How Big Will the Ginger Market be by 2033?

Setting the Stage: The Global Ginger Market Is Experiencing Unprecedented Growth

The global ginger market is currently experiencing a remarkable phase of expansion, positioning itself as one of the most dynamic segments within the spice and functional ingredient industries. As consumers worldwide are increasingly gravitating toward natural, health-promoting ingredients, ginger is emerging as a star performer that is capturing attention across multiple sectors, from culinary applications to pharmaceuticals and nutraceuticals. The market is demonstrating robust momentum that industry analysts are tracking with considerable interest.

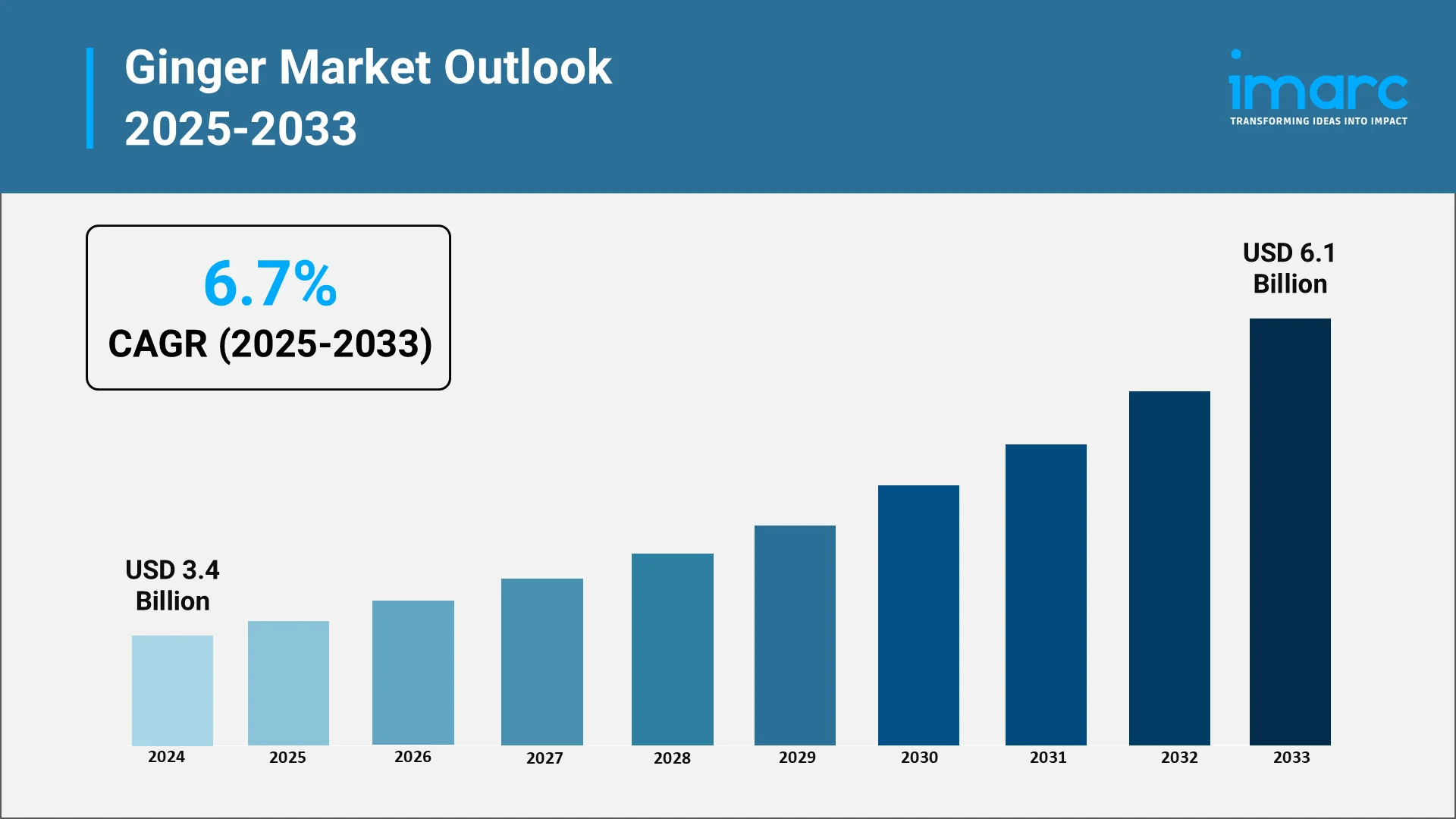

As per IMARC Group, the global ginger market is standing at USD 3.4 Billion in 2024, representing a significant economic footprint in the global agricultural and food processing landscape. This valuation reflects the widespread adoption of ginger across diverse applications, including fresh consumption, processed forms such as powders and oils, and incorporation into beverages, supplements, and personal care products. The current market size is providing a solid foundation for what experts are predicting will be substantial growth over the coming decade.

Geographic production patterns are also playing a crucial role in shaping the market's current structure. China produces around 3 million metric tons of ginger annually. In the third quarter of 2025, export volumes exceeded 450,000 metric tons, marking a 7% rise compared to the previous year. This concentration of production in Asia-Pacific nations is influencing supply chains, pricing dynamics, and export patterns that are rippling through global markets. The region’s climatic advantages established agricultural practices, and economies of scale are making it the epicenter of ginger cultivation and processing.

Explore in-depth findings for this market, Request Sample

Key Drivers Powering Ginger Market Growth Through 2033:

A variety of structural forces are driving the ginger market. One of the most influential is health and wellness awareness. Ginger is being perceived by consumers increasingly as an ingredient with multifunctional benefits that include aiding digestion, easing nausea, and enhancing anti-inflammatory activity. These beliefs are being confirmed by ongoing clinical trials, validating nutraceutical and supplement use.

The clean-label phenomenon is another key driver of the organic ginger market. As consumers move toward natural, organic, and minimally processed products, ginger is falling into place with these aspirations. Fresh and processed organic ginger is achieving robust shelf presence in supermarkets and online. Retailers and manufacturers are meeting this with the creation of certified organic product lines and open sourcing policies. In 2024, Sawari Fresh revealed the debut of its initially locally and organically cultivated ginger. "This achievement in Dutch farming merges sustainable cultivation methods with advancements in environment friendly packaging," states Mark Grim, sales director of Sawari Fresh. Starting from that season, ginger was planned to be offered in several supermarkets and fresh food stores across the Netherlands.

Food diversity is also transforming the ginger production trends and supporting the market growth. International cuisines have traditionally utilized ginger, and its use is now being extended by fusion foods. Across savory foods to sweets, sweets, beverages, and bakery products, ginger is providing unique flavor, aroma, and health signals. High-end soft beverages, kombucha, and functional soft drinks are increasingly incorporating ginger as a leading ingredient. For example, Ginger Cult, located in Portland, produces alcoholic ginger beer brewed in Hillsboro, offering a spicier and fresher taste compared to the commercial ginger sodas most individuals know. After debuting in 2024, the craft beer Ginger Cult is broadening its offerings with a new tropical ginger taste and a forthcoming non-alcoholic variant in 12oz cans and 4-packs, now available statewide through a collaboration with Point Blank Distributing.

Agricultural innovations are enhancing yield consistency and quality. Most producing nations are making investments in superior cultivation techniques, disease control, and mechanized processing. These measures are increasing product uniformity, complying with import standards of quality, and realizing better export returns. Moreover, farmers are adopting climate-smart approaches to support sustainability initiatives and win eco-friendly buyers. In 2024, farmers in Khulna, Bangladesh were experiencing extreme production of ginger farming in sack-method.

Digital marketplaces and e-commerce are opening up new avenues for growth by linking consumers directly with producers and small-scale processors. Third-party certifications, lab-tested quality assurances, and transparent listings are increasing trust and allowing small brands to compete. All these drivers combined are making demand for ginger strong, flexible, and internationally applicable.

Forecasting the Future: Market Size and Growth Expectations by 2033

The ginger market is poised for substantial expansion, with multiple research organizations providing convergent forecasts that are painting a picture of robust, sustained growth. While specific projections are varying based on methodological approaches and market definitions, the overall trajectory is unmistakably upward, signaling strong confidence in ginger's economic prospects through 2033.

The ginger market is expected to attain USD 6.1 Billion by 2033, exhibiting a CAGR of 6.7% during 2025-2033, according to the predictions of the IMARC Group. This projection is representing a near-doubling of market value over the nine-year forecast period, translating to an increase of more than three billion dollars in absolute terms. Such growth is reflecting not only volume increases but also value enhancement through product premiumization, geographic expansion, and diversification into higher-margin applications.

Regional Insights: Leading Producers and Fastest-Growing Markets

The global ginger market is exhibiting fascinating regional dynamics, with production concentrated in specific geographies while consumption is expanding across diverse markets worldwide. Understanding these regional patterns is essential for comprehending supply chain dynamics, investment opportunities, and market evolution through 2033.

Globally, Asia-Pacific is continuing to generate lucrative prospects for the ginger market in the years ahead, maintaining its position as both the dominant production region and an increasingly important consumption market. The region’s favorable climate established agricultural expertise, and economies of scale are creating competitive advantages that are difficult for other regions to match. China's dominance in ginger production is reflecting not only favorable growing conditions but also sophisticated agricultural infrastructure, extensive domestic consumption, and well-developed export capabilities. In the productive fields of Shandong Province in eastern China, Anqiu city is utilizing its advantageous climate to revolutionize ginger farming. In recent years, this farming center has boosted its ginger cultivation and deliberately broadened its industrial chain, effectively establishing a presence in the international market. Anqiu, covering 200,000 mu (13,333 hectares) for ginger farming, generates 1 million tons of ginger each year, establishing it as the top ginger producer north of the Yangtze River. The city distributes 600,000 tons of fresh ginger annually within the country, catering to more than 1,300 wholesale markets throughout China.

India is representing the other major production powerhouse in the Asia-Pacific region, bringing its own distinct characteristics to the market. Indian ginger is often prized for specific varietals that are offering unique flavor profiles and bioactive compound concentrations. As reported by the Agriculture Cooperation & Farmers Welfare (2025), India allocates 193,200 hectares exclusively for ginger farming, emphasizing the significant domestic production. The country's vast domestic market, driven by traditional Ayurvedic medicine applications and culinary traditions, is absorbing substantial production while also supporting a growing export sector. India's organic ginger production is particularly noteworthy, as the country is becoming a preferred source for internationally certified organic ginger that is commanding premium prices in health-conscious Western markets.

The North American ginger market is emerging as one of the fastest-growing consumption regions, despite minimal domestic production. The United States is standing out as a key market disruptor, driven by growing demand for natural and functional ingredients, with consumers becoming more health and wellness conscious, appreciating ginger's health benefits including enhanced digestion, reduced inflammation, and boosted immunity.

The European ginger market is exhibiting similar dynamics to North America, with strong growth in functional food and beverage applications, robust demand for organic products, and increasing incorporation into both traditional and innovative culinary applications. Countries such as Germany, United Kingdom, and France are leading consumption growth, driven by health-conscious consumer populations and well-developed natural products retail channels.

Latin American markets are representing an emerging opportunity area for ginger market expansion. While historically modest consumers of ginger, countries throughout the region are experiencing growing interest in natural health products and functional ingredients.

The Middle East and Africa are presenting a mixed regional picture. Traditional consumption of ginger in certain Middle Eastern and North African cuisines is providing an established market base, while emerging middle classes in sub-Saharan Africa are beginning to discover ginger's health benefits through increased access to information and imported products.

Market Transformations: Emerging Trends Reshaping the Ginger Industry

The ginger market is being transformed by several powerful trends that are fundamentally altering how the ingredient is being produced, processed, marketed, and consumed.

The health and wellness megatrend is dominating the ginger market's trajectory in numerous ways. Consumers are increasingly viewing food choices through the lens of health optimization rather than mere sustenance or pleasure, and ginger is benefiting enormously from this shift. The spice's well-documented anti-inflammatory properties are attracting consumers seeking natural approaches to managing chronic inflammation, which is being implicated in numerous health conditions from arthritis to cardiovascular disease.

The organic and natural products movement is intersecting powerfully with ginger market dynamics. Consumer skepticism toward synthetic additives, pesticide residues, and genetically modified organisms is driving unprecedented demand for certified organic ginger products. This trend is cascading through the supply chain, encouraging producers to adopt organic farming practices, pursue certification, and invest in traceability systems that are providing transparency about product origins.

The natural products trend is extending beyond organic certification to encompass broader sustainability concerns. Consumers are increasingly inquiring about the environmental and social impacts of their purchases, creating demand for ginger products that are fair-trade certified, sustainably sourced, and produced through practices that are supporting smallholder farmers and protecting biodiversity.

Strategic Outlook: Opportunities and Challenges for Market Stakeholders

The ginger market is offering a combination of hopeful opportunities and severe challenges. On the opportunity front, increased demand for traceable and organic products is allowing farmers to secure price premiums. Investing in better cultivation practices, irrigation systems, and post-harvest facilities is raising production and reducing losses. Farmers using integrated pest management and residue monitoring are getting better access to high-value export markets.

Processors and ingredient suppliers are gaining from the trend towards value-added ingredients. Consistent extracts, oils, and oleoresins containing stable active compound levels are drawing formulators for nutraceutical, pharmaceutical, and cosmetic applications. These specialist niches are producing greater margins and stable contract work.

Retailers and brands are taking advantage of flavor-meets-function branding. Ginger-flavored drinks, snacks, and supplements are gaining popularity among consumers who are health-focused. Clear communication of science-based benefits is generating trust and loyalty.

But the industry also has challenges. Volatility in ginger supply chain is a continuing issue, with weather variations, border controls, and geopolitics sometimes interrupting the flow of trade. Inconsistency in quality, particularly regarding pesticide residues and microbial pollution, can result in rejection of shipments in controlled markets. Sustaining rigorous observance of international safety standards needs constant investment in testing and certification.

Price volatility is also something to contend with. Seasonality, logistics expenses, and exchange rate movements can affect profitability. Forward contracting and geographic diversification of sourcing are mitigating risks.

Despite these challenges, the long-term perspective is upbeat. Stakeholders emphasizing sustainable agriculture, quality control, and product development are ready to seize growth. The blend of new technology, open trade practices, and evidence-based marketing is providing a platform for sustained growth through 2033.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)