Philippines Automotive Wiring Harness Industry Embraces Modular Design Innovations

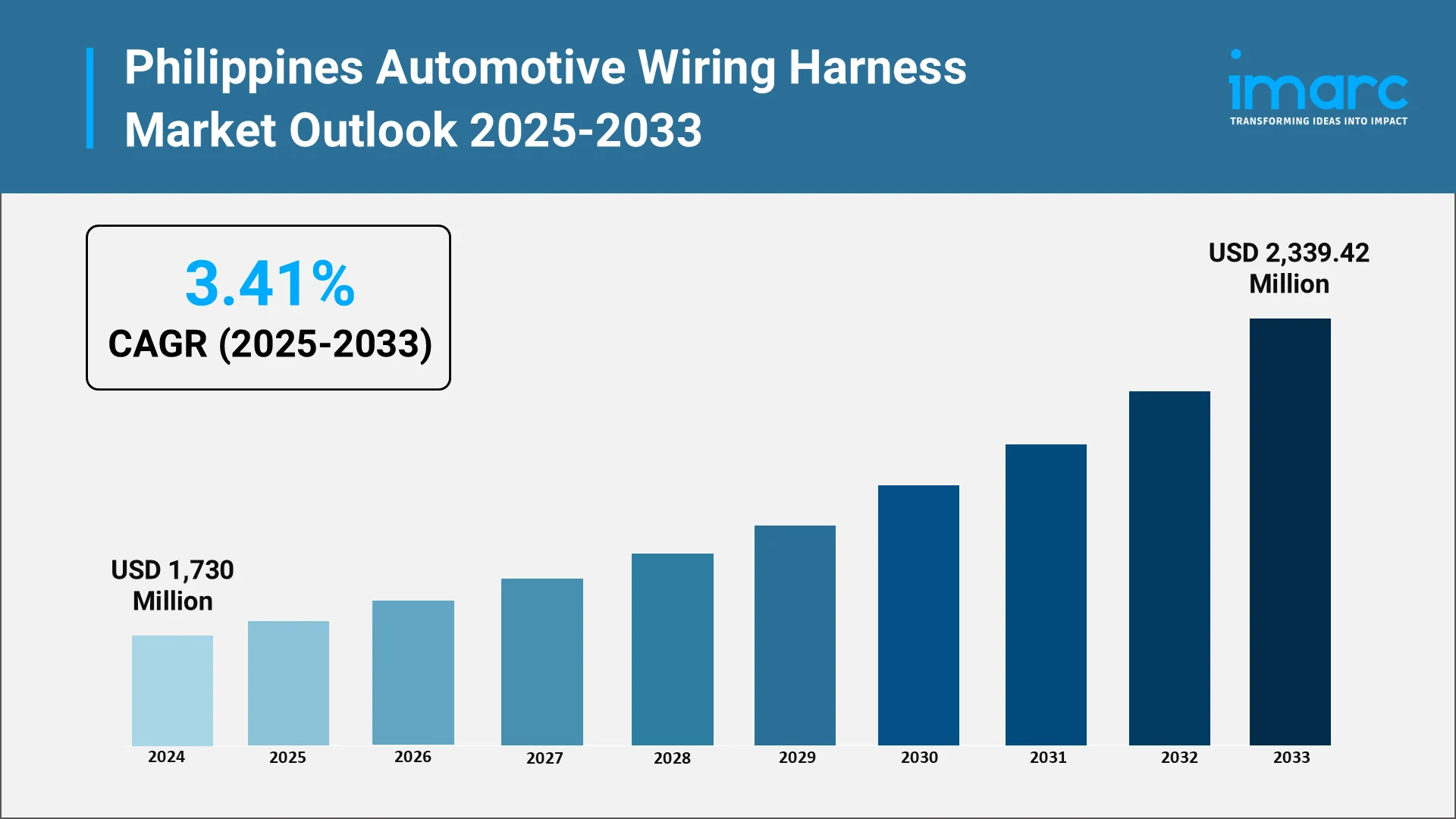

The Philippines automotive wiring harness market is positioned for steady growth, expanding from USD 1,730 Million in 2024 to USD 2,339.42 Million by 2033 at a CAGR of 3.41%. Modular design innovations, artificial intelligence integration, and advanced automation are fundamentally reshaping the industry, enabling manufacturers to meet escalating demands for electric vehicles, advanced driver-assistance systems, and connected car technologies while maintaining cost-effectiveness and operational efficiency.

Explore in-depth findings for this market, Request Sample

Introduction:

The Philippines automotive wiring harness industry stands at a transformative juncture, driven by technological innovations that are reshaping vehicle electrical architectures worldwide. As vehicles evolve into sophisticated mobile computing platforms, the wiring harness, the circulatory system transmitting electrical power and data throughout modern automobiles, has become increasingly complex and critical to vehicle performance.

Modular design innovations represent a paradigm shift in how wiring harnesses are conceptualized, manufactured, and deployed. Rather than custom-designing intricate harness systems for each vehicle model, modular approaches utilize standardized, interchangeable components that can be rapidly configured to meet diverse specifications. This transformation addresses the dual challenges of rising vehicle complexity and the need for manufacturing flexibility in an industry accelerating toward electrification and digitalization.

The Philippines has emerged as a strategic hub for automotive wiring harness production within the ASEAN region, leveraging cost-effective manufacturing capabilities, skilled labor, and proximity to major automotive markets. The sustained growth reflects increasing vehicle assembly activities, ASEAN export strategies, and rising connectivity demands across the automotive sector.

Key market drivers include the electronics uptake in vehicles, which increases harness complexity through infotainment systems, telematics, and sensor integration. This exponential growth in advanced vehicle technologies creates substantial opportunities for wiring harness manufacturers embracing modular design methodologies.

Passenger cars dominate the vehicle type segment, requiring sophisticated electrical architectures to support modern features. Copper maintains material leadership in the Philippines market, ensuring superior electrical conductivity and reliability standards essential for both traditional and high-voltage applications. Geographically, Luzon leads regional distribution with the highest concentration of automotive manufacturing facilities, creating a robust ecosystem for wiring harness production and innovation.

The convergence of modular design with emerging technologies, including artificial intelligence for design optimization, advanced automation for production efficiency, and IoT-enabled quality control, positions the Philippines' automotive wiring harness industry for sustained competitiveness in the global marketplace.

Role of AI, Impact, and Benefits in the Philippines Automotive Wiring Harness Industry:

Artificial intelligence is revolutionizing the Philippines automotive wiring harness industry by transforming design processes, manufacturing operations, and quality assurance protocols. Machine learning algorithms and deep neural networks are enabling manufacturers to optimize harness layouts, predict production failures, and accelerate development cycles in ways previously unattainable through traditional engineering approaches.

AI-Driven Design Optimization

AI algorithms analyze spatial constraints within vehicle architectures to ensure optimal arrangement of wiring components. By processing vast datasets of existing wiring harnesses and vehicle layouts, these systems identify the most efficient routing paths for wires, minimizing overall length and ensuring optimal performance. In April 2024, Yazaki Corporation announced advancements in the development of AI-driven systems to streamline the manufacturing process for automotive wire harnesses, successfully reducing production time by automating traditionally manual planning tasks.

Modern AI-powered design systems utilize Convolutional Neural Networks (CNN) and Deep Neural Networks (DNN) to automate harness routing generation based on predefined specifications and constraints. These trained models can predict production failures before they occur, minimizing downtime and improving manufacturing efficiency. The integration seamlessly translates design parameters into manufacturable outcomes, optimizing critical tasks such as connector placements, grommet fittings, and clip alignments.

Space Optimization and Weight Reduction

AI-driven space optimization delivers tangible benefits for Philippines manufacturers competing in weight-sensitive segments. Algorithms factor in heat dissipation requirements, suggesting layouts that keep temperature-sensitive components away from heat sources while ensuring proper ventilation for entire wiring harness assemblies. This proactive approach prevents overheating and potential malfunctions, particularly crucial for high-voltage electric vehicle applications.

The AI advantage extends to material cost reduction. By minimizing wiring harness length and optimizing component placement, manufacturers achieve significant savings in material costs and labor hours. This cost efficiency strengthens the competitive position of Philippines-based producers in the global supply chain, where cost-effectiveness remains a critical success factor.

Fault Detection and Quality Control

AI classification models enhance the quality control process in wiring harness manufacturing. Traditional Crimp Force Monitoring (CFM) systems, while accurate, require frequent reconfigurations based on material variability and depend heavily on operator skill. AI-powered fault detection systems address these limitations by employing classification models trained on production data to identify defects with superior consistency and speed.

These systems generate synthetic data from normal production samples, simulating potential defects through advanced data scaling techniques. This approach enables comprehensive quality assurance even with limited initial training data, ensuring robust defect detection from the onset of new production runs. Vision systems powered by AI are becoming increasingly sophisticated, allowing robots to identify and locate parts with exceptional accuracy and speed, reducing defects and warranty exposure.

Production Automation Benefits

Philippines harness manufacturers are enhancing production through the adoption of automation and lean methodologies. Crimping robots, visual inspection systems, and barcode traceability improve throughput and reduce defects. Facilities are upgrading to IoT-enabled production lines with ERP-MES (Enterprise Resource Planning-Manufacturing Execution System) integration, creating connected manufacturing environments where AI algorithms optimize real-time production decisions.

The integration of AI with collaborative robots (cobots) designed to work alongside humans enhances productivity and safety on factory floors. These AI-enabled systems can operate continuously, with fully automated facilities running 24/7, significantly increasing productivity and reducing lead times. The combination of AI-driven predictive maintenance, automated inspection, and intelligent routing creates a manufacturing ecosystem capable of handling the increasing complexity of modern vehicle wiring requirements while maintaining consistent quality standards.

Strategic Advantages for Philippines Market

For the Philippines automotive wiring harness industry, AI adoption creates multiple strategic advantages. The technology enables local manufacturers to compete on quality and innovation rather than labor costs alone. AI-powered systems facilitate rapid customization across vehicle models, supporting OEM (Original Equipment Manufacturer) partnerships that demand flexibility and responsiveness. Moreover, workforce development focusing on technical design and quality control skills ensures that Philippines-based facilities can leverage AI tools effectively, combining human expertise with machine intelligence to drive operational excellence.

Recent Market News & Major Research and Development:

The Philippines automotive wiring harness industry has witnessed significant developments in 2024-2025, reflecting broader trends toward sustainability, automation, and technological advancement. These developments demonstrate the industry's commitment to innovation and position Philippines manufacturers as key participants in the global automotive supply chain transformation.

Sustainability Initiatives and Recycled Materials

In May 2024, Yazaki Corporation and Toray Industries jointly created a recycled polybutylene terephthalate (PBT) resin tailored specifically for use in automotive wiring harness connectors. This groundbreaking material is produced from post-manufacturing scrap and offers equivalent performance to virgin material while supporting significant emission reductions. The initiative contributes to sustainable production practices and reinforces circular economy principles in the automotive industry, addressing growing regulatory and consumer demands for environmentally responsible manufacturing.

This development holds particular significance for Philippines-based operations, where environmental sustainability increasingly influences supplier selection and investment decisions. The recycled PBT resin demonstrates that performance and sustainability need not be mutually exclusive, opening pathways for cost-competitive green materials in high-volume production environments.

Strategic Acquisitions and Automation Enhancement

In February 2025, Lear Corporation completed the acquisition of StoneShield Engineering, a company recognized for its capabilities in robotics, automated taping, and high-voltage harness systems. This acquisition enhances Lear's E-Systems division and advances the company's IDEA (Innovation, Diversity, Excellence, Action) strategy, which focuses on leveraging digital tools and automation to boost innovation and efficiency in manufacturing operations.

The StoneShield acquisition signals the critical importance of automation capabilities in the wiring harness industry. For Philippines manufacturers, this development underscores the competitive necessity of investing in advanced robotics and automated processes to remain viable suppliers to major OEMs. The integration of automated taping systems and high-voltage harness technologies addresses the growing complexity of electric vehicle electrical architectures, where safety, precision, and efficiency are paramount.

Industry Collaboration and Technology Transfer

Philippines harness manufacturers benefit from industry collaboration with established harness suppliers, which introduces quality assurance protocols and training programs. These partnerships facilitate technology transfer, enabling local operations to adopt best practices in automation, quality control, and process optimization. The emphasis on workforce development focusing on technical design and quality control skills ensures that Philippines facilities can effectively leverage advanced technologies and maintain competitiveness.

Infrastructure and Digital Transformation

Facilities throughout the Philippines are upgrading to IoT-enabled production lines with ERP-MES integration, creating digitally connected manufacturing environments. Barcode traceability systems, visual inspection technologies, and real-time data analytics improve throughput while reducing defects. These investments help manage rising demand from OEM partners and ensure scalability as vehicle electrical complexity continues to increase.

The adoption of high-speed data lines incorporating Ethernet cables and multi-core pathways for sensor subsystems reflects the industry's preparation for next-generation vehicle requirements. Shielded connectivity technologies strengthen electrical stability through advanced connector designs, addressing electromagnetic interference challenges in increasingly electronics-dense vehicle environments.

Market Indicators and Future Developments

No additional major negative news has emerged regarding the Philippines automotive wiring harness market during the 2024-2025 period. The consistent focus on automation, sustainability, and technological advancement indicates a healthy industry trajectory supported by favorable manufacturing economics and strategic positioning within ASEAN automotive supply chains.

The Philippines automotive wiring harness market growth continues to be driven by increasing vehicle assembly, ASEAN export strategies, and rising connectivity demands. Dashboard and data harness modules deliver strong returns, reinforcing supplier margins and production scale across key OEM platforms. This sustained positive momentum positions the Philippines as an increasingly important node in the global automotive wiring harness manufacturing network.

Opportunities and Challenges in the Philippines Automotive Wiring Harness Industry:

The Philippines automotive wiring harness industry faces a dynamic landscape characterized by significant growth opportunities alongside operational and strategic challenges. Understanding and effectively navigating these factors will determine competitive success for manufacturers operating in this evolving market.

Key Opportunities:

- Philippines Electric Vehicle Market Expansion: The global transition toward electric vehicles creates substantial opportunities for Philippines wiring harness manufacturers. Electric vehicles require significantly more complex wiring systems compared to internal combustion engine vehicles, a typical 2024 BEV requires up to 2,000 additional wiring connections versus similar ICE vehicles. High-voltage harnesses capable of handling 400V to 800V or higher represent a premium segment with strong growth prospects.

- ASEAN Export Platform Advantages: The Philippines' strategic position within ASEAN provides preferential market access to rapidly growing automotive markets throughout Southeast Asia. Regional trade agreements and proximity to major manufacturing centers in Thailand, Indonesia, and Vietnam create opportunities for Philippines-based suppliers to serve multiple markets efficiently. Cost-effective manufacturing combined with improving technical capabilities makes the Philippines an attractive sourcing destination for global OEMs seeking supply chain diversification.

- Modular Design Adoption: The industry shift toward modular vehicle platforms and standardized wiring solutions creates opportunities for manufacturers who invest in flexible production systems. Modular harness designs allow automakers to standardize components across different vehicle models, reducing production costs and enhancing scalability. Philippines manufacturers who develop modular design capabilities can serve multiple OEM platforms efficiently, improving capacity utilization and profitability.

- Technology Integration and Digital Transformation: IoT-enabled production, ERP-MES integration, and AI-powered quality control systems create opportunities for operational excellence. Facilities implementing these technologies achieve superior throughput, reduced defects, and enhanced scalability. The digitalization of manufacturing operations also facilitates remote monitoring, predictive maintenance, and data-driven decision-making, improving overall equipment effectiveness and manufacturing efficiency.

- Workforce Development and Skills Enhancement: Investment in technical training and workforce development creates competitive advantages through improved quality, innovation capabilities, and operational flexibility. Philippines manufacturers focusing on technical design skills and quality control expertise can differentiate themselves through superior execution and problem-solving capabilities, commanding premium positions in OEM supply chains.

- Sustainable Manufacturing Practices: Growing regulatory requirements and consumer preferences for sustainable products create opportunities for manufacturers adopting environmentally responsible practices. The development of recycled materials, energy-efficient production processes, and circular economy approaches can enhance brand value and open access to environmentally conscious customers and supply chains.

Significant Challenges:

- Rising Technological Complexity: Modern vehicles contain increasingly sophisticated electronics requiring harness designs that support high-speed data transmission, high-voltage power distribution, and electromagnetic compatibility. Managing this complexity while maintaining reliability and cost-effectiveness challenges engineering and production capabilities, particularly for smaller manufacturers with limited R&D (research and development) resources.

- Capital Investment Requirements: Automation, advanced manufacturing technologies, and quality control systems require substantial capital investments. Crimping robots, visual inspection systems, IoT sensors, and ERP-MES platforms represent significant financial commitments. For Philippines manufacturers, accessing capital at competitive rates and justifying investments against uncertain future demand volumes can constrain technology adoption and competitiveness improvement.

- Labor Market Dynamics: While the Philippines offers cost-effective labor compared to developed markets, wage inflation and competition for skilled technical workers create ongoing challenges. The transition toward automated manufacturing reduces labor intensity but requires workers with higher technical skills. Recruiting, training, and retaining qualified engineers, technicians, and quality specialists in sufficient numbers to support industry growth requires sustained investment and effective human resource strategies.

- Supply Chain Vulnerabilities: Global supply chains for raw materials—particularly copper, connectors, and specialized components—face periodic disruptions from geopolitical tensions, trade policies, and logistics challenges. U.S. tariffs on Chinese imports have prompted manufacturers to diversify production bases, creating both opportunities and challenges for Philippines suppliers. Managing supply chain risks while maintaining just-in-time delivery performance to demanding OEM customers requires sophisticated planning and supplier relationship management.

- Quality and Reliability Standards: Automotive wiring harnesses are safety-critical components where defects can result in vehicle recalls, warranty claims, and reputational damage. Meeting stringent OEM quality requirements demands robust quality management systems, comprehensive testing capabilities, and continuous improvement cultures. For Philippines manufacturers, demonstrating consistent quality performance and obtaining necessary certifications (such as IATF 16949) represents both a significant challenge and essential prerequisite for accessing premium market segments.

- Competitive Pressure and Margin Compression: Intense competition among wiring harness manufacturers globally creates downward pressure on prices and profit margins. OEMs continually seek cost reductions from suppliers while demanding enhanced capabilities and responsiveness. Philippines manufacturers must continuously improve productivity, reduce waste, and optimize operations to maintain profitability while investing in technology advancement and capability building.

- Technological Disruption and Transition Risk: Rapid evolution in vehicle electrical architectures, including zonal architectures, centralized computing domains, and software-defined vehicles, threatens to obsolete traditional wiring harness designs and manufacturing approaches. Manufacturers must anticipate technological transitions, invest in emerging capabilities, and manage the risk of stranded assets in legacy technologies while continuing to serve current customer requirements efficiently.

Strategic Imperatives:

Successfully navigating these opportunities and challenges requires Philippines wiring harness manufacturers to pursue several strategic imperatives: continuous investment in automation and digital technologies, development of modular and flexible manufacturing capabilities, cultivation of technical expertise and problem-solving skills within the workforce, establishment of strategic partnerships with technology providers and OEM customers, commitment to quality excellence and continuous improvement, and proactive engagement with sustainability requirements and circular economy principles.

Organizations that effectively balance short-term operational excellence with long-term capability building will be best positioned to capture growth opportunities while managing inherent industry challenges in this dynamic and strategically important sector.

Future Outlook: Philippines Automotive Wiring Harness Industry

The future outlook for the Philippines automotive wiring harness industry is characterized by sustained growth, technological transformation, and increasing strategic importance within global automotive supply chains. Multiple converging trends suggest robust long-term prospects for manufacturers who successfully adapt to evolving market requirements and invest in next-generation capabilities.

Market Growth Trajectory

The Philippines automotive wiring harness market is set for steady long-term expansion, supported by growing vehicle assembly activity, stronger export participation within ASEAN, and the increasing electronics content built into modern vehicles. While overall growth may appear moderate, it reflects a market transitioning from traditional applications to more advanced, higher-value segments. The rapid adoption of electric vehicles and driver-assistance technologies is reshaping demand, requiring sophisticated sensor harnesses, high-speed data transmission cables, and enhanced electromagnetic shielding. These specialized components carry greater technical complexity and command premium pricing, creating significant opportunities for manufacturers with strong engineering capabilities and quality performance.

Electrification and High-Voltage Systems

Vehicle electrification represents the most significant structural transformation affecting the wiring harness industry. Battery electric vehicles, plug-in hybrids, and mild hybrid systems all require high-voltage wiring harnesses fundamentally different from traditional 12-volt systems. These high-voltage applications demand specialized materials, enhanced insulation, sophisticated thermal management, and stringent safety protocols.

Philippines manufacturers investing in high-voltage harness capabilities position themselves for disproportionate growth as electrification accelerates. The premium pricing associated with high-voltage harnesses, combined with lower competitive intensity compared to mature ICE applications, creates opportunities for improved margins and differentiated market positioning. However, achieving necessary certifications, developing required expertise, and implementing appropriate manufacturing processes requires sustained investment and organizational commitment.

Modular and Zonal Architecture Adoption

The automotive industry's transition toward modular vehicle platforms and zonal electrical architectures will fundamentally reshape wiring harness design and manufacturing. Zonal architectures consolidate electronic control units into fewer, more powerful domain controllers connected through high-speed data links, dramatically reducing wiring length and complexity. This architectural shift can reduce wiring length by up to 30%, decrease vehicle weight, and simplify assembly processes.

For Philippines manufacturers, this transition creates both opportunities and challenges. Opportunities arise from reduced manufacturing complexity and potential for standardized modular components serving multiple vehicle models. Challenges emerge from potentially reduced total harness content per vehicle and the need for new capabilities in high-speed data transmission and centralized computing support. Manufacturers who successfully develop modular design capabilities and establish partnerships with domain controller suppliers will be best positioned to thrive in this evolving architecture paradigm.

Digital Manufacturing and Industry 4.0

The future competitiveness of Philippines wiring harness manufacturers depends significantly on successful adoption of Industry 4.0 technologies. IoT-enabled production lines, ERP-MES integration, AI-powered quality control, and digital twin simulation create substantial advantages in productivity, quality, flexibility, and cost performance. These technologies enable real-time optimization, predictive maintenance, rapid changeover between product variants, and data-driven continuous improvement.

Investment in digital manufacturing capabilities represents both a competitive necessity and significant opportunity. Facilities implementing comprehensive digital strategies report improvements in overall equipment effectiveness, defect rates, and labor productivity. The Philippines' relatively advanced information technology infrastructure and availability of technically skilled workers provide favorable conditions for successful digital transformation compared to some regional competitors.

Sustainability and Circular Economy

Environmental sustainability will increasingly influence competitive dynamics in the automotive wiring harness industry. Regulatory requirements, OEM sustainability commitments, and consumer preferences are driving demand for recycled materials, energy-efficient manufacturing processes, and circular economy approaches. The May 2024 development of recycled PBT resin by Yazaki and Toray Industries represents an early example of this trend's practical implementation.

Philippines manufacturers who proactively address sustainability requirements will gain competitive advantages through preferential supplier status with environmentally conscious OEMs, potential regulatory advantages, and enhanced brand reputation. Investments in sustainable materials, renewable energy sources, and waste minimization programs generate both environmental and economic returns through reduced material costs, improved energy efficiency, and enhanced customer relationships.

Workforce Development and Knowledge Capital

The future success of Philippines automotive wiring harness manufacturing depends critically on continued workforce development and knowledge capital accumulation. As manufacturing processes become more automated and technologically sophisticated, the required workforce profile shifts from manual assembly skills toward technical expertise in mechatronics, data analytics, quality engineering, and systems integration.

Strategic investments in technical education partnerships, apprenticeship programs, and continuous learning initiatives will determine whether Philippines manufacturers can capture high-value segments requiring advanced capabilities. Organizations that cultivate problem-solving cultures, cross-functional collaboration, and innovation mindsets will differentiate themselves through superior execution and value creation beyond commodity manufacturing.

Regional Integration and Supply Chain Resilience

The Philippines' position within ASEAN creates opportunities for regional integration and supply chain optimization. As global automotive companies continue diversifying manufacturing footprints to enhance resilience, the Philippines benefits from China-plus-one strategies and near-shoring trends. Strategic investments in connectivity infrastructure, trade facilitation, and regional cooperation will enhance these natural advantages and position Philippines manufacturers as preferred suppliers for regional automotive assembly operations.

Conclusion:

The future outlook for the Philippines automotive wiring harness industry is fundamentally positive, characterized by steady market growth, technological evolution, and increasing strategic importance. Manufacturers who successfully navigate the transition toward electric vehicles, modular architectures, and digital manufacturing while maintaining quality excellence and cost competitiveness will capture disproportionate value creation opportunities. The industry's trajectory suggests sustained relevance and growth potential well into the next decade, positioning the Philippines as an increasingly important node in global automotive electronics manufacturing.

Partner with IMARC Group: Your Trusted Advisor in Automotive Wiring Harness Intelligence

Choose IMARC Group to Navigate the Philippines Automotive Wiring Harness Market with Confidence

As the Philippines automotive wiring harness industry undergoes rapid transformation driven by electrification, digitalization, and modular design innovations, strategic decision-making requires comprehensive market intelligence and expert insights. IMARC Group delivers unmatched expertise to help you capitalize on emerging opportunities while mitigating industry challenges.

Our Core Services Include:

- Data-Driven Market Research: Deepen your understanding of wiring harness demand patterns, technological advancements in modular designs, automation technologies, and electric vehicle integration through our comprehensive market research reports. Our analysis covers ADAS market expansion, high-voltage harness requirements, and IoT-enabled manufacturing trends across the Philippines and broader ASEAN region.

- Strategic Growth Forecasting: Anticipate emerging trends in automotive electrical architectures, from intelligent harness systems and AI-driven design optimization to policy changes affecting vehicle manufacturing and export dynamics. Our regional forecasts provide actionable intelligence for capacity planning, technology investments, and market entry strategies.

- Competitive Benchmarking: Analyze competitive dynamics among major players including Yazaki Corporation, Lear Corporation, Sumitomo Electric Industries, and Furukawa Electric. Review product pipelines, automation capabilities, and strategic partnerships. Monitor breakthroughs in sustainable materials, recycled components, and manufacturing process innovations.

- Technology and Infrastructure Advisory: Stay ahead of transformations in zonal architectures, centralized computing domains, and modular platform designs. Understand implications of Industry 4.0 technologies, ERP-MES integration, and digital twin applications for manufacturing competitiveness. Navigate workforce development requirements for technical skills in design engineering and quality control.

- Custom Reports and Consulting: Obtain tailored insights aligned with your organizational objectives—whether expanding wiring harness production capacity, investing in high-voltage capabilities for electric vehicles, developing partnerships with OEM customers, or optimizing supply chain strategies within ASEAN automotive markets.

At IMARC Group, our mission is to empower automotive industry leaders with clarity and intelligence required to succeed in the rapidly evolving wiring harness sector. Join us in supporting a more connected, efficient, and sustainable automotive future—because every connection matters.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)