How Government Policies Are Driving the India Truck Industry

Introduction: A New Era for Indian Commercial Vehicles

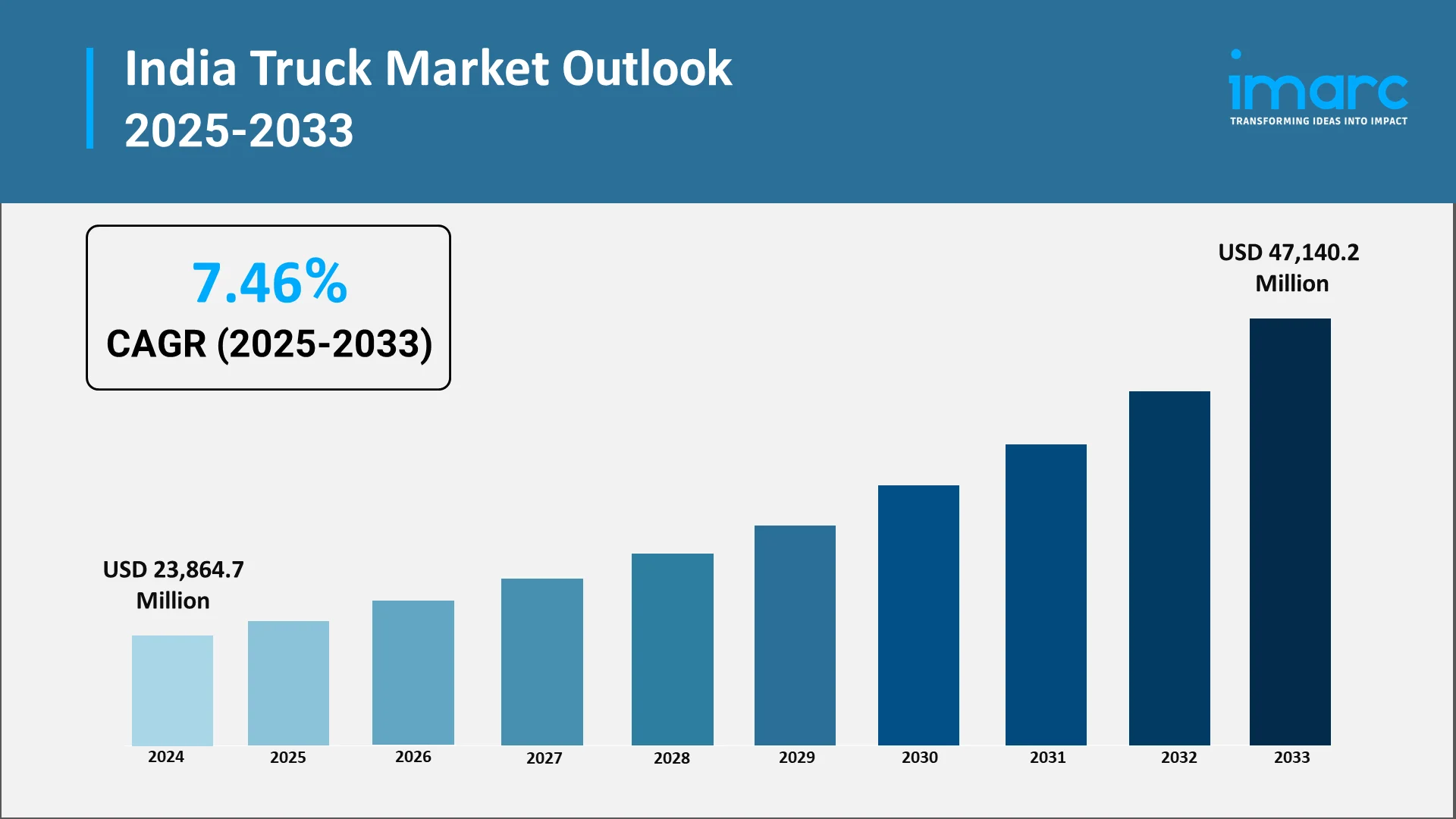

India's truck industry is at a turning point in its development, driven by extensive government policies that are changing the commercial vehicle market. The industry, which is the foundation of the country's logistics ecosystem, is gaining previously unheard-of momentum thanks to smart regulatory frameworks and forward-thinking legislative initiatives. A fundamental change in truck operations on Indian highways is being sparked by government initiatives ranging from infrastructure development to emission standards, digitalization, and financial incentives. The India truck market size reached USD 23,864.7 Million in 2024. The market is projected to reach USD 47,140.2 Million by 2033, exhibiting a growth rate (CAGR) of 7.46% during 2025-2033.

The Ministry of Road Transport and Highways has emerged as a central force orchestrating this transformation, introducing policies addressing multiple facets of the trucking ecosystem. From mandating cleaner fuel technologies to streamlining interstate movement through unified taxation, these measures create an environment conducive to industry growth. The ripple effects extend beyond manufacturers to encompass fleet operators, logistics companies, and ancillary service providers.

A holistic approach, which acknowledges that sustainable growth necessitates concurrent attention to environmental sustainability, operational efficiency, safety standards, and technological advancement, is how the current policy landscape sets itself apart. With this multifaceted approach, India's commercial vehicle industry is positioned for sustained competitiveness in a global market that is becoming more and more demanding.

Explore in-depth findings for this market, Request Sample

Infrastructure Expansion: Building the Foundation for Growth

Government investment in road infrastructure represents the most significant catalyst for truck industry expansion. Ambitious highway development programs have fundamentally altered the operating environment, creating extensive networks of multi-lane expressways and upgraded national highways that facilitate faster, safer goods transportation nationwide.

The Bharatmala initiative and similar projects are engineering sophisticated logistics corridors equipped with modern amenities. These developments include dedicated freight corridors, integrated logistics parks, and multimodal hubs that optimize cargo movement. For manufacturers and fleet operators, improved road quality translates into reduced maintenance costs, lower fuel consumption, and enhanced payload efficiency.

Targeted investments have significantly improved connectivity to ports, industrial clusters, and agricultural zones. Improved connectivity lowers operating costs and transit times while increasing the addressable market for trucking services. Opportunities for cross-border commercial vehicle operations are being created by the government's emphasis on international trade routes and border infrastructure.

Emission Standards: Driving Environmental Compliance

Implementation of stringent emission norms has fundamentally transformed truck manufacturing and procurement patterns. By adopting progressively tighter standards aligned with international benchmarks, regulatory authorities are compelling manufacturers to invest in cleaner engine technologies and advanced emission control systems. This regulatory push accelerates the transition toward environmentally responsible commercial vehicles.

BS-VI emission standards mandate significant reductions in harmful pollutants, requiring comprehensive engine architecture and fuel system redesigns. Manufacturers have developed sophisticated technologies including selective catalytic reduction systems, diesel particulate filters, and advanced fuel injection mechanisms. Although these improvements initially raise the cost of the car, they have long-term advantages due to their increased fuel economy and decreased environmental effect.

The regulatory framework considers wider environmental factors in addition to tailpipe emissions. New market niches are being created by policies that support alternative fuel vehicles, such as trucks that run on electricity or compressed natural gas. Environmentally friendly cars are becoming progressively more appealing to fleet operators who are concerned with total cost of ownership because government incentives for implementing cleaner technologies help offset higher upfront costs.

Vehicle Scrapping Policy: Accelerating Fleet Modernization

The National Vehicle Scrapping Policy represents a strategic intervention designed to phase out aged, polluting vehicles while simultaneously stimulating demand for new trucks. This policy framework creates a structured mechanism for retiring end-of-life vehicles, offering financial incentives to owners who voluntarily scrap old commercial vehicles and replace them with modern, compliant alternatives.

For the truck industry, this scrapping initiative addresses multiple objectives simultaneously. It tackles the environmental challenge posed by aging vehicles with outdated emission control technologies while creating sustained demand for new vehicle sales. The policy includes provisions for establishing automated fitness testing centers and registered vehicle scrapping facilities across the country, creating an entire ecosystem around vehicle end-of-life management.

Manufacturers benefit from predictable replacement demand as the policy sets clear timelines for mandatory fitness certification of older vehicles. Fleet operators gain access to incentives including reduced road tax, registration fee waivers, and manufacturer discounts when purchasing new vehicles as scrapping replacements. This circular approach to fleet management is expected to significantly accelerate the pace of fleet modernization across India's vast commercial vehicle population.

GST Implementation: Revolutionizing Interstate Movement

The Goods and Services Tax introduction has eliminated one of the most significant operational bottlenecks plaguing India's trucking industry. By replacing multiple state-level taxes with a unified national system, GST has dramatically reduced time trucks spend at interstate checkpoints. This singular reform has enhanced the operational efficiency of the entire logistics sector.

The new system's e-way bill mechanism enables seamless interstate goods movement with digital documentation, allowing trucks to maintain continuous movement across state boundaries. This transformation has improved vehicle utilization rates and reduced fuel wastage associated with idling at checkpoints.

GST's economic impact extends throughout the logistics value chain. Reduced transit times enable faster delivery schedules, lower working capital requirements, and improved customer service levels. For truck manufacturers, the efficiency gains make commercial vehicle investments more attractive, as fleet operators achieve better returns through higher utilization rates and reduced non-productive time.

Digital Transformation: Technology-Enabled Operations

Government initiatives promoting digitalization in the transport sector are fundamentally changing truck operations and industry management. Digital platforms for documentation, permit issuance, and regulatory compliance have reduced administrative burdens while enhancing transparency. These technological interventions make commercial vehicle operations more efficient and accountable.

The Vahan and Sarathi platforms represent landmark digital initiatives that have computerized vehicle registration and driver licensing nationwide. These systems enable real-time tracking of registrations, facilitate online service delivery, and provide instant access to vehicle and driver information. The reduction in paperwork and elimination of multiple physical visits represents significant convenience for truck operators.

FASTag implementation for electronic toll collection has removed another major source of delay. By enabling automated toll payments through radio frequency identification technology, trucks pass through toll plazas without stopping, significantly reducing transit times. The government's push toward complete FASTag adoption across commercial vehicles is enhancing highway throughput and reducing operational costs.

Financial Incentives: Supporting Industry Investment

Strategic financial support programs from government institutions are making commercial vehicle acquisition more accessible for operators across different segments. Public sector banks and specialized financial institutions offer preferential lending rates for truck purchases, particularly for vehicles meeting the latest emission standards or incorporating advanced safety features. These financing mechanisms are crucial for supporting industry growth, especially among smaller fleet operators.

The FAME scheme and similar programs provide direct subsidies for electric commercial vehicles, addressing the higher upfront costs that have historically limited adoption of alternative fuel technologies. By reducing the cost differential between conventional and electric trucks, these incentives are accelerating the transition toward cleaner transportation solutions. The government's commitment to expanding charging infrastructure further enhances the viability of electric commercial vehicles.

Priority sector lending provisions direct institutional credit toward transportation and logistics activities, ensuring adequate capital availability for truck acquisition and fleet expansion. Additionally, insurance schemes offering comprehensive coverage at reasonable premiums help mitigate risks associated with commercial vehicle operations. These financial support mechanisms collectively reduce barriers to entry and expansion for trucking businesses across size categories.

Safety Regulations: Enhancing Road Safety Standards

Progressive safety regulations are compelling manufacturers to incorporate advanced safety features in commercial vehicles, raising the baseline safety standards across India's truck population. Mandatory requirements for features such as anti-lock braking systems, speed governors, and driver assistance technologies are transforming vehicle design and manufacturing specifications. These regulatory interventions address the critical challenge of road safety while pushing technological advancement.

The implementation of mandatory driver training programs and standardized licensing procedures ensures that operators possess the necessary skills to handle modern commercial vehicles safely. Enhanced enforcement of working hour regulations prevents driver fatigue, a major contributor to road accidents involving heavy commercial vehicles. Digital tachographs and GPS-based monitoring systems enable regulatory authorities to track compliance with these safety norms effectively.

Vehicle manufacturers are responding to these regulatory demands by developing trucks with improved crashworthiness, better visibility features, and integrated safety management systems. The mandatory fitment of safety equipment has implications for vehicle costs but delivers substantial benefits through reduced accident rates, lower insurance premiums, and enhanced driver welfare. These safety-focused policies are gradually changing the safety culture within India's commercial transportation sector.

Production-Linked Incentives: Boosting Manufacturing

The Production-Linked Incentive scheme for the automotive sector represents a strategic effort to position India as a global manufacturing hub for commercial vehicles. By offering financial incentives tied to incremental production and sales, the program encourages manufacturers to expand capacity, enhance product quality, and invest in advanced manufacturing technologies. This initiative is attracting both domestic and international players to increase their manufacturing footprint in India.

The scheme's focus on promoting electric and hydrogen fuel cell vehicle manufacturing aligns with global trends toward sustainable transportation. Manufacturers investing in these future-oriented technologies receive preferential support, accelerating the development of India's capabilities in next-generation commercial vehicle production. The program also emphasizes exports, encouraging manufacturers to develop globally competitive products that can succeed in international markets.

For the truck industry, production-linked incentives translate into expanded model ranges, improved vehicle quality, and competitive pricing through economies of scale. The anticipated increase in manufacturing activity is creating employment opportunities throughout the automotive value chain, from component suppliers to assembly operations. This comprehensive approach to industrial policy is strengthening India's position in the global commercial vehicle industry.

Future Outlook: Sustaining Growth Momentum

The convergence of supportive policies, infrastructure development, and technological advancement positions India's truck industry for sustained expansion. Government commitment to policy stability provides manufacturers and fleet operators with confidence for long-term investment planning. The continued evolution of regulatory frameworks ensures the industry remains aligned with global best practices.

Emerging policy priorities include expanding electric vehicle infrastructure, promoting hydrogen fuel technologies, and developing intelligent transportation systems. Integration of artificial intelligence and autonomous driving technologies will likely attract regulatory attention as innovations mature. Government support for research and development in advanced vehicle technologies will be crucial for maintaining India's competitive position.

Current policy success in driving industry transformation provides a strong foundation for future initiatives. As India's economy grows and logistics demand expands, the truck industry will remain central to supporting this trajectory. Sustained policy focus on balancing commercial interests with environmental sustainability and safety will be essential for ensuring the sector's long-term viability.

Conclusion: Policy-Driven Transformation

Government policies have emerged as the primary driver reshaping India's truck industry, creating an ecosystem that supports growth, sustainability, and technological advancement. The comprehensive policy framework addressing infrastructure, emissions, taxation, digitalization, and safety has fundamentally altered the commercial vehicle landscape. This transformation extends beyond immediate industry impacts to influence broader economic efficiency, environmental outcomes, and road safety standards across the nation.

The success of these policy interventions demonstrates the power of coordinated government action in catalyzing industrial transformation. As policies continue evolving in response to emerging challenges and opportunities, the truck industry's trajectory will remain closely tied to regulatory frameworks and government initiatives. Stakeholders across the value chain must maintain awareness of policy developments and adapt strategies accordingly to capitalize on the opportunities created by this dynamic regulatory environment.

Choose IMARC Group for Comprehensive Truck Industry Intelligence:

- Data-Driven Market Analysis: Gain deep insights into India's commercial vehicle sector through comprehensive research covering policy impacts, regulatory compliance requirements, emission standard transitions, and technological adoption patterns across vehicle segments and regional markets.

- Strategic Growth Forecasting: Anticipate emerging trends in truck manufacturing, fleet electrification initiatives, safety technology integration, autonomous vehicle developments, and infrastructure expansions shaping the industry's evolution across regions and market segments.

- Competitive Intelligence: Analyze manufacturer strategies, market positioning dynamics, product portfolio developments, technology partnerships, and competitive forces reshaping India's commercial vehicle landscape domestically and globally.

- Regulatory Advisory: Navigate complex emission standards, safety regulations, scrapping policies, incentive programs, and compliance frameworks with expert guidance on regulatory requirements and strategic business implications.

- Custom Research Solutions: Access tailored insights addressing your organizational objectives—whether entering truck manufacturing, expanding fleet operations, investing in commercial vehicle technologies, or evaluating market entry strategies.

IMARC Group empowers industry leaders with actionable intelligence to navigate India's transforming truck industry successfully.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)