Top Factors Driving Growth in the UK Blockchain Market

How the UK is Positioning Itself as Europe's Blockchain Innovation Leader:

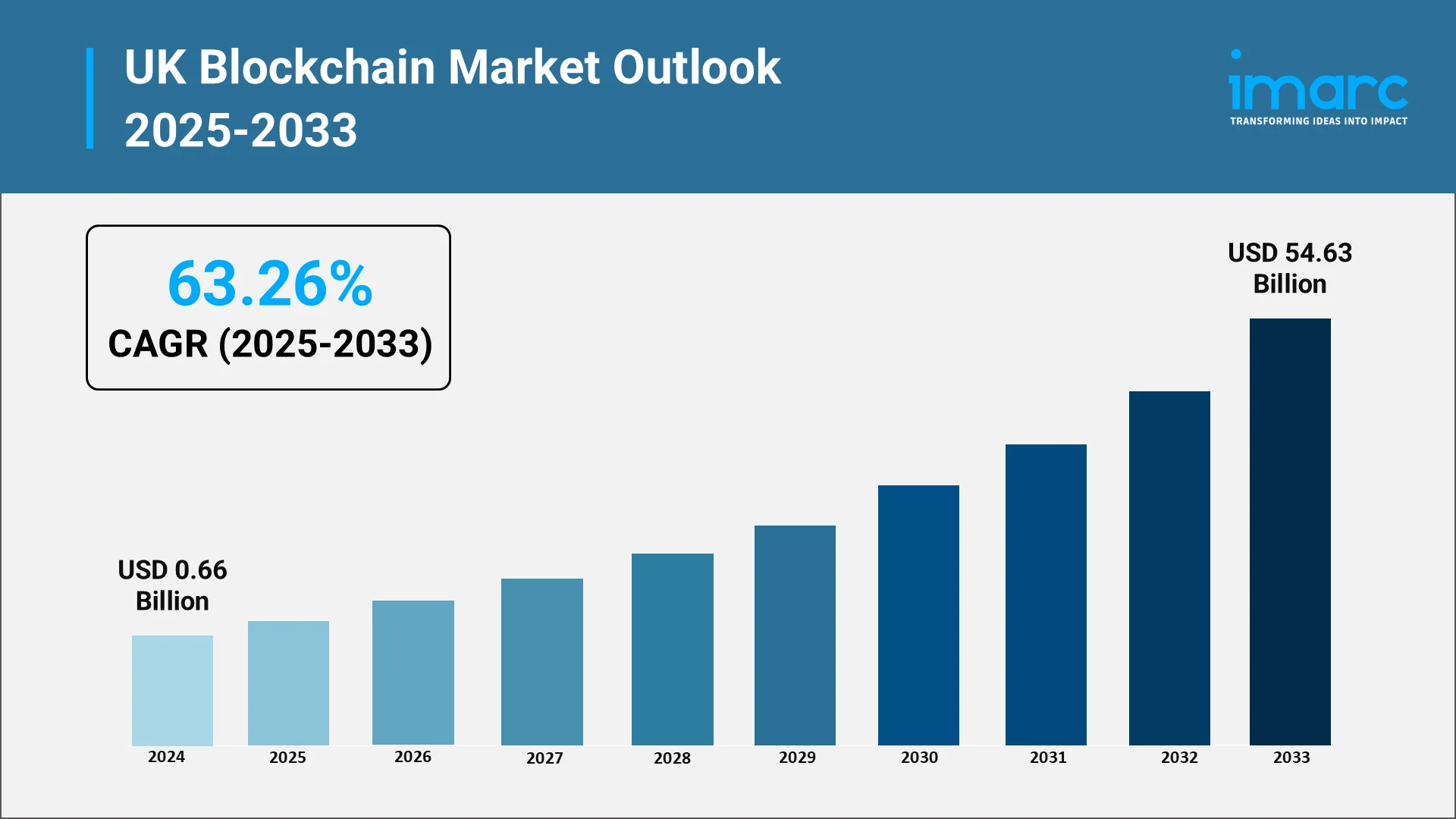

The United Kingdom is currently establishing itself as one of Europe's most dynamic blockchain innovation hubs, demonstrating remarkable resilience and growth despite global economic uncertainties. The UK blockchain market reached a valuation of USD 0.66 Billion in 2024 and is projecting explosive growth toward USD 54.63 Billion by 2033, exhibiting a compound annual growth rate (CAGR) of 63.26% during the forecast period. This extraordinary trajectory is placing the nation at the forefront of distributed ledger technology adoption and development.

London's status as a global financial centre is amplifying the country's blockchain ecosystem, attracting substantial venture capital investment and fostering collaboration between established financial institutions and innovative blockchain startups. As of 2024, UK-based blockchain companies are collectively raising approximately £167 million through 62 funding deals, signalling robust investor confidence in the sector's future potential. The convergence of regulatory clarity, technological advancement, and entrepreneurial dynamism is creating fertile ground for blockchain innovation across multiple industry verticals.

Explore in-depth findings for this market, Request Sample

Understanding Market Valuation and Future Growth Trajectories:

The UK blockchain market is experiencing unprecedented expansion, driven by accelerating enterprise adoption and increasing recognition of blockchain's potential to revolutionize business operations.

Recent market intelligence is revealing that blockchain adoption in UK enterprises is reaching critical mass, with 12% of UK adults now owning some form of digital asset in 2024. This consumer-level adoption is paralleling institutional interest, as people in the UK are currently demonstrating awareness about cryptocurrency and blockchain technology. The expanding user base is creating network effects that are accelerating market growth and encouraging further business investment in blockchain infrastructure.

Investment activity is reflecting this optimistic outlook. In February 2024, Blockchain.com announced the successful first close of its $110 million Series E strategic funding round, led by Kingsway Capital, with participation from prominent investors including Baillie Gifford, Lakestar, Lightspeed Venture Partners, GV, Access Industries, Moore Capital, and Coinbase Ventures. This substantial funding round is highlighting continued confidence in London-based blockchain companies' growth potential and their ability to scale innovative solutions globally.

The blockchain-as-a-service (BaaS) segment is emerging as a particularly strong growth driver, enabling small and medium-sized enterprises to overcome barriers in trade finance and global supply chains. The growing reliance on cloud-based platforms, accelerated by remote working trends, is fuelling demand for BaaS across multiple sectors, including finance, healthcare, and logistics.

What is Accelerating Enterprise Blockchain Implementation:

Multiple convergent factors are propelling blockchain technology trends and driving rapid enterprise adoption across the United Kingdom. The increasing need for data privacy and cybersecurity solutions is ranking among the most significant catalysts, as organizations are seeking robust technologies to protect sensitive information in an increasingly digital economy.

The escalating demand for secure and efficient cross-border payments and remittances is serving as another powerful growth driver. Traditional global payment systems are frequently requiring numerous intermediaries, causing delays and imposing high transaction costs. Blockchain solutions are providing faster, more affordable, and transparent international transactions, leading to their increased adoption in finance and remittance industries.

Rising collaboration between blockchain startups and large enterprises is creating synergies that are accelerating innovation and market penetration. Established corporations are recognizing that partnering with agile blockchain startups enables them to access cutting-edge technology and innovative business models without the constraints of legacy systems. These collaborations are spanning various forms, from joint ventures and strategic partnerships to corporate venture investments and technology licensing agreements.

Navigating the UK's Evolving Regulatory Framework and Standards:

The United Kingdom is currently implementing one of the world's most comprehensive and forward-thinking digital asset regulation frameworks, balancing consumer protection with innovation enablement. Throughout 2025 and 2026, HM Treasury and the Financial Conduct Authority (FCA) are introducing and consulting on a comprehensive new suite of regulations for cryptoassets and related blockchain technologies, positioning the UK to become a global standard-setter in this emerging regulatory domain.

In a landmark development, the Property (Digital Assets) Bill was introduced in September 2024 and progressed through 2024-25, confirming the legal status of digital assets as a distinct category of personal property. This legislation is providing crucial legal clarity and protection for blockchain-based assets, addressing longstanding ambiguity around digital property rights. The Bill received its second reading in the House of Commons in July 2025, representing a significant milestone in the UK's blockchain regulatory journey.

Importantly, in 2025, the UK government amended legislation to exclude cryptocurrency staking from the definition of collective investment schemes, demonstrating regulatory flexibility and responsiveness to industry feedback.

Discovering Transformative Use Cases Across Industry Sectors:

Blockchain technology is demonstrating remarkable versatility, with innovative applications emerging across diverse sectors throughout the UK economy. In the financial services sector, blockchain is revolutionizing payments, settlements, and digital asset management, with institutions exploring Central Bank Digital Currencies (CBDCs) as potential game-changers for monetary policy and payment infrastructure. In 2024, Barclays proposed a digital pound integration framework, aligning with the UK's CBDC exploration efforts to enhance payments, strengthen security, and improve merchant transactions through blockchain-like features for fraud prevention and reliability.

The healthcare sector is witnessing transformative blockchain applications, particularly in medical records management, pharmaceutical supply chains, and clinical trial data integrity. Blockchain's capacity to securely store patient records while ensuring data integrity and confidentiality is addressing long-standing interoperability and security challenges in healthcare information systems. Companies are operating medical device traceability platforms that provide comprehensive views of each device's lifecycle, from raw material through patient application to eventual disposal, demonstrating blockchain's potential to enhance patient safety and regulatory compliance.

Supply chain management is emerging as one of the most promising blockchain application areas, with organizations leveraging distributed ledger technology to enhance transparency, traceability, and efficiency throughout complex global supply networks. Blockchain is enabling real-time tracking of goods, verification of authenticity, and automated compliance documentation, reducing fraud risks and streamlining operations. This capability is proving particularly valuable in industries where provenance and authenticity are critical, such as pharmaceuticals, luxury goods, and food products.

In 2024, SETL announced the launch of its LedgerSwarm RLN test network, Tranquility, designed to allow participants to test Regulated Liability Network (RLN) applications. This network is driving innovation in the financial sector by enabling banks, financial institutions, and tech providers to explore RLN technology, which unifies various regulated monetary forms, including tokenized deposits, central bank digital currencies, and regulated stablecoins with tokenized assets. This initiative is positioning the UK as a leader in blockchain innovation and digital financial infrastructure development.

Anticipating Future Growth Catalysts and Market Evolution:

Looking ahead, multiple factors are positioning the UK blockchain market for continued robust expansion through 2033 and beyond. The integration of blockchain with other transformative technologies, particularly artificial intelligence, Internet of Things, and quantum-resistant cryptography, is creating powerful synergies that are expanding blockchain's applicability and value proposition. Companies are increasingly exploring how these technological combinations can address complex business challenges and create entirely new product categories.

The tokenization of real-world assets is representing a particularly significant growth opportunity. The UK's regulatory clarity and institutional blockchain infrastructure are positioning it favorably to capture a substantial share of this emerging market, as traditional asset managers explore blockchain-based alternatives to conventional securities and fund structures.

Decentralized finance (DeFi) platforms are continuing to reshape traditional financial services by removing intermediaries, lowering costs, and democratizing access to financial products. Through blockchain technology, DeFi is enabling direct transactions, allowing users to earn interest or rewards by participating in networks through yield farming and staking products. This evolution is creating opportunities for both retail and institutional investors while challenging traditional banking business models.

The expanding enterprise blockchain-as-a-service market is lowering barriers to blockchain adoption, enabling organizations of all sizes to integrate distributed ledger capabilities without significant upfront infrastructure investment. Cloud providers and specialized blockchain platforms are offering turnkey solutions that simplify deployment, reduce costs, and accelerate time-to-value, driving broader market penetration across industries.

Sustainability considerations are increasingly influencing blockchain development, with growing emphasis on energy-efficient consensus mechanisms and applications supporting environmental, social, and governance (ESG) objectives. Blockchain's potential to enhance carbon credit tracking, supply chain sustainability verification, and circular economy models is attracting interest from organizations committed to sustainable business practices.

The UK government's proactive approach to blockchain regulation, coupled with initiatives like the Digital Securities Sandbox and CBDC exploration, is signalling long-term commitment to positioning the nation as a global blockchain leader. This supportive policy environment, combined with London's established financial services ecosystem and strong technology talent pool, is creating sustainable competitive advantages that are attracting international blockchain investment and talent.

As the regulatory framework solidifies through 2026, market participants can expect increased institutional participation, greater integration between traditional finance and blockchain-native systems, and continued innovation in blockchain applications across sectors. The UK's principle-based, technology-neutral regulatory approach is providing flexibility to accommodate emerging use cases while maintaining robust consumer protection and market integrity standards.

The convergence of regulatory clarity, technological maturation, increasing enterprise adoption, and growing consumer awareness is creating a powerful momentum driving the UK blockchain market toward its projected valuation by 2033. Organizations positioning themselves strategically within this ecosystem, whether as technology providers, financial institutions, regulators, or end-users, are recognizing blockchain's transformative potential and taking concrete steps to capture value from this fundamental shift in how digital information, assets, and trust are managed in the modern economy.

Driving Digital Trust: IMARC Group’s Contribution to the UK Blockchain Market

IMARC Group is delivering critical insights into the expanding UK blockchain market, empowering businesses, investors, and policymakers across finance, logistics, healthcare, and public services to make informed and strategic choices. Our research and consulting capabilities enable effective decision-making on adoption, regulation, and innovation through:

- Market Intelligence and Insights: Comprehensive analysis of the UK’s blockchain ecosystem, covering market structure, adoption trends, and technology applications across industries. Insights explore opportunities in banking and financial services, supply chain management, healthcare data systems, and digital identity verification.

- Strategic Forecasting: Forward-looking evaluation of growth trajectories, investment flows, and evolving applications of blockchain. Forecasts assess how distributed ledger technology will redefine transparency, efficiency, and security within the UK’s digital economy.

- Competitive Benchmarking: Continuous assessment of domestic and global participants shaping the UK Blockchain Market, including fintech innovators, established technology providers, and start-up ecosystems. Reviews focus on competitive strategies, partnership models, and innovation pipelines driving blockchain implementation.

- Policy and Regulatory Analysis: Examination of government-led blockchain initiatives, evolving regulations from the Financial Conduct Authority (FCA), and emerging standards for data privacy, smart contracts, and tokenized assets. Our recommendations align with national digital strategies and compliance frameworks.

- Tailored Consulting Solutions: Customized advisory support for blockchain integration, digital asset management, and enterprise transformation. Our solutions align business objectives with the UK’s strengths in finance, technology, and regulation—enabling secure, scalable, and ethical blockchain adoption.

IMARC Group continues to serve as a trusted partner in advancing blockchain innovation across the UK, enabling organizations to harness transparency, traceability, and trust in a rapidly digitizing world.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)