Saudi Arabia Factoring Market Trends: Strengthening SME Financing and Working Capital Solutions

Introduction: The Evolution of Alternative Financing in Saudi Arabia

The Saudi Arabia factoring market represents a critical component of the Kingdom's evolving financial services landscape, offering businesses an increasingly popular alternative to traditional bank lending. Factoring, which involves the sale of accounts receivable to a third-party financial institution at a discount, has emerged as a vital mechanism for improving liquidity, managing cash flow, and mitigating credit risk across diverse industry sectors.

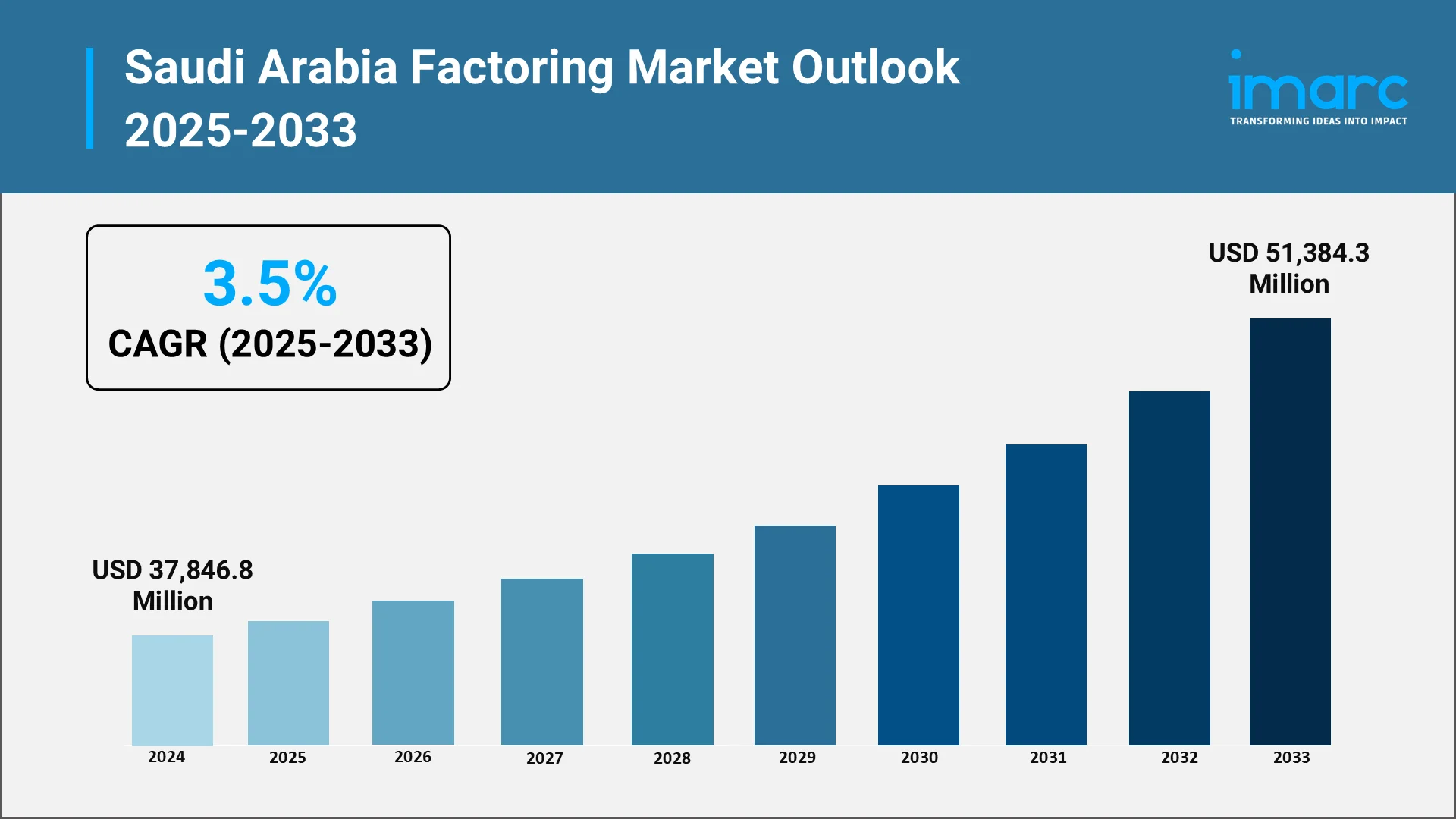

As Saudi Arabia continues its ambitious economic transformation under Vision 2030, the factoring industry has experienced notable momentum driven by the government's commitment to diversifying the economy away from oil dependence and fostering a more dynamic private sector. Small and medium-sized enterprises, which form the backbone of this diversification strategy, increasingly rely on factoring services to address working capital constraints that traditionally hindered their growth potential. Saudi Arabia factoring market size reached USD 37,846.8 Million in 2024.

The influence of factoring on SME liquidity cannot be overstated. By converting outstanding invoices into immediate cash, businesses can maintain operational continuity, invest in expansion opportunities, and navigate the cash flow challenges that often accompany extended payment terms. Beyond liquidity enhancement, factoring plays a significant role in business expansion by enabling companies to take on larger contracts without the cash flow pressures that typically accompany growth.

Credit risk reduction represents another fundamental benefit of factoring services, particularly for businesses operating in industries characterized by extended payment cycles. When companies engage in non-recourse factoring arrangements, they effectively transfer the risk of customer default to the factoring company, providing a valuable hedge against bad debt losses. The role of factoring services in supporting Vision 2030 goals extends beyond individual business benefits to encompass broader macroeconomic objectives.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming the Saudi Arabia Factoring Industry:

Vision 2030 acts as the key driver of change in the Saudi Arabia factoring market, fundamentally altering the competitive dynamics and inspiring new ways of delivering financial services to businesses. The wide-reaching reform program has created an enabling environment for alternative financing mechanisms by putting financial sector development, entrepreneurship support, and regulatory modernization in the spotlight.

The explicit government interest in augmenting the SMEs' contribution to gross domestic product has led to unprecedented demand for flexible financing solutions, which traditional banks have typically found very difficult to supply. The factoring companies positioned themselves as necessary partners in this economic transformation and offered product sets oriented to the particular problems of smaller businesses. This alignment of government priorities with industry capabilities accelerated market development and attracted new participants to the factoring ecosystem.

Regulatory reforms under Vision 2030 have created clearer frameworks governing factoring operations and provided greater legal certainty and investor confidence. Of particular significance to the factoring industry has been the emphasis on digital transformation. Government initiatives promoting electronic invoicing, digital payment systems, and online business registration have created the infrastructure that facilitates more efficient factoring operations.

Key Industry Trends:

- Growing Demand for SME Working Capital Solutions Under Vision 2030

The intensifying demand for SME working capital solutions represents a significant Saudi Arabia factoring market trend. Many SMEs struggle with stringent collateral requirements from conventional banks, creating a financing gap that factoring services uniquely fill. Factoring addresses these challenges through a different credit evaluation approach, emphasizing buyer creditworthiness rather than seller assets. This methodology opens financing opportunities for businesses deemed too risky by traditional lenders. The speed of factoring transactions provides compelling advantages, with arrangements established rapidly and ongoing transactions processed within days or hours.

- Expansion of Digital Factoring Platforms and Fintech-Based Invoice Financing

Digital transformation has revolutionized the market through technology-driven platforms leveraging artificial intelligence, machine learning, and automated workflows. Saudi Arabia's e-invoicing law (Fatoora) under ZATCA enables SMEs to generate verified invoices with digital signatures, reducing credit risk and lowering underwriting time. Saudi National Bank launched a new SME financing platform in September 2025 through partnerships with Tarabut and Geidea, integrating lending directly into platforms SMEs use daily.

- Rising Popularity of Export Factoring Due to Strengthening Trade Activity

Export factoring has gained traction as businesses engage in cross-border commerce, addressing challenges including extended payment terms, currency risks, and legal complexities. International buyers frequently demand payment terms of sixty to one hundred twenty days, creating working capital pressure that export factoring alleviates through immediate cash upon shipment.

- Increased Adoption of Non-Recourse Factoring for Better Risk Management

Non-recourse factoring transfers credit risk from seller to factoring company, providing protection against customer payment defaults. This variant eliminates contingent liabilities and creates more predictable financial outcomes while offering favorable accounting treatment.

- Supportive Regulatory Framework and Rising Participation of Banks & Financial Institutions

The regulatory environment has evolved significantly, creating clearer rules that support industry growth. Banking institutions demonstrate increasing interest, establishing dedicated factoring divisions and bringing additional capital, expertise, and credibility to the market.

Market Segmentation and Regional Insights:

IMARC Group has categorized the market based on type, organization size, and application.

Type Insights:

Based on the type, the market has been divided into international and domestic.

- International: Cross-border factoring services supporting exporters managing foreign receivables, currency risks, and international payment terms.

- Domestic: Local factoring arrangements facilitating working capital solutions for businesses with domestic accounts receivable.

Organization Size Insights:

Based on the organization size, the market has been segregated into small and medium enterprises, and large enterprises.

- Small and Medium Enterprises: SMEs represent the primary growth segment, leveraging factoring to overcome collateral limitations and access immediate working capital.

- Large Enterprises: Established corporations utilize factoring for supply chain optimization, balance sheet management, and strategic liquidity planning.

Application Insights:

On the basis of the application, the market has been categorized into transportation, healthcare, construction, manufacturing, and others.

- Transportation: Logistics and freight companies use factoring to manage extended payment cycles and maintain fleet operations.

- Healthcare: Medical facilities and service providers leverage factoring to bridge gaps between service delivery and insurance reimbursements.

- Construction: Building contractors utilize factoring to manage progress billing delays and maintain project cash flow.

- Manufacturing: Industrial producers employ factoring to finance inventory, raw materials, and production cycles.

Regional Insights:

Region-wise, the market has been segmented into Northern and Central Region, Western Region, Eastern Region, and Southern Region.

- Northern and Central Region: Riyadh-centered hub dominates with highest concentration of SMEs, financial institutions, and government initiatives.

- Western Region: Jeddah's trade gateway position drives strong demand for international factoring and import-export financing.

- Eastern Region: Oil and petrochemical industry clusters in Dammam create specialized factoring needs for industrial suppliers.

- Southern Region: Emerging market with growing factoring adoption supporting agricultural, tourism, and small business development.

Forecast: Growth Trajectory Through 2033

The Saudi Arabia factoring market is expected to reach USD 51,384.3 Million by 2033, exhibiting a growth rate (CAGR) of 3.5% during 2025-2033, driven by multiple reinforcing factors that support sustained growth. The expanding SME sector represents a foundational demand driver, with government initiatives specifically designed to increase small business formation and growth. Rising need for short-term financing solutions reflects both macroeconomic conditions and structural characteristics of the Saudi business environment.

Digital transformation enhancing access to factoring solutions will continue accelerating Saudi Arabia factoring market growth by reducing barriers to entry and improving user experience. Government support for non-bank financing models reflects recognition that diverse financial ecosystems better serve complex economic needs. Increasing cross-border trade fueling export factoring demand represents a particularly dynamic growth opportunity as Saudi businesses expand their international presence.

Conclusion: Strategic Importance of Factoring in Saudi Arabia's Economic Evolution

The Saudi Arabia factoring market stands at an inflection point characterized by accelerating adoption, technological innovation, and strong alignment with national economic priorities. Factoring has evolved from a niche financing alternative into an increasingly mainstream solution embraced by businesses across diverse industries and size categories. The symbiotic relationship between factoring industry development and Vision 2030 objectives creates powerful momentum for continued growth.

Looking forward, the most successful factoring providers will be those that combine technological sophistication with deep industry expertise and customer-centric service delivery. For businesses evaluating financing alternatives, factoring deserves serious consideration as part of a comprehensive working capital strategy.

Partner with IMARC Group for Comprehensive Market Intelligence:

At IMARC Group, we empower financial services leaders and business strategists with the clarity and intelligence required to navigate the evolving Saudi Arabia factoring landscape. Our specialized capabilities support your success through multiple dimensions.

- Our data-driven market research delivers deep insights into factoring market dynamics, emerging business models, and technological innovations reshaping invoice financing. We provide comprehensive analysis of market participants, competitive positioning, and strategic trends enabling informed decision-making for market entry, expansion, or optimization initiatives.

- Through strategic growth forecasting, we help clients anticipate emerging opportunities in SME financing, predict regulatory developments, and understand how digital transformation will reshape service delivery across different market segments. Our forward-looking analysis covers geographic expansion possibilities and sector-specific growth trajectories.

- Competitive benchmarking services analyze key players in the Saudi factoring ecosystem, assess their service offerings and pricing strategies, and identify gaps in current market coverage representing opportunity areas. We monitor technological innovations and best practices that could disrupt traditional business models.

- Our policy and infrastructure advisory keeps clients ahead of regulatory changes affecting factoring operations, monitors government initiatives supporting alternative financing, and analyzes implications of Vision 2030 programs for factoring demand. We provide insights into legal frameworks governing receivables assignment and enforcement mechanisms.

- Custom reports and consulting deliver tailored analysis addressing your specific organizational objectives, whether entering the Saudi factoring market, expanding existing operations, or evaluating acquisition opportunities. We structure insights around your unique strategic questions and decision-making requirements.

Join us in supporting Saudi Arabia's economic transformation by leveraging factoring solutions that strengthen businesses and drive prosperity. Contact IMARC Group today to discover how our market intelligence can enhance your strategic initiatives in this dynamic and growing market. For more details, visit: https://www.imarcgroup.com/saudi-arabia-factoring-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)