Top Factors Driving Growth in the India Smartphone Industry

The India smartphone industry has cemented its position as one of the world's most critical and dynamic technology markets, undergoing a profound transformation driven by consumer aspiration and technological advancement. Far from merely being a volume-driven segment, the market is experiencing a significant value premiumisation trend, where consumers are increasingly upgrading to feature-rich and higher-priced devices. This shift is not confined to metropolitan centers but is being powered by deeper internet penetration, robust government initiatives, and an accelerating replacement cycle across smaller cities and rural regions. Understanding the primary factors driving growth in this diverse and competitive landscape is essential for corporate strategy teams and business development managers seeking to capitalize on one of the last major untapped markets globally.

The sector's resilience is demonstrated by a steady annual growth in shipments, which reached 151 million units in 2024. This growth, coupled with a surge in the Average Selling Price (ASP), has driven the market’s wholesale revenue to an all-time high. As the country transitions towards a fully digitized economy, the demand for sophisticated mobile devices continues to propel the industry towards a projected $50 billion retail value.

1. Rapid Shift from 4G to 5G Smartphones Across All Price Segments:

The transition from 4G to 5G capability is arguably the single most powerful technological factor fueling demand in the India smartphone market. This rapid technological migration is shifting the market's center of gravity from mere connectivity to advanced mobile computing.

The share of 5G smartphones in total shipments has seen an unprecedented surge. In 2024, the shipment penetration of 5G devices rose dramatically, approaching four-fifths of the total smartphones shipped. This trajectory is set to accelerate further, with industry reports indicating that nearly 90% of all smartphone replacements in 2025 are expected to be 5G-capable devices.

Affordable 5G Launches Increasing Sales:

A crucial development is the collapsing price point of 5G technology, making it accessible to mass-market consumers. The Average Selling Price (ASP) for 5G-enabled devices declined significantly in 2024, making the technology more attainable for the budget-conscious consumer.

- The availability of 5G chipsets in entry-level smartphones has been instrumental in this process.

- The mass budget segment ($100–$200) for 5G devices has nearly doubled its share within total 5G shipments, demonstrating the scale of adoption at the lower end of the market.

- Popular 5G models in this price bracket, such as the Xiaomi Redmi 13C and vivo Y28, were among the most shipped 5G models in 2024, showcasing the strong demand for value-driven 5G adoption.

Furthermore, the dedicated and aggressive rollout of 5G networks by major telecom operators, such as Jio and Airtel, has successfully expanded coverage across smaller towns and rural areas. The government's initiatives to promote domestic semiconductor manufacturing are also expected to further reduce component costs, solidifying the market's long-term reliance on affordable 5G devices.

2. Market Size & Growth Opportunity: A Global Powerhouse

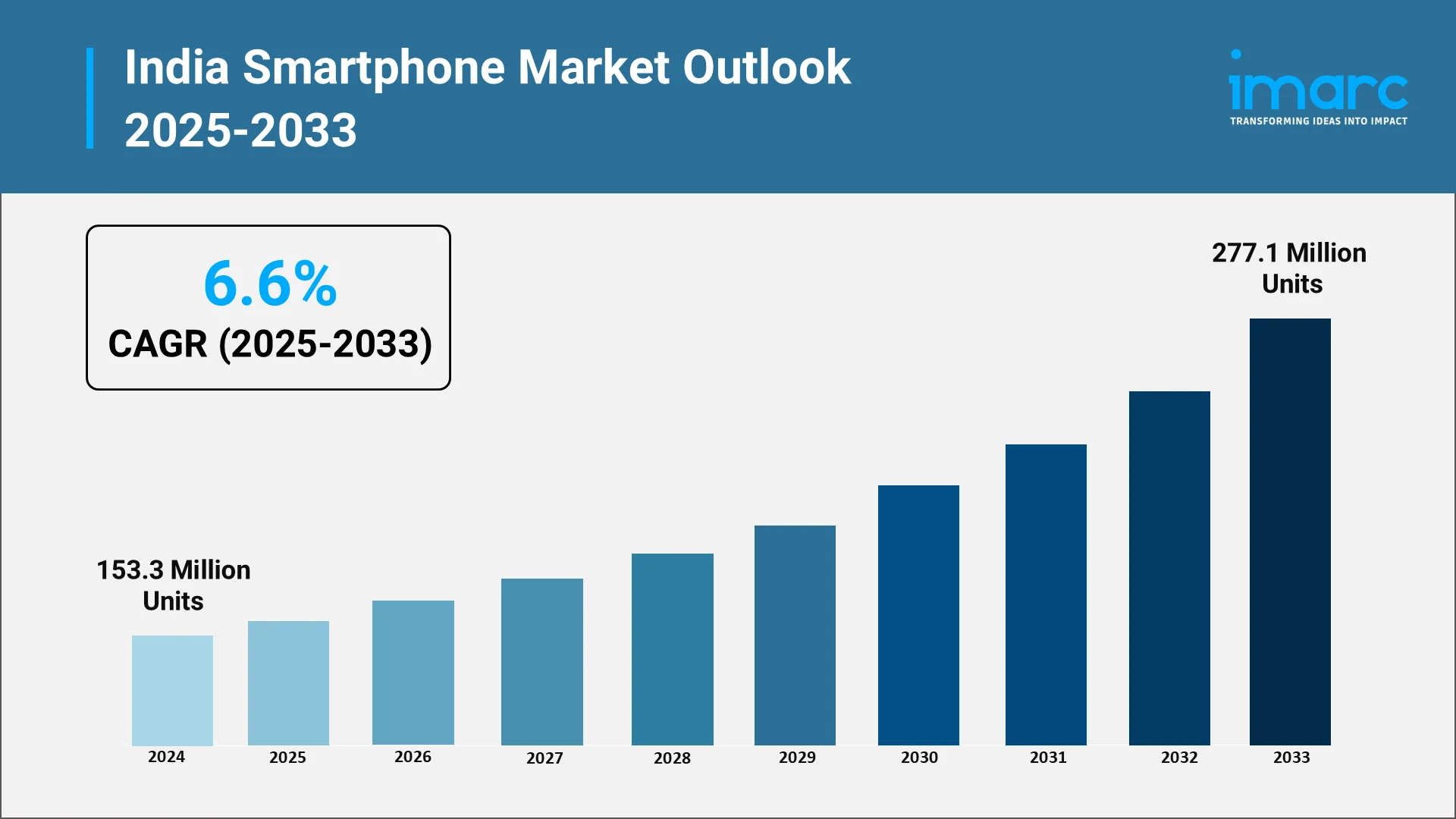

The scale and growth trajectory of the Indian market position it as an undeniable global force in consumer electronics. This sheer magnitude and the underlying demographic potential define the current and future market opportunity. The India smartphone market size reached 153.3 Million Units in 2024. Looking forward, IMARC Group expects the market to reach 277.1 Million Units by 2033, exhibiting a growth rate (CAGR) of 6.6% during 2025-2033.

India Among the World’s Largest Smartphone Shipment Markets:

India has consistently outperformed global market growth figures and has solidified its position on the world stage.

- In terms of unit volume, India's smartphone market has emerged as the second largest globally.

- In the third quarter of 2024, India accounted for a significant portion of global smartphone shipments, surpassed only by China.

- This rank reflects the country’s massive active user base, which stands at approximately 690 million smartphone users. Given the population of 1.4 billion, there remains substantial untapped potential for new user acquisition and user upgrades.

The increasing Average Selling Price (ASP) is the clearest indicator of the underlying shift in market dynamics, reflecting the strong trend of value premiumisation. The ASP of smartphones has reached record highs, driven by the strong consumer shift towards higher-priced devices. This sustained value growth is positioning the market to exceed a $50 billion retail value as the value-driven segments continue to expand.

The market’s robust growth is also structurally supported by India's emergence as a global manufacturing and export hub for mobile phones. Government initiatives, such as the Production Linked Incentive (PLI) scheme, have been highly effective in boosting local manufacturing.

- Mobile phone exports from India have seen a monumental rise, increasing by over 127-fold between FY2014-15 and FY2024-25, reaching a value of INR 2 lakh crore.

- Leading global brands, including Apple and Samsung, have significantly expanded their production bases in India, further driving this export growth and establishing the country as a crucial node in the global electronics supply chain.

Explore in-depth findings for this market, Request Sample

3. Rising Demand for Budget & Mid-Range Models:

While the high-end premium segment receives much attention, the true engine of volume growth in India remains the budget and mid-range segments, which cater to the vast majority of consumers who are upgrading from feature phones or older 4G devices. The market can be characterized by a "sandwich" effect: an enormous volume base sustaining growth from below, and an increasingly profitable premium segment driving value from above.

The INR 8,000–INR 20,000 Category Driving Volume Sales:

The mass budget segment, which roughly corresponds to the $100–$200 (approx. INR 8,000–INR 16,000) price bracket, accounts for the largest share of total volume shipments. This segment is fiercely competitive, dominated largely by Chinese OEMs like vivo, OPPO, and realme, which collectively hold a significant majority market share within this price range. These brands offer an optimal blend of performance and value, frequently including features like fast-charging and high refresh-rate displays that appeal directly to performance-conscious young users.

However, the most dynamic growth is occurring just above this base, in the entry-premium segment (approximately $200–$400). This segment witnessed the highest surge in growth in 2024. This is the sweet spot for consumers who are undertaking their second or third smartphone purchase, seeking improved specifications, better camera quality, and 5G connectivity without committing to flagship prices.

- The overall trend is an increase in the Average Selling Price (ASP) across the market, which grew by over 10% year-on-year in the second quarter of 2025.

- This indicates that while the entry-level segment is contracting slightly due to a stabilization in new user entry, the shift towards higher-value devices is strong and sustained.

The longevity and performance improvements in mid-range devices mean that replacement cycles are extending, forcing manufacturers to innovate and offer compelling reasons for consumers to upgrade. This has led to the rapid integration of advanced features, such as AI-enabled capabilities, even into the mid-range offerings from brands like Samsung.

4. Online Flash Sales and Festive Offers Boosting Shipments:

The retail landscape is a dual-channel powerhouse, with modern e-commerce strategies and traditional offline presence driving market reach. The aggressive use of online platforms, combined with strategically timed seasonal offers, is a critical growth factor, especially for mass adoption.

Amazon, Flipkart & Brand Websites Driving Mass Adoption:

The Indian smartphone market is characterized by a unique balance between online and offline channels. In 2024, online and offline channels experienced similar growth rates, maintaining a near-equal share of the market, with online channels accounting for just under half of all shipments.

Key Role of E-commerce:

- Flash Sales and Offers: Major e-tailers like Amazon and Flipkart, along with brand-owned websites, leverage mega-sales events during the festive season (Q3) to drive massive shipment volumes. These sales contribute significantly to quarterly growth, with the early start of the festive season in 2024 notably boosting Q3 performance.

- Pricing and Discounts: E-commerce platforms are essential for offering steep discounts and attractive pricing on both mid-range and premium devices, helping brands to remain competitive.

- Financial Accessibility: The affordability factor is amplified by the widespread availability of consumer financing options. Features like No-Cost EMI (Equated Monthly Installment) and lucrative exchange/cashback offers have become standard practice. This financial accessibility is pivotal, particularly in making high-end devices from brands like Apple and Samsung attainable for a wider segment of the population.

Brands are increasingly adopting omnichannel strategies, expanding their physical presence through new stores and better margins for offline retailers, while simultaneously running online-exclusive models and discounts to cater to both customer bases. The synergy between online deals and financing options is particularly effective in driving up the ASP by enabling customers to upgrade to better, more expensive models.

5. Top Companies in India Smartphone Market: The Competitive Landscape

The Indian smartphone market is a hyper-competitive arena where global powerhouses and aggressive Chinese brands clash for market dominance in both volume and value. While the top five companies account for the majority of the market, a "long tail" of emerging brands is also gaining ground.

The competitive dynamics are distinctly separated by price segment: volume leadership is primarily captured by Chinese Original Equipment Manufacturers (OEMs), while value leadership is controlled by premium players.

Volume vs. Value Leaders:

- Volume Leadership: Vivo has demonstrated remarkable consistency, securing the top spot in market volume in 2024, driven by a strong and expansive omnichannel presence that appeals to a wide consumer base. Vivo and its sub-brand, iQOO (which was one of the fastest-growing brands), are focusing on a balanced portfolio across all price segments. Xiaomi has also regained a strong position, particularly in the mass-budget segment, capitalizing on its reputation for high-feature, value-for-money devices.

- Value Leadership: Samsung and Apple dominate the premium and super-premium segments (devices above $600). They consistently hold the highest wholesale market share in terms of value.

- Apple's performance has been historic, with record shipments in 2024, driven by strong growth in smaller cities and a successful local manufacturing push. It entered the top five brands in India for the first time in the fourth quarter of 2024.

- Samsung maintains a strong presence across all segments, utilizing its flagship Galaxy S series to drive premium value and its Galaxy A/M/F series to compete effectively in the mid-range, integrating new features like AI capabilities into non-flagship models.

- Other Key Players: OPPO and Realme remain critical players, especially in the volume and entry-premium segments. OnePlus continues to bridge the gap, offering a near-flagship experience with a clean operating system (OxygenOS) to a loyal user base. Emerging brands like Nothing have also registered exceptional growth in recent years, highlighting the market's appetite for new entrants and innovative designs.

The intensified competition is pushing all brands toward innovation, notably the introduction of Generative AI features, which are expected to move beyond flagship devices and become key differentiators across various price points in the coming years.

Conclusion: Strategic Outlook for the India Smartphone Market

The growth of the India smartphone industry is a multi-faceted narrative, driven equally by technological shifts, economic factors, and aggressive competitive strategies. The sector is moving from a volume-focused market to a value-led growth engine, positioning it as one of the most profitable opportunities in global technology. The market’s future is intrinsically linked to the continued rollout of 5G, the democratisation of advanced features into affordable segments, and the expansion of consumer financing options.

The Top Factors Driving Growth can be summarized as follows:

- 5G Penetration and Affordability: The accelerated shift to affordable 5G devices, fueled by falling component costs and nationwide network deployment, is driving new sales and upgrades in both urban and rural India.

- Value Premiumisation: A strong consumer preference for higher-priced devices, reflected in the rising Average Selling Price (ASP), is maximizing market revenue even as volume growth stabilizes.

- Digital Commerce and Financial Inclusion: The effective leveraging of e-commerce platforms for mass sales and the proliferation of accessible consumer financing (EMI) are broadening the market for high-value purchases.

- Local Manufacturing and Export: Government support and massive investments by global players like Apple and Samsung have established India as a major global manufacturing and export base, providing structural stability and economic tailwinds.

- Competitive Intensity: The fierce rivalry between Chinese OEMs (Vivo, Xiaomi, OPPO, Realme) for volume and global giants (Samsung, Apple) for value is forcing constant innovation across all price points, from the mass-budget segment to the ultra-premium category.

Strategic Recommendations:

For business stakeholders, the following strategic insights are key to navigating the future of the India smartphone industry:

- Target the Entry-Premium Segment: With the most dynamic growth, the $200–$400 segment represents the sweet spot for both volume and value. Success here requires offering compelling 5G and camera features.

- Master the Omnichannel Approach: Relying on either offline or online alone is insufficient. Brands must harmonize channel strategies, offering competitive online pricing while building a strong, serviced-focused offline footprint.

- Innovate with AI: As hardware differentiation narrows, the next frontier will be in software and user experience. Integrating Generative AI and hyper-personalized features, even in mid-range devices, will be a critical differentiator in 2025 and beyond.

- Leverage Financial Products: Partnerships with financial institutions to offer seamless, low-interest EMI options and trade-in programs are essential tools to reduce the perceived cost of ownership and accelerate the consumer's upgrade cycle to premium devices.

By focusing on these strategic pillars, companies can effectively capture the immense potential of India’s burgeoning and increasingly sophisticated smartphone market.

Why Choose IMARC Group for India Smartphone Market Intelligence:

- Data-Driven Market Research: Gain deeper insights into smartphone market dynamics, including 5G adoption rates, price segment performance, brand positioning strategies, and technological innovations through our comprehensive market research reports tailored specifically for the India smartphone industry.

- Strategic Growth Forecasting: Anticipate emerging trends in smartphone technology, from AI-powered features and advanced camera systems to foldable devices and sustainability initiatives, with detailed forecasts segmented by price brackets, geographic regions, and consumer demographics.

- Competitive Benchmarking: Analyze competitive forces shaping the India smartphone market, evaluate product pipelines from leading manufacturers, and monitor breakthrough innovations in processor technology, battery performance, display quality, and software ecosystems.

- Distribution Channel Analysis: Stay ahead of evolving retail dynamics, e-commerce platform strategies, offline expansion initiatives, and omnichannel approaches that are reshaping smartphone distribution and customer engagement in India.

- Custom Reports and Consulting: Access tailored insights aligned with your organizational objectives, whether launching new smartphone models, entering the Indian market, expanding distribution networks, or evaluating investment opportunities in India's mobile technology sector.

At IMARC Group, our mission is to empower technology leaders, investors, and market entrants with the clarity and intelligence required to navigate India's complex and rapidly evolving smartphone landscape. Partner with us to transform market insights into strategic advantages, because in India's digital revolution, every decision matters.

For more details, please click on this link: https://www.imarcgroup.com/india-smartphone-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)