Phosphorus Pentasulfide Cost Model: From Base Elements to Sulfide Solutions

_11zon.webp)

What is Phosphorus Pentasulfide?

Phosphorus Pentasulfide (P2S5) is a yellow-green crystalline compound primarily produced through the controlled reaction of elemental phosphorus and sulfur. As a key phosphorus-based intermediate, it plays a critical role in the chemical industry, particularly in the manufacture of lubricant additives such as zinc dialkyldithiophosphate (ZDDP), agrochemicals, and battery electrolytes.

Key Applications Across Industries:

Structurally, P2S5 consists of phosphorus and sulfur atoms bonded in a cage-like configuration, imparting high reactivity and compatibility with organic synthesis pathways. It is valued for its sulfur-donating properties, thermal stability, and role as a bridging compound in synthesizing more complex phosphorus-sulfur compounds. Produced in enclosed reactors under strict safety protocols due to its flammability and fume release upon hydrolysis, P2S5 is typically handled as flakes or granules. Its downstream applications span lubricants, pesticides, flame retardants, and increasingly, battery materials, especially in the push toward solid-state lithium-ion technologies. With growing global interest in sustainable agriculture, energy storage, and high-performance lubricants, phosphorus pentasulfide remains a vital industrial chemical, offering both technical functionality and market adaptability in a range of advanced material applications.

What the Expert Says: Market Overview & Growth Drivers

The global phosphorus pentasulfide market reached a value of USD 486 Million in 2024. According to IMARC Group, the market is projected to reach USD 696 Million by 2033, at a projected CAGR of 4.0% during 2025-2033. Demand for phosphorus pentasulfide (P2S5) is being driven by a combination of industrial trends and strategic shifts across core application sectors.

A key market driver is the continued reliance on ZDDP-based lubricant additives in automotive and industrial engines, where P2S5 acts as a critical precursor in enhancing wear protection and thermal stability. The agrochemical sector also fuels growth, as P2S5 is essential in producing organophosphorus pesticides widely used in crop protection, especially in developing regions with expanding agricultural outputs. In the energy space, rising interest in solid-state lithium batteries and advanced electrolyte formulations is opening new avenues for phosphorus-based compounds, further reinforcing the material’s strategic importance. Regulatory tightening around lubricant emissions and pesticide formulation is encouraging innovation that still leans heavily on phosphorus intermediates, preserving P2S5's relevance. Over the coming years, competitive dynamics will be shaped by factors such as feedstock (yellow phosphorus) availability, production process modernization to mitigate toxic emissions, and regional capacity expansions aimed at localizing supply.

Case Study on Cost Model of Phosphorus Pentasulfide Manufacturing Plant:

Objective

One of our clients reached out to us to conduct a feasibility study for setting up a medium-to-large-scale phosphorus pentasulfide manufacturing plant.

IMARC Approach: Comprehensive Financial Feasibility

We developed a comprehensive financial model for the setup and operation of a proposed phosphorus pentasulfide manufacturing plant in Turkey. This plant is designed to produce 10,000 tons of phosphorus pentasulfide annually.

Manufacturing Process: The manufacturing process of phosphorus pentasulfide (P2S5) involves a series of tightly controlled steps to ensure product quality, safety, and environmental compliance. It begins with the procurement of molten yellow phosphorus and molten sulfur, which are continuously fed into a cast iron reaction kettle under a nitrogen blanket to prevent oxidation. The exothermic liquid-phase reaction occurs at 410–430°C and under slightly positive pressure, promoting efficient conversion to P2S5. The molten product is then transferred to an electrically heated distillation kettle, where purification is performed under reduced pressure (80–95 mbar) and high temperature (390–395°C), utilizing residual reaction heat. Solid residues, including phosphates and metal sulfides, are extracted and sent to off-site incineration facilities for safe disposal. Gaseous byproducts like SO2 and H2S are treated in chemical scrubbers, and resulting effluents are neutralized before discharge. After purification, the molten P2S5 is cooled and solidified into either crystalline or amorphous forms, or a controlled mixture of both, to achieve specific reactivity profiles. Final product quality is confirmed through ion chromatography analysis, with precise detection of phosphate and sulfate ions. The material is then packaged in sealed, GPS-tracked tote bins and distributed via licensed hazardous goods carriers. Reusable packaging undergoes rigorous cleaning to eliminate any residual material, ensuring a safe and closed-loop logistics system.

_11zon.webp)

Get a Tailored Feasibility Report for Your Project Request Sample

Mass Balance and Raw Material Required: The primary raw materials used in the phosphorus pentasulfide producing plant are phosphorus, sulfur, and water. For a plant producing 1 ton of phosphorus pentasulfide, 0.29 ton of phosphorus, 0.74 ton of sulfur and 2.0 ton of water are required.

Techno-Commercial Parameter:

- Capital Investment (CapEx): Capital expenditure (CapEx) in a manufacturing plant includes various investments essential for its setup and long-term operations. It covers machinery and equipment costs, including procurement, installation, and commissioning. Civil works expenses involve land development, factory construction, and infrastructure setup. Utilities such as power, water supply, and HVAC systems are also significant. Additionally, material handling systems, automation, environmental compliance, and safety measures are key components. Other expenditures include IT infrastructure, security systems, and office essentials, ensuring operational efficiency and business growth.

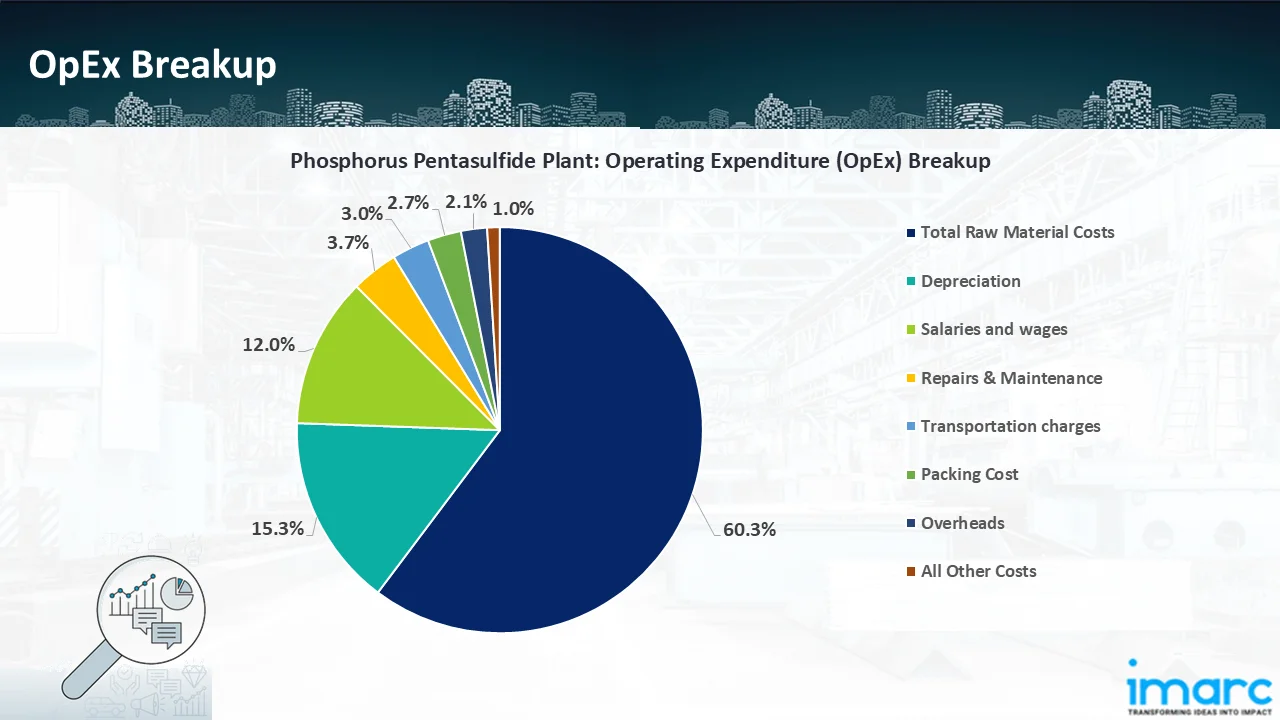

- Operating Expenditure (OpEx): Operating expenditure is the cost incurred to operate a manufacturing plant effectively. Opex in a manufacturing plant typically includes the cost of raw materials, utilities, depreciation, taxes, packing cost, transportation cost, and repairs and maintenance. The operating expenses are part of the cost structure of a manufacturing plant and have a significant effect on profitability and efficiency. Effective control of these costs is necessary for maintaining competitiveness and growth.

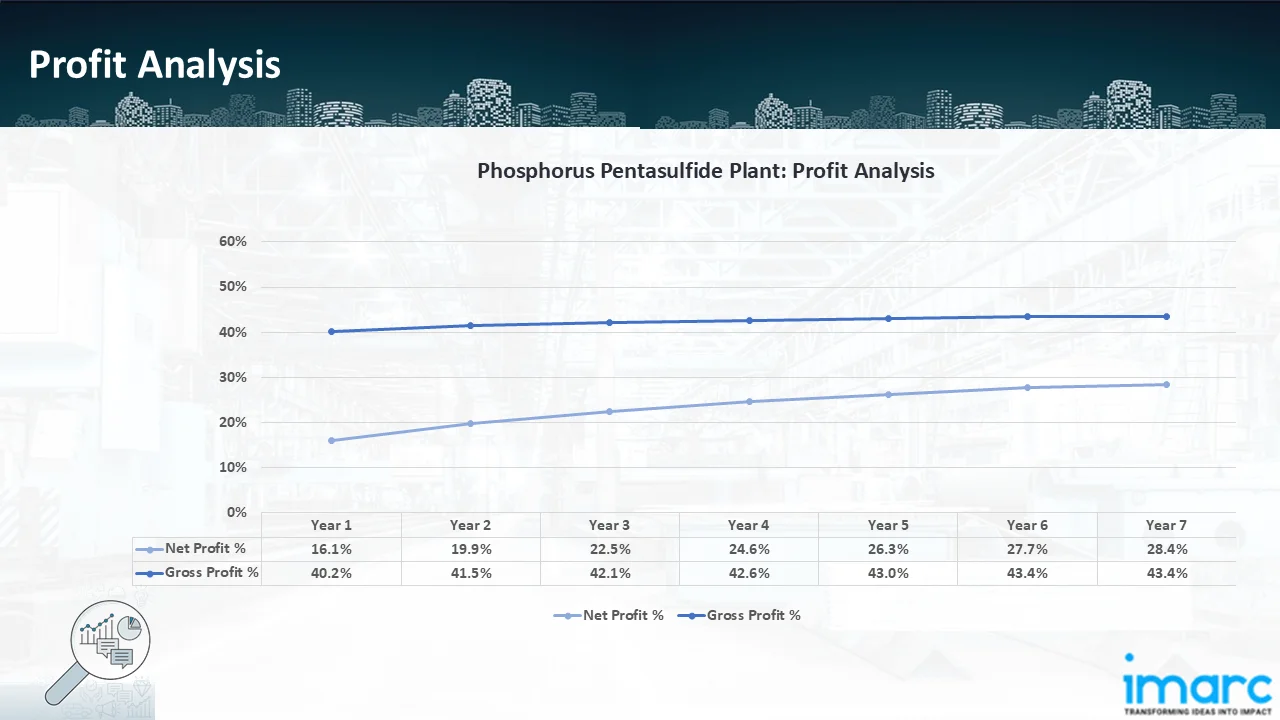

- Profitability Analysis Year on Year Basis: The proposed phosphorus pentasulfide plant, with a capacity of 10,000 tons of phosphorus pentasulfide per year, achieved an impressive revenue of US$ 9.88 Million in its first year. We assisted our client in developing a detailed cost model, which projects steady growth, with revenue rising throughout the projected period. Moreover, gross profit margins improve from 40.2% to 43.4% by year 7, and net profit rises from 16.1% to 28.4%, highlighting strong financial viability and profitability.

Conclusion & IMARC's Impact:

Our financial model for the phosphorus pentasulfide manufacturing plant was meticulously developed to meet the client’s objectives, providing an in-depth analysis of production costs, including raw materials, manufacturing, capital expenditure, and operational expenses. By addressing the specific requirements of producing 10,000 tons of phosphorus pentasulfide per year, we successfully identified key cost drivers and projected profitability, considering market trends, inflation, and potential fluctuations in raw material prices. This comprehensive financial model equipped the client with valuable insights into strategic decision-making, demonstrating our commitment to delivering high-quality, client-focused solutions that ensure the long-term success of large-scale manufacturing ventures.

Latest News and Developments:

- In September 2025, Trecora, a leading provider of phosphorus pentasulfide (P2S5), announced today that all products within its P2S5 line have been branded under the unified TRECOR trademark as part of Trecora’s broader effort to streamline branding across its portfolio.

Why Choose IMARC:

IMARC's Financial Model Expertise: Helping Our Clients Explore Industry Economics

IMARC is a global market research company that offers a wide range of services, including market entry and expansion, market entry and opportunity assessment, competitive intelligence and benchmarking, procurement research, pricing and cost research, regulatory approvals and licensing, factory setup, factory auditing, company incorporation, incubation services, recruitment services, and marketing and sales.

Under our factory setup services, we assist our clients in exploring the feasibility of their plants by providing comprehensive financial modeling. Additionally, we offer end-to-end consultation for setting up a plant in India or abroad. Our financial modeling includes an analysis of capital expenditure (CapEx) required to establish the manufacturing facility, covering costs such as land acquisition, building infrastructure, purchasing high-tech production equipment, and installation. Furthermore, the layout and design of the factory significantly influence operational efficiency, energy consumption, and labor productivity, all of which impact long-term operational expenditure (OpEx). So, every parameter is covered in the analysis.

At IMARC, we leverage our comprehensive market research expertise to support companies in every aspect of their business journey, from market entry and expansion to operational efficiency and innovation. By integrating our factory setup services with our deep knowledge of industry dynamics, we empower our clients to not only establish manufacturing facilities but also strategically position themselves in highly competitive markets. Our financial modeling and end-to-end consultation services ensure that clients can explore the feasibility of their plant setups while also gaining insights into competitors' strategies, technological advancements, and regulatory landscapes. This holistic approach enables our clients to make informed decisions, optimize their operations, and align with sustainable practices, ultimately driving long-term success and growth.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104