Australia Aged Care Market: Elderly Care Reform, Digital Health Integration, Trends & Growth Drivers

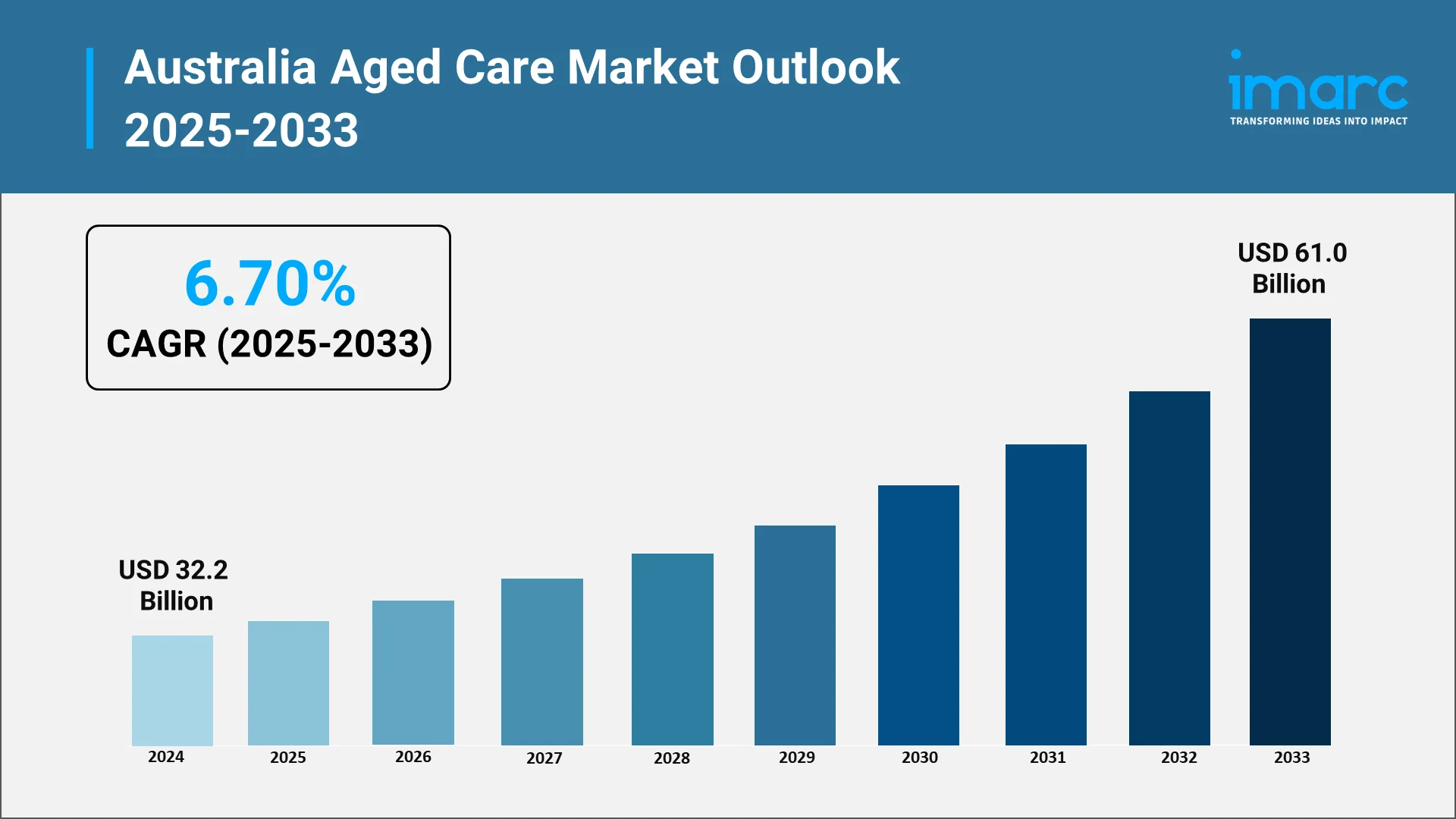

The Australia aged care industry stands at a pivotal juncture as the nation grapples with demographic shifts that are reshaping the landscape of elderly care services. With an aging population that continues to expand, Australia faces both unprecedented challenges and remarkable opportunities in delivering quality care to its senior citizens. The sector has undergone significant transformation in recent years, driven by regulatory reforms, technological innovation, and evolving consumer expectations. According to IMARC Group, the Australia aged care market reached USD 32.2 Billion in 2024.

Australia's aged care system encompasses a diverse range of services including residential care facilities, home care packages, respite care, and community support programs. The industry serves as a critical pillar of the nation's social infrastructure, ensuring that older Australians receive dignified, person-centered care that respects their independence and quality of life.

The business has seen a turning point due to the Royal Commission into Aged Care Quality and Safety, which exposed structural problems and sparked extensive reforms. The way aged care is provided, financed, and governed throughout Australia is being drastically altered by these reforms. The government's dedication to resolving quality and safety issues has led to extensive modifications to accountability frameworks, financing sources, and accreditation criteria. In order to fulfill increased expectations, this regulatory change is forcing providers to reevaluate their operating models and make investments in technology, infrastructure, and staff development.

The convergence of demographic pressures, regulatory reform, and technological advancement has created a dynamic environment where innovation is not merely advantageous but essential. Digital health technologies, telecare solutions, and assistive devices are emerging as transformative forces that promise to enhance care quality, improve accessibility, and address workforce challenges. As Australia's aged care sector navigates this period of transition, stakeholders across the ecosystem are seeking sustainable pathways to deliver care that is both high-quality and financially viable.

Explore in-depth findings for this market, Request Sample

Role of Digital Health, Telecare & Assistive Technologies, Impact, and Benefits in the Australia Aged Care Market:

Digital health technologies are revolutionizing how aged care services are delivered across Australia, offering solutions to longstanding challenges around accessibility, quality monitoring, and care coordination. These technologies encompass a broad spectrum of innovations including remote patient monitoring systems, telehealth platforms, electronic health records, medication management solutions, and artificial intelligence-driven care optimization tools. The adoption of digital health in aged care represents a fundamental shift from reactive, facility-centric models toward proactive, person-centered approaches that prioritize prevention and early intervention.

Telecare solutions have emerged as particularly valuable in addressing Australia's geographic challenges, where many elderly Australians live in regional and remote areas with limited access to specialized healthcare services. In September 2024, the Department of Health and Aged Care issued tender for telehealth solution to deliver virtual nursing services to 30 residential aged care homes. Virtual consultations enable aged care residents to connect with general practitioners, specialists, and allied health professionals without the need for physically demanding and costly travel. This enhanced accessibility not only improves health outcomes but also reduces the burden on family members and caregivers who might otherwise need to coordinate complex logistics for medical appointments.

Remote monitoring technologies allow care providers to track vital signs, detect falls, monitor medication adherence, and identify early warning signs of health deterioration. These systems use sensors, wearable devices, and connected home technologies to provide continuous oversight while respecting residents' autonomy and privacy. When abnormalities are detected, alerts are automatically generated, enabling rapid intervention that can prevent hospitalization and serious complications. The ability to provide this level of monitoring without constant physical presence represents a significant advancement in care delivery efficiency.

Assistive technologies are empowering elderly Australians to maintain independence and age in place, which remains the preference for most seniors. On November 1, 2025, Australian Government Department of Health and Aged Care launched Assistive Technology and Home Modifications Scheme (AT-HM), which is an equipment loan scheme offering funding of up to $15,000 for assistive technologies. It covers walkers, wheelchairs, hearing aids, video call systems, personal alarms, fall detectors, blood pressure monitors, telehealth platforms, wearable fitness trackers, automated lighting, and medication reminders.

Smart home adaptations including automated lighting, voice-activated controls, and intelligent safety systems help create environments where individuals with mobility limitations or cognitive impairments can live safely with minimal assistance. Mobility aids enhanced with technology, such as GPS-enabled walkers and fall-detection pendants, provide peace of mind to both users and their families while enabling greater freedom of movement.

The impact of these technologies extends beyond individual care outcomes to address systemic workforce challenges facing the aged care sector. Australia's aged care workforce is under considerable strain, with recruitment and retention difficulties affecting service quality and provider sustainability. Digital solutions help optimize staff allocation, streamline administrative tasks, and enable care workers to focus their time on high-value interpersonal interactions rather than paperwork. Clinical decision support systems assist less experienced staff in making appropriate care decisions, effectively augmenting workforce capability during a period of rapid sector growth.

Electronic medication management systems represent another critical application of digital health in aged care, addressing one of the most significant safety risks in the sector. These systems reduce medication errors through barcode scanning, automated dispensing, and real-time verification of prescriptions against resident records. They also facilitate better coordination between aged care facilities, pharmacies, and prescribing physicians, ensuring that medication regimens are current and appropriate for each individual's changing health needs.

The integration of digital health data across the care continuum enables more holistic and coordinated care for elderly Australians who often interact with multiple healthcare providers. Interoperable electronic health records ensure that critical information follows the individual whether they're in residential care, receiving home care services, visiting their GP, or being treated in hospital. This seamless information exchange reduces duplicated tests, medication conflicts, and gaps in care continuity that have historically plagued aged care delivery.

Artificial intelligence and predictive analytics are beginning to demonstrate potential in aged care applications, from predicting which residents are at elevated risk of falls or infections to optimizing staffing rosters based on anticipated care needs. While still emerging, these advanced technologies promise to enable more proactive and efficient care delivery as they mature and become more widely adopted across the sector.

Recent Market News & Major Research and Development in the Australia Aged Care Sector:

The Australia aged care sector has witnessed substantial activity in recent times as providers, technology companies, and healthcare organizations collaborate to address the challenges identified by regulatory reforms and changing demographic patterns. Major residential aged care operators have announced significant investments in facility upgrades, technology infrastructure, and workforce training programs designed to meet new quality standards and resident expectations.

Several leading aged care providers have embarked on ambitious digital transformation initiatives, implementing comprehensive technology platforms that integrate care planning, clinical documentation, family communication, and operational management. These integrated systems represent a departure from fragmented, paper-based processes that have historically characterized the sector. The implementation of such platforms requires substantial capital investment and change management, but providers recognize that digital capability is increasingly essential for competitive positioning and regulatory compliance.

The home care segment has experienced particularly dynamic innovation as consumer preference for aging in place drives demand for technology-enabled home services. New models are emerging that combine traditional in-person care visits with remote monitoring and virtual check-ins, creating hybrid approaches that offer more continuous oversight at lower cost. Companies specializing in technology-enabled home care are attracting investment as they demonstrate the viability of these models in improving outcomes while managing costs.

Research and development efforts in aged care are increasingly focused on addressing dementia care, which represents one of the most complex and resource-intensive aspects of the sector. Virtual reality applications are being explored as tools for cognitive stimulation and reminiscence therapy for dementia patients. These immersive experiences can help reduce anxiety and behavioral symptoms while providing meaningful engagement for individuals whose cognitive capabilities are declining. Early results from pilot programs have been promising, though broader implementation requires further validation and refinement.

Robotics and automation technologies are being cautiously introduced in Australian aged care settings, primarily in applications like medication dispensing, cleaning, and heavy lifting tasks that pose injury risks to care workers. While humanoid companion robots have garnered attention internationally, Australian providers have generally taken a more conservative approach, focusing on technologies that augment rather than replace human interaction. The cultural and ethical considerations around robotics in aged care remain subjects of ongoing discussion among providers, regulators, and consumer advocates.

Partnerships between aged care providers and universities have intensified, with collaborative research programs investigating best practices in care delivery, workforce models, and technology integration. These academic partnerships are generating evidence-based insights that inform both policy development and operational strategies. The research is particularly valuable in Australia's context, where unique geographic, demographic, and cultural factors mean that international findings cannot always be directly applied without local validation.

The emergence of specialized technology startups focused on aged care represents another significant development. These companies are developing purpose-built solutions addressing specific pain points in the sector, from staff scheduling optimization to family engagement platforms. Many of these startups are working directly with aged care providers to co-design solutions that address real operational needs rather than offering generic technologies that require extensive customization.

Government-funded innovation programs have provided support for pilot projects testing novel approaches to aged care delivery. These initiatives are exploring diverse concepts including intergenerational care models that combine childcare and aged care services, technology-enabled wellness programs, and community-based care coordination platforms. While not all pilots will scale to widespread implementation, they contribute valuable learning about what works in the Australian aged care context.

The increased focus on preventive care and wellness in aged care settings represents a philosophical shift from purely medical models toward holistic approaches that address physical, cognitive, social, and emotional wellbeing. Providers are implementing exercise programs, social activities, and cognitive stimulation initiatives designed to maintain function and delay decline. Technology plays a supporting role in these programs through fitness tracking, virtual group activities, and gamified cognitive training applications.

Opportunities and Challenges in the Australia Aged Care Market:

The Australia aged care market presents compelling opportunities for organizations that can navigate the complex regulatory environment while delivering high-quality, sustainable services. The most fundamental opportunity stems from demographic inevitability – Australia's aging population ensures continued demand growth for aged care services across all segments. This demand is not merely quantitative but increasingly sophisticated, with consumers expecting higher quality, greater choice, and more personalized care than previous generations.

Home care services represent particularly strong growth opportunities as consumer preference for aging in place aligns with government policy objectives to delay or avoid residential care admission. The flexibility of home care packages, which allow consumers to direct their own care within funding parameters, has created space for innovative service providers to differentiate through technology, care coordination, and specialized services. Organizations that can deliver effective home care at scale have significant runway for expansion.

The integration of technology and digital health creates opportunities for both established aged care providers and new entrants. Companies offering solutions that address real operational pain points – workforce management, clinical documentation, remote monitoring, family engagement – can find receptive markets among providers seeking to improve efficiency and quality. The sector's historically low technology adoption means substantial room exists for value-creating innovation, though solutions must be designed with aged care's unique constraints and requirements in mind.

Specialized care services for conditions like dementia, Parkinson's disease, and other age-related conditions represent differentiation opportunities. Providers that develop genuine expertise in these challenging care domains can command premium positioning and attract residents with specific needs. The complexity of such care creates barriers to entry that protect skilled providers from commoditization.

Opportunities exist in workforce solutions as the sector struggles with recruitment and retention challenges. Organizations that can develop sustainable workforce models – whether through innovative training programs, technology augmentation, or improved working conditions – will have competitive advantages. The chronic workforce shortage means that human capital capabilities are increasingly central to provider success.

However, the sector faces formidable challenges that test even experienced operators. Funding adequacy remains a persistent concern, with providers arguing that government funding rates do not fully cover the costs of delivering care that meets regulatory standards. The complexity of the funding system, which involves multiple payment streams and intricate rules, creates administrative burdens and financial uncertainty. Providers must carefully manage the economics of each resident or care package to ensure overall sustainability.

Regulatory complexity and compliance costs have intensified following the Royal Commission reforms. Providers must navigate detailed quality standards, staffing requirements, reporting obligations, and accreditation processes that demand significant administrative resources. Smaller providers particularly struggle with compliance costs that don't scale proportionally with facility size. The risk of regulatory penalties for non-compliance adds another layer of concern for operators.

The workforce crisis in aged care represents perhaps the sector's most pressing challenge. Recruiting and retaining qualified care workers, nurses, and allied health professionals is increasingly difficult given competing opportunities in other healthcare settings that often offer better pay and conditions. High staff turnover disrupts care continuity and quality while increasing training costs. The emotional and physical demands of aged care work contribute to burnout, particularly in the wake of challenging periods that have tested workforce resilience.

Reputational challenges stemming from highly publicized quality failures have affected public confidence in aged care providers. Rebuilding trust requires not only improved practices but transparent communication and genuine cultural change within organizations. Providers must demonstrate commitment to quality that goes beyond compliance to genuine person-centered care. This reputational recovery takes time and sustained effort.

Capital requirements for facility upgrades and technology investments create financial pressures, particularly for providers operating older facilities that require significant refurbishment to meet contemporary standards. The payback periods on such investments are long, and uncertainty about future funding arrangements makes investment decisions challenging. Access to capital varies considerably based on provider size and ownership structure, potentially creating competitive disparities.

Consumer expectations are rising as aged care is increasingly viewed through a consumer lens rather than a purely welfare perspective. Families conduct detailed research, compare providers, and expect high-quality amenities and services. Meeting these expectations while managing cost constraints requires operational excellence and strategic positioning. Providers that fail to adapt to consumer-driven markets risk occupancy challenges and competitive disadvantage.

The sector must also address complex challenges around culturally appropriate care for Australia's diverse aging population. Different cultural communities have varying expectations and preferences around aged care, and providers must develop cultural competency to serve these communities effectively. This extends beyond language services to understanding cultural norms, dietary requirements, and family involvement preferences.

Future Outlook: Australia Aged Care Market

The future trajectory of the Australia aged care market will be shaped by the interplay of demographic forces, technological evolution, regulatory frameworks, and societal attitudes toward aging and care. The industry is expected to reach USD 61.0 Billion by 2033 at a CAGR of 6.70% during the forecast period (2025-2033). The sector is transitioning from a relatively stable environment toward one characterized by continuous change and adaptation. Organizations that embrace this dynamic context and develop strategic capabilities to navigate uncertainty will be best positioned for sustainable success.

Technology integration will accelerate across all segments of aged care, moving from optional enhancement to fundamental infrastructure. Digital health platforms will become standard rather than exceptional, with providers expected to offer robust remote monitoring, telehealth access, and digital care coordination as baseline capabilities. Artificial intelligence applications will mature, enabling more sophisticated predictive analytics, personalized care planning, and operational optimization. The providers that invest strategically in technology will gain efficiency advantages and quality improvements that translate to competitive positioning.

The home care segment is expected to continue expanding as consumer preferences and policy settings favor aging in place. New care models will emerge that blur traditional boundaries between home care and residential care, offering flexible options that adjust to changing needs rather than requiring disruptive transitions between care settings. Technology will be central to enabling these flexible models, providing the monitoring and coordination capabilities necessary to deliver complex care safely in home environments.

Workforce models will evolve as the sector experiments with different approaches to addressing chronic labor shortages. Greater use of technology to augment workforce capability, task reallocation between different skill levels, and innovative training pathways will change how care is delivered. Immigration policies that facilitate recruitment of international care workers may play a role in workforce supply, though sustainable long-term solutions require improving the attractiveness of aged care careers for domestic workers.

Funding arrangements will likely continue evolving as governments seek to balance quality imperatives with fiscal sustainability. Greater consumer co-contribution may be required, shifting more costs to individuals and families while government funding focuses on those with limited means. This evolution toward a more market-based system with stronger safety nets could fundamentally reshape provider business models and consumer behavior.

Quality and safety standards will remain high on the agenda, with continuous improvement expected rather than a return to previous norms. Transparency around quality outcomes will increase, with public reporting enabling more informed consumer choice while creating reputational incentives for excellence. Providers will need to embed quality into organizational culture rather than treating it as a compliance exercise.

The physical infrastructure of aged care will transform as contemporary design principles emphasizing homelike environments, connection to nature, and resident autonomy replace institutional models. New facilities will incorporate technology infrastructure from inception rather than as afterthought retrofits. The aesthetics and amenities of aged care accommodation will increasingly resemble premium residential settings rather than healthcare facilities.

Preventive approaches and wellness will receive greater emphasis as the sector recognizes that maintaining function and preventing decline delivers better outcomes and more efficient resource utilization than reactive medical models. Exercise programs, social engagement, cognitive stimulation, and nutrition management will be integrated into care models as core components rather than optional additions. This shift requires different workforce skills and facility designs that support active lifestyles.

Partnerships and collaborations across the aged care ecosystem will intensify as organizations recognize that addressing complex challenges requires collective effort. Providers will partner with technology companies, healthcare organizations, research institutions, and community groups to deliver integrated solutions. These collaborative models enable specialization while maintaining coordinated person-centered care.

Consumer expectations will continue rising as younger generations with different attitudes and experiences enter aged care. These consumers will demand greater control, transparency, and personalization in their care arrangements. Providers must develop capabilities to respond to individual preferences while maintaining operational efficiency. The most successful organizations will find ways to offer genuine personalization at scale through a combination of process design, technology, and workforce capability.

The aged care sector will likely see continued consolidation as scale becomes more important for managing regulatory complexity and funding technology investments. However, specialist providers and regional operators that develop distinct capabilities or serve particular communities will continue thriving alongside large operators. The market will segment, with different provider types serving different consumer segments based on needs, preferences, and financial resources.

Ultimately, the future of Australia's aged care market will be defined by how successfully the sector can deliver the quality of care that older Australians deserve while managing economic realities and workforce constraints. The trajectory is toward more technologically enabled, consumer-directed, and quality-focused care delivered across diverse settings. Organizations that align their strategies with these trends while maintaining financial sustainability will lead the sector's transformation.

Choose IMARC Group for Unmatched Expertise in Aged Care Market Intelligence:

- Data-Driven Market Research: Gain clear insights into Australia’s aged care sector through detailed analysis of demographics, regulations, technology use, and care delivery innovations.

- Strategic Growth Forecasting: Identify key trends in service delivery, digital health, assistive technologies, consumer behavior, and workforce models across regions.

- Competitive Benchmarking: Track provider performance, assess differentiation strategies, and review innovations in technology, care models, and quality improvement.

- Policy and Regulatory Advisory: Monitor government funding, compliance changes, and evolving quality standards impacting aged care operations.

- Custom Reports and Consulting: Receive tailored insights to support market entry, investment assessment, technology integration, or care model optimization.

At IMARC Group, we empower aged care stakeholders with data and intelligence to make informed decisions. Partner with us to strengthen quality care across Australia—ensuring every senior experiences dignity, respect, and excellence in their care journey.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)