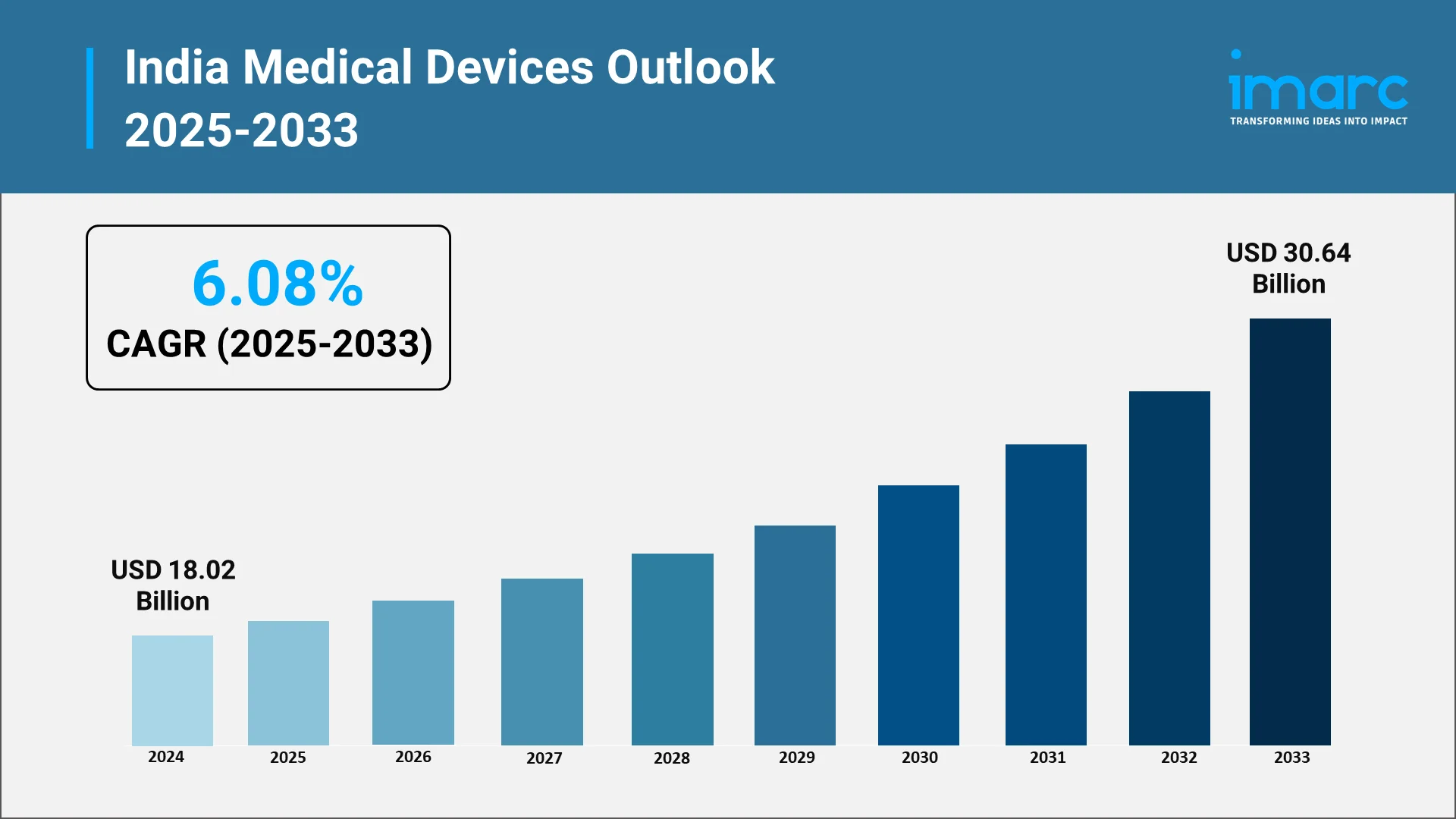

How Big Will the India Medical Devices Industry Be by 2033

Summary:

India’s medical devices industry is on a sustained growth trajectory driven by expanding hospital infrastructure, rising chronic disease burden, stronger local manufacturing supported by government incentives, and a rapidly growing shift toward portable and home care devices. Looking forward, the market is expected to reach USD 30.64 Billion by 2033, reflecting the sector’s expanding commercial potential as adoption increases across hospitals, clinics and households. This creates both broad opportunity and niche high-margin spaces for manufacturers, distributors and service providers, particularly those focused on innovation, affordability, and localized production.

Explore in-depth findings for this market, Request Sample

Expansion Of Hospitals Clinics and Diagnostic Labs as The Demand Engine:

India is rapidly broadening its healthcare delivery ecosystem, driven by sustained investments from both public and private players. The expansion of hospitals, specialty centers, diagnostic chains, and primary health facilities is creating a strong and recurring demand cycle for medical devices, ranging from high-value capital equipment to routine consumables and disposables. In fact, according to the Secretary of the Department of Pharmaceuticals, India’s share of domestically produced medical devices has grown from under 10% to around 30% over the past five years. As healthcare access improves across metros, Tier II–III cities, and emerging rural clusters, institutions are increasingly required to modernize infrastructure, adopt advanced diagnostic capabilities, and upgrade patient-care systems, thereby strengthening the long-term outlook for domestic and global device manufacturers.

A major demand catalyst is the significant scale-up of hospital capacity nationwide. As institutions add intensive care unit beds, upgrade operation theatres, and enhance diagnostic laboratory capabilities, they require a wide spectrum of equipment including patient monitoring devices, anesthesia systems, ventilators, imaging platforms, and surgical tools. Parallel to this, India is witnessing strong momentum in diagnostics-led care models. The growing use of multimodality systems such as MRI, CT, and PET-CT, complemented by rising adoption of point-of-care testing, is expanding demand for both large, sophisticated imaging platforms and compact diagnostic systems suitable for high-throughput environments.

Additionally, the rapid expansion of private hospital groups, diagnostic chains, and franchised networks is altering procurement dynamics. According to reports, India’s hospital sector attracted US$4.96 billion in private-equity funding, driven largely by big chains like Manipal, Apollo, and Fortis, signaling strong investor confidence in scalable, organized healthcare delivery . Organized players prefer structured, large-scale procurement that shortens the sales cycle for reliable suppliers and supports predictable order volumes. This shift is also transforming purchasing behavior: instead of one-time capital buys, institutions are opting for lifecycle contracts that bundle installation, maintenance, service, and consumables. Such models enhance revenue visibility for manufacturers, strengthen long-term customer relationships, and benefit companies capable of delivering integrated device-plus-service solutions. As this transformation accelerates, India’s healthcare expansion will continue to drive robust, multi-segment demand for medical devices across the value chain.

Market Size and Growth Opportunity:

The India medical devices market size reached USD 18.02 Billion in 2024, exhibiting a growth rate (CAGR) of 6.08% during 2025–2033. India’s medical devices market is expanding rapidly, with major industry estimates showing minor variations due to differences in methodology and segment definitions. Key factors propelling this growth include the increasing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory conditions, which are driving demand for diagnostic and therapeutic devices. Additionally, the government’s strategic initiatives, including Production Linked Incentive (PLI) schemes for medical devices, the establishment of medical device parks, and support for research and innovation, are encouraging local manufacturing and reducing reliance on imports. Rising awareness among consumers, the growth of private healthcare infrastructure, and the adoption of advanced technologies such as digital health monitoring and portable diagnostic devices are further expanding market opportunities. The combined effect of these factors positions India as one of the fastest-growing medical device markets globally, attracting both domestic and international investment and fostering innovation across multiple segments.

For strategic planning, companies typically model three scenarios: a base case with steady growth and moderate localisation, an upside case with stronger localisation backed by government investment and export gains, and a downside case reflecting weaker hospital spending or supply-chain challenges. Firms focusing on portable and home-care devices can expect faster-than-average growth given the rapid expansion of remote monitoring and home-based healthcare.

Dependence on Imports Along with Rising Domestic Manufacturing:

India has traditionally relied heavily on imports for high-sophistication medical devices such as advanced imaging systems, implants, high-end diagnostics, and specialized therapeutic equipment. This dependence exposes the healthcare sector to multiple risks. Foreign exchange volatility, fluctuations in global commodity prices, tariff revisions, and geopolitical disruptions can all influence the landed cost and availability of these critical devices. During periods of global supply chain stress, this vulnerability becomes even more evident, leading to delays, price spikes, and procurement challenges for hospitals and diagnostic networks. According to reports, between FY2020-21 and FY2024-25, India spent more than USD 25 billion on imported electromedical equipment (such as ventilators and diagnostic imaging systems) and surgical instruments. At the same time, the import-heavy landscape presents a substantial opportunity for domestic manufacturers to strengthen their presence, particularly in low- and mid-complexity product categories where technological barriers are lower and demand is consistently growing.

In recent years, a strong policy push has accelerated the shift toward localisation. Government initiatives such as the Production Linked Incentive (PLI) Scheme, the creation of medical device parks, and easier regulatory pathways for domestic innovators have encouraged both local firms and multinational corporations to increase manufacturing within India. Global companies are also expanding their footprint by setting up assembly lines, component manufacturing units, and R&D centers to serve India as well as export markets. This environment opens up multiple avenues for domestic industry growth—not only in the manufacturing of mid-complexity devices but also in component production, contract manufacturing for international brands, and the provision of aftermarket services such as maintenance, calibration, and consumables supply. These segments typically offer attractive margins, recurring revenue streams, and long-term customer relationships, making them key drivers of India’s evolving medical devices ecosystem.

Shift Toward Portable and Home Care Medical Equipment:

One of the most significant structural transformations in India’s medical devices landscape is the rapid rise in adoption of portable and home care equipment. Devices such as digital oximeters, blood pressure monitors, glucometers, portable ECG systems, remote monitoring kits, and various home therapy solutions including portable suction units, CPAP machines, and mobility aids are becoming integral to patient care beyond clinical settings. This shift reflects the growing preference for decentralized healthcare, where individuals increasingly manage routine monitoring and treatment from the comfort of their homes. For instance, Japan’s Omron is aggressively expanding in India, building its first manufacturing plant in Chennai to make blood pressure monitors and ECG devices more affordable and accessible for home use — partly because BP-monitor penetration remains low (around ~6%) despite high hypertension prevalence. As awareness of preventive health rises and digital literacy improves, home-based devices are steadily moving from niche products to mainstream essentials.

Multiple factors are fueling this movement toward portable and home care technologies. The growing burden of chronic illnesses such as diabetes, hypertension, and cardiovascular disorders requires frequent monitoring outside hospital environments. At the same time, India’s expanding elderly population is driving demand for solutions that support aging in place and reduce the dependence on caregivers. Telemedicine has also witnessed sharp adoption, and validated home measurements have become indispensable for virtual consultations and remote care models. Advances in technology including more affordable sensors, improved battery performance, compact device design, and seamless smartphone connectivity have further enhanced usability and accessibility, encouraging wider adoption across diverse population segments.

Market research consistently indicates that the home healthcare monitoring category is expanding much faster than the overall medical devices industry. The segment’s strong outlook highlights significant opportunities for companies focused on consumer health tools and clinically validated home care devices. Businesses that strengthen partnerships with pharmacy networks, direct to consumer channels, e-commerce platforms, and telehealth providers will be better positioned to capture a larger share of the growing demand. This strategic alignment not only increases market reach but also supports sustainable long term growth as home-based care becomes a core pillar of India’s healthcare system.

Government Support Through PLI Device Parks and Incentives:

The Government of India is prioritizing the expansion of domestic medical device manufacturing, supported by initiatives such as the Production Linked Incentive (PLI) scheme. The PLI program provides financial rewards for incremental sales of approved products, encouraging new projects and greenfield investments. Updated guidelines and approved beneficiary lists released through 2023 and 2024 have broadened both the eligible device categories and the number of participating companies. By March 2023, 21 companies had been approved under the PLI scheme to manufacture medical devices across four target segments such as imaging, cardio-respiratory devices, implants, and cancer-care equipment. Moreover, 50 new greenfield plants are expected to be established over the next two years under the pharma-and-medical-device PLI scheme, according to the Department of Pharmaceuticals.

Alongside the PLI scheme, central and state governments are developing medical device parks, offering capital subsidies, and implementing dedicated manufacturing policies to build a stronger ecosystem. These initiatives provide manufacturers with access to testing labs, shared infrastructure, and regulatory support. For businesses, incorporating these incentives into project planning is crucial, as they can significantly improve returns, shape capital expenditure decisions, shorten break-even timelines, and enhance export strategies.

Competitive Landscape and Leading Companies:

India’s medical devices market features a strong mix of multinational corporations and established domestic manufacturers, each contributing differently across product categories and technology tiers.

GE Healthcare remains one of the most influential global players, with a deep portfolio in imaging, diagnostics, patient monitoring and ultrasound systems. The company has expanded its manufacturing and R&D footprint in India through joint ventures and local partnerships, enabling faster product customization, competitive pricing and adherence to government localisation norms.

Siemens Healthineers holds a similarly strong position in advanced imaging, laboratory diagnostics and digital health platforms. Its emphasis on precision diagnostics, automation and AI-driven imaging solutions aligns well with India’s fast-modernizing tertiary hospitals. Supporting this, in April 2023, Siemens inaugurated an MRI manufacturing facility in Bengaluru to locally produce its MAGNETOM Free.Star (helium-free) scanner, under India’s PLI scheme . Continuous investments in local training centers and manufacturing expansion further strengthen its competitive edge.

Philips Healthcare is another dominant multinational, known for imaging, critical care monitoring, respiratory devices and home-health technologies. Philips has focused heavily on integrated care and telehealth in India, leveraging its global expertise to address the country’s growing demand for connected care solutions.

Mindray, a major Chinese manufacturer, has rapidly gained market share in patient monitoring, anaesthesia machines, ventilators and ultrasound devices by offering technologically strong products at competitive price points. Its expanding distribution network and service infrastructure have helped it penetrate both public and private healthcare sectors.

On the domestic front, Trivitron Healthcare stands out as one of India’s most diversified medical device manufacturers, with strengths in diagnostics, imaging, in vitro diagnostics (IVD), radiation protection and critical-care equipment. The company has expanded through strategic acquisitions and overseas manufacturing facilities, helping it compete in both domestic and export markets.

BPL Medical Technologies remains a key Indian brand in patient monitoring, ECG machines, defibrillators and home-health equipment. Its strong brand recall, cost-effective product range and distribution reach allow it to compete effectively in value-driven segments. Several other Indian companies specializing in consumables, disposables and mid-complexity devices are scaling rapidly through technology partnerships, OEM manufacturing and product innovation.

Overall, multinational corporations continue to dominate high-end capital equipment, while domestic players excel in consumables, monitoring devices and price-sensitive categories. With global firms expanding local manufacturing and Indian companies investing in R&D and international acquisitions, competition is intensifying, signalling a more mature and innovation-driven market ahead.

Choose IMARC Group for Unmatched Expertise in Medical Devices:

IMARC Group empowers healthcare leaders with precise, actionable insights to navigate India’s dynamic medical devices market. We provide data-driven market research, delivering comprehensive market sizing, trend analysis, and competitive benchmarking to support evidence-based decisions. Through strategic growth forecasting and scenario modeling, we help companies plan for multiple outcomes, reducing risk and enabling informed long-term strategies.

Our policy and infrastructure advisory guides businesses in leveraging government initiatives, such as PLI schemes and medical device parks, to optimize investment and production planning. IMARC also offers custom reports and consulting, tailored to market entry, localization, and expansion strategies, ensuring solutions fit each client’s specific goals.

We deliver deep insights across domestic manufacturing, home care devices, diagnostics, and high-end capital equipment, helping firms identify high-growth, profitable segments. Additionally, we provide guidance on investment planning, export strategies, and operational efficiency to maximize returns.

By combining global expertise with local market knowledge, IMARC enables clients to capture emerging opportunities and gain a competitive edge. Our focus on innovation, sustainable growth, and long-term advantage ensures that businesses not only keep pace with the evolving medical devices ecosystem but also lead it, driving success in India’s fast-growing healthcare market.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)