How Innovation is Shaping the Global Frozen Food Market: Trends, Challenges, and Opportunities?

The global frozen food industry has undergone a remarkable transformation over the past decade, evolving from a convenience-focused sector into a sophisticated, technology-driven marketplace that prioritizes quality, nutrition, and sustainability. Innovation serves as the primary catalyst for this evolution, fundamentally reshaping consumer perceptions and market dynamics across all geographic regions. The integration of smart technologies throughout the supply chain has created unprecedented levels of transparency and quality control. The FAO states that most vegetables, when properly blanched and frozen, can be stored for 8–12 months, and meats/fish for 6–12 months, whereas fresh shelf life is typically less than a week. Internet of Things (IoT) sensors now monitor temperature fluctuations in real-time during storage and transportation, while blockchain technology enables complete traceability from farm to freezer.

Digital transformation has also democratized access to diverse culinary experiences, allowing consumers worldwide to enjoy authentic international cuisines through premium frozen offerings. This globalization of taste preferences has created new market segments and opportunities for both established players and innovative startups. The economic impact of these innovations extends beyond immediate market growth. This efficiency has translated into consumer benefits through improved affordability and accessibility, particularly in urban markets where time-pressed consumers increasingly rely on convenient, high-quality meal solutions. In April 2025, the German frozen food sector reported record retail sales of 4.137 million tons in 2024, with per capita consumption reaching 50 kg and household consumption surpassing 100 kg for the first time.

Explore in-depth findings for this market, Request Sample

Key Growth Drivers in the Global Frozen Food Market:

Rising Demand for Convenience and Time Efficiency

The acceleration of urbanization globally has fundamentally altered consumer lifestyle patterns, creating unprecedented demand for convenient food solutions and fueling the global frozen meals market. Urban dwellers typically face longer commuting times, extended working hours, and reduced time for traditional meal preparation. This time constraint has driven significant innovation in frozen food product development, with manufacturers creating sophisticated ready-to-eat and ready-to-cook options that maintain restaurant-quality standards. Modern frozen meals now incorporate complex flavor profiles, premium ingredients, and restaurant-inspired presentation that appeals to discerning consumers who refuse to compromise on quality for convenience.

According to recent industry reports, 84% of frozen food items in the U.S. are now consumed as complete meals (not appetizers), and sales of spicy frozen foods reached USD 2.4 Billion, as younger consumers increasingly ask for bold flavors. Additionally, the rise of dual-income households has created a substantial market for family-oriented frozen solutions. Working parents increasingly rely on frozen foods that can feed multiple family members while accommodating diverse taste preferences and dietary restrictions within a single product line, which is driving the global frozen ready-to-eat market.

Technological Advancements in Freezing and Packaging

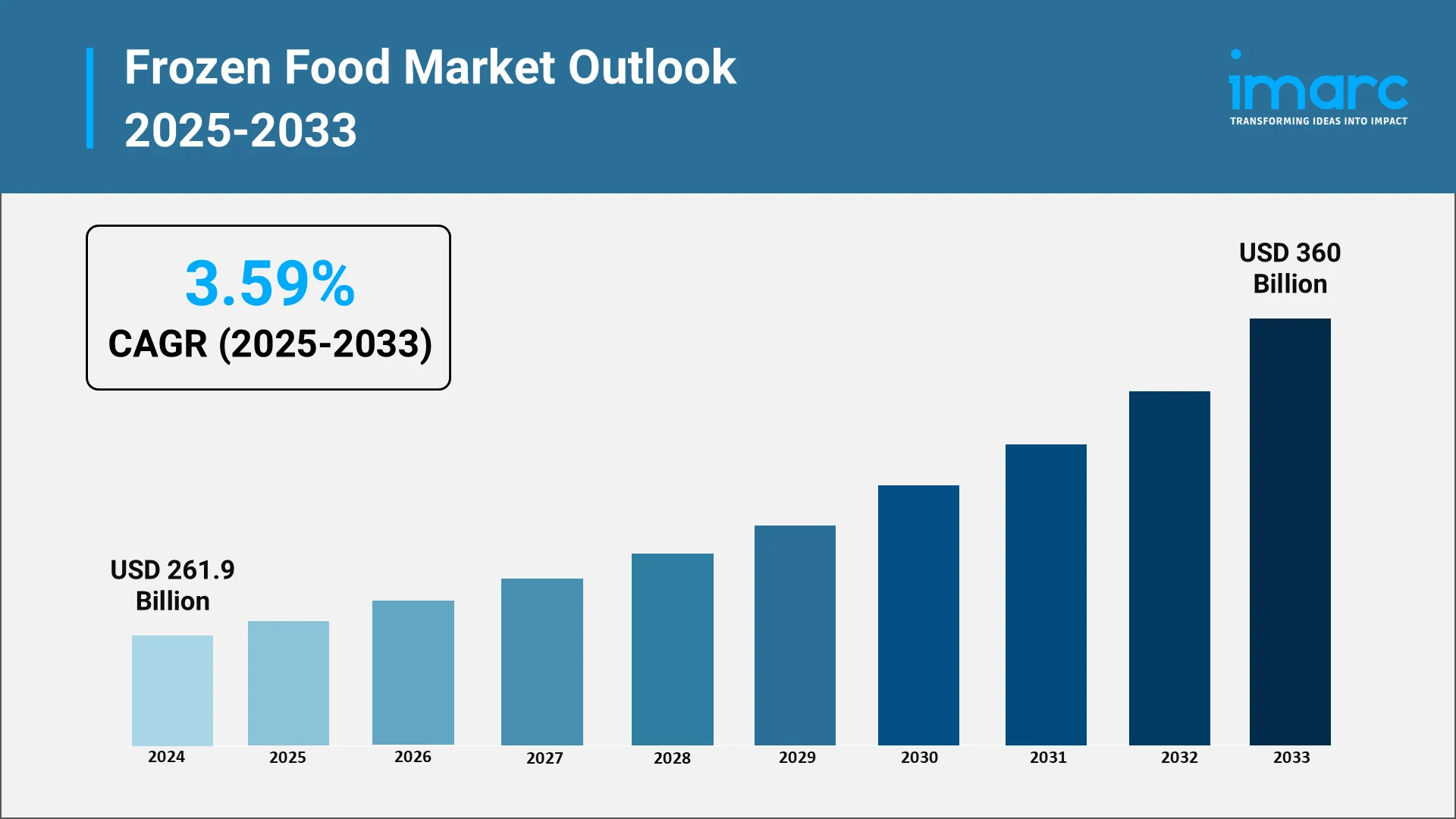

Revolutionary advances in freezing technology have transformed the fundamental quality proposition of frozen foods. The global frozen food market size reached USD 261.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 360 Billion by 2033, exhibiting a growth rate (CAGR) of 3.59% during 2025-2033.

- Blast freezing techniques now rapidly freeze products to -18°C within minutes, creating smaller ice crystals that preserve cellular structure and maintain original taste and texture profiles. This technology has enabled frozen food manufacturers to compete directly with fresh alternatives in premium market segments.

- Cryogenic freezing using liquid nitrogen has emerged as a game-changing technology for preserving delicate products like seafood, berries, and prepared foods with complex textures. This ultra-rapid freezing process maintains the integrity of sensitive ingredients that previously could not be successfully frozen without significant quality degradation.

- Microwave-compatible packaging with steam venting technology ensures even heating while maintaining moisture content, as packaging innovations have equally transformed the frozen food experience. Smart packaging incorporating time-temperature indicators provides consumers with real-time quality assurance, while sustainable packaging alternatives address growing environmental concerns.

- Modified Atmosphere Packaging (MAP) technology has extended frozen food quality by replacing oxygen with nitrogen or carbon dioxide, preventing oxidation and maintaining color, flavor, and nutritional content throughout extended storage periods. These advances have enabled manufacturers to offer premium frozen, processed products with extended shelf life without artificial preservatives, which in turn is propelling the global processed food market.

Shift Toward Healthier, Nutrient-Rich Options

Consumer health consciousness has reached unprecedented levels, driving fundamental changes in frozen food formulation and positioning. Modern consumers actively seek products with clean ingredient labels, reduced sodium content, enhanced protein profiles, and elimination of artificial additives and preservatives. Dietary restriction accommodations have become standard practice, with manufacturers developing extensive gluten-free, keto-friendly, paleo-compliant, and allergen-free product lines. These specialized offerings often command premium pricing while serving underserved consumer segments. India’s frozen French fry industry has evolved into a net exporter, with overseas shipments now surpassing local demand. In FY 2023–24, the country exported close to 136,000 Tons of frozen fries worth about INR 1,479 Crore (USD 178 Million), outpacing domestic consumption estimated at nearly 100,000 Tons per year.

Functional foods incorporating superfoods, probiotics, and enhanced nutritional profiles have created new premium frozen food categories. Products featuring ingredients like quinoa, chia seeds, turmeric, and adaptogenic herbs appeal to health-conscious consumers seeking convenient access to trending nutritional benefits. The sports nutrition and fitness market has embraced frozen food solutions designed for active lifestyles. High-protein frozen meals, portion-controlled options for weight management, and performance-oriented frozen smoothie ingredients have created specialized market segments with premium pricing potential.

Regulatory Framework and Policy Landscape

The global regulatory environment for frozen foods has become increasingly sophisticated, reflecting growing consumer expectations for safety, quality, and transparency. Regulatory frameworks now encompass comprehensive requirements for temperature control, traceability, labeling accuracy, and environmental impact across the entire supply chain. Hazard Analysis and Critical Control Points (HACCP) systems are now mandatory in most developed markets, requiring systematic identification and control of potential safety hazards throughout the freezing and storage process.

International trade regulations have become increasingly complex as frozen foods cross multiple borders during production and distribution. Harmonized System (HS) codes for frozen products require detailed classification and documentation, while bilateral trade agreements often include specific provisions for frozen food quality standards and inspection procedures. Labeling regulations have expanded to require detailed nutritional information, allergen declarations, and country-of-origin labeling.

Government Support and Initiatives in the Global Frozen Food Market

Government initiatives worldwide have recognized the strategic importance of frozen food infrastructure in ensuring food security, reducing waste, and supporting agricultural development. These programs encompass direct financial support, infrastructure development, research funding, and regulatory streamlining to promote industry growth. New production clusters in Gujarat, Madhya Pradesh, and Punjab are further strengthening export capacity and positioning India as a rising player in the global frozen potato market.

Cold chain infrastructure development has become a priority for governments in emerging markets, recognizing its critical role in reducing post-harvest losses and improving food distribution efficiency.

Export promotion initiatives help domestic frozen food manufacturers access international markets through trade missions, certification support, and marketing assistance. Countries with strong agricultural sectors, including Canada, Australia, and Brazil, have developed comprehensive export support programs specifically targeting frozen food products.

Energy efficiency incentive programs encourage adoption of sustainable freezing and storage technologies. Tax credits, rebates, and low-interest loans for energy-efficient equipment help manufacturers reduce operational costs while meeting environmental objectives.

Top Frozen Food Companies in the Global Market:

The global frozen food industry is dominated by diversified multinational corporations that leverage extensive distribution networks, advanced technology capabilities, and comprehensive product portfolios to maintain competitive advantages across multiple market segments. Some of the major market players in the frozen food industry include Ajinomoto Co. Inc., Aryzta A.G., Associated British Foods plc, Bellisio Foods Inc. (Charoen Pokphand Foods), Cargill Incorporated, Conagra Brands Inc., General Mills Inc., The Kraft Heinz Company, JBS S.A., Jeanie Marshal Foods Ltd, Kellogg Company, McCain Foods Limited, Nestlé S.A., Wawona Frozen Foods, among many others. Recent developments include:

- Ajinomoto: In 2025, Ajinomoto Frozen Foods launched more than 10 new and renewed products for the autumn season, including “Ebi Niku Shumai” (shrimp-meat dumplings), following nearly 100 prototype iterations to balance pricing, packaging, and serving size.

- Conagra Brands: In December 2024, Conagra released its Future of Frozen Food 2025 report, identifying trends such as health-centric options, bold flavors, bite-size formats, and noting that frozen food spending among Millennials and Gen Z jumped 54% during family formation years.

- The Kraft Heinz Company: In 2024, Kraft Heinz signed a perpetual licensing deal to market TGI Fridays frozen appetizers in retail, enhancing its presence in the frozen snacks segment.

- McCain Foods Limited: In 2025, McCain Foods, a global manufacturer of frozen potato products, launched “Regen Fries,” a frozen potato product made using regenerative agriculture methods to promote soil health and sustainability.

Opportunities and Challenges in the Global Frozen Food Market:

Emerging Market Opportunities

Rapid economic development in Asia-Pacific, Latin America, and Africa presents unprecedented growth opportunities for frozen food expansion. Rising disposable incomes, urbanization trends, and changing lifestyle patterns create favorable conditions for frozen food adoption in markets previously dominated by fresh and traditional food preparation methods.

E-commerce penetration in emerging markets offers new distribution channels that bypass traditional retail infrastructure limitations. Online grocery platforms and direct-to-consumer delivery services enable frozen food manufacturers to reach consumers in markets where cold chain retail infrastructure remains underdeveloped.

Premium and international cuisine segments represent significant opportunities in emerging markets where consumers increasingly seek diverse culinary experiences. Authentic ethnic frozen foods, gourmet ingredients, and restaurant-quality prepared meals appeal to growing middle-class populations with sophisticated taste preferences.

Plant-based and health-focused products present substantial growth potential as emerging market consumers become more health-conscious and environmentally aware. Local adaptation of global plant-based trends, incorporating regional ingredients and flavor preferences, creates opportunities for both international and domestic manufacturers.

Industry Challenges

Energy costs represent a persistent challenge for frozen food manufacturers, with freezing and storage operations requiring substantial electricity consumption. Volatile energy prices and increasing carbon pricing mechanisms are pressuring companies to invest in energy-efficient technologies and renewable energy sources. Supply chain complexity and vulnerability have become critical concerns, particularly following recent global disruptions. Frozen food manufacturers must maintain temperature-controlled logistics across multiple geographic regions while managing risks related to transportation delays, border restrictions, and infrastructure limitations.

Consumer perception challenges persist in certain markets where frozen foods are still viewed as inferior to fresh alternatives. Educational marketing efforts and continued product quality improvements are necessary to overcome these perceptions and expand market acceptance.

Regulatory compliance complexity increases costs and operational challenges as manufacturers navigate varying standards across international markets. Harmonization efforts remain incomplete, requiring companies to maintain multiple certification standards and quality control systems. Environmental sustainability pressures are intensifying as consumers and regulators demand reduced packaging waste, lower carbon footprints, and sustainable sourcing practices. These requirements often conflict with food safety and quality preservation needs, creating complex optimization challenges for industry participants.

Future Outlook of the Market: 2033 and Beyond

Innovation continues driving fundamental transformation across the global frozen food industry, creating opportunities for companies that successfully balance technological advancement with consumer needs and sustainability objectives. The industry's evolution from convenience-focused offerings to premium, health-conscious products reflects broader societal trends toward quality, transparency, and environmental responsibility.

Future success will depend on companies' ability to leverage emerging technologies like artificial intelligence, biotechnology, and sustainable packaging solutions while maintaining the cost-effectiveness and convenience that define frozen food value propositions. Strategic investments in automation, alternative proteins, and supply chain optimization will determine competitive positioning in an increasingly sophisticated marketplace.

Why Choose IMARC – Global Foresight in Frozen Food Intelligence:

- Features verified 2024–2025 data across all major frozen food categories, including ready-to-eat and premium meat products.

- Analyzes emerging consumption patterns shaped by convenience, health-conscious choices, and clean-label demand.

- Maps technological innovations in freezing, preservation, and sustainable packaging.

- Offers cross-regional benchmarking across North America, Europe, Asia-Pacific, and Latin America.

- Monitors supply chain efficiency, cold storage investments, and e-commerce-driven retail growth.

- Highlights sustainability practices like carbon reduction, waste minimization, and green packaging initiatives.

- Equips stakeholders with strategic insights to capture growth in both mature and emerging frozen food markets.

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)