Aluminium Conductor Cost Model: From Wire Rod to Power-Grid Value

_11zon.webp)

What is Aluminium Conductor?

Aluminium conductors are electrical wires or cables whose current-carrying core is primarily made of aluminium (or its alloys), used for overhead transmission lines, distribution, AAC (All Aluminium Conductor), AAAC (All Aluminium Alloy Conductor), ACSR (Aluminium Conductor Steel Reinforced), etc.

Key Applications Across Industries:

The material is lightweight, has relatively good electrical conductivity (lower than copper but acceptable for many applications), and is cost-effective per unit weight. Key properties include conductivity, tensile strength, corrosion resistance (especially for AAAC), mechanical rigidity (especially when steel core is used), ductility for drawing and stranding processes, and compatibility with connectors etc.The processing involves melting/refining aluminium, alloying (if needed), casting/rolling into billets/wire rods, drawing, stranding, annealing, surface treatment, testing, and packaging. Applications are power transmission and distribution, overhead lines, industrial and utility infrastructure, sometimes in telecommunications or specialty cables. Advantages include lower material costs vs copper, lighter weight (reducing support structure cost), good recyclability, and adaptability across many voltages. Sustainability benefits include high recyclable content and lower energy consumption when using recycled aluminium ingots; potential to reduce the lifecycle environmental impact. Future outlook looks promising: growing electricity demand, expansion of grids (especially in developing countries), renewable energy transmission lines, demand for lighter high-voltage lines, plus improvements in alloys, manufacturing efficiency, and stricter environmental regulation pushing recycling and energy efficiency.

What the Expert Says: Market Overview & Growth Drivers

The global aluminium conductor market size reached USD 48.2 Billion in 2024. According to IMARC Group, the market is projected to reach USD 75.2 Billion by 2033, at a projected CAGR of 4.9% during 2025-2033. The aluminium conductor market is driven by multiple perennial demand factors: expansion of electrical grids both in developed and developing regions; increasing electrification (homes, EVs, industrial loads); growth in renewable energy (solar, wind) which needs long transmission lines; need for cost-efficient materials as copper prices rise; infrastructure projects including rural electrification and smart grid deployment.

Futuristic trends include greater use of recycled aluminium in producers’ feedstock; development of higher-performance aluminium alloys for conductors; automation and digitalization in manufacturing to reduce labor costs and improve quality; advanced line balancing and process optimization to reduce idle times and increase throughput. Competitive advantages of aluminium conductor manufacturers include lower raw material cost compared to copper-based conductors, ability to supply lighter wires (less structural support), and recyclability. Challenges/risks: volatility in aluminium ingot prices; energy cost, especially electricity (smelting, rolling, etc.); competition from alternative conductor materials or technologies; maintaining quality in presence of recycled content; logistical and supply chain disruptions. From sustainability side: using recycled aluminium significantly cuts energy consumption and CO2 emissions versus virgin aluminium. Also, regulatory pressure to reduce carbon footprint and to ensure environmental compliance is increasing. The industry response: many manufacturers are adopting recycling, installing energy-efficient equipment, employing process improvements, hedging raw material purchases, and forming partnerships to ensure stable supply of high-quality aluminium feedstock.

Case Study on Cost Model of Aluminium Conductor Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a medium-to-large-scale aluminium conductor manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed aluminium conductor manufacturing plant in India. This plant is designed to produce 40,000 tons of total aluminium conductors per year.

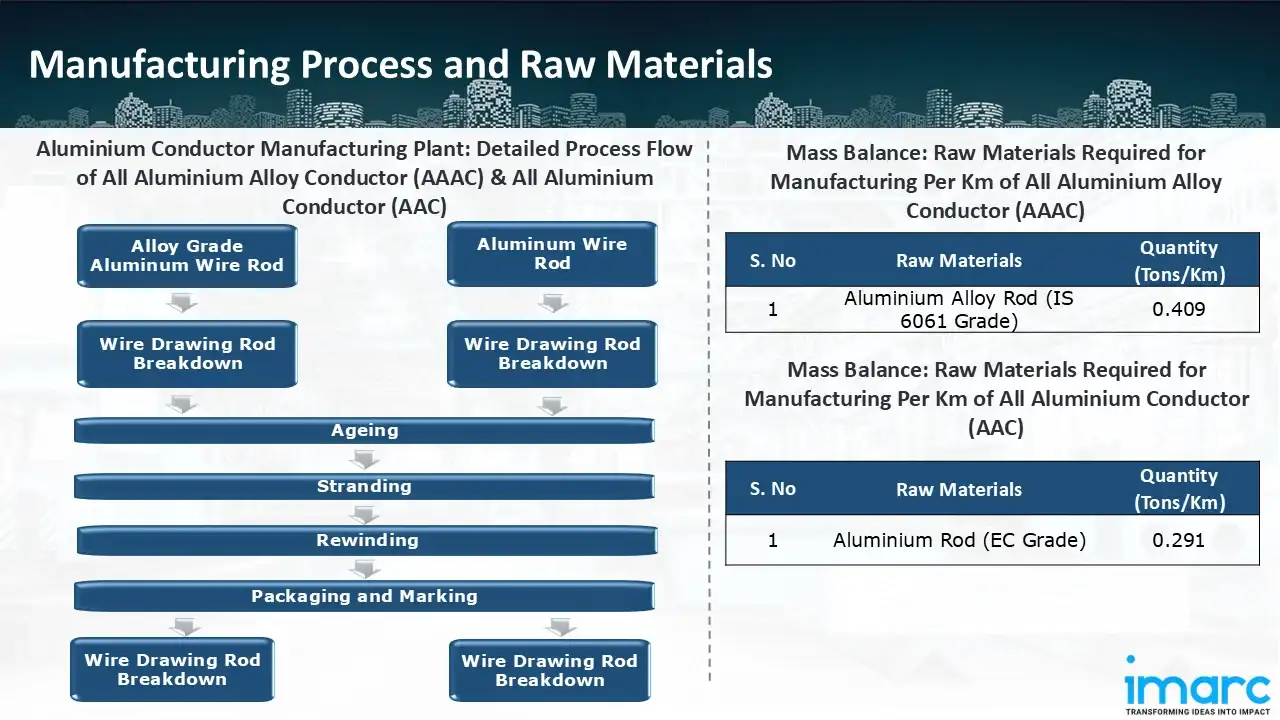

Manufacturing Process: The manufacturing of ACSR, AAAC, and AAC conductors follows a systematic process to ensure high performance and durability. The input materials vary by conductor type: AAC uses high-purity aluminium rods for excellent conductivity and corrosion resistance, AAAC uses aluminium alloy rods containing elements like magnesium, silicon, and copper for greater strength, while ACSR combines EC grade aluminium rods with galvanized steel wires to balance conductivity and mechanical strength. The process begins with aluminium wire drawing, where rods are gradually reduced in diameter through a series of dies under tensile force. This multi-stage reduction produces wires with the desired uniformity, flexibility, and mechanical strength. For AAC, the drawn aluminium wires are stranded into a helical core. In AAAC, both aluminium and alloy wires are stranded together, often using tubular, bobbin pintle, or cage-type stranding machines, with ageing sometimes applied to improve mechanical properties. ACSR manufacturing involves skip stranding of aluminium wires to form the conductive core, followed by tubular stranding of galvanized steel wires around it, ensuring strength to withstand environmental stress. Throughout all types, stranding machines ensure precise twisting and configuration for durability and efficiency. After stranding, conductors undergo rigorous testing, including electrical conductivity, tensile strength, elongation, corrosion resistance, and visual inspections to confirm compliance with standards. Once approved, conductors are carefully packaged to prevent mechanical damage, moisture, and contamination during storage and transport. Auxiliary systems such as hydraulic and lubrication systems support production, maintaining efficiency, reducing breakdowns, and ensuring consistent quality. This integrated process results in reliable conductors suitable for varied power transmission applications.

_11zon.webp)

Mass Balance and Raw Material Required: The primary raw materials used in the aluminium conductor steel reinforced (ACSR) manufacturing plant are Aluminium Rod (EC Grade) and Galvanized Steel (IS 4826). For a plant producing 1 ton of aluminium conductor steel reinforced (ACSR), 0.44 ton of Aluminium Rod (EC Grade) and 0.291 ton of Galvanized Steel (IS 4826) are required.

Mass Balance and Raw Material Required: The primary raw materials used in the All Aluminium Alloy Conductor (AAAC) manufacturing plant are Aluminium Alloy Rod (IS 6061 Grade). For a plant producing 1 ton of all aluminium alloy conductor (AAAC), 0.409 ton of Aluminium Alloy Rod (IS 6061 Grade) are required.

The primary raw materials used in the All Aluminium Conductor (AAC) manufacturing plant are Aluminium Rod (EC Grade). For a plant producing 1 ton of all aluminium conductor (AAC), 0.291 ton of Aluminium Rod (EC Grade) are required.

Techno-Commercial Parameter:

- Capital Investent (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

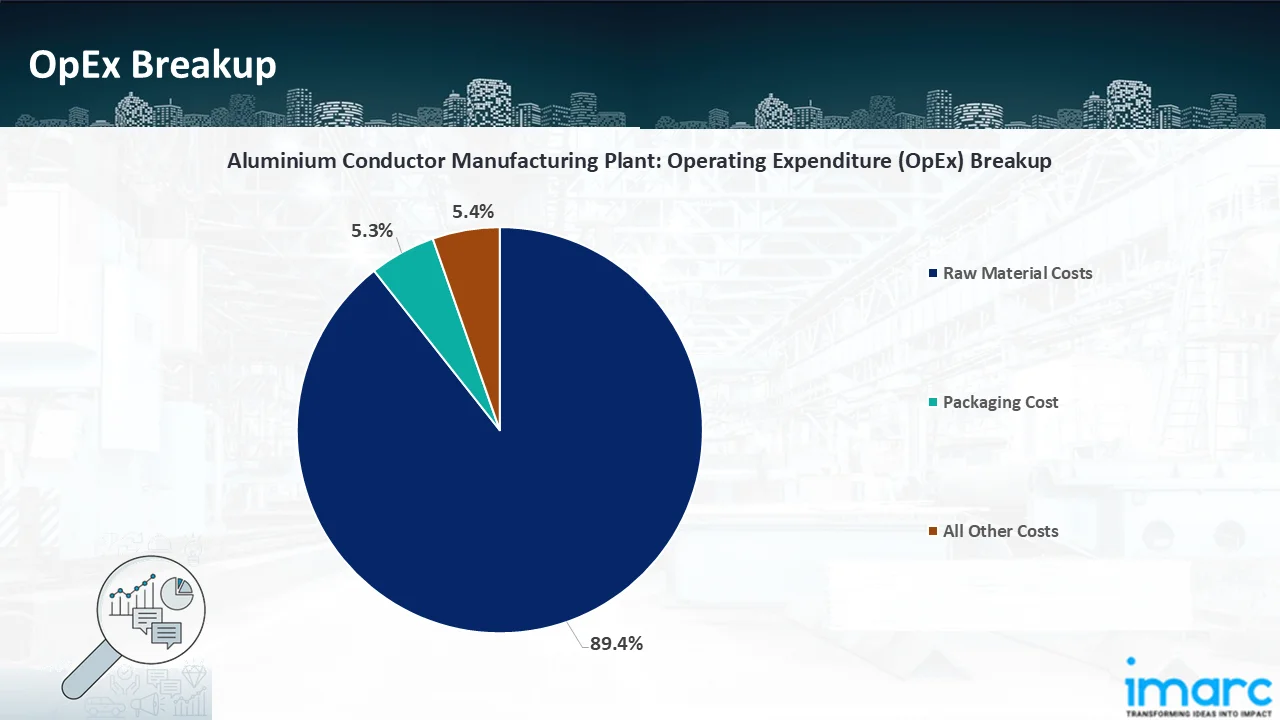

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

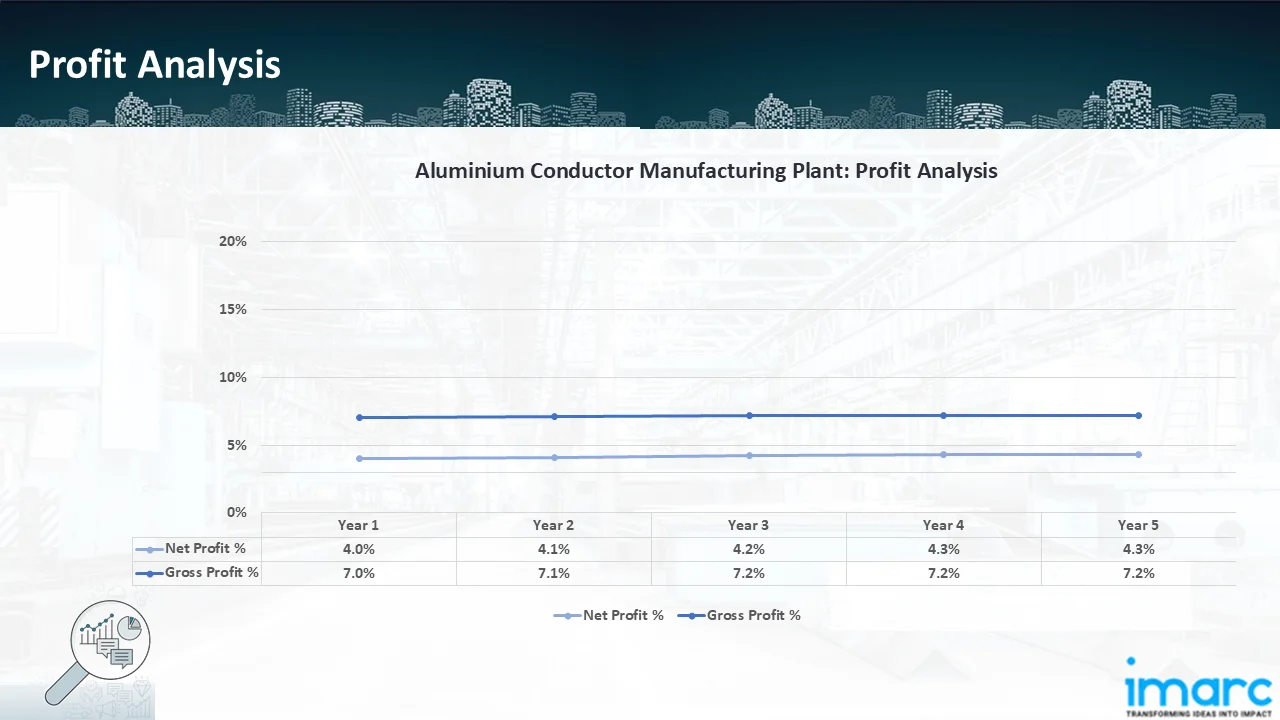

- Profitability Analysis Year on Year Basis: The proposed aluminium conductor manufacturing plant, with a capacity of 40000 tons of total aluminium conductor per year, achieved an impressive revenue of US$ 107.2 million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins improve from 7.0% to 7.2% by year 5, and net profit rises from 4.0% to 4.3%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the aluminium conductor manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of producing 40,000 tons of total aluminium conductor per year, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

-

In June 2025, Vedanta Aluminium, India’s largest aluminium producer, announced an expansion of its wire rod production capacity at Bharat Aluminium Company (BALCO), as part of its broader plan to increase overall output to 1 million metric tonnes per annum (MTPA). This move aligns with the growing demand for high-quality aluminium wire rods driven by India’s rapid growth in digital infrastructure, power transmission, and industrial development.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104