Australia Industrial Couplings Industry: Automation Boom, Major Sectors, Leading Manufacturers

Introduction: Overview of Australia's Industrial Couplings Market

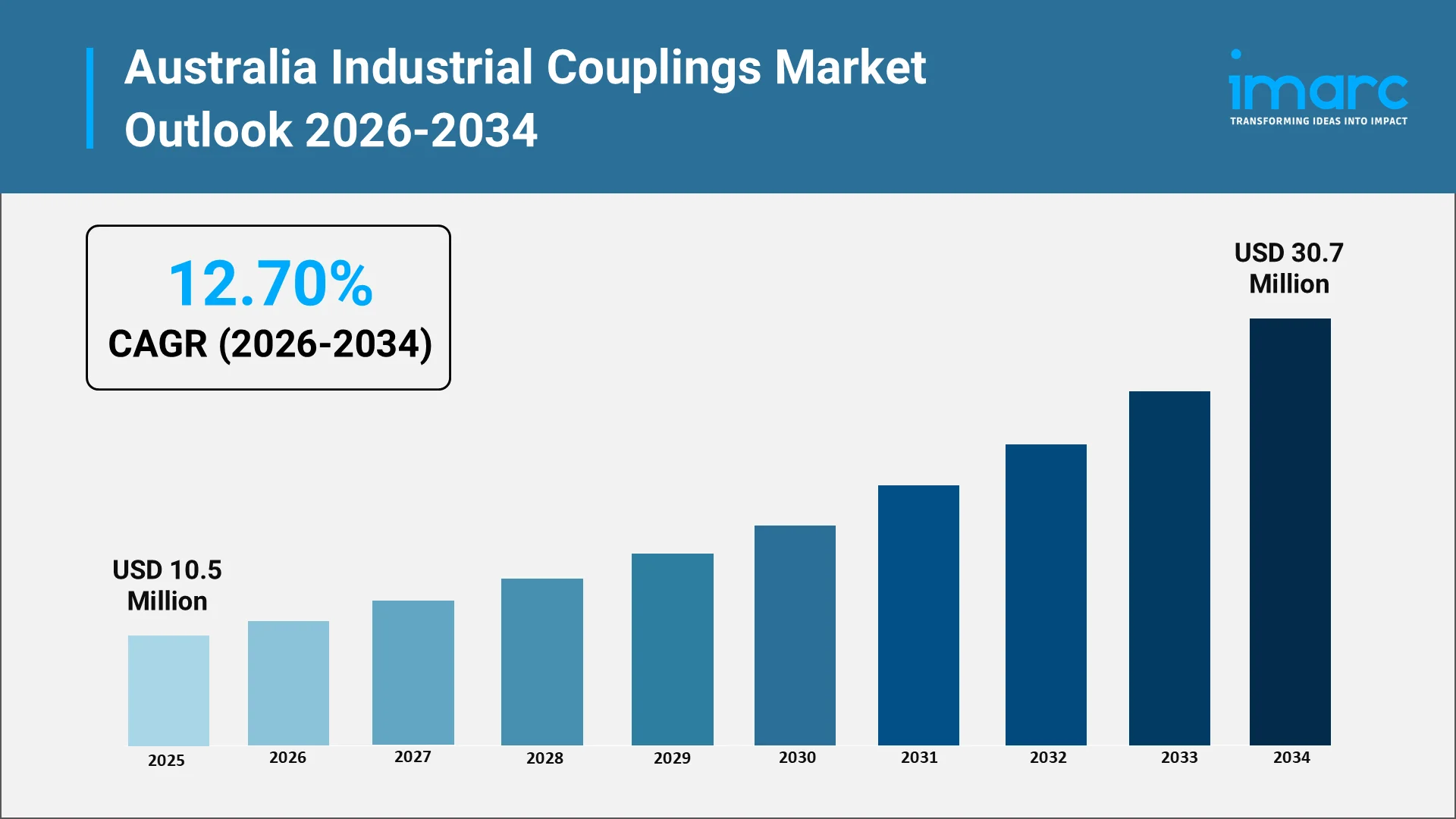

The Australia industrial couplings industry stands at a transformative juncture in 2025, propelled by technological advancement and surging demand across critical sectors. As mechanical devices connecting two shafts to transmit power and torque, industrial couplings form the backbone of machinery operations in manufacturing, mining, automotive, and energy sectors. The Australia industrial couplings market size reached USD 10.5 Million in 2025. Looking forward, the market is expected to reach USD 30.7 Million by 2034, exhibiting a growth rate (CAGR) of 12.70% during 2026-2034.

Recent market intelligence reveals promising growth trajectories. The Australia coupling market is projected to witness growth during the forecast period, reflecting strong domestic demand and technological advancement. This acceleration aligns with broader industrial trends, as the Australia Industry 4.0 market reached USD 3,294.00 Million in 2024 and is projected to grow to USD 11,142.25 Million by 2033, exhibiting a CAGR of 14.50%.

The industrial couplings market encompasses diverse product categories including flexible couplings, rigid couplings, gear couplings, fluid couplings, and elastomeric couplings. Each type serves specific applications across industries, offering solutions for misalignment compensation, vibration absorption, and efficient power transmission. Australia’s manufacturing sector plays a vital role in driving demand for essential industrial components, serving as a key pillar of the national economy and a major source of employment across multiple industries.

Explore in-depth findings for this market, Request Sample

Key Drivers: Automation, Industrial Growth, and Technological Advancements

Automation adoption represents the primary catalyst transforming Australia's industrial couplings demand. Australian manufacturing experienced significant technological progress throughout 2024, with automation, robotics, and digital manufacturing accelerating across the industry, enhancing operational efficiency.

Industry partners report accelerated adoption of smart technologies, including robotics, AI, IoT, and digital twins, across Australian manufacturing in June 2025, enabling smart factories that boost productivity and workplace safety. Many SMEs deploy robotic automation and predictive maintenance systems to drive operational efficiency.

Australia’s mining sector remains a major driver of demand for industrial couplings, supported by extensive extraction and processing activities across the country. The industry’s reliance on heavy machinery such as drills, haul trucks, and conveyors creates strong incentives for adopting predictive maintenance technologies that enhance equipment reliability and operational efficiency.

The National Robotics Strategy unveiled in June 2024 targets AUD 170-600 billion annual GDP contribution by 2030 with 50-150% productivity growth. AUD 15 billion National Reconstruction Fund and Industry Growth Program support deployment, creating demand for precision coupling solutions.

Role of AI, Impact, and Benefits in the Australia Industrial Couplings Market:

Artificial intelligence applications are revolutionizing industrial coupling utilization through predictive maintenance and performance optimization. The Australia predictive maintenance market reached USD 254.00 Million in 2024, with projections to reach USD 1,620.05 Million by 2033, exhibiting a CAGR of 22.86%. This exponential growth directly impacts coupling industry dynamics.

AI-based predictive maintenance systems analyze sensor data embedded in coupling equipment, detecting anomalies and forecasting failures before they occur. This proactive approach enables timely, targeted interventions, helping companies avoid costly disruptions. Research suggests that predictive maintenance can significantly reduce maintenance expenses while prolonging equipment lifespan, key benefits for capital-intensive industries that depend on maximizing asset performance and minimizing unplanned downtime.

In March 2025, Razor Labs revealed plans to conduct webinars demonstrating how AI sensor fusion aids in revolutionizing predictive maintenance in the Australian mining sector, helping anticipate significant failures and recognize concealed problems that conventional systems overlooked.

IoT integration allows businesses to analyze large volumes of data using advanced analytics and machine learning, leading to more accurate maintenance scheduling. In Australia, where industries operate in remote environments, IoT-supported maintenance solutions provide critical insights without physical inspections. As IoT devices become more affordable, their role in benefiting the predictive maintenance market continues to strengthen.

Smart coupling technologies incorporating sensors to monitor torque, misalignment, and wear in real-time enable predictive maintenance strategies, reducing unplanned downtime. As connected technologies continue to expand worldwide, the adoption of smart couplings within automated systems is poised for strong growth, driven by the increasing integration of IoT-enabled monitoring and control solutions across industrial operations.

Top Companies in the Australia Industrial Couplings Market:

The Australia industrial couplings market features established global manufacturers creating a competitive yet consolidated landscape. Leading companies leverage technological innovation and extensive distribution networks to maintain market positions.

The Timken Company maintains a prominent position as a global technology leader. Timken posted $4.6 billion in sales in 2024 and employs approximately 19,000 people globally, operating from 45 countries. The company's coupling portfolio, including the Lovejoy brand, experiences strong demand for jaw and grid couplings used widely in diverse OEM applications.

KTR Systems GmbH specializes in mechanical couplings with strong emphasis on customization meeting specific client requirements. KTR's expertise in flexible elastic couplings, projected to dominate the industrial coupling industry with 42% market share in 2025, positions the company advantageously for growth in sectors requiring vibration damping and misalignment tolerance.

Regal Rexnord Corporation offers extensive power transmission solutions including diverse coupling types serving multiple industrial sectors. The company's comprehensive product portfolio addresses applications ranging from simple shaft connections to complex drivetrain systems requiring sophisticated torque management.

SKF Group brings bearing expertise to coupling solutions, offering integrated approaches to rotating equipment challenges. SKF's focus on reliability, efficiency, and condition monitoring aligns with Australian industry's emphasis on asset optimization and predictive maintenance.

Additional significant players include ABB Ltd, Altra Industrial Motion Corporation, Voith GmbH, John Crane, Renold PLC, and Tsubakimoto Chain Co., collectively serving Australia's industrial coupling needs while investing in research and development to advance coupling technology.

Major Sectors and Applications of Industrial Couplings:

The mining and resources sector represents the largest consumer. Mining contributed 14.3% of Australia's GDP in 2024, creating 1.1 million jobs. The sector's heavy machinery demands robust coupling solutions handling extreme torque and harsh conditions.

Australia leads globally in iron ore exports and supplies over half the world's lithium—critical for electric vehicle batteries and energy storage. Mining equipment depends on industrial couplings for efficient power transfer.

The manufacturing sector encompasses automotive components, food processing, pharmaceuticals, and metal fabrication. The automotive sector, projected to command 38% of the global coupling market share in 2025, requires lightweight, high-torque couplings for electric vehicle drivetrains.

Energy and power generation utilize specialized couplings in renewable installations, including wind turbines and hydroelectric plants. Wind turbine drivetrains employ couplings that manage torque variations while protecting equipment.

Oil and gas, water treatment, and material handling sectors create additional demand across diverse applications requiring specialized coupling solutions.

Opportunities and Challenges in the Australian Market:

Significant growth opportunities emerge from Australia's transition toward clean energy and critical minerals production. The CSIRO's Critical Energy Materials roadmap estimates annual demand for metals and minerals exceeding 700 million tonnes by 2050, including 9 million tonnes of lithium, over 130 million tonnes each of silicon and copper, and 48 million tonnes of nickel. This demand expansion necessitates corresponding mining equipment growth, directly translating to increased coupling requirements.

The government's $2 Billion Critical Minerals Tax Credit supports domestic processing of minerals essential for the clean energy transition. Infrastructure development initiatives, including strategic transmission networks and industrial precincts, create additional coupling demand. Regional development opportunities in areas like Upper Spencer Gulf, Pilbara, and Gladstone promise sustained industrial activity.

Smart manufacturing initiatives create opportunities for advanced coupling products incorporating condition monitoring sensors and IoT connectivity. As 30% of Australian manufacturers have implemented Industrial IoT at scale, demand grows for couplings supporting digital transformation initiatives.

Challenges include skills gaps limiting advanced manufacturing adoption. The National Skills Commission projects at least 15,000 new workers needed in clean energy sectors by 2030, slowing Industry 4.0 adoption, particularly among SMEs.

Infrastructure challenges persist, given Australia's vast geography and uneven access to digital infrastructure in remote areas. High initial costs of implementing automation can be barriers for SMEs, while integrating technologies with legacy systems proves complex.

Supply chain vulnerabilities remain concerning due to Australia's geographic isolation and dependence on imported components. Environmental pressures intensify, with mining companies facing pressure to reduce carbon footprints through renewable energy adoption.

Leading Manufacturers, Recent Developments, and Market Outlook:

Recent developments demonstrate ongoing innovation. In February 2025, Timken reported implementing cost reduction actions expected to generate approximately $75 million in savings, reflecting industry trends emphasizing efficiency.

Smart couplings incorporating sensors enable predictive maintenance strategies. Emerging trends include increased focus on sustainability, with manufacturers developing products that minimize power losses. Electrification of mining fleets creates new requirements as companies transition to electric-powered equipment.

The Australia industrial couplings market outlook remains positive, supported by sustained mining activity, manufacturing digitalization, infrastructure development, and renewable energy expansion.

Conclusion:

The Australia industrial couplings industry stands poised for significant expansion through 2025 and beyond, driven by automation adoption, mining sector strength, and manufacturing digitalization. The convergence of Industry 4.0 technologies, artificial intelligence, and IoT connectivity is fundamentally transforming coupling applications, creating opportunities for innovative suppliers.

Key growth drivers, including the National Robotics Strategy, critical minerals development, and renewable energy transition, establish strong foundations for sustained coupling demand. The sector’s strong growth outlook underscores solid market fundamentals, though ongoing challenges such as workforce skill gaps and infrastructure constraints remain key factors influencing long-term development.

Leading manufacturers, including Timken, KTR Systems, and other global players, continue investing in advanced coupling technologies incorporating smart sensors and predictive maintenance capabilities. As Australia advances toward ambitious economic and environmental targets, industrial couplings will remain essential components enabling reliable power transmission.

Companies successfully navigating technological disruption while maintaining focus on fundamental engineering excellence will capture greatest opportunities in this evolving market landscape. Stakeholders must remain agile, innovative, and committed to excellence to thrive in this dynamic environment characterized by unprecedented opportunity.

Partner with IMARC Group for Strategic Market Intelligence:

Choose IMARC Group as your trusted advisor for navigating the complexities of Australia's industrial couplings market and achieving sustainable competitive advantage through data-driven insights and strategic intelligence.

- Data-Driven Market Research: Deepen your knowledge of industrial coupling market dynamics, technological advancements, and application trends across mining, manufacturing, and infrastructure sectors through comprehensive market research reports analyzing market size, growth forecasts, competitive landscapes, and emerging opportunities.

- Strategic Growth Forecasting: Predict emerging trends in industrial automation, smart manufacturing adoption, and digital transformation impacting coupling requirements—from IoT-enabled predictive maintenance and Industry 4.0 integration to electrification of industrial equipment—with detailed analysis by technology type, end-use sector, and geographic region.

- Competitive Benchmarking: Analyze competitive forces shaping the industrial couplings market, review product portfolios of leading manufacturers, monitor technological innovations in coupling design and materials, and understand strategic positioning of major players including Timken, KTR Systems, and other key suppliers serving Australian industrial customers.

- Policy and Infrastructure Advisory: Stay informed of regulatory developments, government support programs for advanced manufacturing and automation, industrial policy initiatives impacting equipment investments, and infrastructure projects creating coupling demand across mining, energy, and manufacturing sectors nationwide.

- Custom Reports and Consulting: Obtain tailored insights aligned with your organizational objectives—whether expanding into Australian industrial markets, developing new coupling products for automation applications, evaluating acquisition opportunities, or optimizing supply chain strategies for serving demanding industrial sectors across Australia and the broader Asia-Pacific region.

At IMARC Group, our mission is empowering industrial leaders, equipment manufacturers, and investors with clarity and intelligence required to capitalize on opportunities in Australia's dynamic industrial couplings market. Join us in driving industrial innovation and operational excellence—because every connection matters for industrial performance, reliability, and competitiveness in the evolving landscape of modern manufacturing and automation.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)