Top Factors Driving Growth in the Saudi Arabia Real Estate Market

Introduction to the Saudi Arabia Real Estate Industry:

The Saudi Arabia real estate market stands at a pivotal juncture in its evolution, representing one of the most dynamic and transformative sectors within the Kingdom's economy. With this country having a very ambitious agenda of economic diversification and modernization, the real estate business has come out as one of the pillars of this transformation. The market is rich in variety of types of property, starting with residential and commercial developments to recreational places, industrial complexes, and mixed-use projects that are dynamically changing to meet the demands of fast modernizing society.

The Saudi real estate market has undergone substantial structural changes in recent years, moving away from traditional models toward more sophisticated, regulation-driven frameworks that align with international best practices. This development is an indication that the Kingdom is dedicated to establishing a sustainable, transparent and friendly investment environment to the capital, both local and international. The significance of the sector goes beyond just the construction action but can be viewed as an indicator of economic confidence, a source of employment and an agent of change in the city life of both the large metropolitan regions and the new cities.

Understanding the Saudi Arabia real estate market overview requires recognizing the interplay between demographic forces, policy initiatives, technological adoption, and shifting consumer preferences. All these have led to a situation where stakeholders in the entire value chain, such as developers and investors, construction firms, and property management companies have opportunities never seen before in the history of the industry. The real estate industry will be part of the success of the Kingdom in its pursuit of economic diversification, which will in turn help enhance the overall aims of social development, creation of employment opportunities, and improvement in the quality of life among members of society and tourists.

Rapid Urbanization and Infrastructure Development:

One of the most significant drivers propelling the Saudi Arabia real estate market growth forward is the accelerating pace of urbanization and the corresponding infrastructure investments that are reshaping the Kingdom's physical landscape. The concentration of economic activities in major urban centers has created sustained demand for residential, commercial, and industrial properties, while simultaneously necessitating the development of supporting infrastructure including transportation networks, utilities, and public amenities.

The Kingdom's approach to urbanization extends beyond simply accommodating population growth; it embodies a strategic vision to create world-class cities that can compete on the global stage for talent, investment, and innovation. This ambition is reflected in the development of giga-projects and mega-developments that integrate advanced urban planning principles, sustainable design methodologies, and cutting-edge technologies. These initiatives are fundamentally altering the Saudi Arabia real estate market trends 2025 by establishing new benchmarks for quality, sustainability, and liveability.

Infrastructure development serves as both a catalyst and enabler for real estate growth. The expansion of transportation networks, including metro systems, high-speed rail connections, and modernized airports, enhances connectivity and accessibility, thereby unlocking previously underutilized land parcels for development. Similarly, investments in digital infrastructure, including fiber-optic networks and smart city technologies, are creating new value propositions for property developers who can integrate these capabilities into their projects.

The emphasis on creating integrated urban communities represents a departure from traditional development patterns. Modern projects increasingly incorporate mixed-use designs that combine residential, commercial, retail, and recreational spaces within walkable, transit-oriented neighborhoods. This holistic approach to urban development not only enhances the quality of life for residents but also creates more sustainable and economically vibrant communities that can adapt to changing demographic and economic conditions.

Explore in-depth findings for this market, Request Sample

Expansion of Tourism and Hospitality Projects under Vision 2030:

The transformation of the Saudi Arabia real estate market outlook is inextricably linked to the Kingdom's ambitious tourism strategy, which forms a central pillar of Vision 2030. The strategic decision to open the Kingdom to international tourism and position it as a global destination has created unprecedented demand for hospitality infrastructure, entertainment venues, cultural attractions, and supporting real estate developments. This shift represents a fundamental recalibration of the sector's dynamics, introducing new property types, investment models, and operational frameworks.

The tourism-driven real estate expansion encompasses multiple dimensions, from luxury resort developments in coastal regions to heritage restoration projects in historic districts and entertainment complexes in urban centers. Each of these initiatives requires specialized real estate expertise, from design and construction to operations and asset management. The diversification of tourism offerings, ranging from religious pilgrimages and cultural experiences to adventure tourism and business travel, necessitates a corresponding diversity in hospitality real estate products.

The Saudi Arabia real estate market outlook 2025 is significantly influenced by the Kingdom's goal of attracting substantial international visitor arrivals annually. Achieving this ambitious target requires not only the development of accommodation facilities but also the creation of comprehensive tourism ecosystems that include retail destinations, entertainment venues, dining establishments, and experiential attractions. This holistic approach to tourism development is generating ripple effects throughout the real estate sector, creating opportunities for specialized developers and operators across multiple property categories.

Beyond the direct hospitality infrastructure, tourism expansion is driving demand for related real estate assets including convention centers, exhibition facilities, transportation hubs, and second-home developments. The emergence of tourism-related special economic zones and destination developments is creating new investment opportunities and introducing innovative financing and operational models to the Kingdom's real estate sector. These developments are attracting international expertise and capital, further accelerating the sector's modernization and sophistication.

Growing Investments in Affordable and Smart Housing:

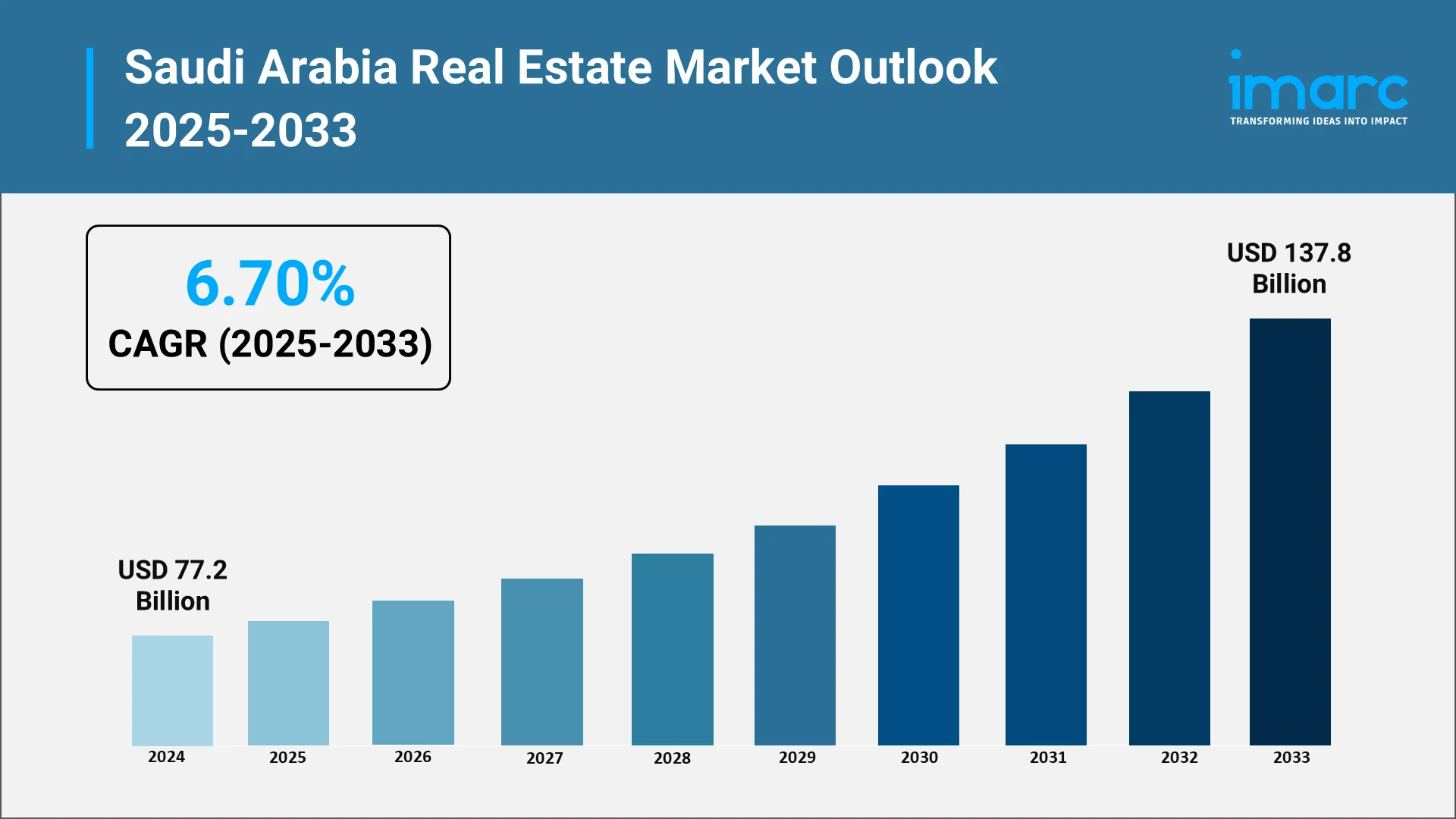

The residential segment of the Saudi Arabia real estate market size is experiencing transformative change driven by twin imperatives: expanding access to affordable homeownership and embracing smart technologies that enhance quality of life. The Kingdom's commitment to increasing homeownership rates among citizens has catalyzed substantial investments in affordable housing programs, creating significant demand for residential development across various price points and property types. The Saudi Arabia real estate market size was valued at USD 77.2 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 137.8 Billion by 2034, exhibiting a CAGR of 6.70% during 2026-2034.

Affordable housing initiatives represent more than simple construction programs; they embody comprehensive approaches to community development that integrate quality design, adequate amenities, and strategic location planning. The emphasis on creating sustainable, well-planned communities rather than merely delivering housing units reflects a mature understanding of the multifaceted role that residential real estate plays in social development and economic prosperity. This approach ensures that affordable housing projects contribute positively to urban fabric and resident wellbeing.

The integration of smart technologies into residential developments is revolutionizing the Saudi Arabia real estate market trends by creating properties that offer enhanced convenience, security, efficiency, and sustainability. Smart homes equipped with automated systems for climate control, lighting, security, and energy management are transitioning from luxury features to standard expectations, particularly among younger buyers and renters. This technological evolution is reshaping developer strategies, construction methodologies, and property management practices.

The convergence of affordability objectives and technological advancement is creating innovative housing models that deliver value without compromising quality. Developers are leveraging modern construction techniques, including modular and prefabricated building systems, to reduce costs while maintaining high standards. Similarly, the adoption of energy-efficient designs and renewable energy integration helps reduce operational costs for homeowners, making properties more affordable over their lifecycle. These approaches are establishing new paradigms for residential real estate development that balance economic accessibility with modern amenities and sustainable operations.

Rising Demand for Commercial and Mixed-Use Properties:

The evolution of the Saudi Arabia real estate market share across different property categories reflects fundamental shifts in economic structure, consumer behavior, and urban living preferences. Commercial real estate, encompassing office buildings, retail centers, logistics facilities, and industrial parks, is experiencing robust demand driven by the Kingdom's economic diversification efforts and the growth of new sectors beyond traditional oil and gas industries.

The office market is being reshaped by the emergence of new industries, the expansion of multinational corporations' presence, and the growth of the entrepreneurial ecosystem. Modern office developments emphasize flexibility, technological integration, and amenities that support employee wellbeing and productivity. The rise of flexible workspace solutions, co-working facilities, and innovation hubs reflects changing work patterns and organizational structures, creating new subsegments within the commercial real estate market.

Retail real estate is undergoing significant transformation as consumer preferences shift and e-commerce adoption accelerates. While traditional shopping mall models face challenges, experiential retail concepts that integrate entertainment, dining, and social experiences are thriving. Developers are reimagining retail spaces as community gathering places that offer value beyond mere transactions, incorporating elements such as cultural programming, recreational facilities, and technology-enhanced experiences that cannot be replicated online.

Mixed-use developments represent the future direction of the Saudi Arabia real estate market forecast 2025 by creating integrated environments that combine residential, commercial, retail, and hospitality components within cohesive, walkable communities. These projects respond to contemporary urbanization trends favoring convenience, sustainability, and vibrant urban experiences. Mixed-use developments generate synergies across different property types, creating more resilient investment assets that can adapt to changing market conditions and consumer preferences while contributing to more sustainable urban development patterns.

Government Initiatives to Promote Real Estate Transparency and Regulation:

The institutional framework governing the Saudi Arabia real estate market statistics 2025 has undergone comprehensive modernization, establishing robust regulatory mechanisms that enhance transparency, protect stakeholder rights, and promote market efficiency. These reforms reflect the Kingdom's recognition that well-functioning real estate markets require clear rules, transparent processes, and effective enforcement mechanisms that build confidence among all participants.

Regulatory reforms have addressed multiple dimensions of real estate transactions, from property registration and title documentation to mortgage lending and property management standards. The digitalization of property records and transaction processes has reduced complexity, minimized transaction costs, and enhanced accessibility for all market participants. Electronic platforms for property registration, title verification, and transaction completion are streamlining processes that historically involved extensive paperwork and lengthy processing times.

The establishment of specialized regulatory bodies with clear mandates for market oversight has strengthened governance and accountability within the Kingdom of Saudi Arabia real estate market. These institutions develop and enforce standards, resolve disputes, and ensure compliance with established regulations. Their presence provides market participants with recourse mechanisms and confidence that rules will be applied consistently and fairly, creating a more predictable operating environment that encourages long-term investment.

Consumer protection frameworks have been strengthened to ensure that buyers, sellers, tenants, and landlords operate within clear legal parameters that define their rights and obligations. Enhanced disclosure requirements for developers, improved contract standardization, and more effective dispute resolution mechanisms protect consumers while promoting professional practices among real estate service providers. These reforms are elevating industry standards and encouraging the professionalization of real estate services, from brokerage and property management to development and construction.

Opportunities and Challenges in the Saudi Arabia Real Estate Industry:

The Saudi Arabia real estate market 2025 outlook presents a compelling landscape of opportunities balanced against significant challenges that will shape the sector's trajectory. Understanding both dimensions is essential for stakeholders seeking to navigate this dynamic environment successfully and capitalize on emerging possibilities while managing inherent risks.

Opportunities within the Kingdom's real estate sector are multifaceted and substantial. The ongoing economic transformation creates demand across all property categories as new industries establish operations, international companies expand their presence, and consumer spending patterns evolve. The tourism expansion generates opportunities not only in hospitality but across the broader ecosystem of supporting real estate assets. Demographic factors, including a young, increasingly educated population and evolving household formation patterns, sustain residential demand across multiple segments. The Kingdom's strategic geographic position as a logistics hub connecting Asia, Europe, and Africa creates opportunities in industrial and logistics real estate.

Technological adoption represents another significant opportunity dimension. The integration of smart building technologies, sustainable design principles, and innovative construction methodologies enables developers to differentiate their offerings and create value-added propositions for buyers and tenants. The digitalization of real estate services, from property search and transaction processes to building management and tenant services, is creating efficiencies and enhancing user experiences across the value chain.

However, the sector also faces meaningful challenges that require careful navigation. Market cyclicality inherent to real estate requires sophisticated risk management and financial planning. Balancing supply and demand across different property types and geographic markets demands accurate market intelligence and disciplined development strategies. The rapid pace of change in technology, consumer preferences, and regulatory frameworks requires agility and adaptability from market participants.

Talent development represents an ongoing challenge as the sector requires skilled professionals across multiple disciplines, from urban planning and architecture to project management and property technology. Building local capacity while attracting international expertise requires coordinated efforts among industry participants, educational institutions, and government agencies. Similarly, ensuring sustainable development practices that balance economic objectives with environmental stewardship and social responsibility requires sustained commitment and innovation across the development community.

Future Outlook for the Saudi Arabia Real Estate Industry:

The Saudi Arabia real estate market news today reflects an industry in transition, moving toward a more mature, diversified, and internationally integrated sector that will play an increasingly important role in the Kingdom's economic landscape. The future trajectory of the market will be shaped by the continued implementation of transformative national strategies, evolving consumer expectations, technological innovation, and the Kingdom's deepening integration into global real estate capital markets.

The residential segment will likely see continued emphasis on homeownership expansion, with innovation in financing mechanisms, product types, and community designs that respond to evolving lifestyle preferences. The emergence of new urban centers and satellite cities will create development opportunities beyond traditional metropolitan areas, while existing cities undergo densification and renewal processes that modernize aging neighborhoods and infrastructure.

Commercial real estate will reflect the Kingdom's economic diversification, with growing demand from new sectors including technology, entertainment, healthcare, and professional services. The evolution of work patterns and organizational structures will drive continued innovation in office design and workspace solutions. Retail will continue its transformation toward experiential and community-oriented formats that complement rather than compete with e-commerce.

The hospitality and tourism-related real estate sectors will expand substantially as the Kingdom establishes itself as a significant global tourism destination. This expansion will encompass not only traditional hotel products but also alternative accommodation formats, entertainment venues, and destination developments that create comprehensive tourism ecosystems.

Sustainability will emerge as a central consideration across all property types, driven by both regulatory requirements and market demand. Green building certifications, energy-efficient designs, renewable energy integration, and circular economy principles will transition from differentiators to standard expectations. The real estate sector's role in achieving broader environmental and social objectives will receive increasing emphasis from policymakers, investors, and consumers.

Technological integration will accelerate across all dimensions of real estate activity, from development and construction to operations and transactions. Artificial intelligence, Internet of Things technologies, blockchain applications, and advanced data analytics will create new capabilities and efficiencies while fundamentally transforming how properties are designed, built, marketed, transacted, and managed.

The internationalization of the Kingdom's real estate sector will deepen as cross-border capital flows increase, international developers and operators expand their presence, and local firms develop capabilities to compete regionally and globally. This integration will bring new standards, practices, and innovations while creating opportunities for knowledge transfer and partnership.

Choose IMARC Group for Unmatched Real Estate Market Intelligence and Strategic Advisory:

- Comprehensive Market Analysis: Enhance your understanding of the Saudi Arabia real estate landscape through detailed research examining residential, commercial, hospitality, and industrial segments, alongside emerging trends in smart buildings, sustainable development, and mixed-use projects.

- Strategic Development Forecasting: Anticipate future opportunities in urban expansion, mega-project development, tourism infrastructure, and affordable housing initiatives by analyzing demographic shifts, policy changes, and investment patterns across key Saudi regions.

- Competitive Intelligence: Evaluate competitive dynamics in the Kingdom's real estate sector, assess developer positioning, monitor project pipelines, and identify strategic opportunities in undersupplied segments and emerging submarkets.

- Regulatory and Policy Advisory: Stay ahead of evolving regulatory frameworks, government initiatives, foreign investment policies, and compliance requirements affecting property development, transactions, and ownership across Saudi Arabia's transforming real estate landscape.

- Customized Research and Consulting: Access tailored insights aligned with your specific objectives, whether entering the Saudi market, identifying investment opportunities, evaluating development sites, or formulating portfolio strategies for the Kingdom's dynamic real estate sector.

At IMARC Group, we empower real estate professionals, investors, and developers with the clarity and intelligence required to navigate Saudi Arabia's transformative property market. Partner with us to unlock opportunities in one of the world's most dynamic real estate landscapes, because strategic insight drives successful outcomes.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)