Top Factors Driving Growth in the India Electric Two-Wheeler Industry

Transportation in India is undergoing a spectacular change with the advent of electric two-wheelers that are quite an enticing alternative to traditional fuel-powered ones. This change is not merely an act of technological transformation, but an indication of how millions of Indians will think about city mobility, eco-awareness, and economic effectiveness.

The India market of electric two-wheeler is experiencing a never-before momentum, led by the intersecting forces of technology and government policies, as well as the turn in consumer preferences. With the country struggling to overcome air pollution in the city and high gas prices, electric scooters and motorcycles are making a case to be affordable, convenient, and sustainable to everyday commuters.

This comprehensive analysis explores the key factors propelling growth in India's electric two-wheeler sector, examining market dynamics, infrastructure developments, technological advancements, and the competitive landscape shaping this rapidly evolving industry.

E-Scooters Gaining Popularity as Low-Cost Urban Mobility Option:

Electric scooters have become an innovation that has transformed the lives of urban commuters who want to have an affordable, efficient means of transportation. The economics of owning electric two-wheelers make a strong argument over other conventional petrol-powered variants.

Electric scooters have a high operating cost advantage. Although petrol scooters have fuel that is influenced by the prices of oil in the world, the scooters that run on electricity have costs per kilometer that are considerably lower. The cost to charge an electric two-wheeler is between 0.50 and 1.00 per kilometer on average (according to data by the Ministry of Power), which is lower than the 2.50 to 3.50 per kilometer that it costs to charge a petrol scooter. This translates to a saving of about 60-70 percent in the cost of fuel alone.

In addition to fuel efficiency, the electric scooters have lower maintenance costs. The fewer moving parts since the complexity of internal combustion engines is absent, and hence there is no need for regular oil changes, spark plug replacement, and engine tune-ups. As compared to the maintenance of conventional scooters, the Society of Indian Automobile Manufacturers (SIAM) says that the annual cost of maintaining electric two-wheelers is about 40 percent less.

India has a favorable urban mobility environment that can be adapted to the adoption of electric two-wheelers. The average area to be covered by commuting in India cities can be said to be between 20-40 kilometers, which is not far at all in the range of modern electric scooters. The Bureau of Indian Standards has set up technical standards which ensure that the electric two-wheelers are safe and perform to the expected standards, which have given the consumer confidence in the vehicles.

Government initiatives have further enhanced the affordability equation. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme provides direct purchase incentives, reducing the upfront cost barrier. Several state governments, including Delhi, Maharashtra, and Gujarat, offer additional subsidies and road tax exemptions for electric vehicle buyers.

Market Size & Growth Opportunity:

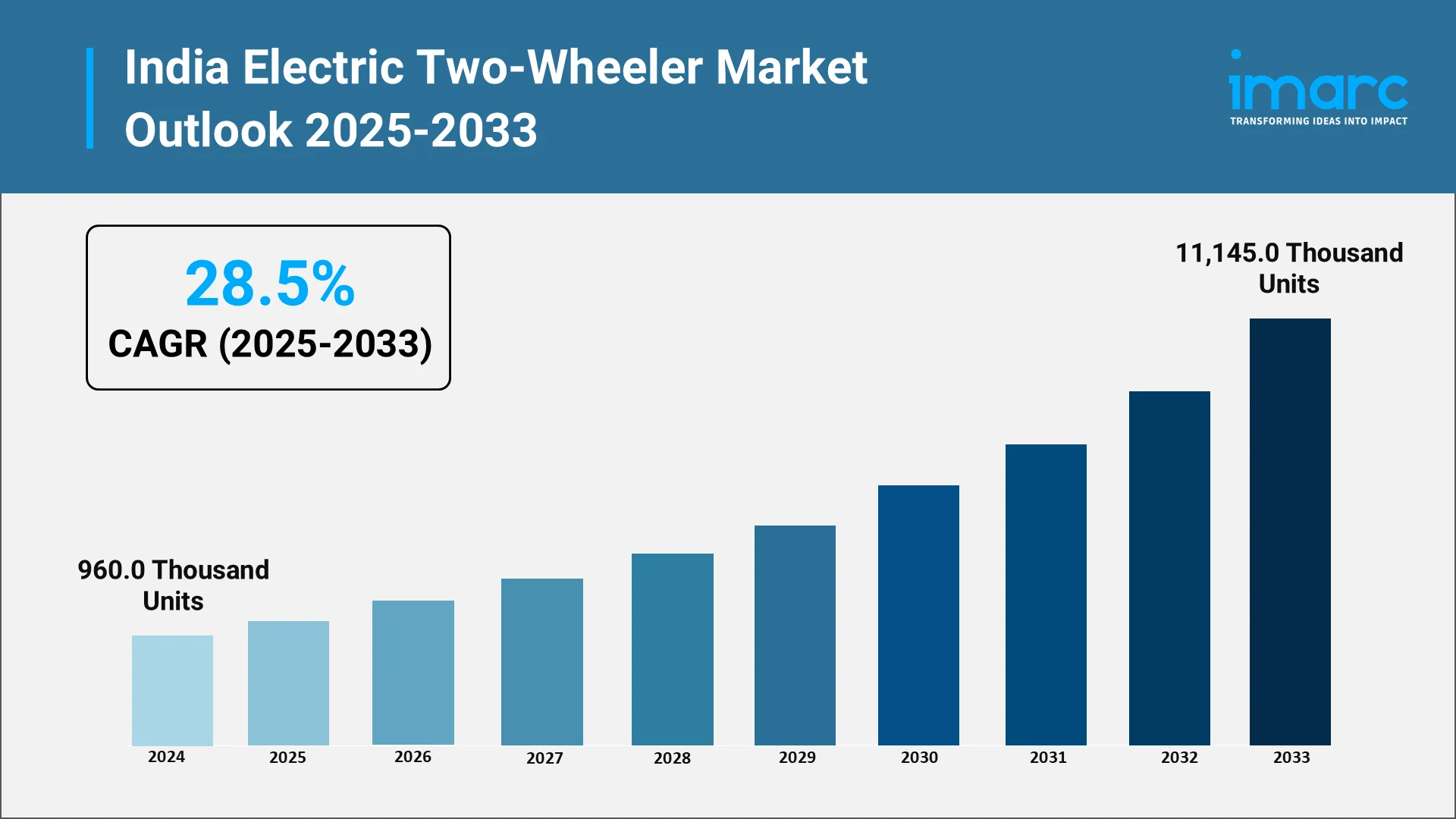

The Indian electric two-wheeler sector represents one of the most dynamic growth opportunities in the global automotive industry. The convergence of policy support, rising environmental awareness, and economic factors has created fertile ground for market expansion. India electric two-wheeler market size reached 960.0 Thousand Units in 2024. Looking forward, IMARC Group expects the market to reach 11,145.0 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 28.5% during 2025-2033.

Government subsidies through the FAME II scheme have played a pivotal role in market acceleration. The Ministry of Heavy Industries allocated substantial funding under FAME II, with specific incentives for electric two-wheelers. According to official Ministry data, the scheme provides incentive support ranging from INR 10,000 to INR 15,000 per kWh of battery capacity for electric two-wheelers, significantly reducing the effective purchase price for consumers.

Rising fuel prices have emerged as a critical catalyst for electric vehicle adoption. Data from the Petroleum Planning and Analysis Cell shows that petrol prices in major Indian cities have experienced significant volatility and upward trends over recent years, making the stable and lower operating costs of electric vehicles increasingly attractive to budget-conscious consumers.

The Society of Indian Automobile Manufacturers reports substantial growth in electric two-wheeler registrations. Vehicle registration data from the Ministry of Road Transport and Highways indicates that electric two-wheeler sales have shown exponential growth, with penetration rates increasing significantly in urban and semi-urban markets.

Regional adoption patterns reveal interesting dynamics. States like Delhi, Karnataka, Maharashtra, and Gujarat have emerged as leading markets, supported by robust state-level policies and better charging infrastructure. According to data from the Central Motor Vehicles Rules, these states account for a substantial portion of national electric two-wheeler sales.

The electric vehicle policy framework continues to evolve supportively. The National Electric Mobility Mission Plan and the Production Linked Incentive (PLI) scheme for Advanced Chemistry Cell (ACC) battery storage are designed to strengthen the domestic manufacturing ecosystem, potentially reducing costs further and improving availability.

Explore in-depth findings for this market, Request Sample

Declining Battery Prices Improving Vehicle Affordability:

Battery technology represents the single most critical component influencing electric two-wheeler economics. The dramatic reduction in battery costs over recent years has fundamentally altered the affordability equation for electric vehicles.

Lithium-ion battery technology, which powers most modern electric two-wheelers, has experienced significant cost reductions globally. While specific Indian battery pricing data from government sources is limited, international benchmarks tracked by the International Energy Agency show that lithium-ion battery pack prices have declined substantially over the past decade, making electric vehicles increasingly cost-competitive with conventional alternatives.

The Indian government's focus on battery manufacturing through the PLI scheme for ACC battery storage demonstrates a strategic commitment to localizing this critical component. The Ministry of Heavy Industries has outlined ambitious targets for domestic battery production capacity, which is expected to reduce import dependence and further lower costs for Indian manufacturers.

Battery performance improvements have paralleled cost reductions. Modern lithium-ion batteries used in Indian electric two-wheelers typically offer ranges of 80-150 kilometers on a single charge, sufficient for most urban commuting needs. The Bureau of Indian Standards has established specific testing protocols (IS 17855) for lithium-ion batteries used in electric vehicles, ensuring safety and performance standards.

Battery management systems have become increasingly sophisticated, extending battery life and improving charging efficiency. Most contemporary electric two-wheelers feature smart battery management that optimizes charging cycles, prevents overcharging, and maintains thermal stability. These technological advances translate directly into lower total cost of ownership for consumers.

The battery warranty provisions offered by manufacturers have also improved consumer confidence. Most leading manufacturers now offer battery warranties of 3-5 years or 50,000-70,000 kilometers, addressing one of the primary concerns potential buyers have about long-term ownership costs.

Energy density improvements in lithium-ion technology mean that newer electric two-wheelers can offer greater range without proportionally increasing battery size or weight. This technological progression is making electric scooters more practical for a broader range of use cases, from daily commuting to longer intercity travel.

Charging Infrastructure Development:

The expansion of charging infrastructure represents a critical enabler for electric two-wheeler adoption across India. A multi-faceted approach encompassing public charging stations, home charging solutions, and innovative battery swapping networks is addressing range anxiety and convenience concerns.

Public charging station deployment has accelerated significantly. According to the Ministry of Power, the government has issued guidelines for charging infrastructure, establishing technical standards, and promoting uniform charging protocols. The Bureau of Energy Efficiency publishes data on public charging station installations across various Indian cities.

The Central Electricity Authority has developed model guidelines for electric vehicle charging infrastructure, providing a framework for both public and private sector players to establish charging facilities. These guidelines address technical specifications, safety requirements, and grid integration protocols.

Home charging solutions have emerged as the preferred charging method for most electric two-wheeler owners. The convenience of overnight charging using standard household electrical connections aligns well with typical usage patterns. Most electric scooters can be fully charged using a standard 15-ampere socket in 4-6 hours, making home charging practical and economical.

Several state electricity boards have introduced special tariff structures for electric vehicle charging during off-peak hours, further reducing charging costs. According to data from various State Load Dispatch Centres, off-peak electricity rates can reduce charging costs by 20-30% compared to standard residential tariffs.

Battery swapping networks represent an innovative approach to addressing charging time constraints. The government's Draft Battery Swapping Policy, released by NITI Aayog, outlines a framework for standardized battery swapping infrastructure. This approach offers the convenience of rapid battery replacement (typically 2-3 minutes) rather than waiting for charging cycles.

Leading electric two-wheeler manufacturers have established battery swapping stations in major cities. According to company disclosures and press releases, these networks are expanding rapidly in urban centers, offering subscription-based models that separate battery ownership from vehicle ownership, potentially reducing upfront purchase costs.

Workplace charging facilities are gaining traction in corporate parks and commercial establishments. The Ministry of Power's charging infrastructure guidelines encourage offices and commercial buildings to provide charging facilities for employees and visitors, supporting the integration of electric vehicles into daily routines.

Top Companies in India Electric Two-Wheeler Market:

The Indian electric two-wheeler market features a dynamic competitive landscape with established automobile manufacturers, new-age startups, and technology-focused companies vying for market leadership. Understanding the key industry players provides insight into market evolution and competitive strategies.

Ola Electric has emerged as a significant force in the Indian electric two-wheeler market. The company's manufacturing facility in Tamil Nadu represents one of the largest electric two-wheeler production capacities globally. According to company disclosures and press releases on their corporate website, Ola Electric has established an extensive direct-to-consumer sales network and battery swapping infrastructure across multiple Indian cities.

Ather Energy, a Bangalore-based electric vehicle manufacturer, has established itself as an innovation leader in the premium electric scooter segment. The company's focus on technology integration, performance, and proprietary charging infrastructure has created a distinctive market position. According to information available on Ather Energy's corporate website and regulatory filings, the company has deployed fast-charging stations across major cities and continues expanding its manufacturing capacity.

Hero Electric, part of the Hero Motors company group, represents one of the early movers in India's electric two-wheeler space. With decades of experience in the two-wheeler industry, Hero Electric has leveraged its understanding of Indian consumer preferences and distribution networks. Company announcements indicate a broad product portfolio targeting various price segments and use cases.

Bajaj Chetak symbolizes the revival of an iconic Indian brand in electric avatar. Bajaj Auto, a major player in India's automotive industry, re-launched the Chetak nameplate as an electric scooter. According to Bajaj Auto's investor presentations and corporate communications available on their website, the Chetak electric scooter combines heritage with modern electric vehicle technology.

TVS Motor Company, one of India's largest two-wheeler manufacturers, entered the electric segment with the TVS iQube. Leveraging its extensive manufacturing expertise and dealer network, TVS has positioned the iQube as a mainstream electric scooter option. Company annual reports and regulatory filings detail TVS's investment in electric vehicle technology and expansion plans.

Okinawa Autotech has established a significant presence in India's electric two-wheeler market with a range of products across different price points. The company's focus on localization and extensive dealer network has supported its market penetration. Corporate disclosures on Okinawa's official channels outline their manufacturing capabilities and distribution strategy.

Ampere Vehicles, acquired by Greaves Cotton Limited, represents another established player in the Indian electric two-wheeler space. According to Greaves Cotton's investor communications and annual reports, Ampere focuses on affordable electric scooters designed specifically for Indian market conditions and consumer preferences.

The competitive dynamics reveal distinct strategic approaches. Premium players emphasize technology, performance, and integrated ecosystems including proprietary charging infrastructure. Mass-market focused companies prioritize affordability, extensive distribution networks, and after-sales service accessibility. Technology startups bring innovative approaches to battery management, connectivity features, and user experience.

Manufacturing localization has become increasingly important. Government policies favoring local production through the PLI scheme and Phase Manufacturing Programme (PMP) have encouraged companies to establish or expand domestic manufacturing facilities. According to the Ministry of Heavy Industries, this localization trend supports job creation and reduces dependency on imports.

Recent Developments and News:

- November 2025: Yamaha Motor Co., Ltd. announced plans to introduce two new electric scooter models in India by November 2025, the AEROX E, an in-house developed electric sport scooter, and the EC-06, created in collaboration with River Mobility Private Limited.

Conclusion:

The India electric two-wheeler industry stands at an inflection point where multiple favorable factors are converging to drive unprecedented growth. The combination of economic advantages through lower operating costs, supportive government policies and subsidies, declining battery prices, expanding charging infrastructure, and strong competition among established and emerging manufacturers has created a robust foundation for market expansion.

The transformation of India's urban mobility landscape is being powered by electric two-wheelers that offer practical solutions to pressing challenges—from air pollution and fossil fuel dependency to rising transportation costs for middle-class consumers. The substantial cost savings of 60-70% in operational expenses compared to petrol scooters make electric alternatives financially compelling for daily commuters.

Government initiatives through FAME II subsidies, state-level incentives, and policy frameworks supporting charging infrastructure development demonstrate sustained institutional commitment to electric mobility. The localization of battery manufacturing and vehicle production under schemes like the PLI program promises to further improve affordability and accessibility while strengthening domestic manufacturing capabilities.

The infrastructure ecosystem is maturing rapidly with expanding public charging networks, convenient home charging solutions, and innovative battery swapping models addressing range anxiety concerns. This multi-pronged infrastructure approach ensures that electric two-wheelers can serve diverse usage patterns across urban and semi-urban markets.

Looking forward, the India electric two-wheeler market is positioned for sustained expansion as technology continues advancing, costs decline further, and consumer awareness grows. The convergence of environmental consciousness, economic pragmatism, and technological innovation is reshaping how millions of Indians will travel in the coming decades.

The question for stakeholders is not whether electric two-wheelers will dominate India's urban mobility future, but how quickly this transformation will unfold and who will emerge as the leaders in this dynamic marketplace.

Choose IMARC Group for Unmatched Expertise and Strategic Intelligence:

- Data-Driven Market Research: Enhance your understanding of the India electric two-wheeler market through comprehensive research reports covering vehicle adoption trends, battery technology developments, charging infrastructure expansion, and segment-wise growth patterns across different price categories and regional markets.

- Strategic Growth Forecasting: Anticipate emerging opportunities in electric mobility, from advancements in lithium-ion and solid-state battery technologies to the evolution of battery swapping networks, smart connectivity features, and the impact of evolving government policies on market dynamics across Indian states.

- Competitive Benchmarking: Analyze the competitive landscape with detailed assessments of market leaders, emerging players, product portfolios, technology strategies, manufacturing capabilities, and distribution approaches that define success in India's electric two-wheeler sector.

- Policy and Infrastructure Advisory: Stay ahead of the regulatory curve with insights into central and state-level electric vehicle policies, FAME scheme evolutions, charging infrastructure guidelines, battery safety standards, and incentive structures affecting vehicle affordability and market penetration.

- Custom Reports and Consulting: Access tailored intelligence aligned with your specific objectives—whether launching new electric two-wheeler models, investing in charging infrastructure, developing battery technologies, expanding manufacturing operations, or building supply chain partnerships in India's electric mobility ecosystem.

At IMARC Group, our mission is to empower mobility leaders, automotive manufacturers, technology providers, and investors with the clarity and strategic intelligence required to navigate India's electric two-wheeler revolution. Partner with us to accelerate the transition to sustainable urban transportation—because every journey toward cleaner mobility matters.

For more details, please click on this link: https://www.imarcgroup.com/india-electric-two-wheeler-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)