GCC Cigarette Lighter Market Trends: Understanding Consumer Demand and Product Innovation

Introduction:

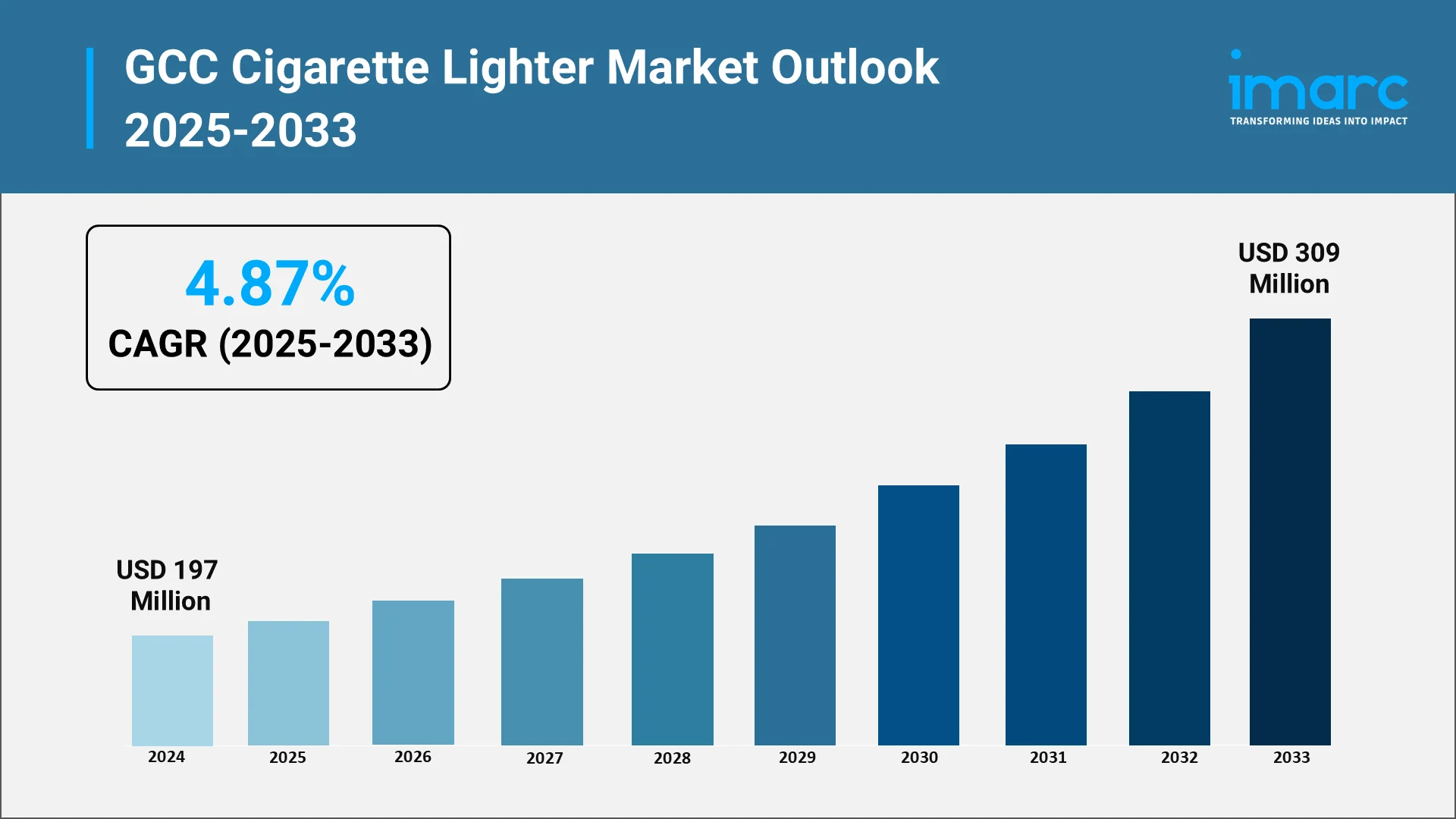

The GCC cigarette lighter market is undergoing a steady phase of expansion due to evolving consumer habits, sustained product demand, and widening distribution channels across the region. In 2024, the GCC cigarette lighter market was valued at USD 197 Million. A key factor shaping industry performance is the rise in convenience-led purchases, driven by widespread retail penetration, duty-free availability, and the continued popularity of smoking-related accessories. Manufacturers are increasingly focusing on product differentiation, durability, and design enhancements to strengthen brand recall and appeal to lifestyle-oriented buyers. Growing interest in multi-purpose utility lighters is also broadening the scope of applications beyond smoking, contributing to new pockets of demand across household, automotive, and outdoor-use segments. These developments are collectively boosting the GCC cigarette lighter market size, which continues to benefit from younger consumer demographics, expatriate populations, and expanding tourism-led sales across key GCC economies.

Explore in-depth findings for this market, Request Sample

How Vision 2030 is Transforming the GCC Cigarette Lighter Industry:

National transformation strategies, particularly Saudi Arabia’s Vision 2030 and UAE’s industrial development frameworks, are significantly shaping the region’s cigarette lighter manufacturing and distribution ecosystem. These initiatives prioritize diversified retail expansion, enhanced product safety regulations, and improved industrial capabilities, resulting in stronger support for consumer goods sectors. The push toward local manufacturing and reduced import dependency is encouraging investments in lighter production facilities, packaging units, and value-added assembly operations. At the same time, Vision 2030’s emphasis on tourism growth, entertainment infrastructure, and airport modernization is creating new retail avenues where lighters remain high-volume, impulse-purchase items. Additionally, regulatory bodies across the GCC are implementing more stringent safety and quality certifications, promoting the adoption of standardized, child-resistant, and ISO-compliant lighter designs. These structural reforms are laying the foundation for sustainable GCC lighter industry growth by developing a more resilient, regulated, and innovation-driven operating environment.

Key Industry Trends:

- Rising Demand for Refillable, Windproof, and Torch Lighters: The demand for refillable and windproof lighter formats is increasing due to their convenience, longevity, and cost efficiency compared to disposable alternatives. Consumers seeking durable and performance-oriented products are gravitating toward metal-body and torch-based lighters that offer superior flame stability in outdoor environments. The rising interest in windproof and utility lighters also reflects broader lifestyle changes, including higher participation in camping, sports, and leisure travel across GCC countries. As a result, manufacturers are expanding their product assortments with premium and mid-range refillable SKUs to address varied GCC cigarette lighter demand and strengthen long-term customer retention. Additionally, advancements in fuel-efficient burner mechanisms and ignition technologies are encouraging wider adoption of high-performance lighters. The segment is also benefiting from increased gifting and collectible trends, especially within premium product lines.

- Increasing Availability Across Convenience Stores and E-Commerce Platforms: Distribution channels are becoming more diverse as cigarette lighters gain broader visibility across supermarkets, hypermarkets, convenience stores, and fuel stations. This expansion is particularly strengthening the GCC disposable lighter market, where high-volume, low-cost products benefit from impulse-driven retail environments. In parallel, e-commerce platforms have emerged as an essential sales channel, offering wider product selection, easy price comparison, and bundled multi-pack deals. Online marketplaces are increasingly popular among value-conscious buyers seeking bulk purchases, multipurpose lighters, and branded collectibles. As tourism recovers and expatriate populations expand, demand from duty-free and travel retail outlets is rising as well.

- Growth of Promotional & Custom-Branded Lighters for Corporate Use: Promotional lighters have become an important marketing tool across hospitality, nightlife, and event-driven sectors in the region. Companies are increasingly investing in custom-printed lighters for brand visibility, giveaways, and customer engagement initiatives. This trend is prevalent in cafés, entertainment venues, shisha lounges, hotels, and corporate events, where branded merchandise enhances customer recall and adds value to the overall experience. With improved printing technologies, manufacturers can now offer high-quality, durable customization options that support a wide range of designs and branding requirements.

- Shift Toward Safer, Child-Resistant, and ISO-Certified Lighter Designs: Governments and regulatory bodies across the GCC are reinforcing safety standards for cigarette lighters, leading to increased adoption of ISO-certified, child-resistant, and tamper-proof models. Companies are prioritizing compliance by integrating enhanced ignition systems, durable casings, and flame-control mechanisms that align with international benchmarks. Safety-driven innovation is becoming a competitive advantage, particularly as regulators intensify inspections and mandate adherence to specific quality levels. In parallel, consumers are demonstrating greater awareness of product reliability, prompting a shift toward certified lighters that minimize safety risks and offer consistent performance.

- Adoption of Eco-Friendly and Recyclable Lighter Materials: Sustainability is gradually emerging as a notable trend within the region, with manufacturers adopting recyclable plastics, metal alloys, and reduced-waste packaging formats. Although the transition is still in early stages compared to global markets, GCC consumers are increasingly receptive to environmentally conscious product alternatives. Companies are experimenting with refillable structures, reduced single-use formats, and materials that support circular economy practices. Retailers are also introducing eco-friendly lighter collections that align with broader sustainability goals set by GCC governments. Growing alignment with eco-friendly material preferences is expected to further strengthen GCC refillable lighter market.

Market Segmentation & Country Insights:

Product Type Insights:

- Flint Cigarette Lighter: Flint lighters hold the largest share due to their low cost, strong durability, and widespread use across both daily smokers and occasional users. Their simple ignition mechanism, compatibility with varied flame intensities, and reliable performance in different conditions continue to drive strong demand across GCC retail and duty-free channels.

- Electronic Cigarette Lighter: Electronic lighters are gaining traction as consumers seek windproof ignition, rechargeable formats, and enhanced safety features. Their appeal is supported by rising interest in premium accessories and modern gifting options across GCC markets.

Material Type Insights:

- Plastic: Plastic lighters dominate the market due to their affordability, lightweight construction, and suitability for high-volume production. Their flexibility in shape, color, and branding enables strong positioning across retail shelves. Manufacturers also favor plastic for its lower cost structure and compatibility with both disposable and refillable lighter formats.

- Metal: Metal lighters attract premium and long-term users, valued for durability, heat resistance, and sophisticated designs. They are commonly selected for gifting, outdoor use, and high-end product lines within GCC markets.

Distribution Channel Insights:

- Tobacco Shops: Tobacco shops remain the primary sales channel due to steady footfall from smokers, diversified product assortments, and convenient access to both disposable and refillable lighter categories. Their ability to stock varied flame types, premium designs, and imported brands ensures strong consumer preference across all GCC countries.

- Supermarkets and Hypermarkets: Modern retail chains offer wide visibility and multi-brand options, supporting impulse purchases. These outlets attract a broad consumer base, including tourists and residents, boosting overall market penetration.

- Convenience Stores: Convenience stores serve fast-moving consumer needs, particularly in urban and transit-heavy locations. Their 24/7 accessibility ensures consistent lighter sales across various consumer groups.

- Online Stores: E-commerce channels are expanding due to broader product variety, transparent pricing, and doorstep delivery. Online platforms support niche categories, customizable designs, and premium lighter purchases.

Country Insights:

- Saudi Arabia: Saudi Arabia leads the market owing to its large population, high smoking prevalence, and extensive retail infrastructure. Strong demand from convenience stores, tobacco shops, and duty-free outlets, combined with rising interest in premium and multipurpose lighters, ensures the Kingdom’s continued dominance across product segments.

- UAE: The UAE market benefits from tourism, airport retail, and strong e-commerce penetration. Premium and branded lighters experience particularly high demand within this region.

- Qatar: Qatar’s rising retail modernization and growing expatriate population support consistent lighter demand, particularly across supermarkets and convenience channels.

- Oman: Oman’s market is shaped by expanding neighborhood retail formats and increasing availability of low-cost imported lighters, supporting steady sales.

- Kuwait: Kuwait demonstrates stable demand driven by high purchasing power and strong presence of global lighter brands across urban retail outlets.

- Bahrain: Bahrain’s compact retail environment and strong duty-free presence contribute to continued demand for both disposable and refillable lighter options.

Forecast (2025–2033):

The GCC cigarette lighter market is expected to reach USD 309 Million by 2033, exhibiting a CAGR of 4.87% during 2025-2033, supported by a stable consumer base, retail modernization, and ongoing product innovation.

Demand Drivers:

- Growing Smoking Population: A gradually expanding smoking population, supported by demographic diversity and steady tobacco product consumption, continues to create consistent demand for cigarette lighters across the GCC. This driver strengthens both premium and mass-market segments, ensuring sustained sales volume throughout the forecast horizon while encouraging manufacturers to diversify product lines to cater to evolving consumer preferences and usage occasions.

- Inexpensive Product Pricing: Affordability remains a key catalyst for lighter consumption, as low unit pricing encourages frequent purchases, easy product replacement, and broader accessibility across consumer groups. Competitive pricing also supports higher retail turnover, enabling convenience stores, kiosks, and supermarkets to maintain strong inventory rotation while allowing manufacturers to retain market relevance in price-sensitive environments across the region.

- Expansion of Retail & Duty-Free Channels: The rapid enhancement of modern retail formats, coupled with increased international passenger movement, is strengthening lighter sales across supermarkets, hypermarkets, airports, and duty-free outlets. These channels improve product visibility, promote brand-led differentiation, and offer consistent access to both disposable and refillable variants, ultimately supporting higher transaction volumes and widening consumer reach across domestic and travel-retail ecosystems.

- Rising Popularity of Utility & Multi-Purpose Lighters: Consumer preference is shifting toward versatile lighter designs suitable for household use, outdoor activities, and DIY applications. Multi-purpose lighters offer enhanced durability and safety, making them appealing beyond traditional smoking-related usage. This demand shift is prompting manufacturers to introduce windproof, torch, and extended-nozzle models that align with broader lifestyle needs, thereby expanding the market’s non-tobacco-driven growth potential.

Conclusion:

The GCC cigarette lighter market is experiencing structured growth driven by changing consumer preferences and product innovation. Refillable, windproof, and multipurpose lighters are becoming popular as demand for durability and usability increases. Convenience stores, duty-free outlets, and e-commerce are expanding market access, while regulatory focus on ISO-certified, child-resistant designs is raising safety standards. Sustainability initiatives, customizable promotional lighters, and advanced printing are creating differentiation opportunities. With national transformation agendas supporting retail and industrial development, the region is set for long-term growth. Overall, rising consumer demand and continuous product enhancements are key factors propelling the GCC cigarette lighter industry.

How IMARC Group Enables Strategic Clarity in the Evolving GCC Cigarette Lighter Market:

IMARC Group supports stakeholders across the lighter manufacturing, distribution, and retail ecosystem with research-driven insights that enable informed decision-making in an increasingly competitive and innovation-led environment. Our intelligence solutions help organizations identify emerging opportunities, mitigate supply chain and regulatory risks, and strengthen long-term strategic positioning through:

- Market Intelligence: Gain a comprehensive understanding of regional consumption patterns, pricing developments, regulatory requirements, and product innovation trends shaping the GCC Cigarette Lighter Market. Our insights provide clarity on segment-level performance including refillable, disposable, and utility lighters along with retail dynamics, duty-free demand, and evolving consumer behaviour across GCC countries.

- Strategic Forecasting: Plan effectively for future market shifts with long-term projections built on robust modelling and scenario-based forecasting. We highlight key growth triggers such as rising tourism, expanding expatriate populations, evolving safety regulations, and increasing acceptance of premium and multifunctional lighters. These insights help organizations prepare for structural changes and capitalize on new revenue streams.

- Competitive Benchmarking: Stay informed on competitor strategies, product diversification efforts, supply chain enhancements, and differentiation approaches within the lighter industry. Our assessments cover advancements in ignition systems, fuel efficiency, child-resistant mechanisms, and sustainable material usage enabling companies to refine product roadmaps and maintain competitive resilience.

- Regulatory and Policy Assessment: Understand the influence of emerging safety standards, ISO compliance requirements, import regulations, and environmental guidelines on product design and market access. We provide detailed evaluations of policy developments to help businesses ensure regulatory alignment and optimize regional market entry strategies across the GCC.

- Customized Consulting Solutions: Whether assessing expansion opportunities, evaluating manufacturing feasibility, optimizing product portfolios, or designing market entry frameworks, our tailored consulting services align with your strategic mandates. From retail channel analysis to distribution partner identification, we deliver precise, actionable recommendations that support sustained business growth.

As consumer preferences continue to shift and product innovation accelerates, IMARC Group remains a trusted partner for organizations seeking deep market intelligence, forward-looking forecasts, and strategic advisory support in the GCC Cigarette Lighter Market. For detailed data, projections, and insights, access the full report here: https://www.imarcgroup.com/gcc-cigarette-lighter-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)