Top Factors Driving Growth in the India Confectionery Industry

The India confectionery industry has emerged as one of the most dynamic segments within the country's food and beverage sector. Driven by changing consumer preferences, rising disposable incomes, and evolving lifestyles, the market continues to witness remarkable transformation across urban and rural landscapes. Indian consumers are increasingly embracing diverse confectionery products that cater to various occasions, tastes, and health considerations.

The growing middle class, increasing urbanization, and heightened exposure to global brands have expanded the consumer base for premium chocolates, sugar-free alternatives, and innovative formats. The cultural significance of gifting during festivals has created sustained demand for elegantly packaged chocolate assortments.

Premium Chocolates and Gifting Packs Boosting Seasonal Demand:

Premiumization has been one of the major defining features of the India confectionery industry, with more consumers switching toward high-end chocolate products. This is part of a broader shift in consumer behavior, wherein, for a well-off urban population, quality and brand reputation often come first among purchase considerations. Premium brands have successfully made their products symbols of sophistication and indulgence.

Gifting during festivals forms the strong foundation of confectionery demand in India, driven by cultural traditions of gifting on occasions like Diwali, Raksha Bandhan, and regional festivals. Companies have used this opportunity by launching gifting packs that are specially designed and include beautiful packaging, multiple flavor variants, and premium positioning. These collections have used traditional Indian design elements with a modern feel.

Corporate gifting has emerged as a substantial revenue stream within the premium segment. Organizations utilize chocolate gift hampers to strengthen business relationships, reward employees, and enhance brand visibility during festive seasons. The corporate segment values presentation quality, brand reputation, and product consistency, driving manufacturers to invest in packaging innovation and differentiation.

The seasonal demand entails distinctive consumption patterns in the year, peaking at major festival occasions. In response, manufacturers introduce limited editions and innovative flavor collections to capture the peak periods. This has ensured not only volume growth but also revenue expansion.

Market Size and Growth Opportunity:

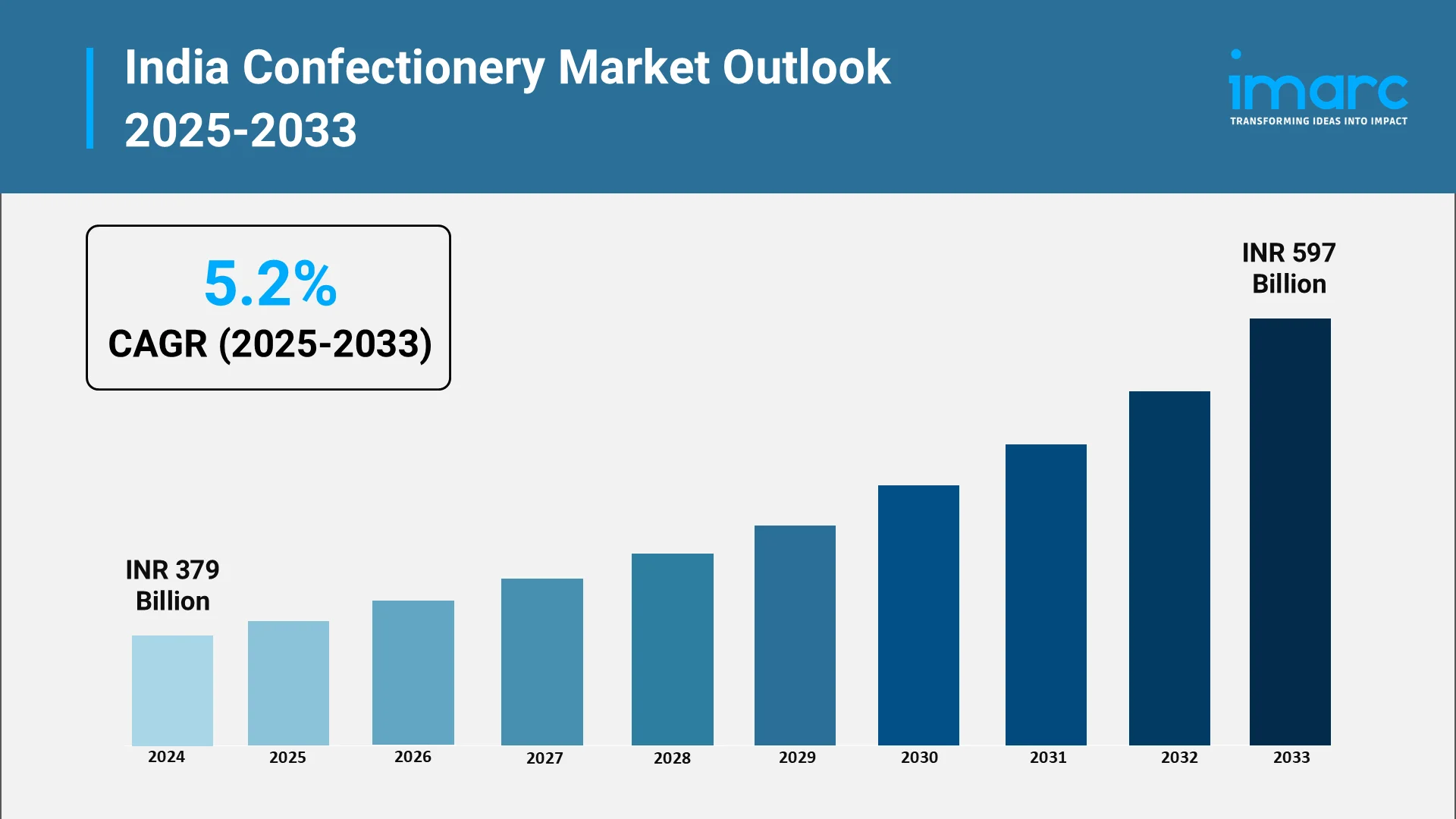

The India confectionery market presents exceptional growth opportunities, by reaching INR 597 Billion by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The market is further driven by favorable demographics, economic development, and evolving consumer lifestyles. Urban areas demonstrate strong market potential, characterized by higher purchasing power and greater brand awareness. Metropolitan cities lead consumption patterns, while tier-two and tier-three cities are emerging as significant growth engines.

Impulse purchase behavior plays a crucial role in driving confectionery sales. Strategic placement of products at checkout counters, convenience stores, and kiosks capitalizes on spontaneous buying decisions. Consumers frequently purchase confectionery items without prior planning, influenced by attractive packaging and competitive pricing. This behavior has encouraged manufacturers and retailers to optimize product visibility across retail formats.

Urban consumers demonstrate greater willingness to experiment with new flavors, premium products, and international brands. They value convenience, quality assurance, and brand authenticity, creating opportunities for both established players and innovative entrants to capture market share through differentiated offerings.

Changing family structures and lifestyle patterns have contributed to increased confectionery consumption across age groups. Nuclear families, dual-income households, and busy urban lifestyles have created demand for convenient products offering quick energy and momentary indulgence. Parents increasingly incorporate quality confectionery into children's diets as occasional treats.

The organized retail sector's expansion has significantly influenced market growth by improving product availability and ensuring quality standards. Modern retail formats provide extensive confectionery selections, enabling consumers to explore diverse brands. This retail evolution has democratized access to premium and international products.

Digital commerce platforms have emerged as important distribution channels, particularly during recent e-commerce acceleration. Online platforms offer convenience, extensive selections, and home delivery services appealing to urban consumers. The integration of traditional and digital channels creates omnichannel experiences that strengthen brand-consumer relationships.

Explore in-depth findings for this market, Request Sample

Shift Toward Gourmet, Sugar-Free and Dark Chocolates:

Health consciousness has become a powerful force reshaping the India confectionery industry, driving significant innovation in product formulations. Urban consumers increasingly seek confectionery options that align with wellness goals while delivering taste satisfaction. This has catalyzed the development of sugar-free chocolates, reduced-sugar variants, and products incorporating natural sweeteners.

Dark chocolate has experienced remarkable growth in popularity among health-aware consumers who appreciate its perceived nutritional benefits and sophisticated taste. Rich in antioxidants and containing less sugar than traditional milk chocolate, dark chocolate appeals to consumers seeking indulgence with functional benefits. Manufacturers have introduced diverse dark chocolate products spanning various cocoa intensity levels.

The gourmet confectionery segment represents a premium niche characterized by artisanal craftsmanship, exotic ingredients, and innovative flavor combinations. Urban affluent consumers gravitate toward these premium options for personal consumption and gifting, valuing authenticity, exclusivity, and sensory excellence.

Health-focused innovations extend beyond sugar content to encompass broader wellness considerations. Manufacturers increasingly incorporate functional ingredients such as nuts, dried fruits, and superfoods into confectionery formulations. These additions enhance nutritional profiles while creating distinctive products that resonate with health-conscious demographics.

The sugar-free category has evolved significantly from early iterations. Modern sugar-free products utilize advanced sweetening technologies and flavor enhancement techniques that deliver satisfying taste experiences. This category particularly appeals to diabetic consumers, fitness enthusiasts, and individuals managing sugar intake.

Premium positioning strategies emphasize natural ingredients, minimal processing, and transparent sourcing practices that build consumer trust. Brands communicate health benefits and quality attributes through sophisticated marketing campaigns that educate consumers about product differentiation.

Small Value Packs Increasing Affordability:

Price accessibility remains fundamental to market expansion, where small-format packaging has proven instrumental in broadening consumer reach across economic segments. Products priced in the range of five to twenty rupees represent the highest-selling price bracket, making quality confectionery accessible to mass-market consumers while maintaining profitability through volume-driven business models.

Small value packs address multiple consumer needs simultaneously. They lower the entry barrier for first-time buyers experimenting with new brands, reduce purchase risk through affordable trial opportunities, and enable consumption occasions that might not justify larger purchases. This packaging strategy has democratized access to branded confectionery across income levels.

The affordability equation extends beyond initial purchase price to encompass value perception. Small packs offer portion control benefits that appeal to health-conscious consumers managing caloric intake. Parents appreciate the ability to provide controlled treat portions to children without encouraging overconsumption or generating waste.

Rural market penetration has been significantly enabled by small value pack strategies that align with purchasing patterns in these areas. Rural consumers often prefer immediate consumption products over bulk purchases, making single-serve options ideal for this segment. Lower price points accommodate limited disposable incomes while delivering branded product experiences.

Impulse purchase dynamics are particularly strong within the small value pack segment, where minimal financial commitment encourages spontaneous buying. Retailers optimize shelf placement near checkout areas, maximizing conversion opportunities. Quick turnover benefits retailers through efficient inventory management.

Distribution efficiency gains from small value packs contribute to market expansion. These products penetrate deep into distribution networks reaching small outlets, kiosks, and neighborhood stores where storage space and working capital constraints limit inventory of larger pack sizes. This extensive coverage ensures availability across diverse retail formats and geographic locations.

Top Companies in India Confectionery Market:

The competitive landscape features prominent multinational corporations and emerging domestic players who shape industry dynamics through innovation, marketing excellence, and distribution strength. Leading companies leverage established brand equity, extensive networks, and substantial marketing investments to maintain dominant positions while adapting to evolving consumer preferences.

- Cadbury, operating under Mondelez International, represents the most iconic chocolate brand in India with unparalleled market penetration. The company's product portfolio spans multiple price points and consumption occasions, from affordable small bars to premium gifting assortments. Cadbury's deep understanding of Indian consumer preferences has cemented its market leadership position. Cadbury Dairy Milk Milkinis, a crème-filled chocolate bar targeted for younger, mobile consumers, was introduced by Mondelez India in September 2025. It comes in 17g single bars priced at Rs 20 and 34g twin-bar packs priced at Rs 40. The product was created especially to appeal to Gen-Z consumers with changing snacking patterns.

- Nestlé maintains strong presence through well-established brands including KitKat and Munch that resonate across demographic segments. The company emphasizes product quality, consistent messaging, and strategic distribution partnerships that ensure widespread availability. Nestlé's global expertise combines with local market insights to drive continuous innovation.

- ITC Limited has emerged as a formidable competitor through its Fabelle and Sunfeast brands. Leveraging its extensive distribution infrastructure developed through diversified business operations, ITC has rapidly scaled its confectionery presence. The company focuses on premium positioning while offering mass-market products that address diverse consumer segments.

- Mars International brings global brands including Snickers and Galaxy to Indian consumers, complementing its successful Wrigley portfolio. The company emphasizes premium positioning and targeted marketing campaigns that build brand aspiration. Mars leverages international product development capabilities while adapting offerings to Indian tastes.

- Perfetti Van Melle dominates the candy and mint category through brands like Alpenliebe and Mentos that enjoy strong consumer recall. The company's expertise in hard-boiled candy manufacturing and innovative product variants has established it as a category leader. Strategic pricing and extensive distribution ensure accessibility across markets.

- Ferrero represents ultra-premium positioning through flagship brands including Ferrero Rocher and Kinder that command premium pricing and aspirational brand status. The company's selective distribution strategy and emphasis on gifting occasions differentiate its market approach. Ferrero's focus on product quality and distinctive packaging creates strong brand differentiation.

Conclusion:

The India confectionery industry stands at an exciting inflection point characterized by robust growth prospects and evolving consumer preferences. The convergence of premiumization trends, health consciousness, affordability innovations, and corporate excellence creates a multifaceted market environment rich with opportunities for strategic participants.

Festival and corporate gifting will continue anchoring seasonal demand patterns, while everyday consumption occasions expand through impulse purchases. The health-focused shift toward dark chocolates, sugar-free variants, and gourmet offerings reflects broader wellness trends that will shape product development strategies. Simultaneously, small value packs will remain essential for market expansion, ensuring accessibility across economic segments.

Leading companies demonstrate that success requires balancing global expertise with local market insights, combining operational scale with consumer intimacy, and maintaining brand relevance through continuous innovation. As the market matures, differentiation through quality, health benefits, and authentic brand experiences will increasingly determine competitive outcomes.

Choose IMARC Group to gain essential strategic clarity and intelligence for your lucrative confectionery venture in India:

- Data-Driven Market Research: Deepen your knowledge of local consumption patterns, distribution channel dynamics (from traditional retail to quick commerce), and consumer shifts toward premium and health-focused products through our in-depth market research reports.

- Strategic Growth Forecasting: Predict emerging trends in product innovation, from the adoption of fusion flavors (combining Indian and Western tastes) and artisanal recipes to the rising demand for organic and sugar-free segments.

- Competitive Benchmarking: Analyze competitive forces across the fragmented Indian confectionery landscape, review brand market shares (local vs. international players), and monitor breakthroughs in product launches, sustainable packaging, and supply chain efficiency.

- Policy and Regulatory Advisory: Stay one step ahead of food safety standards (FSSAI), potential sugar taxation policies, and government-led initiatives that influence manufacturing compliance and distribution logistics in the country.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it quantifying the precise factory setup investment, optimizing your product-mix for regional preferences, or building a robust strategy for maximizing profitability in the dynamic Indian sweets and snacks market.

At IMARC Group, our goal is to empower food industry leaders with the clarity and intelligence required to formulate, market, and succeed in the dynamic India confectionery market. To visit website, click: https://www.imarcgroup.com/india-confectionery-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)