Philippines Pharmaceutical Industry: Generic Drugs Surge, Major Sectors, Leading Companies

Introduction:

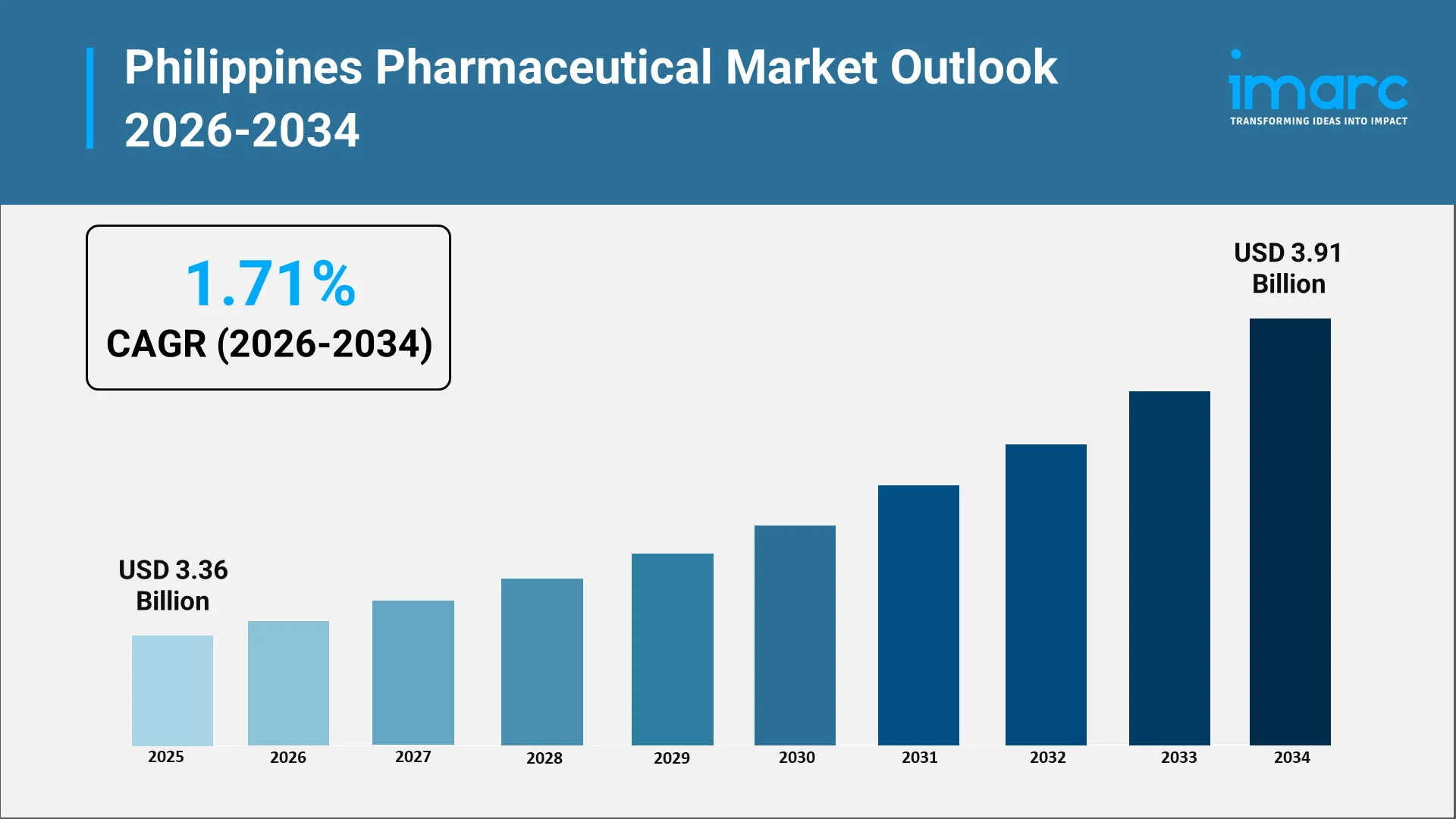

The Philippines pharmaceutical industry stands as one of Southeast Asia's most dynamic and rapidly expanding healthcare markets in the ASEAN region. With a market valuation reaching USD 3.36 Billion in 2025, the sector demonstrates resilience and tremendous growth potential. The industry's transformation is driven by a perfect confluence of factors including an expanding population of over 111 million people, progressive government healthcare initiatives, rising chronic disease prevalence, and an unprecedented surge in generic drug adoption that is revolutionizing access to affordable medicines across the archipelago.

The Filipino pharmaceutical landscape has evolved significantly over the past decade, transitioning from a market dominated by expensive branded medications to one where generic alternative now account for approximately 76% by volume of the total pharmaceutical market. This fundamental shift reflects not only changing consumer preferences but also the successful implementation of government policies aimed at making healthcare more accessible and affordable for all Filipinos, particularly those in underserved communities.

Explore in-depth findings for this market, Request Sample

Market Overview and Growth Drivers in the Philippines Pharmaceutical Industry:

Market Size and Projections:

The Philippines pharmaceutical market is expected to grow to USD 3.91 Billion by 2034, exhibiting a steady growth rate of 1.71% during the forecast period. Industry analysts project the market to remain a major pharmaceutical hub in Asia, driven by robust demand for both prescription and over-the-counter medications.

Key Growth Drivers:

- Universal Health Care (UHC) Act Implementation: The 2019 UHC Act ensures all Filipinos are automatically enrolled in national health insurance (PhilHealth). This expansion of coverage increases the demand for medications and makes essential drugs more accessible and affordable, especially in public health facilities.

- Rising Demand for Generic Drugs: Government measures, like the Cheaper Medicines Act, promote generic drug usage and bulk procurement. The high cost-effectiveness and increasing acceptance of generics boost consumption volumes, driving growth across both domestic and foreign generic manufacturers.

- Favorable Demographic and Disease Trends: The Philippines has a growing and aging population, leading to a higher incidence of non-communicable, lifestyle-related diseases (e.g., heart disease, diabetes). This demographic shift fuels sustained, long-term demand for various chronic disease management pharmaceuticals.

Key Pharmaceutical Companies Operating in the Philippines:

The Philippines pharmaceutical industry features a competitive landscape with both multinational corporations and robust local manufacturers serving diverse market segments.

- United Laboratories (Unilab)

With its headquarters located in Mandaluyong, the United Laboratories, Inc., also referred to as Unilab, is a privately held global consumer goods corporation based in the Philippines. It focuses on a broad spectrum of veterinary, personal care, biotechnology, and consumer healthcare goods. The company's product line includes branded medications such Biogesic, Neozep, and Alaxan, as well as vitamin supplements like Conzace and Enervon. Additionally, Unilab owns the generic medication brands Pharex and RiteMed, both of which are run by its subsidiary RiteMed Philippines, Inc.

- AstraZeneca Philippines

AstraZeneca has emerged as a key player with significant investments in the Philippine pharmaceutical sector. In August 2025, the Philippine Economic Zone Authority (PEZA) and AstraZeneca Pharmaceuticals (Phils.) Inc. signed an agreement to support investment promotion programs and the establishment of a local innovation hub, which is anticipated to improve the nation's pharmaceutical and healthcare innovation landscape. AstraZeneca Pharmaceuticals will continue to invest over PhP 7 Billion from 2026 to 2028.

Government Regulations, Policy Support, and Healthcare Initiatives:

Regulatory Framework:

- Food and Drug Administration (Philippines)

All medicines must be approved by the Philippines FDA before being marketed, with most medicines restricted to retail pharmacies staffed by licensed pharmacists. The FDA Act of 2009 (Republic Act 9711) established the FDA as the regulatory authority ensuring safety, efficacy, and quality of health products.

- Generic Act of 1988

The Generics Act requires the generic name of medicines prescribed by doctors to be written on prescription slips, giving patients the option to choose more affordable generic alternatives. This legislation has been instrumental in promoting generic drug acceptance and reducing healthcare costs for Filipino families.

- Universal Health Care Act

Republic Act 11223, known as the Universal Health Care Act, mandates the institutionalization of health technology assessment as a fair and transparent priority-setting mechanism. The act ensures progressive realization of universal health care through a systemic approach, guaranteeing all Filipinos equitable access to quality and affordable health care goods and services while protecting them against financial risk.

Before UHC implementation, only one-third of the Philippine population had access to appropriate medicines; the program now aims to supply required healthcare services particularly to economically disadvantaged members of society.

Investment Incentives:

-

Board of Investments Initiatives

The Board of Investments actively promotes the Philippines as a manufacturing hub for pharmaceutical companies, having approved projects such as Lloyd Laboratories' PHP 24 million investment to manufacture COVID-19 drug Molnupiravir.

-

CREATE Act

The government encourages foreign pharmaceutical companies to establish manufacturing facilities through the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act, offering attractive tax incentives.

-

Pharmaceutical Economic Zones

The first dedicated pharmaceutical park was established on July 31, 2024, at Victoria Industrial Park in Tarlac, designed to enhance research and development, technology transfer, and local patent registration.

Recent Market News & Research and Development in the Philippines Pharmaceutical Industry:

Major Developments in 2025:

- AstraZeneca Innovation Hub

AstraZeneca Pharmaceuticals announced plans to establish the first Pharma Innovation Hub in the Philippines, partnering with the Department of Trade and Industry to operate as a regional center for digital health technologies and research collaborations. The facility will utilize artificial intelligence for early cancer detection, expand patient-support systems, build healthcare workforce capacity, and promote evidence-based policy development.

Clinical Trials and Research:

The Philippines is now ranked third in Southeast Asia for pharmaceutical industry-sponsored clinical trials, following Thailand and Singapore. As originator companies conduct clinical trials as part of their worldwide research and development efforts, participation in global clinical trials creates early access to innovation, attracts major investments, and builds scientific capacity among Filipino researchers.

-

Biopharmaceutical Development

The Pharmaceutical and Healthcare Association of the Philippines has partnered with the Department of Trade and Industry to establish a vibrant biopharmaceutical industry, positioning the Philippines as a regional hub for biopharmaceutical innovation. The government has identified the health and life sciences industry cluster as one of three priority export industry clusters for development.

Opportunities and Challenges in the Philippines Pharmaceutical Industry:

Significant Opportunities:

- Expanding Generic Drug Market

The widespread availability of generic drugs has reduced prices across all prescription drug categories, with many financially challenged Filipinos opting for quality generic alternatives. Some local pharmaceutical companies that once produced only branded medicines have branched out into generic drug manufacturing and distribution, recognizing generics as the future of the Philippine market.

- Government Procurement Expansion

The Department of Health plans to implement an outpatient drug benefit initiative aligned with universal healthcare, presenting domestic drug industry opportunities to participate in bids supplying national and local government hospitals.

- Digital Health Integration

Digital health integration is advancing through telemedicine platforms and remote patient monitoring systems, creating new avenues for pharmaceutical delivery and patient care.

- Manufacturing Hub Development

PEZA's focus on pharmaceutical ecozones, combined with the CREATE MORE Bill's attractive incentive packages and the Tatak Pinoy Act, creates favorable conditions for manufacturing both for local consumption and export.

Key Challenges:

- Research and Development Limitations

A considerable gap exists in both financial resources and skilled human capital necessary for advanced pharmaceutical research, limiting indigenous innovation capabilities.

- Regulatory Complexities

Industry players have identified slow registration processes, taxes on pharmaceuticals, and price ceilings imposed under regulatory frameworks as significant barriers. The FDA can inspect local manufacturers at any time but lacks capacity to inspect international manufacturers, creating quality assurance disparities.

- Infrastructure Gaps

The industry faces challenges balancing pricing strategies and equitable access to essential medicines, particularly addressing rural healthcare needs and production efficiency concerns.

- Strategic Considerations

The implementation of Universal Health Care creates opportunities to provide large volumes of medicine, with generic medicine demand expected to increase due to lower pricing, making healthcare accessible to economically disadvantaged populations. The proposed implementation of the Pharmaceutical Inspection Cooperation Scheme would require all imported medicines to be PICS-certified, addressing quality concerns and leveling the competitive playing field.

Conclusion:

The Philippines pharmaceutical industry stands at a transformative juncture, experiencing unprecedented growth driven by progressive government policies, demographic advantages, and increasing adoption of affordable generic medicines. With market projections indicating steady expansion through 2034, strategic investments in research and development infrastructure, manufacturing capacity enhancement, and regulatory streamlining will be critical to realizing the sector's full potential.

The establishment of pharmaceutical innovation hubs, expansion of local manufacturing capabilities, and growing participation in global clinical trials position the Philippines as an emerging regional leader in pharmaceutical development and production. However, addressing challenges related to import dependency, counterfeit drug proliferation, and research capacity gaps remains essential for sustainable long-term growth.

As the industry continues evolving, collaboration between government agencies, multinational corporations, local manufacturers, and healthcare providers will be paramount in ensuring all Filipinos have access to safe, effective, and affordable medicines while building a robust pharmaceutical ecosystem capable of serving both domestic needs and regional export markets.

Partner with IMARC Group for Strategic Pharmaceutical Market Intelligence:

As the Philippines pharmaceutical industry continues its dynamic transformation, staying ahead of market trends, regulatory changes, and competitive dynamics is essential for business success. IMARC Group offers unmatched expertise in delivering actionable intelligence tailored to pharmaceutical industry stakeholders.

Our Core Services for the Philippines Pharmaceutical Sector:

- Data-Driven Market Research: Gain comprehensive insights into generic drug adoption patterns, branded pharmaceutical performance, market segmentation across prescription and over-the-counter categories, and emerging therapeutic areas through meticulously researched market intelligence reports.

- Strategic Growth Forecasting: Anticipate future market developments including Universal Health Care implementation impacts, pharmaceutical innovation hub establishment effects, digital health integration trends, and evolving consumer preferences across urban and rural markets throughout Luzon, Visayas, and Mindanao regions.

- Competitive Benchmarking: Analyze competitive dynamics among multinational corporations and local manufacturers, evaluate product pipeline developments, monitor research and development investments, and assess strategic partnerships shaping the pharmaceutical landscape.

- Policy and Regulatory Advisory: Stay informed about FDA regulatory updates, Universal Health Care Act implementation milestones, pharmaceutical inspection cooperation scheme developments, government procurement policies, and incentive programs affecting market entry and operational strategies.

- Custom Reports and Consulting Solutions: Receive tailored insights aligned with your organizational objectives—whether launching generic drug formulations, establishing manufacturing facilities, entering therapeutic segments, forming strategic partnerships, or expanding distribution networks across the Philippine archipelago.

At IMARC Group, we empower pharmaceutical leaders, healthcare investors, and industry stakeholders with the clarity and strategic intelligence required to navigate the Philippines' complex and rapidly evolving pharmaceutical market. Partner with us to capitalize on emerging opportunities, mitigate operational risks, and drive sustainable growth—because accessible, affordable, quality healthcare for all Filipinos starts with informed strategic decisions.

Please click on this link for more details: https://www.imarcgroup.com/philippines-pharmaceutical-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)