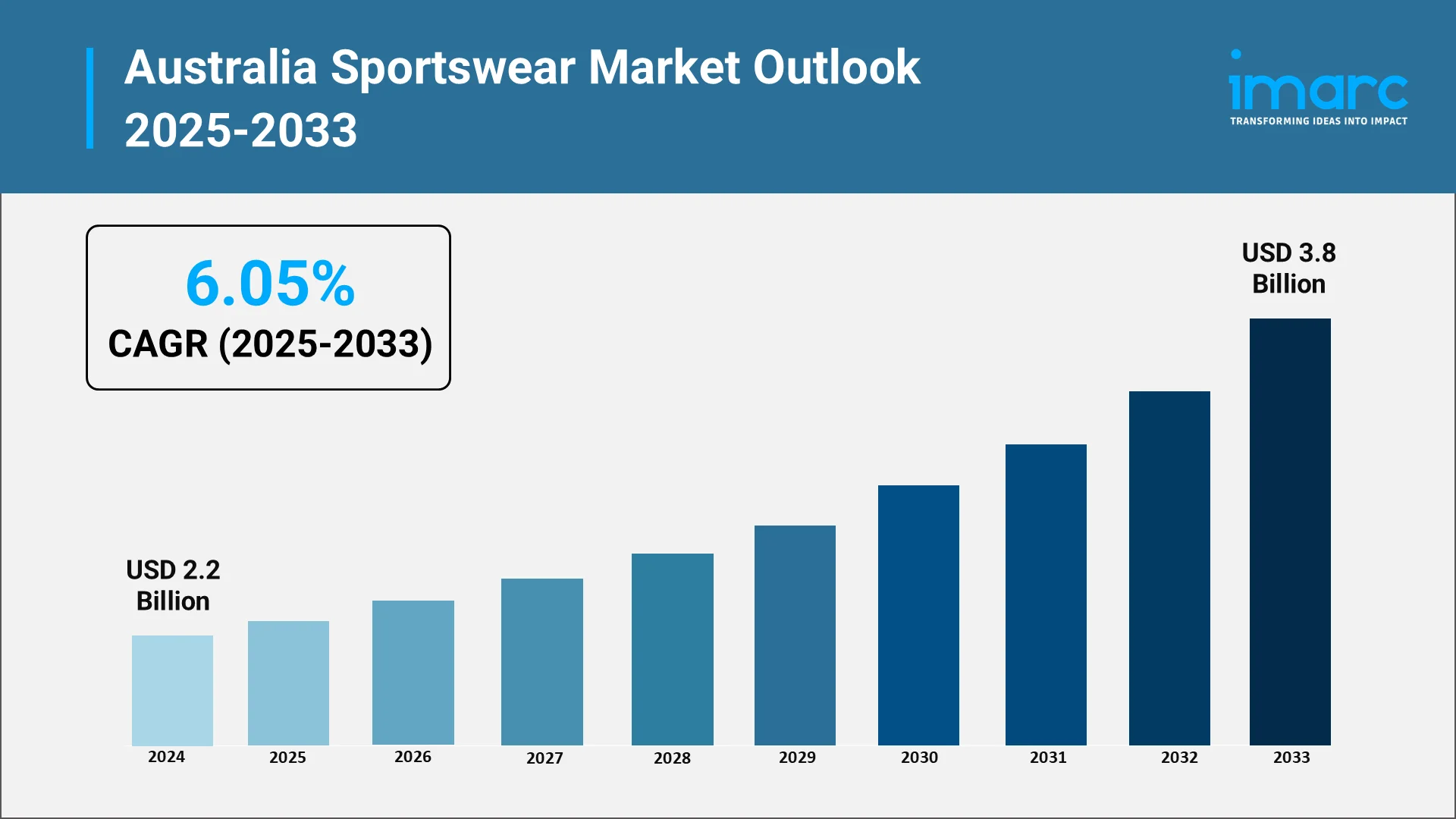

The Australia sportswear market reached USD 2.2 Billion in 2024. This trajectory reflects fundamental shifts in consumer behavior, technological innovation in fabric development, and an increasingly active population viewing fitness apparel as both performance necessity and fashion statement. For corporate strategists, investors, and industry stakeholders, understanding these dynamics is essential for capitalizing on one of Australia's most vibrant consumer segments.

Explore in-depth findings for this market, Request Sample

Recent Market News and Major Research and Development:

- Strategic Partnerships Reshape Competitive Landscape

The Australian sportswear sector witnessed significant strategic developments throughout 2024-2025. In January 2025, Under Armour announced a strategic investment in ISC Sport, becoming a major shareholder of the premier Australian custom teamwear provider. This partnership combines Under Armour's global brand strength with ISC's local expertise, serving over 2,500 amateur clubs and connecting with more than 800,000 athletes annually through a made-to-order business model.

Under Armour secured its first NRL club partnership in October 2025 with the Canberra Raiders, positioning the brand as the exclusive high-performance apparel partner for the Raiders' programs. This five-year agreement demonstrates strategic penetration into Australian team sports markets.

- Product Innovation and Launches

Adidas launched a new women's sportswear collection in April 2024 designed for high-performance activities, emphasizing inclusivity for the growing female athletic demographic. In July 2024, Adidas introduced the "Adidas Ultraboost 25" featuring advanced Boost technology, while promoting athleisure collections bridging athletic and casual wear.

Nike launched the "Nike Training Essentials" collection exclusively online in October 2024, featuring eco-friendly materials and advanced performance wear aligned with sustainability goals. ASICS introduced running shoes with advanced cushioning technology in January 2024, while Nike launched the Air Zoom Pulse 2 for children in July 2024.

In a groundbreaking collaboration, Pace Athletic partnered with Saucony in July 2024 to launch the Sydney/Eora Endorphin Speed 4 featuring Indigenous artwork—Australia's first performance shoe collaboration of its kind.

- Sustainability Initiatives

Lorna Jane launched an eco-friendly activewear line in February 2024, reflecting three decades of innovation commitment. Puma introduced an eco-friendly sportswear range in May 2023 incorporating recycled materials. Athletics Australia extended its partnership with PUMA until 2032 in January 2025, supporting elite athletes ahead of Brisbane 2032 Olympics.

Opportunities and Challenges in the Australia Sportswear Industry:

Key Growth Opportunities

- Athleisure Expansion: Athleisure represents the most significant growth opportunity, transcending traditional fitness contexts as consumers wear performance apparel for work-from-home, social activities, and daily errands. This lifestyle integration dramatically expands addressable markets beyond dedicated athletes to style-conscious consumers seeking comfort and functionality.

- Digital Commerce Growth: E-commerce reached USD 32.3 Billion in Australia in 2024, recording 15.5% year-over-year growth according to the International Trade Administration. Online channels enable geographic reach, personalized experiences, and direct-to-consumer models that capture higher margins and build stronger customer relationships.

- Women's Market Expansion: The women's segment is a significant area of growth within the Australian sportswear market. This expansion is driven by the rising numbers of women participating in sports and fitness activities, coupled with increased visibility and representation of female athletes. Consequently, sportswear brands are actively concentrating on developing designs, products, and inclusive sizing tailored specifically for the female consumer.

- Sustainability Differentiation: Environmental consciousness creates opportunities for brands authentically embracing sustainable practices. Consumers demand transparency regarding materials sourcing, production methods, and supply chain ethics. Brands utilizing recycled materials and sustainable production differentiate themselves in crowded markets.

- Youth Demographics: Australia's large, active youth demographic fuels sustained demand for innovative sportswear reflecting contemporary values. Gen Z prioritizes brands demonstrating social responsibility, diversity, and authentic digital engagement through social media and community-oriented marketing.

- Brisbane 2032 Olympics: Hosting the Brisbane 2032 Olympic and Paralympic Games creates a decade-long opportunity for sportswear brands through heightened sports participation, government infrastructure investments, and international attention focused on Australian athletic achievement.

- Smart Technology Integration: Integration of wearable technology and smart textiles represents emerging growth. Consumers increasingly value apparel tracking fitness metrics, monitoring biometric data, and enhancing performance through sensors and moisture management systems.

Critical Market Challenges

- Intense Competition: The industry faces pressure from both global powerhouses and emerging brands, creating pricing pressure and margin compression. Major international brands leverage economies of scale and extensive marketing budgets that challenge smaller competitors.

- Economic Pressures: Rising inflation and economic uncertainties contribute to decreased consumer spending on non-essential items. The cost-of-living crisis prompts consumers to prioritize essential expenditures, potentially constraining market growth despite strong demand drivers.

- Counterfeit Products: Counterfeit sportswear poses challenges to brand integrity and consumer safety. Inferior products compromise performance while eroding consumer trust, with over 90% of counterfeit seizures occurring in mail and express channels according to enforcement reports.

- Supply Chain Complexity: Implementing sustainable practices throughout global supply chains requires substantial investments in management and verification systems. Regulatory frameworks targeting microplastic emissions add compliance costs affecting product development and pricing.

- Digital Infrastructure: While e-commerce presents opportunities, brands must invest significantly in user experience optimization and cybersecurity. Performance data indicates major brands experience website reliability challenges, with uptime rates below standards potentially translating to millions in lost revenue monthly.

Future Outlook: Australia Sportswear Industry:

- Sustained Market Expansion

The Australian sportswear industry is positioned for sustained expansion through 2034, driven by demographic, cultural, and technological forces transcending short-term economic cycles. Market projections indicate the industry will achieve USD 3.8 Billion by 2033, exhibiting a (CAGR) of 6.05% from 2025-2033.

- Technology and Innovation

Future evolution will feature accelerating technological integration within sportswear products. Smart textiles incorporating biometric sensors, moisture management, and temperature regulation will transition from niche to mainstream features. Materials science advances in compression, breathability, and sustainability will differentiate premium offerings. Brands investing in research and development will establish competitive advantages.

- Sustainability Imperative

Environmental sustainability will transition from differentiator to baseline expectation. Regulatory frameworks addressing textile waste and carbon emissions will intensify pressure for circular economy principles. Leading brands will embrace take-back programs, recycling initiatives, and biodegradable materials. Consumer demands for supply chain transparency will compel comprehensive traceability systems verifying ethical practices.

- Channel Evolution

Digital commerce will potentially exceed 50% of market transactions within the forecast period. Omnichannel strategies integrating online convenience with physical retail experiences will define success. Physical stores will serve as experiential destinations while digital channels provide transactional efficiency. Social commerce through Instagram, TikTok, and metaverse environments will create new acquisition channels for younger demographics.

- Demographic and Competitive Shifts

Brisbane 2032 will serve as a transformative catalyst, creating sustained brand-building opportunities through national pride and athlete excellence associations. Aging populations will drive specialized sportswear for seniors, while youth markets continue prioritizing socially responsible brands. Gender-neutral and inclusive sizing will evolve from progressive initiatives to standard practices. Market consolidation through mergers and acquisitions will accelerate as brands seek scale advantages and technology capabilities.

Unlock Strategic Insights for the Australia Sportswear Industry:

Choose IMARC Group for unmatched expertise and core services in sportswear market intelligence:

- Data-Driven Market Research: Access comprehensive insights into Australia's sportswear market dynamics, consumer behavior patterns, distribution channel evolution (e-commerce vs. physical retail), and competitive positioning. Our research provides granular analysis of market segmentation, pricing strategies, and emerging opportunities in athleisure and performance wear.

- Strategic Growth Forecasting: Anticipate market trajectory through detailed forecasting models incorporating demographic trends (youth and aging markets), economic indicators, technological innovations (smart textiles), and shifts in consumer preferences. Enable confident decision-making for product development and market entry timing, particularly around events like the Brisbane 2032 Olympics.

- Competitive Benchmarking: Gain actionable intelligence on competitive dynamics, market share distribution, and strategic positioning of major local and global players. Monitor product pipeline developments, innovation strategies, and marketing approaches (including social commerce) that define competitive success.

- Sustainability and Policy Advisory: Stay ahead of transformative trends and regulatory frameworks addressing textile waste, microplastic emissions, and supply chain ethics. Inform proactive strategies for adopting circular economy principles and verifying ethical sourcing claims.

- Custom Reports and Consulting: Receive tailored insights aligned with your organizational objectives—be it launching a new line of sustainable activewear, evaluating potential brand acquisitions, optimizing your omnichannel distribution, or assessing technology integration initiatives. Our consulting provides actionable recommendations grounded in deep industry expertise.

At IMARC Group, we empower sportswear industry leaders, investors, and decision-makers with the clarity and intelligence required to navigate Australia's dynamic marketplace—because every strategic decision matters in winning the future of fitness fashion. For more details, click on this link: https://www.imarcgroup.com/australia-sportswear-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)