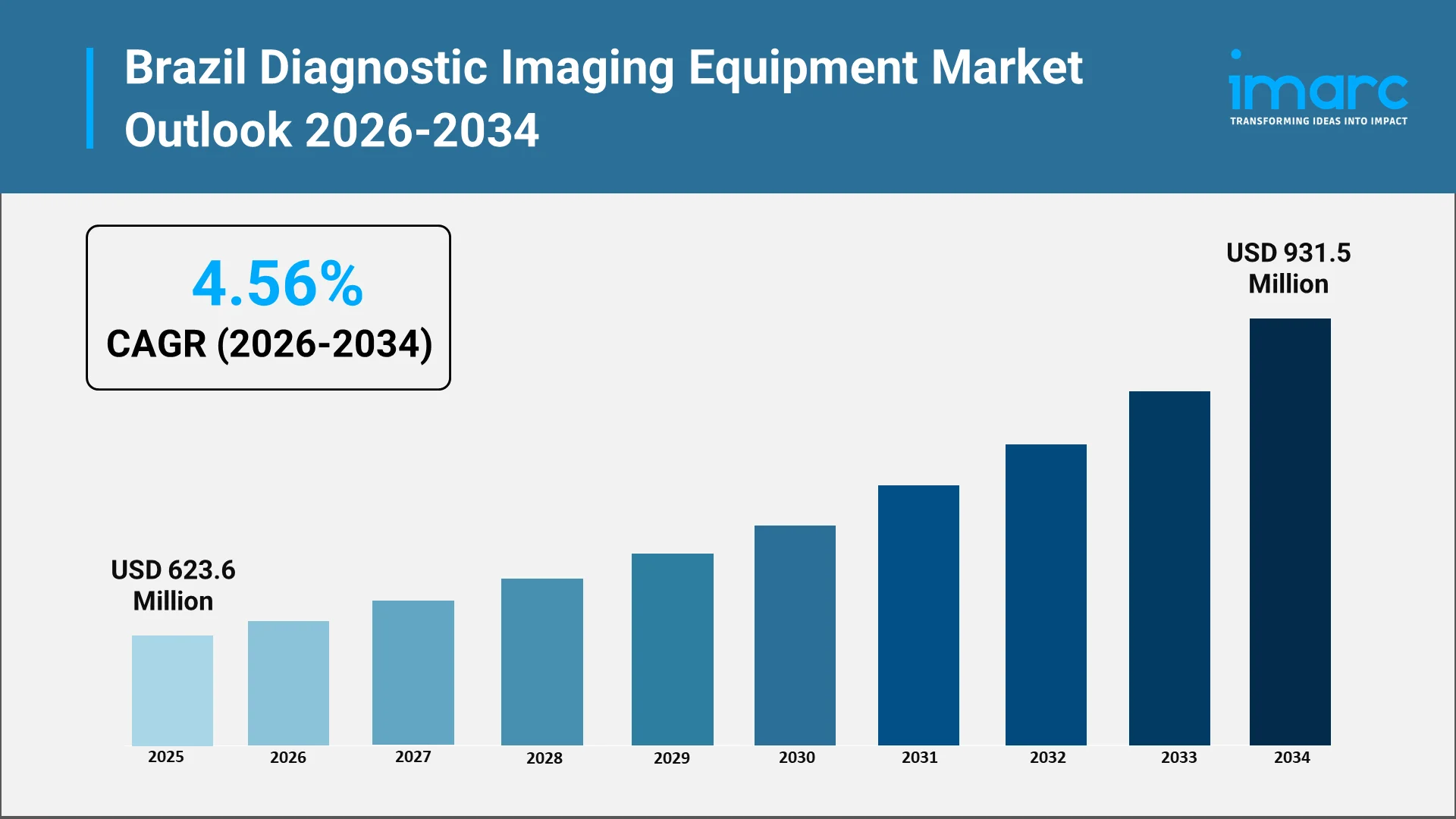

How Big Will the Brazil Diagnostic Imaging Equipment Market Be by 2034?

Brazil's diagnostic imaging equipment market stands at a pivotal moment as Latin America's largest and most dynamic healthcare arena. With substantial investments in hospital modernization, regulatory reforms, and artificial intelligence adoption, the market is transforming rapidly. As providers transition from analog to AI-ready platforms, Brazil emerges as a critical destination for medical device manufacturers seeking growth through the next decade.

Overview of Brazil's Diagnostic Imaging Equipment Market:

Brazil diagnostic imaging equipment market represents the cornerstone of the nation's medical technology sector. The country commands the largest share of Latin America's healthcare spending, with substantial government allocations driving procurement cycles for advanced medical imaging Brazil systems across public and private facilities throughout the nation.

The market encompasses major radiology equipment categories including X-ray systems, computed tomography scanners, magnetic resonance imaging units, ultrasound devices, and nuclear medicine equipment. Urban centers in the Southeast region demonstrate the highest concentration of advanced imaging infrastructure, while rural areas increasingly receive portable units addressing geographical access disparities.

Brazil's dual healthcare system creates unique market dynamics. The public Unified Health System serves the majority through universal coverage, while supplementary private insurance covers additional segments. Both sectors drive equipment demand with distinct purchasing patterns. Public procurement emphasizes cost-effectiveness through competitive bidding, whereas private facilities prioritize premium features and vendor-managed service contracts.

Market Size Forecast and Technology Outlook to 2034:

Looking toward the next decade, Brazil diagnostic imaging equipment market trajectory reflects converging factors promising sustained expansion. Healthcare facilities across public and private sectors recognize the imperative of upgrading imaging capabilities to meet rising patient volumes and increasing clinical complexity driven by demographic and epidemiological shifts.

Advanced modalities gain prominence in the equipment mix. MRI systems experience robust adoption driven by oncology and neurology applications requiring precise soft tissue visualization. CT scanners benefit from cardiac and trauma care expansion, with newer generations offering dose reduction features. Ultrasound equipment maintains strong demand across obstetrics, cardiology, and point-of-care applications.

The healthcare technology landscape evolves as digital transformation reshapes clinical workflows. Picture archiving and communication systems now represent mandatory infrastructure, with government e-health plans requiring PACS compatibility for reimbursement. Vendor-neutral archives gain traction among larger networks seeking interoperability. Cloud-based image storage emerges as a practical solution for institutions lacking on-premise capacity.

Import dependencies characterize the market structure, with substantial equipment value sourcing from international manufacturers. This positions Brazil as a strategic destination for global medical device companies establishing regional operations to optimize logistics and customer support.

Explore in-depth findings for this market, Request Sample

Key Drivers of Equipment Demand and Innovation:

Demographic shifts fundamentally reshape healthcare utilization patterns. Brazil's aging population generates disproportionate imaging volumes as elderly citizens require extensive diagnostic workups for chronic conditions. Life expectancy improvements mean more individuals reach ages where oncologic, neurologic, and musculoskeletal disorders necessitate regular imaging surveillance. This demographic dividend for the healthcare sector creates sustained baseline demand independent of technological advancement cycles.

Chronic disease prevalence escalates across multiple categories. Cardiovascular conditions, diabetes complications, and cancer incidence all trend upward in alignment with lifestyle and environmental factors. Each disease category drives specific imaging modality requirements—cardiac CT for coronary assessment, mammography for breast cancer screening, and MRI for tumor characterization and treatment monitoring. The epidemiological transition from predominantly infectious to predominantly chronic disease burden fundamentally alters imaging equipment portfolio requirements.

Hospital modernization accelerates as both public and private facilities compete for patient volumes and clinical reputation. Legacy institutions upgrade aging infrastructure to attract physicians and maintain accreditation standards. New specialty hospitals and diagnostic centers enter markets with state-of-the-art equipment configurations designed around efficient throughput and premium patient experience. These greenfield projects often specify the latest equipment generations, creating valuable opportunities for manufacturers to showcase innovation.

Clinical practice evolution demands enhanced imaging capabilities. Minimally invasive interventions require real-time imaging guidance with exceptional spatial resolution. Image-guided radiation therapy necessitates precise tumor localization through repeat imaging. Screening programs for early disease detection expand coverage to younger age cohorts, multiplying examination volumes. Each clinical trend translates into equipment specifications that push technological boundaries and justify capital investments.

Healthcare Infrastructure and Government Initiatives:

Brazil's Ministry of Health orchestrates ambitious digital transformation programs restructuring healthcare delivery. Substantial commitments target digitalization of the public system, with resources allocated toward IT equipment and software deployment across thousands of municipalities. Initiatives emphasize connectivity between primary care units and specialized diagnostic facilities, enabling remote consultation even in underserved regions.

The APS Digital program exemplifies government commitment to universal healthcare access through technology. By equipping basic care units in the majority of municipalities, the initiative creates a digital backbone supporting telemedicine and teleradiology services. Patients in remote areas gain access to specialized imaging interpretation without traveling to distant urban centers.

Regulatory modernization through ANVISA accelerates market access for innovative devices. Recent reforms align Brazilian device classification with International Medical Device Regulators Forum standards, incorporating provisions for software as a medical device and nanomaterial-based technologies. The agency now recognizes regulatory clearances from Australia, Canada, Japan, and the United States, substantially reducing local review timelines.

In a significant regulatory milestone, ANVISA officially launched its Unique Device Identification system (Siud) in July 2025, during an event at its headquarters in Brasília. This national system aligns Brazil with IMDRF standards, requiring manufacturers to register devices in the centralized database and apply standardized UDI labels across all risk classifications, supporting enhanced post-market surveillance and global interoperability.

Public-private partnerships gain momentum as financing mechanisms for equipment acquisition. Service contracts with extended warranties, AI-subscription bundles, and performance-based payment models enable institutions to access premium equipment without large upfront capital expenditures.

Adoption of AI and Digital Imaging Technologies:

AI in diagnostics emerges as the defining characteristic of next-generation imaging infrastructure. Artificial intelligence algorithms integrate across the imaging workflow from examination scheduling through image acquisition, reconstruction, analysis, and reporting. Early adopters demonstrate measurable improvements in radiologist productivity, examination throughput, and diagnostic accuracy. The technology proves particularly valuable in addressing radiologist shortages in secondary cities and rural areas.

On October 30, 2025, Brazil became the first South American member of the HealthAI Global Regulatory Network through a formal agreement signed by Minister of Health Dr. Alexandre Padilha at the ABRAMGE Congress in São Paulo. This partnership positions Brazil as a regional catalyst for responsible AI governance in healthcare, emphasizing proper regulation, data protection safeguards, and transparent oversight.

Leading manufacturers bundle AI capabilities as standard features. Smart algorithms automatically adjust acquisition parameters based on patient characteristics, reducing radiation exposure while maintaining diagnostic quality. Computer-aided detection highlights suspicious findings for radiologist review, minimizing oversight errors in high-volume workflows. Automated quantification tools measure anatomical structures with precision exceeding manual assessment.

Telemedicine platforms incorporating AI-assisted interpretation expand rapidly. Portal Telemedicine operates cloud-based systems processing thousands of reports daily, enabling tier-two hospitals to access on-demand reads from remote radiologists. Machine learning applications extend beyond radiology into broader analytics, with predictive algorithms identifying patients requiring earlier intervention based on imaging findings combined with electronic health record data.

Competitive Scenario and Future Growth Potential:

The competitive landscape features moderate consolidation with established corporations commanding substantial market shares. GE Healthcare, Siemens Healthineers, and Philips maintain strong positions reinforced by in-country subsidiaries, comprehensive product portfolios, and extensive service networks capable of supporting diverse institutional needs.

GE Healthcare pursues digital transformation through cloud partnerships and remote control specialists. Siemens Healthineers targets cost-sensitive markets with value-engineered products and diversifies into radiopharmaceuticals. Philips Healthcare leads in AI-enabled systems and integrated ecosystems extending beyond equipment to software and services.

Emerging competitors challenge incumbents through differentiated propositions. United Imaging Healthcare offers price-performance advantages with flexible financing. Local innovators like Mobissom's wireless ultrasound fill niche applications. Brazilian developers create tailored radiology information systems understanding local requirements.

Distribution strategies evolve toward life-cycle partnerships with extended warranties, maintenance contracts, and software licensing creating recurring revenues. The refurbished equipment segment addresses budget constraints in resource-limited settings.

The market outlook remains constructive supported by demographic aging, chronic disease proliferation, government spending commitments, and technological innovation consistently delivering clinical value. However, economic volatility, currency depreciation, and workforce shortages present ongoing challenges requiring strategic navigation.

Choose IMARC Group as We Offer Unmatched Expertise and Core Services:

- Data-Driven Market Research: Deepen your knowledge of diagnostic imaging adoption rates, equipment specifications, and technological advancements such as AI-powered diagnostics, cloud-based PACS systems, and telemedicine platforms through in-depth market research reports.

- Strategic Growth Forecasting: Predict emerging trends in Brazil's imaging sector, from portable ultrasound devices and low-field MRI systems to regulatory changes and public health digitalization initiatives across federal and state levels.

- Competitive Benchmarking: Analyze competitive forces in the diagnostic imaging equipment market, review manufacturer product pipelines, and monitor breakthroughs in digital imaging technologies and hybrid modality systems.

- Policy and Infrastructure Advisory: Stay one step ahead of ANVISA regulatory paradigms, government-sponsored modernization programs, and reimbursement strategies affecting diagnostic equipment procurement, installation, and operational sustainability.

- Custom Reports and Consulting: Get tailored insights geared to your organizational objectives—be it launching new imaging modalities, investing in AI-driven diagnostic ventures, or expanding healthcare infrastructure across Brazil's diverse regional markets.

At IMARC Group, our goal is to empower healthcare leaders with the clarity and intelligence required to navigate Brazil's dynamic diagnostic imaging landscape. Join us in advancing diagnostic excellence—because accurate imaging saves lives. Click here for more detailed report: https://www.imarcgroup.com/brazil-diagnostic-imaging-equipment-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)