Key Challenges and Opportunities Shaping the Latin America Carbon Footprint Management Market

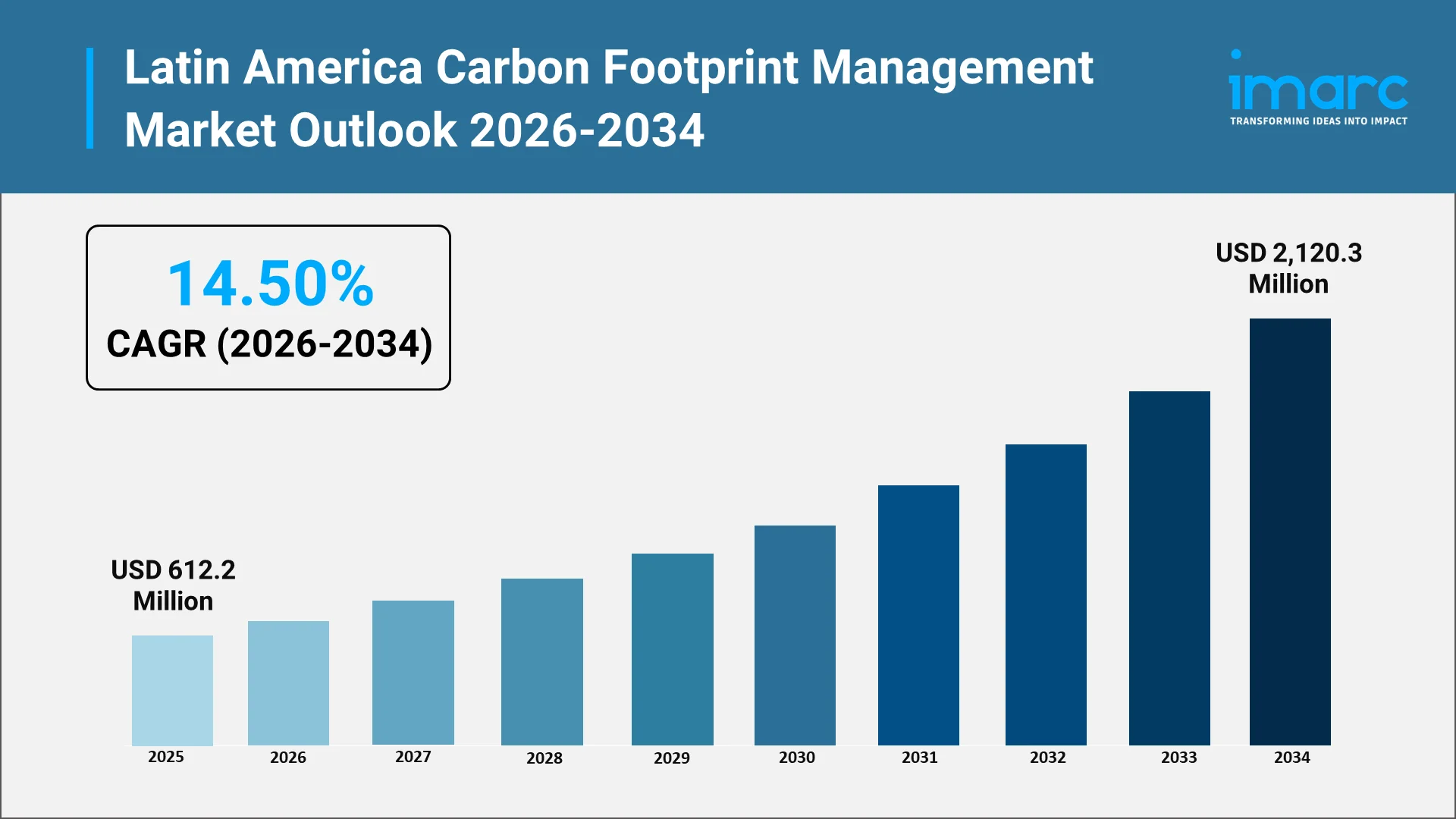

The Latin America carbon footprint management market represents a critical frontier in the global transition toward sustainable business practices and environmental accountability. As organizations across the region confront mounting pressure from stakeholders, investors, and regulatory bodies, the demand for sophisticated carbon emission tracking systems has intensified dramatically. This market encompasses a comprehensive ecosystem of technologies, platforms, and consulting services designed to measure, monitor, and reduce organizational carbon footprints while supporting compliance with evolving environmental standards. In 2025, the Latin America carbon footprint management market size reached USD 612.2 Million.

Latin American enterprises navigate a complex landscape where economic development aspirations must be balanced against urgent climate commitments. The region's diverse industrial base presents unique measurement and management challenges. Growing awareness of ESG compliance Latin America requirements is driving corporate transformation across sectors, as companies recognize that environmental performance directly influences market valuation, access to capital, and competitive positioning. Advanced sustainability analytics platforms enable unprecedented visibility into emissions across supply chains while modeling tools project financial implications of decarbonization pathways.

Overview of the Latin America Carbon Footprint Management Market:

The Latin America carbon footprint management market encompasses a comprehensive ecosystem of software platforms, consulting services, and verification providers enabling organizations to quantify greenhouse gas emissions across operational boundaries. The market serves enterprises seeking to establish baseline measurements, implement reduction strategies, and demonstrate alignment with international climate frameworks. Regional dynamics distinguish Latin America through its unique combination of resource-dependent economies and vulnerability to climate impacts, with Brazil's biofuels sector, Chile's renewable energy leadership, Mexico's manufacturing integration, and Argentina's agricultural prominence creating distinct market characteristics. IMARC Group expects the Latin America carbon footprint management market to reach USD 2,120.3 Million by 2034, exhibiting a growth rate (CAGR) of 14.50% during 2026-2034.

Market participants range from multinational corporations implementing enterprise-wide carbon accounting systems to small enterprises taking initial measurement steps. Technology providers are increasingly localizing offerings to address regional requirements including languages, currencies, and regulatory frameworks. Professional services firms are expanding capabilities to meet surging demand for strategic advisory and verification services.

Explore in-depth findings for this market, Request Sample

Market Growth and Emission Reduction Goals:

Market expansion reflects intensifying corporate commitments to achieve emission reductions aligned with climate agreements. According to the Latin American Energy Organization (OLADE), renewable energy in Latin America's electricity production increased by 4% year over year to reach 68% renewable electricity generation. Organizations are establishing ambitious carbon neutrality targets and investing in management capabilities. The momentum behind carbon offsetting initiatives demonstrates recognition that operational improvements alone cannot address required reduction scale, necessitating investment in verified offset projects.

Corporate sustainability commitments drive systematic changes in operations, procurement, and capital allocation. Leading companies implement science-based targets establishing reduction pathways consistent with temperature limitations. These commitments cascade through supply chains as buyers require suppliers to measure and report carbon footprints, creating network effects accelerating adoption. The integration of renewable energy integration strategies with carbon management platforms represents a critical growth driver. Organizations leverage modeling tools to evaluate renewable investments, assess grid impacts, and optimize energy portfolios for cost efficiency and emission reduction.

Key Challenges Facing Implementation:

Organizations encounter substantial obstacles implementing effective carbon management systems despite market momentum. Data availability and quality issues represent fundamental challenges, as enterprises lack robust systems for tracking energy consumption across value chains.

Technical capacity constraints pose significant barriers. Many organizations lack internal expertise in carbon accounting methodologies and sustainability analytics interpretation. This gap extends beyond measurement to strategic planning and stakeholder communication. Professional shortages create consultant dependency, increasing costs and limiting knowledge transfer supporting sustained efforts.

Financial considerations influence adoption timelines significantly. Initial investments in platforms, verification services, and change management can be substantial for enterprise-wide implementations. Return on investment calculations remain challenging when quantifying benefits including risk mitigation and regulatory compliance. Supply chain complexity creates difficulties measuring Scope 3 emissions comprehensively, with companies participating in global value chains where suppliers operate across jurisdictions with varying transparency levels.

Opportunities in Corporate Sustainability and Technology:

The expanding emphasis on ESG compliance Latin America creates substantial opportunities for market participants. Investors increasingly incorporate environmental performance into valuation models, creating financial incentives for robust carbon management. Companies demonstrating leadership experience improved capital access, lower borrowing costs, and enhanced valuations, positioning carbon management as strategic capability rather than compliance function.

Technological advancement democratizes access to sophisticated capabilities. Cloud-based platforms with intuitive interfaces reduce implementation complexity. Artificial intelligence applications enhance data collection automation, improve emission factor accuracy, and enable predictive analytics. Regional carbon offsetting market development presents significant opportunities, as Latin America's forests and renewable energy potential provide advantages for developing quality offset projects. Organizations increasingly seek locally sourced offsets delivering co-benefits including biodiversity protection and community development, stimulating verification infrastructure investment.

Cross-sector partnerships accelerate decarbonization at scale. Industry associations develop sector-specific protocols and share best practices reducing implementation costs. Public-private collaborations create shared monitoring infrastructure, enabling resource pooling and knowledge transfer benefiting entire industries.

Government Initiatives and Green Regulations:

Government action establishes regulatory frameworks mandating or incentivizing corporate carbon management. ECLAC's November 2025 report highlights that climate action offers opportunities for spurring growth, creating jobs, and enhancing international positioning. National climate strategies translate international commitments into domestic policies affecting businesses directly. Regulatory approaches vary significantly, with jurisdictions implementing mandatory reporting requirements or focusing on voluntary mechanisms supported by incentives and technical assistance programs.

Carbon pricing mechanisms emerge as policy instruments in major economies. These systems create explicit financial incentives for emission reductions by establishing economic costs for pollution. Pricing mechanisms drive demand for robust measurement capabilities enabling organizations to determine obligations and identify cost-effective opportunities. Regulatory harmonization efforts gradually reduce cross-border compliance complexity, with international standards influencing national approaches and creating consistency in measurement methodologies and verification protocols.

Government support programs address implementation barriers through financial assistance and technical training. Development banks offer concessional financing for carbon management investments targeting small and medium enterprises. Public institutions develop emission factor databases and guidance documents reducing adoption costs, accelerating market development by lowering barriers.

Competitive Insights and Future Prospects:

The competitive landscape features diverse participants from established global vendors to specialized regional providers. International firms adapt platforms for Latin American requirements through local partnerships and language support. Homegrown providers leverage deep knowledge of local business practices and regulatory environments to capture market share among enterprises prioritizing regional expertise.

Strategic differentiation centers on integration capabilities connecting carbon management with enterprise systems. Leading platforms incorporate APIs and connectors synchronizing with financial systems and supply chain applications. This integration reduces manual entry and enables frequent reporting. Organizations prioritize solutions offering seamless connectivity over standalone applications requiring parallel data collection efforts.

Future market evolution will be shaped by converging trends. Artificial intelligence will enable sophisticated predictive modeling and automated anomaly detection. Blockchain may enhance offset market verification while reducing transaction costs. Internet of Things sensors will provide real-time monitoring at granular levels, moving toward continuous measurement systems supporting dynamic decisions. The expansion of renewable energy integration throughout electricity grids will fundamentally alter corporate footprints, requiring organizations to adapt approaches to reflect evolving grid emission factors and renewable procurement tracking.

Stakeholder expectations regarding transparency will continue intensifying. Investors demand granular disclosure including Scope 3 emissions and transition planning. Consumers increasingly consider environmental performance in purchasing decisions. Employees prioritize environmental values when evaluating employers. These pressures will sustain demand for comprehensive capabilities while raising credibility standards.

Conclusion:

The Latin America carbon footprint management market stands at a pivotal juncture where environmental imperatives, regulatory evolution, and business strategy converge to create unprecedented momentum. Organizations throughout the region are recognizing that effective carbon management represents not merely a compliance obligation but a strategic capability that influences financial performance, competitive positioning, and long-term resilience. The challenges of data availability, technical capacity, and financial resources remain significant, yet the opportunities emerging from technological innovation, supportive policies, and stakeholder engagement provide compelling pathways forward.

Success in this evolving landscape requires organizations to move beyond viewing carbon footprint management as a standalone environmental initiative. Leading companies are integrating carbon emission tracking into core business processes, embedding sustainability considerations into strategic planning, capital allocation, and performance management. This transformation demands investment in enabling technologies, development of internal capabilities, and cultivation of organizational cultures that value environmental stewardship alongside traditional business metrics.

The trajectory of the Latin American market suggests continued expansion as regulatory frameworks mature, technological capabilities advance, and stakeholder expectations intensify. Organizations that establish robust carbon management foundations today will be positioned to navigate future regulatory requirements, capture emerging commercial opportunities, and demonstrate leadership in the transition toward a low-carbon economy. The question facing Latin American businesses is not whether to invest in carbon footprint management capabilities, but rather how quickly they can build the systems, expertise, and partnerships necessary to thrive in an increasingly carbon-constrained world.

Choose IMARC Group for Unmatched Expertise:

- Data-Driven Market Intelligence: Enhance your understanding of carbon footprint management adoption patterns, technology innovations, and regulatory developments throughout Latin America through comprehensive research reports.

- Strategic Growth Forecasting: Anticipate emerging trends in sustainability analytics, carbon offsetting mechanisms, and corporate environmental disclosure by analyzing regional market dynamics and stakeholder expectations.

- Competitive Intelligence: Evaluate competitive positioning within the carbon management ecosystem, assess technology provider capabilities, and identify strategic partnership opportunities that accelerate market entry.

- Policy and Regulatory Advisory: Navigate evolving carbon pricing mechanisms, mandatory reporting requirements, and voluntary disclosure frameworks affecting organizational compliance obligations across Latin American jurisdictions.

- Custom Research and Consulting: Access tailored insights addressing your organizational objectives, whether launching carbon solutions, investing in sustainability technologies, or developing decarbonization strategies that drive outcomes.

For more detailed report, please visit: https://www.imarcgroup.com/latin-america-carbon-footprint-management-market

Our Clients

Contact Us

Have a question or need assistance?

Please complete the form with your inquiry or reach out to us at

Phone Number

+91-120-433-0800+1-201-971-6302

+44-753-714-6104

.webp)